Is your seatbelt fastened? Quality as a safeguard in a momentum market

Quality Growth Boutique

Uncertainty has dominated the landscape in 2025, from a cooling US labor market to questions surrounding the return on investment (ROI) of artificial intelligence (AI) initiatives. Despite the implications of higher-for-longer interest rates, geopolitical volatility, and divergent global growth trajectories, markets are charging full steam ahead.

Following the volatility surrounding Liberation Day in April, global equities rallied sharply. Two major themes have emerged since the mid-April bottom:

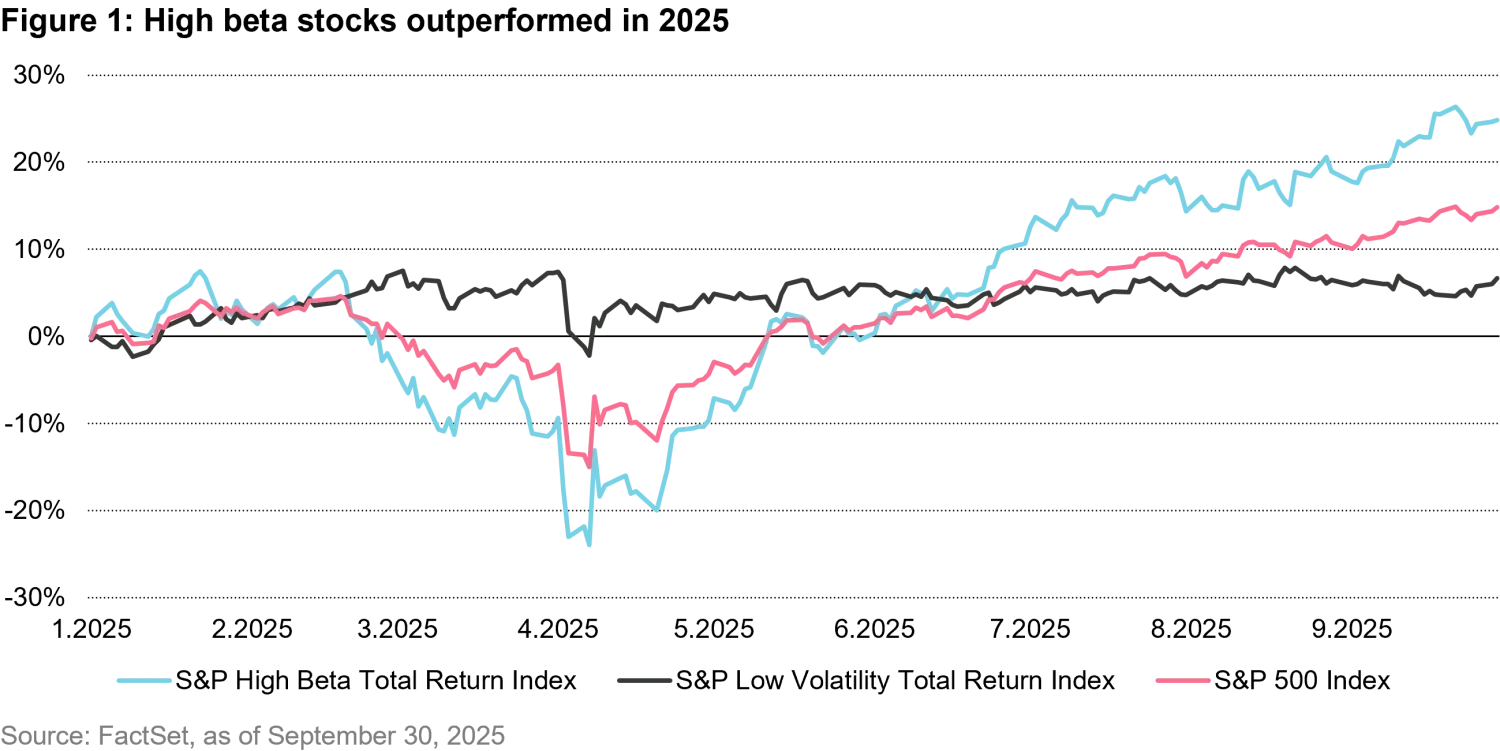

High-beta US stocks significantly outperformed their low-volatility peers.

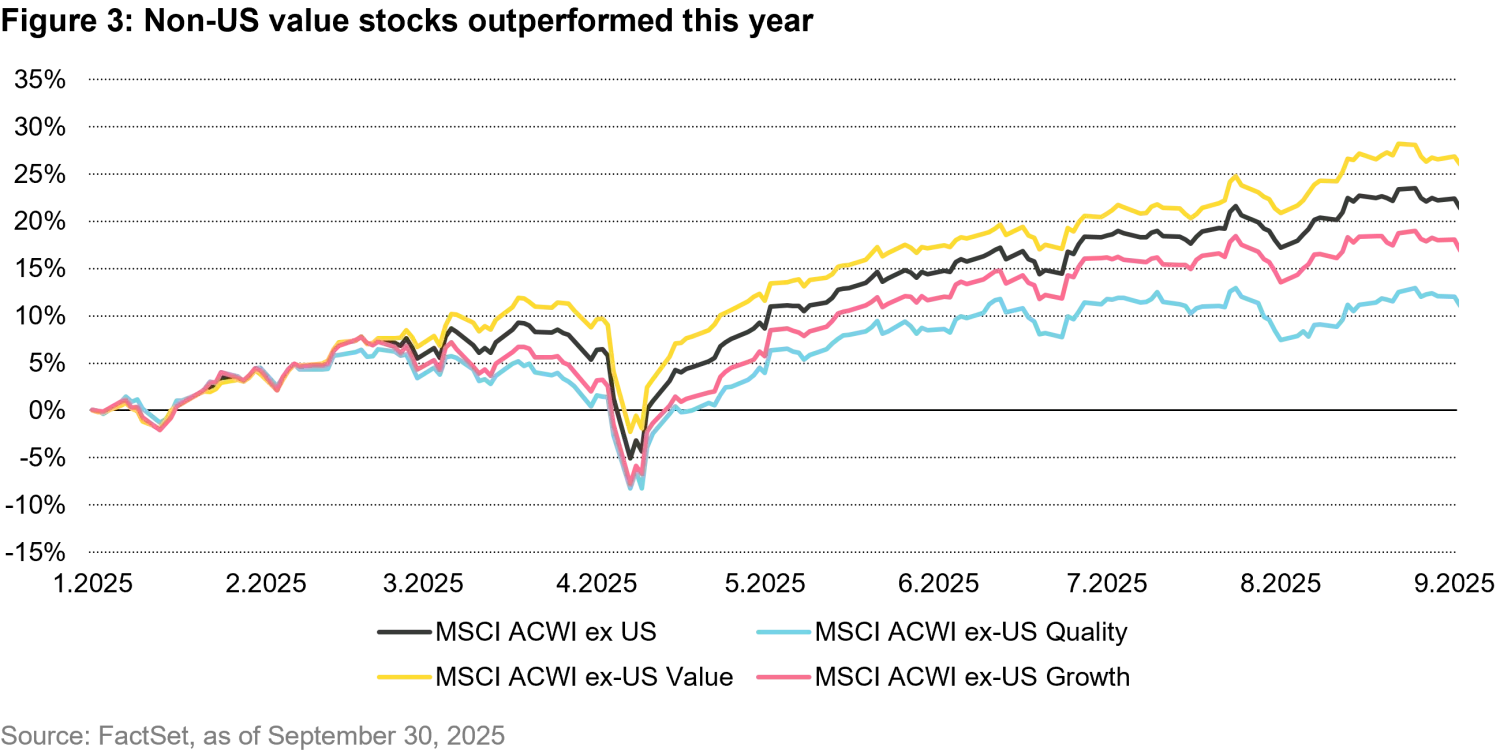

Non-US value stocks also staged a strong rally, outperforming their US counterparts.

As investors continue to chase high growth, quality stocks have become underappreciated. Our flavor of quality, investing in companies with not only superior profitability but also high predictability and stability in earnings growth, has been disproportionately punished.

We believe investors should remain cautious of momentum trades in both the tech and banks sectors, which have driven the rally this year. Given the resilience and lower earnings sensitivity of quality stocks during economic uncertainty, they can offer an attractive combination of upside participation and downside protection. Much like a seatbelt, quality may come in handy for the potential turbulence ahead.

1. The high beta rally

High beta US stocks have outperformed low-volatility peers by roughly 50% since the April lows. This surge represents one of the strongest momentum-driven moves in recent history, underpinned by the resilient nature of the US economy and investors’ conviction that AI is a transformative, world-changing technology. During the first several months of the year, investors feared the trade wars and unprecedented levels of tariffs would push the economy into recession.

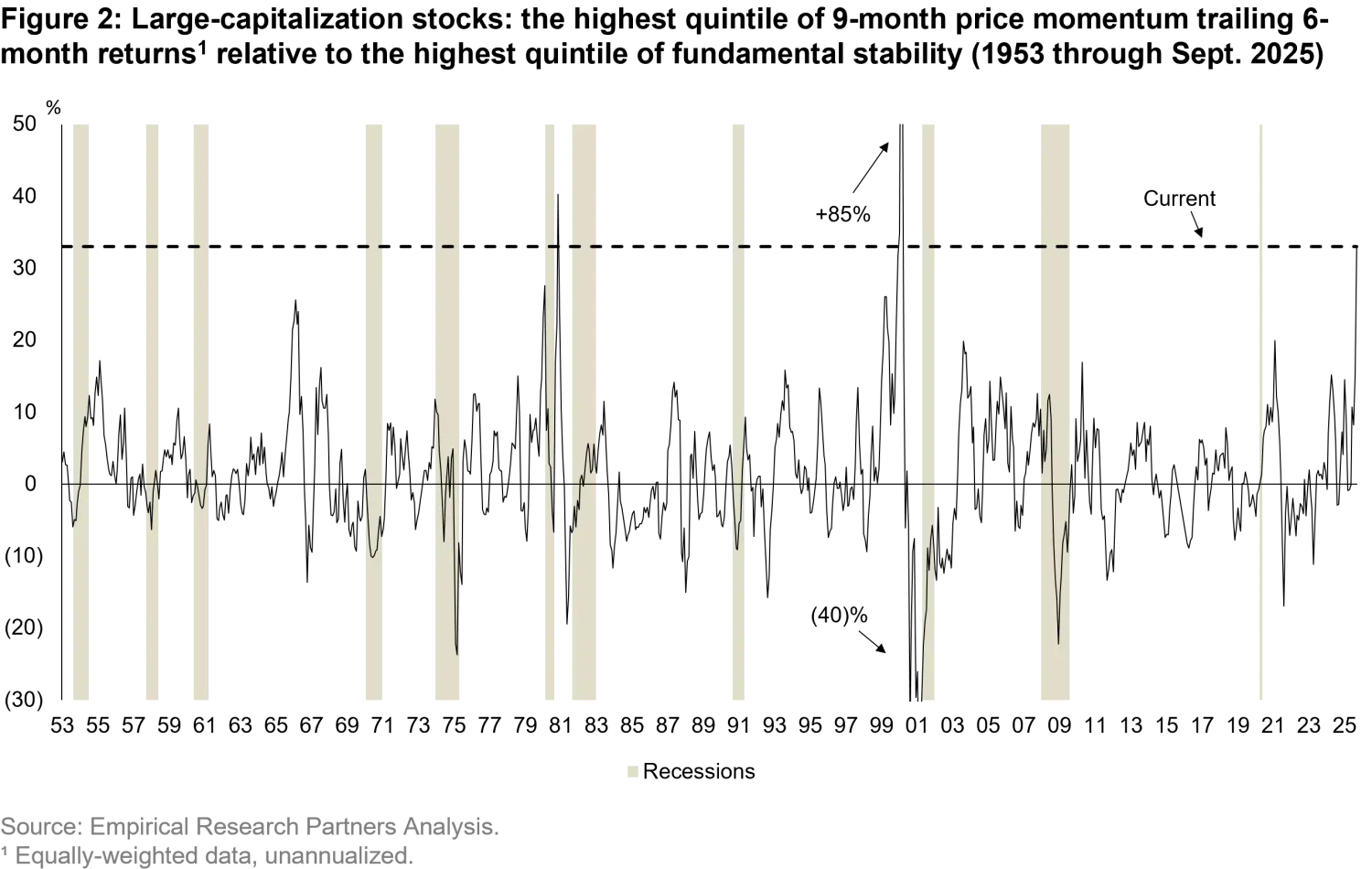

In the US, the AI frenzy has driven momentum stocks to outperform their more stable counterparts at the widest margin in over 25 years. Small-cap performance tells a similar story: since Liberation Day, small-cap companies with negative earnings have outpaced those with positive earnings – a sign of heightened speculative risk appetite. Furthermore, year-to-date, companies in the Nasdaq with no revenues are up over 30%, surpassing the return of even the Magnificent 7 stocks.

Behind the headlines, the ROI of unprecedented AI-related capex remains to be seen

Demand for AI infrastructure has outpaced capacity growth this year, driven by compute-intensive applications like reasoning models and video creation. In response, leading AI players have significantly increased their capital expenditure (capex) targets. Major hyperscalers – Amazon, Microsoft, and Alphabet – along with Meta have raised their capex outlooks for 2025 and 2026 by 20-30%, compared to projections at the start of the year. A recently published report by McKinsey cited the need for AI related capex could be almost USD 7 trillion by 2030.1 This would have a substantial impact on the global economy and individual companies.

This surge in investment has raised concerns about overcommitment. The landmark USD 300 billion cloud computing deal between OpenAI and Oracle and Nvidia’s USD 100 billion investment into OpenAI reflects the massive demand for AI infrastructure. The scale and long-term nature of these deals have heightened expectations for multi-year order growth across the server supply chain.

Nvidia’s deal with OpenAI helps fund OpenAI’s infrastructure, which in turn drives demand for Nvidia’s chips. This "circularity" has become a defining feature of many AI deals, drawing comparisons to the excesses of the dot-com bubble.

The AI ecosystem is deeply interconnected, with companies like Nvidia, OpenAI, Microsoft, Oracle, AMD, and CoreWeave engaging in intricate financial and operational relationships. These include equity investments, revenue-sharing agreements, and backstopping unsold capacity.

Although these arrangements are not inherently problematic, they rely heavily on continued investor enthusiasm and the promise of future returns. If AI companies fail to generate strong cash flows or if investors lose patience with the high capital expenditures and limited visibility into profits, we believe the ecosystem could face significant challenges. Much like the dot-com era, circular financing in AI could be virtuous on the way up but turn vicious on the way down, highlighting the risks of overreliance on such structures.

Finding quality in AI: a selective, predictable, and low-risk approach

While consumers have shown significant enthusiasm for adopting AI products, as seen in the initial rollout of ChatGPT, businesses so far have seen less success. A recent study by MIT showed that 95% of AI-related projects failed to deliver any real savings or improvement in profits.2 Business use cases for AI currently remain inward-focused, with an emphasis on improving operational efficiency in areas such as knowledge management, software development, and help desk automation. This reflects the complexity of integrating AI into existing workflows and underscores the uncertainty surrounding the scale of productivity gains that AI can ultimately deliver.

We are managing our overall AI exposure carefully, as we believe there is a risk of a pullback in spending over the next two years. Our exposure to companies whose fortunes are entirely dependent on AI is lower than the index. Instead, we are taking a more selective approach, focusing on ways to benefit from AI's long-term growth in a more predictable and lower-risk manner.

Amazon, Microsoft, and Alphabet are parts of highly profitable firms with other secular growth drivers, which gives them greater ability to absorb the impact of an AI pullback. They also have greater ability to reallocate AI computing infrastructure toward internal projects, providing another avenue to digest potential excess capacity. In addition, Alphabet and Meta are benefiting from some of the most impactful use cases of AI, such as content recommendation, content generation, and improved ad monetization.

In our view, mission-critical supply chain company Taiwan Semiconductor Manufacturing Corporation, the dominant global semiconductor foundry, and Amphenol, a leading player in data center connectors, play critical roles in supporting AI infrastructure.

In the software and data analytics area, we believe companies with high moats and proprietary, hard-to-replicate data are particularly well positioned. These businesses are already generating efficiencies from AI in software engineering, which is helping to drive better margins, and some companies are seeing incremental growth from AI modules.

This area of the market pulled back in the third quarter on concerns that AI start-ups could erode their competitive advantage; however, we believe the market should focus on individual companies and the strength of their specific competitive advantages as it relates to the customers they serve and the nature of the products they offer. For example, Intuit, which provides tax and accounting software to small and medium size enterprises. Its customer base likely lacks the resources and willingness to build internal software solutions even if the barriers to entry within software are diminished by AI. Additionally, its software helps its customers avoid significant regulatory risks, meaning that deviating to a lesser known, cheaper solution can result in an outsized risk to the business.

Given the substantial portion of the US and global markets that have become AI dependent, we believe investors should diversify into other areas. Opportunities still exist in less crowded corners of the market where fundamentals are strong and valuations remain attractive. For example, waste collection is a highly predictable and recession-resilient business. We recently purchased Waste Management, the largest provider of waste services in North America that offers waste collection, recycling, disposal, and sustainability solutions. We believe Waste Management is well-positioned to grow through a combination of strong pricing, volume gains, renewable natural gas initiatives, and M&A opportunities.

2. The non-US value rally

International value stocks have also staged a strong rally, outperforming their US counterparts. Using MSCI AC World ex-US indices as proxies, value stocks outside the US have delivered outsized returns. Despite the media’s intense focus on AI, it’s particularly striking that non-US value stocks have kept pace with the Nasdaq 100 – often viewed as the benchmark for high-growth technology companies.

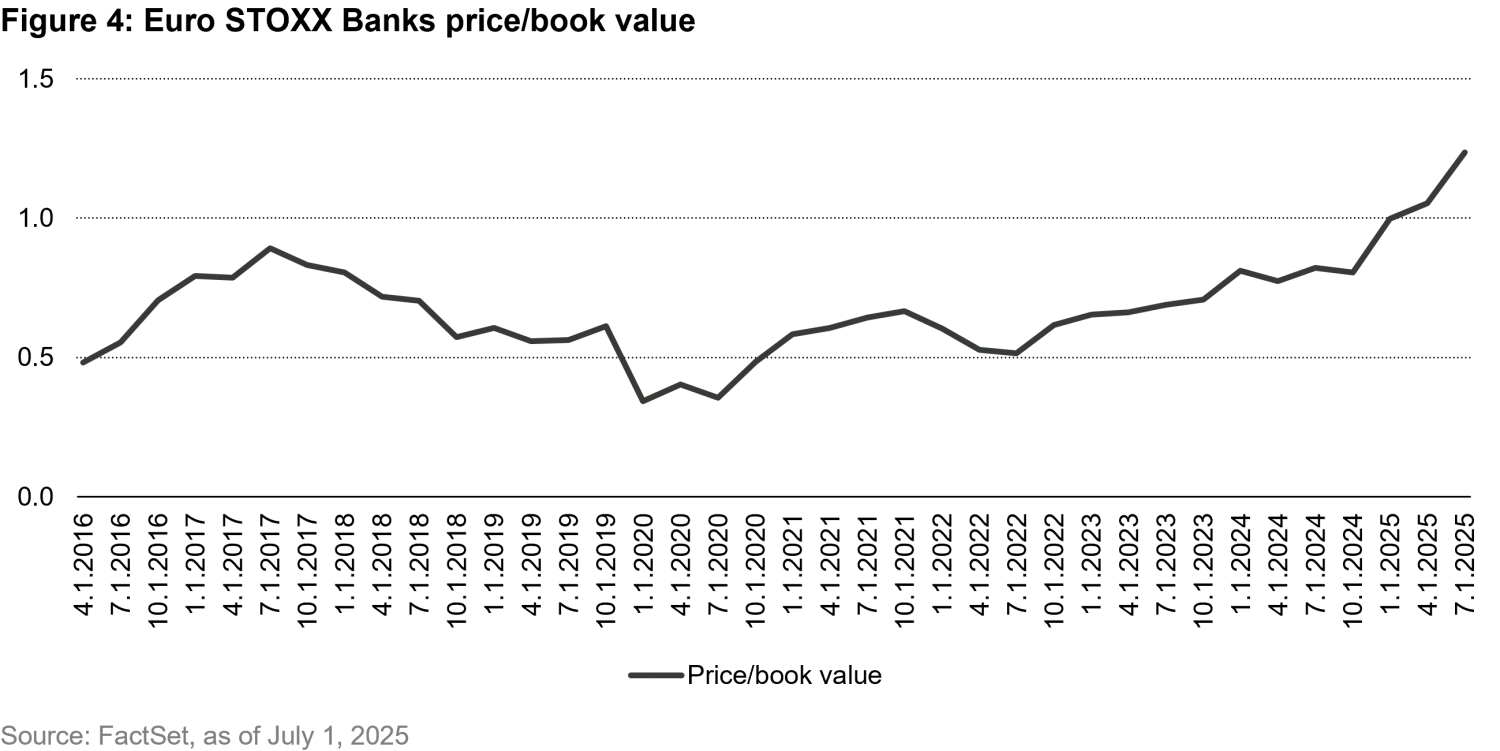

What’s driving this global value renaissance? A large part of it comes down to the re-rating of cyclical sectors – especially banks. Investors are now pricing in stronger earnings potential, improved capital return policies, and a more supportive fiscal and monetary outlook. European banks, in particular, have been standout beneficiaries. For the first time since the Global Financial Crisis, their price-to-book ratios have climbed above 1x – a symbolic and significant shift in investor sentiment.

Quality focus

With US tech stocks pricing in aggressive growth expectations and non-US banks undergoing a revaluation after over a decade of skepticism, where can investors find overlooked opportunities? One answer stands out: quality.

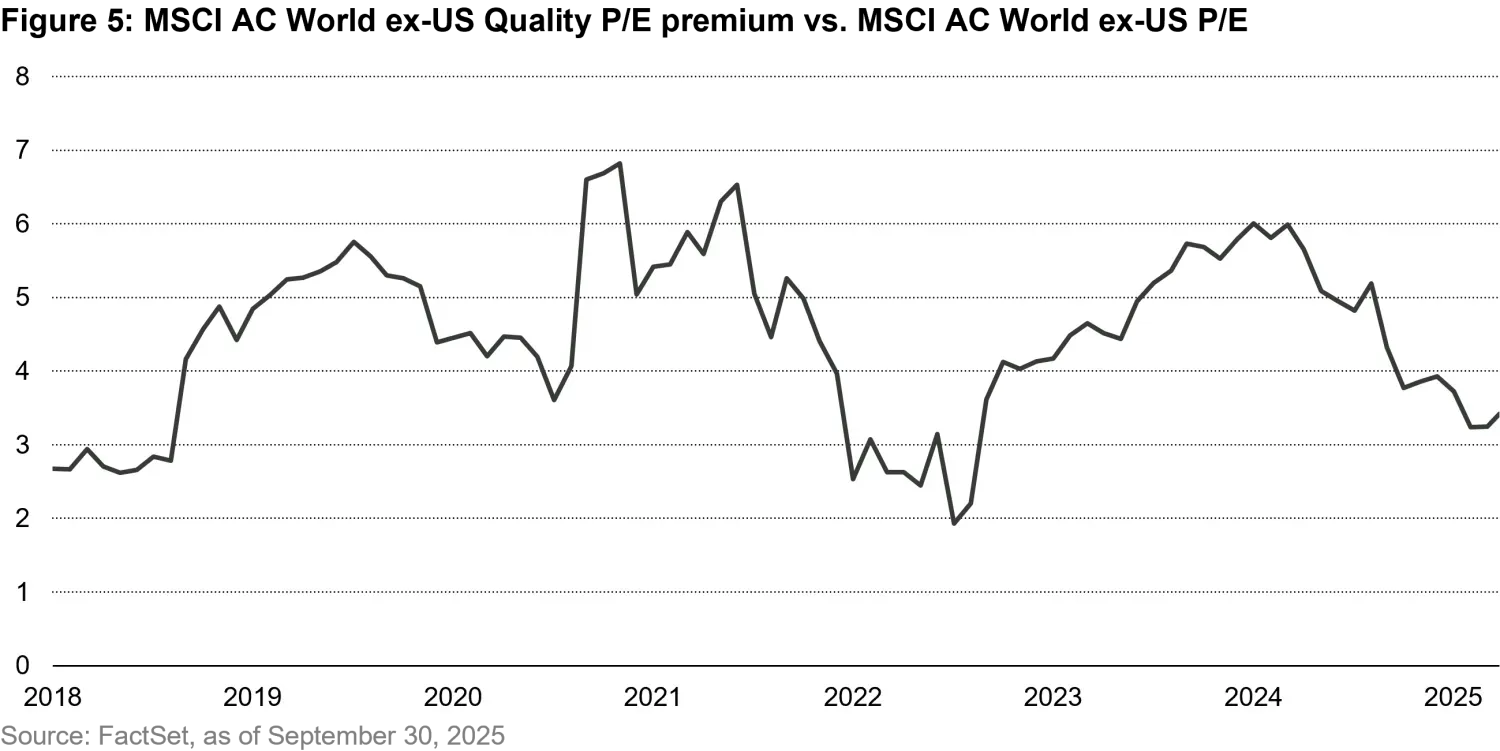

Outside the US, quality stocks – those with consistent earnings, strong balance sheets, and high returns on capital – have historically commanded a premium. But after the recent rally in lower-quality, higher-risk names, that premium has compressed to one of its lowest levels in the past decade. Given their resilience and lower earnings sensitivity during economic uncertainty, quality stocks may offer an attractive combination of protection and upside in the current environment.

Valuations reminiscent of the 2000 tech bubble

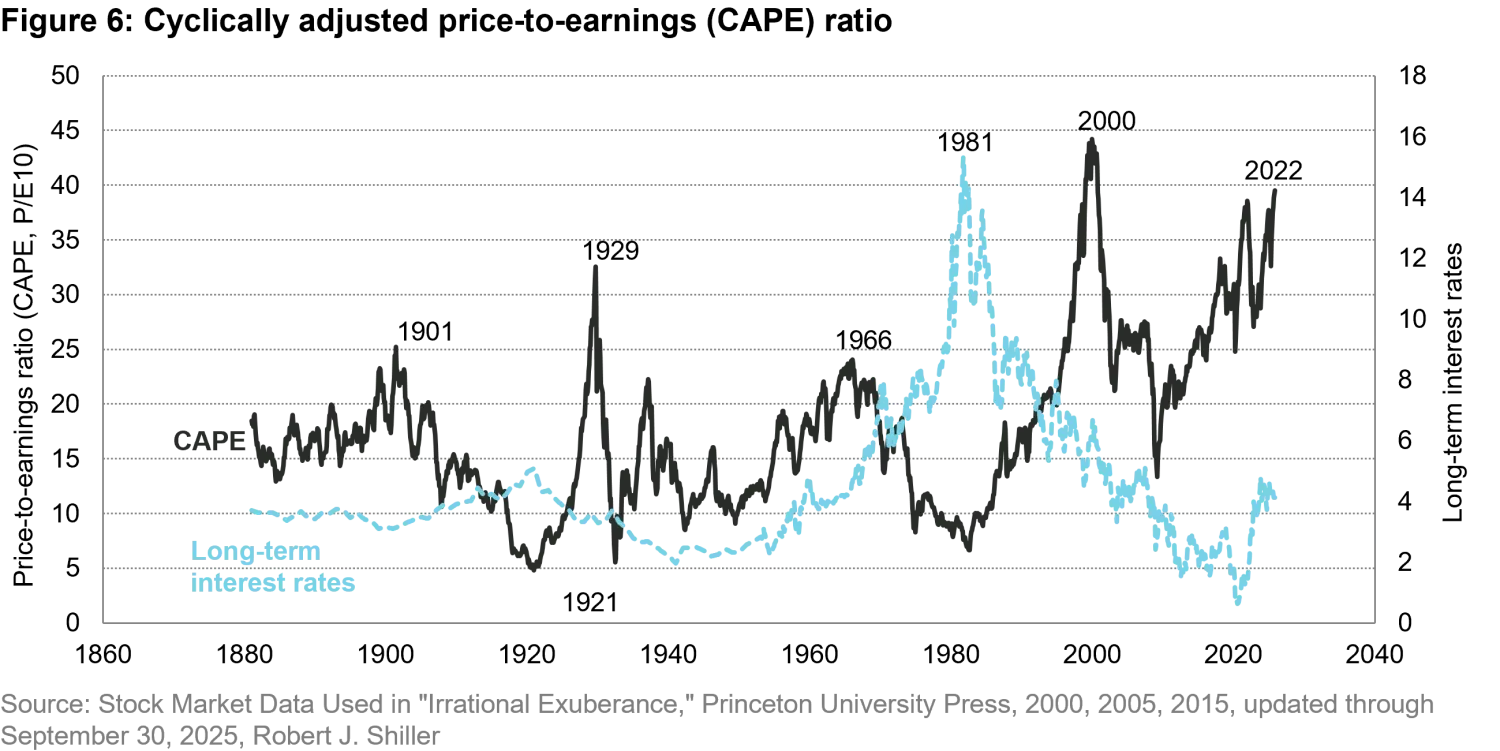

For over four decades, declining interest rates have provided a tailwind for equity multiples. Combined with the extraordinary profitability of US corporations, this trend fueled one of the strongest bull markets in modern history. However, the sharp rise in interest rates from generational lows in 2022 temporarily paused that rally. More recently, the surge in AI-driven capital investment, especially since the launch of ChatGPT, has reignited investor enthusiasm, pushing valuations to levels reminiscent of the 2000 tech bubble.

Cyclically adjusted price-to-earnings (CAPE) ratios, popularized by renowned Yale professor Robert Shiller, offer a valuable long-term perspective on whether equities are historically cheap or expensive. CAPE ratios account for the way corporate profits ebb and flow with the business cycle. While CAPE isn’t particularly useful for timing market inflection points, it uses a 10-year earnings average to smooth out cyclical volatility and thus provides a more accurate reflection of underlying market value than short-term P/E ratios based on the next 12 months. Shiller’s chart of the CAPE ratio alongside long-term interest rates highlights a critical dynamic: the gravitational pull of rates on equity valuations.

With the enthusiasm for everything AI-related propelling markets higher, investors should continue to be grounded to the fact that valuations over the long term matter. Extrapolating out exponential growth far into the future and assigning a high multiple to that earnings only works if those future earnings are realized. Investors banking on AI to be the next dominant technology theme, may well be disappointed if that future turns out different than they predicted.

Conclusion

Market complexities of 2025 are characterized by AI-driven momentum trades and non-US value rallies. While speculative enthusiasm has fueled high-beta and AI-related stocks, the sustainability of these trends remains uncertain, particularly given circular financing and unproven ROI of AI investments. Amid this backdrop, quality stocks emerge as a prudent choice, offering both resilience and steady growth potential. By focusing on companies with strong profitability, predictability, and stability, investors can better weather potential turbulence of a momentum-driven market.