Staying power: the lasting potential of international equities

Quality Growth Boutique

Despite the strong rally in US equities post Liberation Day, 2025 is the first year in over a decade where many investors recognized the growth potential outside of the US. That said, some investors believe it was a short-lived phenomenon and that US equities will continue to dominate. In our view, investors can find long-term opportunities driven by structural growth in non-US markets.

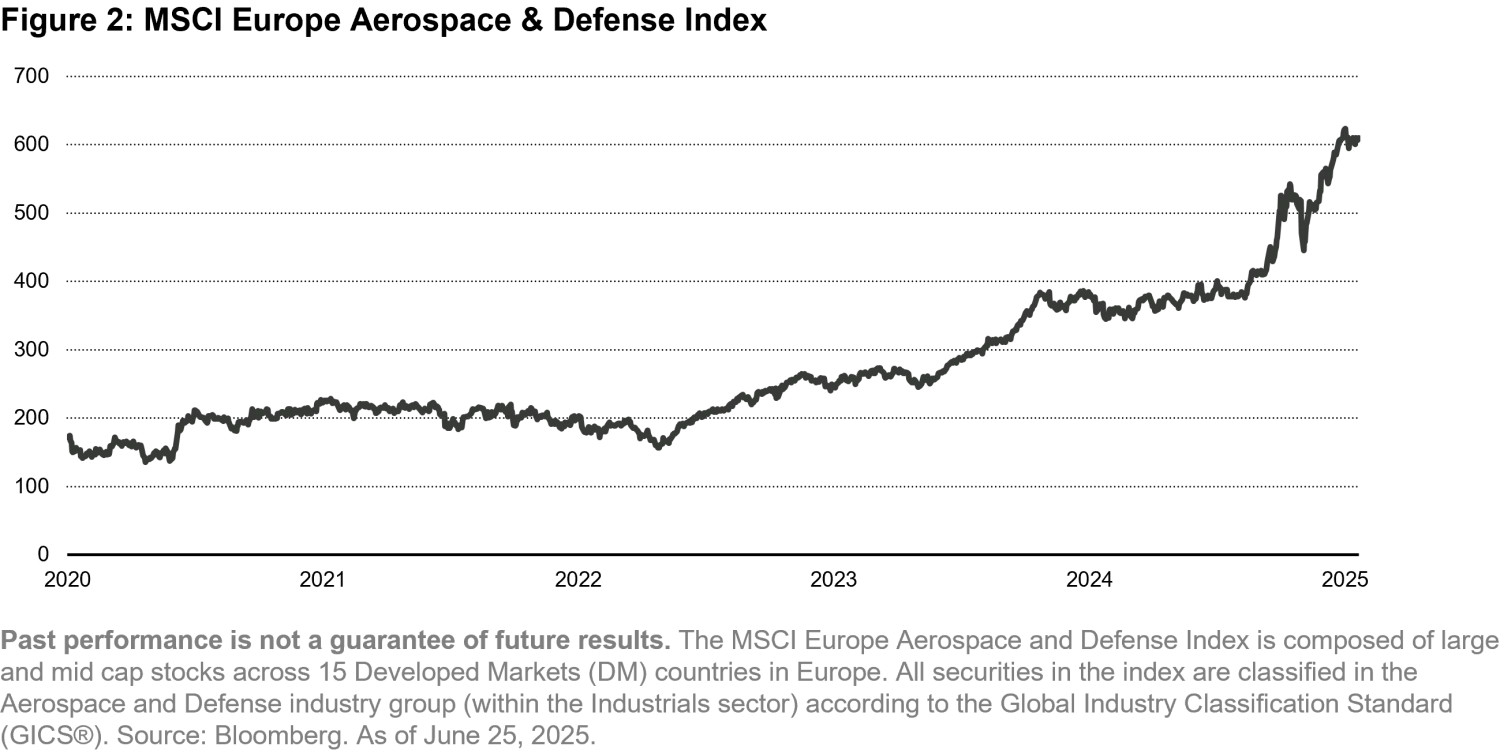

Europe’s economic transformation: defense, technology, and infrastructure

Driven by their geographic proximity to Russia and the Middle East, and doubts about the reliability of US support in potential conflicts, European governments are ramping up their defense budgets. At the 2025 NATO Summit, NATO allies committed to investing 5% of annual GDP on defense related spending by 2035. The European Commission also took steps to increase investments in AI and technology. And, Germany’s debt brake marked a historic constitutional reform with the country loosening its national fiscal rule. Germany is increasing investments in infrastructure, earmarking billions for rail, broadband, and bridges.

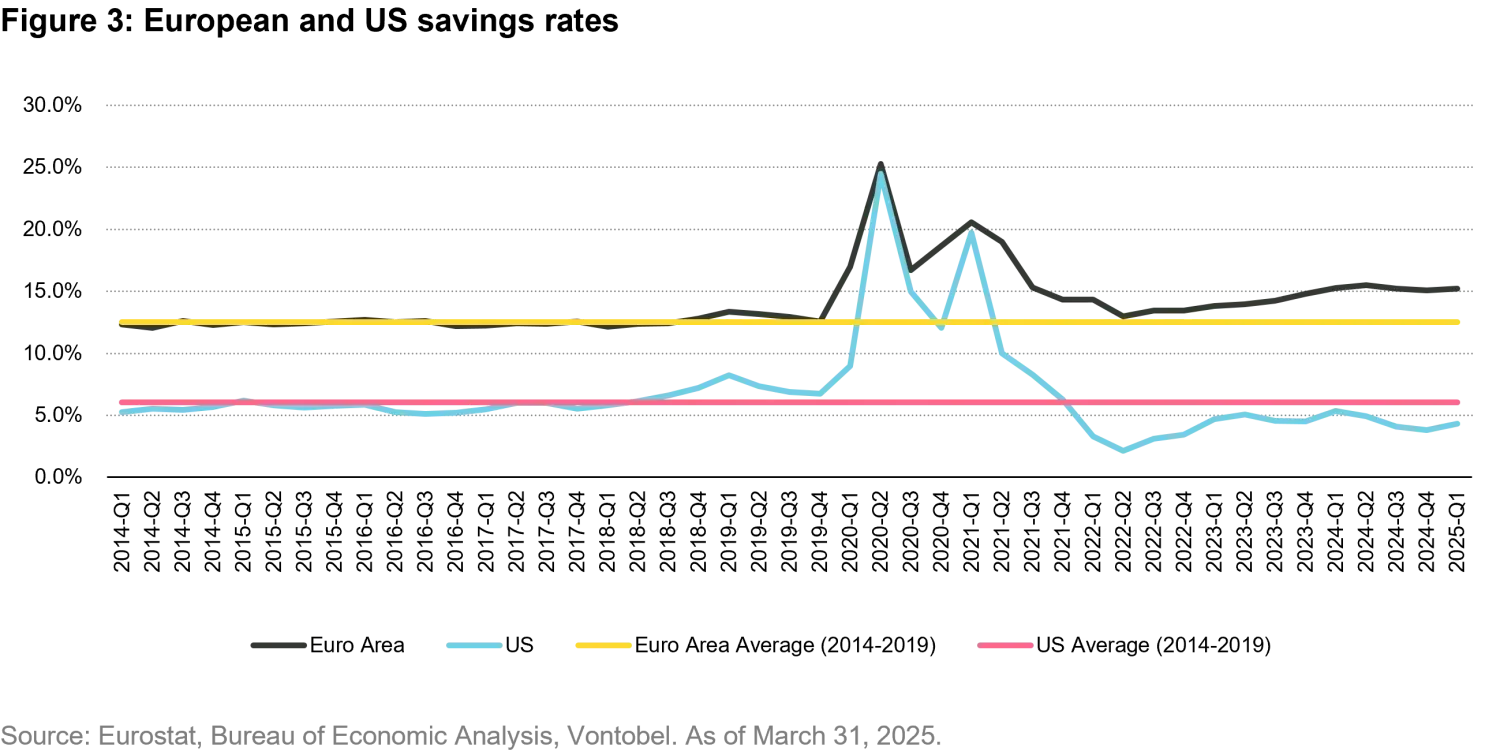

European consumer strength

The current savings rate for European households is above its pre-COVID average, while the US savings rate has fallen below its pre-COVID average. This suggests that European consumers may have more capacity to increase consumption compared to their US counterparts – a potential catalyst for heightened economic activity in the European region.

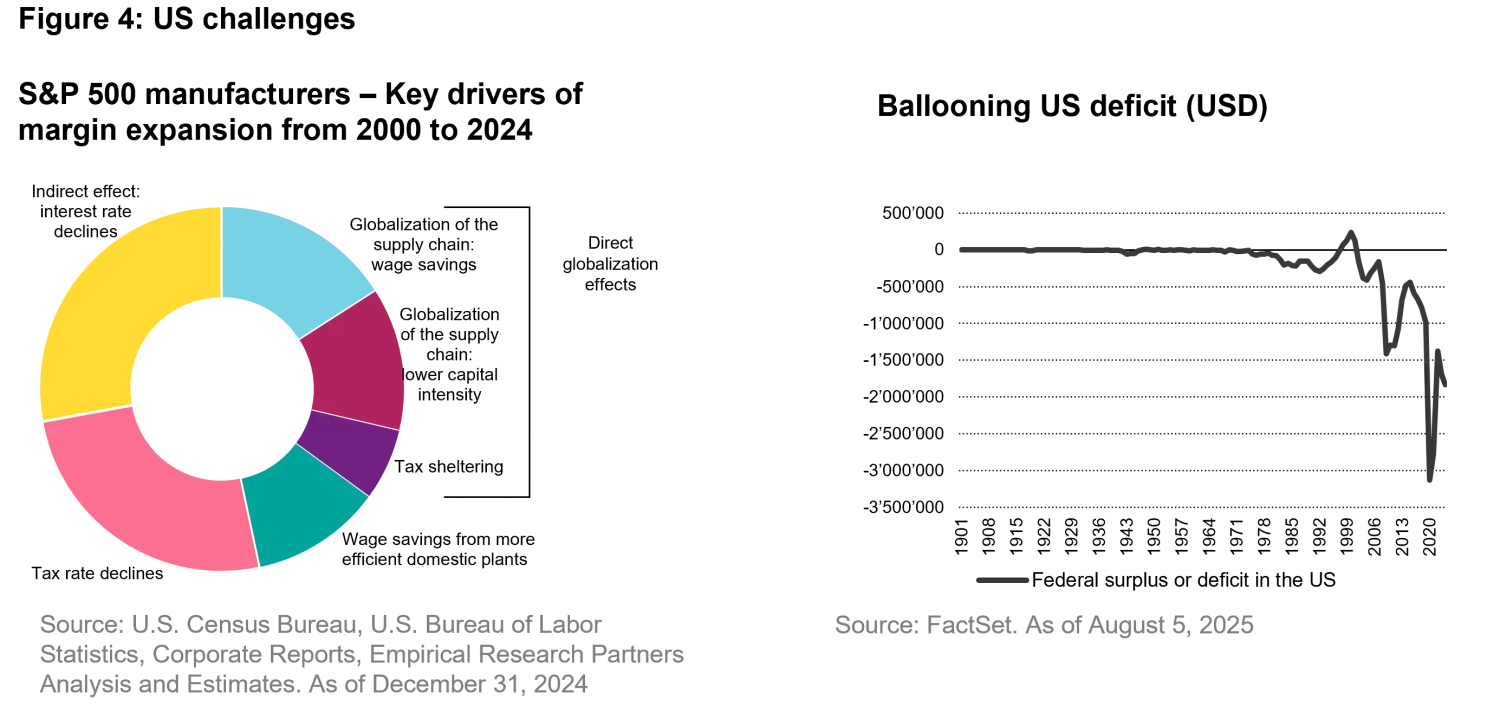

Rising risks in the US highlight the need for international diversification

Margin expansion has been driven by manufacturers; however, the imposition of tariffs may put pressure on profit margins. The rising fiscal deficit poses further risks to the US market.

International equities: an enduring opportunity

In our view, the international equity story is not a fleeting trend. With fiscal stimulus, accommodative monetary policy, robust consumer spending potential, and favorable currency dynamics, the case for looking beyond the US is strong.

Investing involves risk, including the possible loss of principal. Investment risks include, but are not limited to, the following: International investing can be more volatile and have lower overall liquidity than investments in U.S. securities and may lose value because of adverse local, political, social, or economic developments overseas, or due to changes in the exchange rates between foreign currencies and the U.S. dollar. Emerging markets involve heightened risks related to the same factors as well as increased volatility and lower trading volume. Diversification does not ensure a profit or guarantee against loss. Indices are unmanaged, and one cannot invest directly in an index. They do not reflect any fees, expenses or sales charges.