Beyond the AI bubble: finding predictable growth in video game stocks

Quality Growth Boutique

Markets are overflowing with enthusiasm for artificial intelligence, but it’s not the only game in town.

As a parent, I’ve often heard my kids asking for the latest Fortnite skins or to play Clash Royale with their friends. Many parents can relate to these seemingly countless requests. What might come as a surprise, however, is that both of these popular games are backed by Tencent, a company at the forefront of the video gaming industry.

Video games, a familiar yet constantly evolving industry, offer technology exposure that combines predictability with structural growth, a hallmark of enduring value creation that we look for at the Quality Growth boutique. Few industries embody this combination as powerfully as gaming, where long-lived franchises developed over multiple years generate recurring revenues – a concept we refer to as “Evergreen” titles.

Over time, select gaming companies have developed a base of Evergreen titles that continue to grow, providing stability through established revenue streams while complementing this with growth from the release of new titles. These gaming companies are rare, but they demonstrate strong compounding potential, which we believe is often underestimated by the market.

Three key elements common among successful gaming companies:

- Predictability: Build a strong, growing base of Evergreen game titles that deliver steady cashflows and attract a loyal, expanding fan base

- Growth: Develop a consistent pipeline of new games that evolve into future Evergreen franchises

- Global Leverage: Expand domestically-developed intellectual property (IP) into international markets through overseas platforms

In our view, only a few gaming companies truly excel across all three dimensions – notably Tencent, NetEase, and Capcom. Each of these companies has compounded earnings by approximately 20% annually over the past decade, outperforming both the broader index and the average of our Quality Growth portfolios.

Tencent Holdings: Leveraging a massive global platform

Tencent, a Chinese multinational technology powerhouse, is a top 10 holding in Vontobel’s Quality Growth Global, International, and Emerging Market Equity portfolios. The company has built a growing foundation of Evergreen titles while consistently launching successful new games.

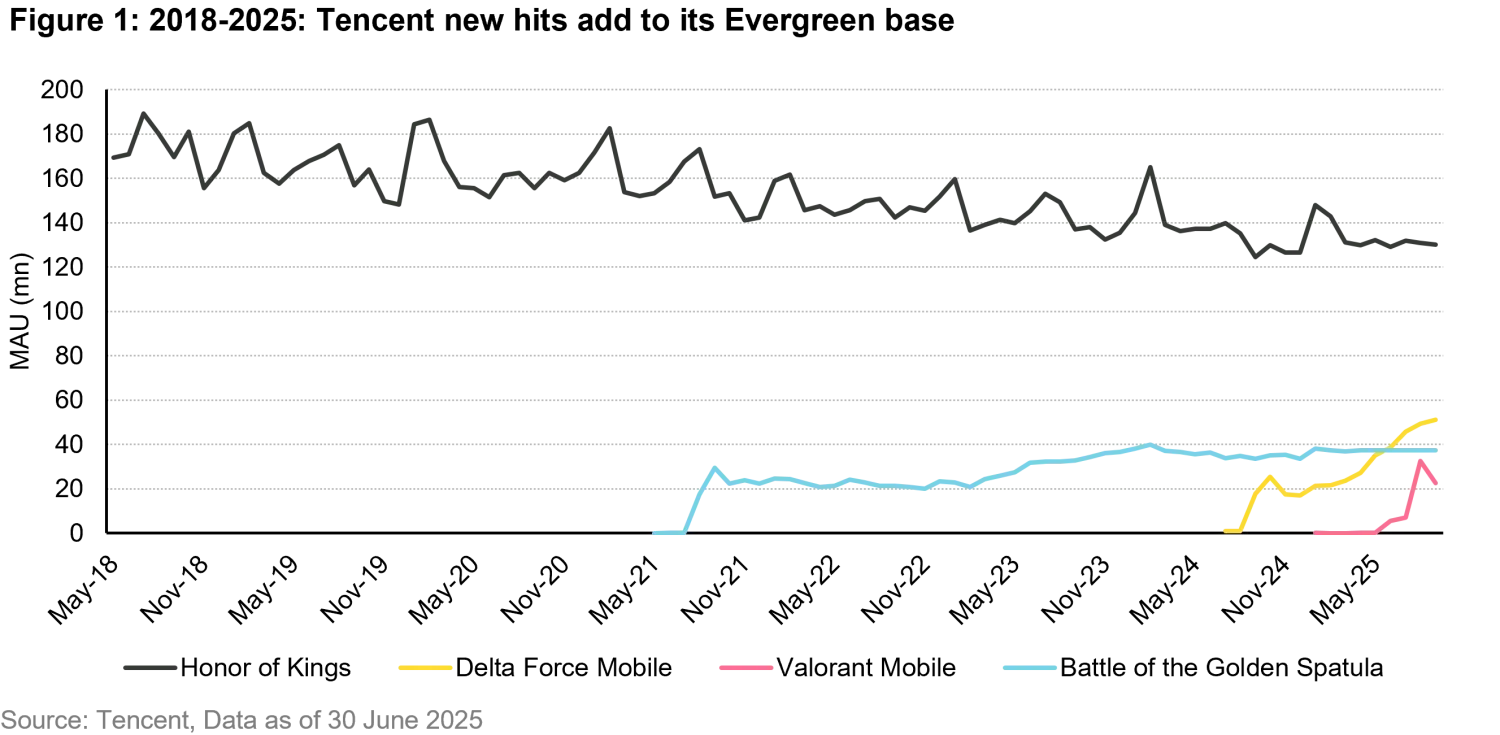

Tencent defines an Evergreen title as one that generates over RMB 4 billion (approximately US$560 million) in annual revenue and maintains more than five million daily active users (DAU) on mobile or two million on PC. By this definition, Tencent’s Evergreen titles have grown from 12 in 2023 to 14 in 2025, with new hits like Valorant mobile and Delta Force joining long-standing successes such as Honor of Kings and Peacekeeper Elite. We estimate that Evergreen titles account for approximately 70% of Tencent’s gaming revenues, providing a robust foundation of predictable and growing cash flows. As Figure 1 shows, Tencent has been able to maintain a steady user base for Evergreen Honor of Kings while adding new users with successful hits in Valorant and Delta Force mobile.

Tencent consistently refreshes existing franchises by introducing new seasons, character skins, and collaborations, ensuring its gains remain relevant and engaging. This approach allows Tencent to focus its resources on large-scale titles, where it can maximize R&D efficiency, marketing reach, and long-term franchise value. Additionally, Tencent has developed a fast-growing international business through successful launches, such as Valorant from acquired studio Riot Games, and by successfully expanding domestic IP’s, such as Crossfire, overseas. Over the past five years, international games have grown from mid-teens as a percentage of revenues to nearly 30% of revenues currently and has become an important driver of Tencent’s sustained double digit growth in its gaming business.

NetEase's winning formula: legacy franchises and new hits

NetEase, like Tencent, is an example of how select gaming companies can create long-term growth, making them attractive investments for our Quality Growth portfolios. As one of China’s leading gaming businesses and a top 10 position in our Emerging Markets Equity portfolio, NetEase has compounded earnings at 19% annually over the past decade. NetEase has successfully built enduring Evergreen franchises and continues to expand its revenue base with successful new titles that are evolving into future Evergreen titles.

NetEase’s legacy franchises, Fantasy Westward Journey and Westward Journey, both launched in 2002, remain highly successful, thriving into their third decade. The company has transitioned these titles from PC to mobile platforms while consistently releasing expansion packs to keep games fresh. These mature titles provide a dependable stream of cash flows that fund new growth.

Over the past five years, NetEase has built on these legacy titles by adding new hits such as Naraka Bladepoint, Knives Out, and Onmyoji, which have evolved into Evergreen titles. The company has also leveraged relationships with popular IPs to create successful titles like the Harry Potter series and, more recently, Marvel Rivals.

NetEase’s international expansion is accelerating, with games like Naraka Bladepoint and Eggy Party gaining strong traction in overseas markets and now accounting for a low-teens percentage of gaming revenue.

We estimate that Evergreen titles for NetEase comprise around 40% of gaming revenue, which is lower than Tencent. However, like Tencent, NetEase demonstrates how leading gaming companies can combine the longevity of established franchises with innovation and global expansion to create enduring value.

Capcom: masterful monetization of storied IP across games and media

Capcom, which we added this year to our Global and International portfolios , is a Japan-based video game company that dates back to the 1980s. It is renowned for iconic franchises such as Street Fighter, Resident Evil, and Monster Hunter. Like Tencent and NetEase, Capcom has successfully developed and grown well-established franchises, but it has done so through a differentiated strategy.

For over a decade, Capcom has achieved consistent annual operating profit growth of over 10%, with earnings compounding at an impressive 23% during the period. The company achieved this impressive track record by growing and reinforcing its core franchises through a steady release schedule of new installments, effectively selling its back catalog and using its IP library to license movies and television shows. We estimate that Capcom’s Evergreen titles account for close to 90% of its revenue.

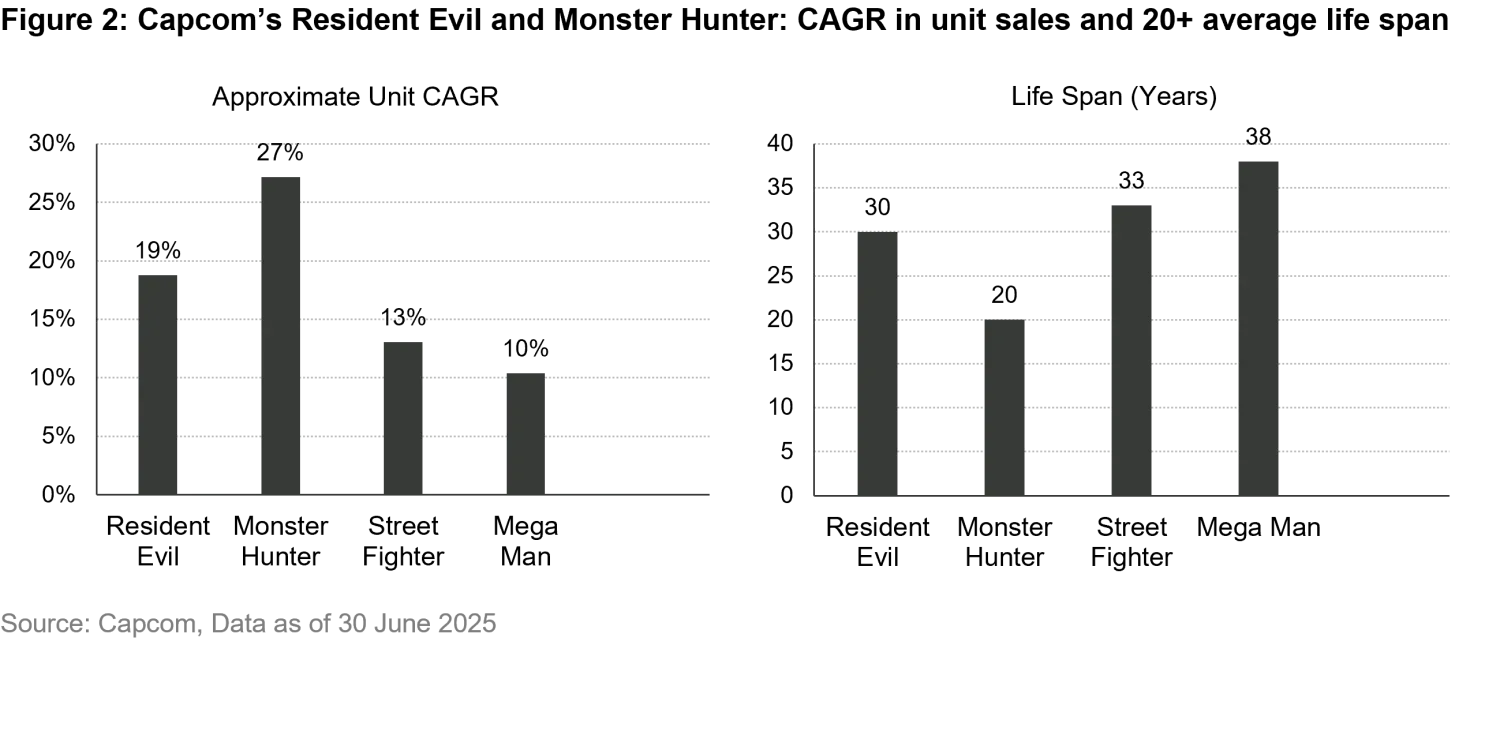

Capcom’s two largest titles, Resident Evil and Monster Hunter, together account for slightly more than half of the company’s total unit sales. Impressively, these franchises have achieved a compound annual growth rate (CAGR) of approximately 20% in unit sales, despite having an average lifespan of over 20 years (Figures 2).

Rather than taking on the risks of developing entirely new IP, Capcom mainly leverages its strong franchises by releasing remastered versions of older titles with updated graphics or new installments. This approach provides greater sales visibility, as these titles already have an established fan base. Additionally, Capcom strategically uses its back catalog to promote new games, selling older titles at discounted prices as launch dates approach. This strategy not only boosts sales but also expands its fan base by providing customers with lower entry points and less computationally demanding games. Both points are important as video games become more popular in developing countries, a key growth market.

With its storied franchises, some dating back to the 1980s, Capcom has excelled in monetizing its IP beyond video games. Capcom has now created six Resident Evil movies, which have collectively grossed $1.2 billion at the box office. This year, the company released an animated Devil May Cry television series on Netflix. When Capcom releases a movie or TV series based on its IP, it in turn drives sales for the games. For example, this year, Capcom sold 1.7 million copies of Devil May Cry 5, a game that was released in 2019.

This distinct, multi-pronged strategy demonstrates Capcom’s ability to achieve the predictability and structural growth we seek. By prioritizing lower-risk franchise installments and remastered versions of older titles rather than costly new IP, Capcom ensures a steady cadence of hits for an established fanbase. Furthermore, its savvy use of back catalog sales and external media adaptations creates a powerful flywheel effect: movies and TV shows drive game sales, while discounted older titles build the audience for new releases. This differentiated, low-risk approach highlights Capcom’s highly effective path to creating the long-term, compounding value that we believe is a hallmark of a quality growth business.

A rare combination of durability and expansion

While Tencent, NetEase, and Capcom execute distinct strategies, they all validate our core investment thesis. Each company has successfully cultivated a base of Evergreen franchises that deliver a predictable stream of cash flows, which they then use to fund and launch new titles that drive structural, long-term growth. Whether through Tencent's massive global platform, NetEase's blend of decades-old legacy titles and new hits, or Capcom's masterful monetization of its storied IP across games and media, these companies demonstrate a rare combination of durability and expansion. It is this demonstrated ability to create, sustain, and leverage powerful franchises that makes these select gaming companies such compelling and core holdings for our Quality Growth portfolios.

Important Information: References to portfolio holdings and other companies are for illustrative purposes only as of the date of publication to elaborate on the subject matter under discussion. Information provided should not be considered research or a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the present or future profitability or performance of any company identified or security associated with them. There is no assurance that any securities discussed herein will remain in the portfolio at the time you receive this communication, or that securities sold have not been repurchased. Securities discussed may represent only a certain percentage of a portfolio’s holdings. Refer to the “Related Strategies/Funds” for further evaluation. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. Such information should not be regarded as an indication that Vontobel considers these forecasts to be reliable predictors of future events and they should not be relied upon as such. Actual events or results may differ materially and, as such, undue reliance should not be placed on such forward-looking information.