Different ways needed to meet multi-asset expectations

Quantitative Investments

Our Head of Multi-Asset Investing, Daniel Seiler, recently participated in Investment Magazine’s Absolute Returns Digital Conference 2020. You can view the session here:

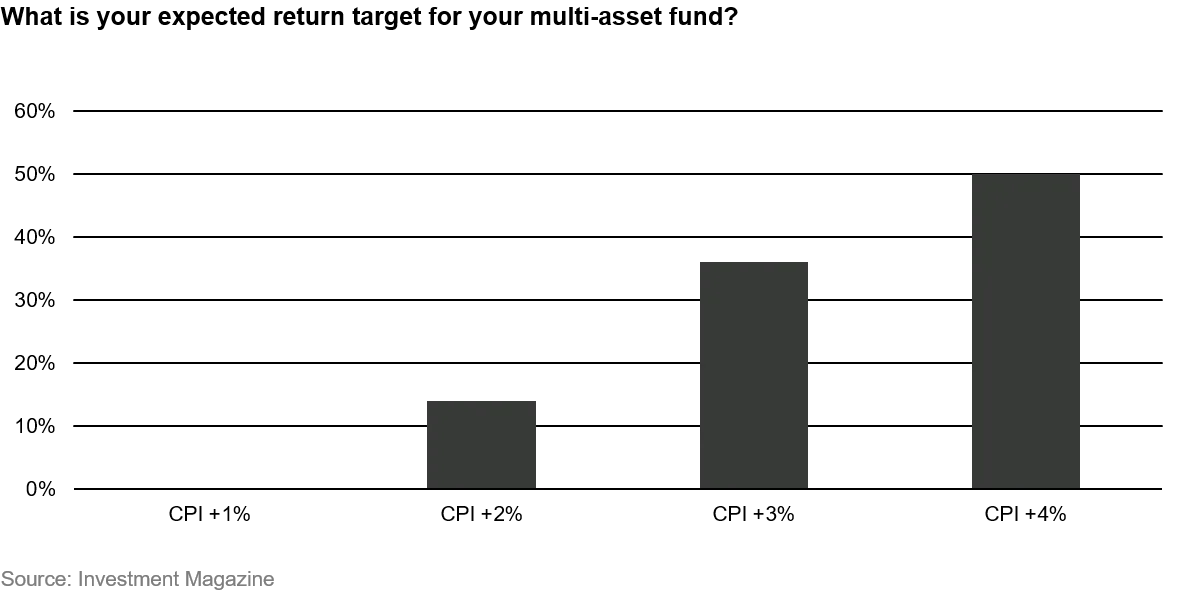

During the conference, participating asset owner representatives and consultants were asked what returns they expect from their multi-asset funds. Whilst half of the respondents indicated an expected return equal to the inflation rate (CPI) plus 4%, a good third expected a minimum return of CPI plus 3%.

Assuming a realistic long-term Sharpe ratio of 0.6, a portfolio has to take risk within a target volatility range of 5-7% to be able to achieve a return of CPI plus 3-4% – a struggle for many multi-asset portfolios, given the current environment of low interest rates. The remedy? Applying a flexible investment approach, we believe, one that allows leverage and dynamically manages investments in risk premia.

Another question discussed at the event was the objective of multi-asset funds. A good three quarters of the respondents think their multi-asset fund’s main objective is diversification.

Ingredient 1: get rid of complexity

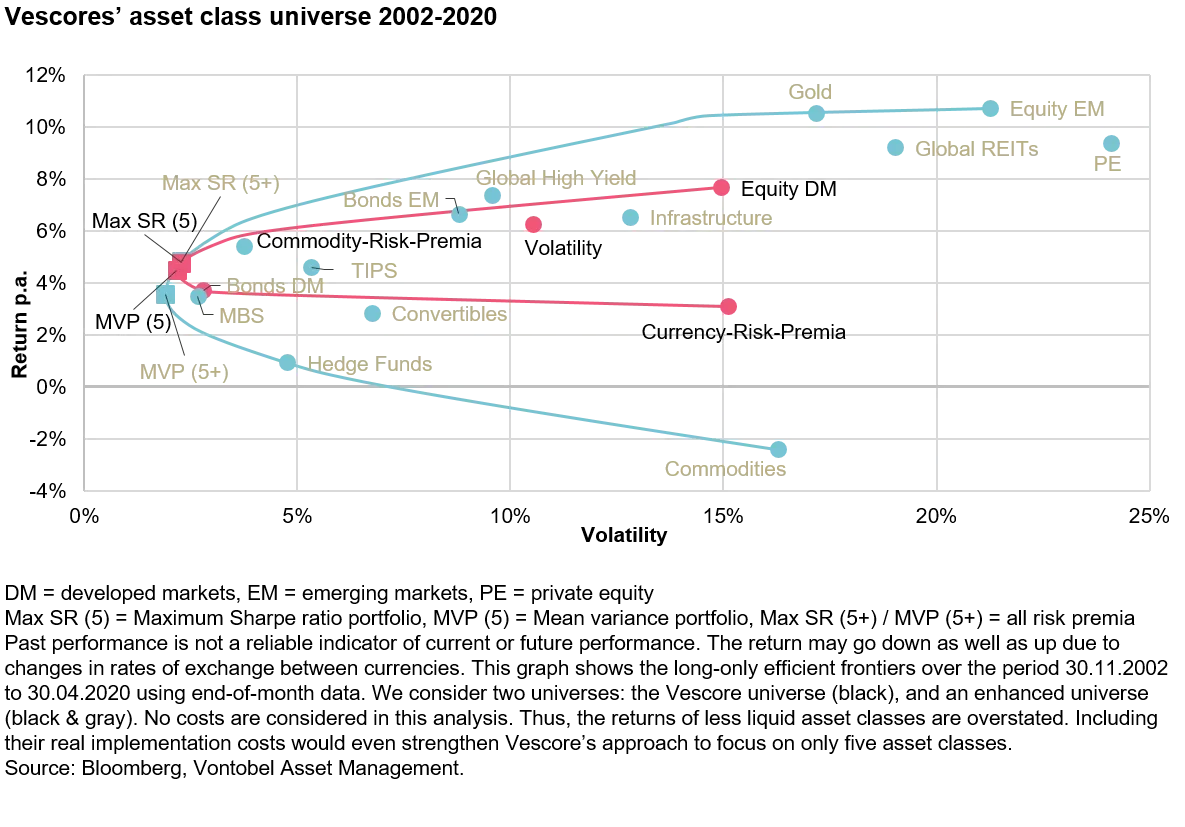

"Diversification is the only free lunch" reads Harry Markowitz’s famous statement. The US economist and originator of the modern portfolio theory was right. However, there are different ways to diversify a portfolio. From our standpoint, achieving excess returns requires a diversification focus, preferably on liquid risk premia investments with solid economic foundations and long-term tailwinds. As there are not many of these, the portfolio stays simple instead of complex. We are convinced that exposure to five risk premia is enough to build robust portfolios: traditional risk premia in equities and government bonds, plus alternative risk premia in commodities (market-neutral), volatility, and currencies (market-neutral). The graph below shows that over the past 18 years simple portfolios focusing on those five risk premia provided the same results as complex portfolios involving partially illiquid investments across all asset classes.

Ingredient 2: be flexible and use a system

Since the future market environment will probably be characterized by low interest rates and phases calling for caution, achieving a return of CPI plus 3-4% requires dynamic management of portfolio exposure in line with market movements. For this reason, we also tactically allocate exposure to the five risk premia. This we do with the help of quantitative models and risk management that has a tight grip on correlations. We are convinced that only a systematic approach, which avoids any emotional decisions, can generate stable, repeatable excess returns in the long term.