Vescore Global Market Outlook December 2023

Quantitative Investments

Key takeaways

- Risk environment: Resembling the 1980s, 2007 and 2018

- Economic Outlook: Tight Liquidity Impacts Growth Momentum

- Equities: Overweight reduction stopped in October

- Bonds: Overweight for the first time since May

False dawn or genuine Fed pivot?

Stock markets have surged in November following the Federal Reserve's early-month meeting, which was perceived as less hawkish than anticipated. Fed Chairman Powell signalled substantial progress on the inflation front, and that the recent tightening in financial conditions should be deemed comparable to additional tightening measures, making a compelling case for a genuine dovish Fed policy pivot. However, sceptics argue that this might be another instance of history repeating itself, with investors falling for yet another false dawn, a scenario witnessed multiple times during this Fed tightening cycle. Notably, even the challenges faced by the US banking sector in March failed to alter the Fed's policy course, and longer-dated US Treasury yields reached highs in October last observed in 2007.

The Fed's stubbornly clinging to policy tightening can be attributed to the resilience exhibited by the US consumer and banks. Even in the face of the housing market undergoing its most severe correction since the Great Financial Crisis, consumption has remained steadfast, prompting questions about whether the Fed has truly subdued inflationary pressures. However, the prevailing odds seem favorable for the bulls to maintain control, at least for the time being. Recent data releases following the Fed meeting in early November align with their stance. The US economy is showing signs of losing steam, as indicated by our business cycle model wave, suggesting a potential relapse into contraction. This signifies a gradual waning of consumer resilience. Moreover, inflation progress is becoming increasingly evident, with both US headline and core inflation surprising to the downside in recent developments.

Our allocation models align with the assessment of a rising probability of an imminent Fed pivot. The bond allocation model suggests a slight overweight in government bonds, marking a significant shift after six months of being underweight, indicating that easier policy ahead may push yield curves lower. Likewise, the equity allocation model ceased reducing the equity overweight in November, acknowledging the change in sentiment since early in the month. Key model variables, such as the term spread, persist at levels typically associated with an impending negative economic and financial market environment. However, in the current scenario, our equity allocation model interprets this, via market sensitivities, as a positive. This implies that the persistently gloomy economic outlook may prompt a genuine dovish Fed pivot. In other words, bad economic news is interpreted as positive for financial markets, as it strengthens the case for concluding the policy tightening cycle.

Risk environment: Resembling the 1980s, 2007 and 2018

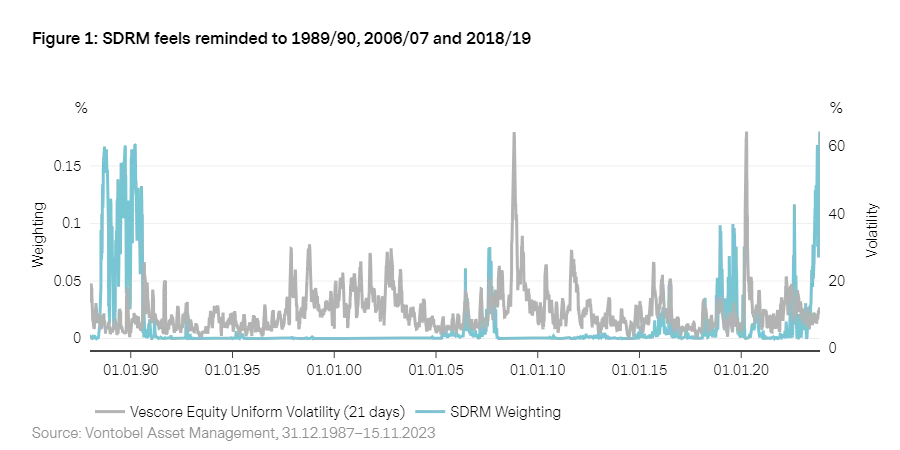

In recent months, our SDRM1 risk model has evolved beyond its traditional reliance on comparing the current risk environment solely with the late 1980s. While the 1980s remain a crucial reference point, we've acknowledged the increasing significance of other periods, such as 2006/07 and 2018/19.

1. More information on our SDRM model can be found in “

Risk Management: Forward on calm seas, adaptive and agile in stormy phases

”

2. Our SDRM model compares the current market environment with the past based on the dividend yield, credit spread, ted spread, term spread, short term interest rate and two volatility measures

Economic Outlook: Tight Liquidity Impacts Growth Momentum

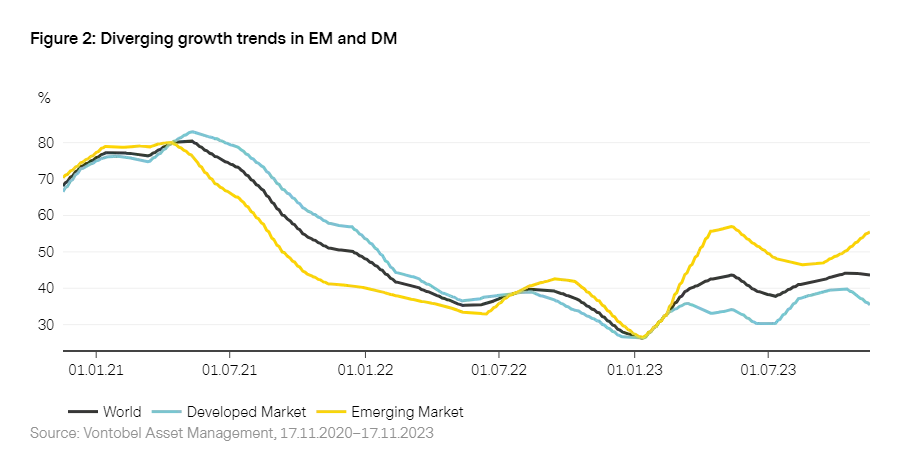

In recent weeks, the economic news flow has taken a negative turn, leading to a global relapse into contraction3, primarily driven by developed economies. This downturn is not totally unexpected, given that our forward-looking transition model assigned a 40% probability to a scenario involving a contraction relapse. From an economic sector perspective, the deterioration is primarily attributed to sentiment, characterized as "soft” economic data, encompassing factors like consumer sentiment and business confidence in several major economies. Despite the resilience of hard economic data, certain key components within this bloc remain weak, such as the banking sector, while others, like the labor market, have experienced a deterioration. This is occurring against the backdrop of historically tight global liquidity conditions.

Developed Markets: US economy experiencing a relapse to contraction

The growth outlook for developed markets has worsened in November, with the entire region slipping back into contraction. Sentiment data, including business and consumer sentiment, weakened in late October and November as labor market conditions eased, and the effects of the persistent high interest rate environment gradually set in. While the US economy has exhibited significantly stronger growth momentum compared to the Eurozone in recent months, now the US seems to be losing steam. This is echoed by the US Atlanta Fed now-cast, which showed GDP growth above 5% in October but dropped sharply to 2.5% in November.

Emerging Markets: More solid growth momentum

In contrast to developed markets, emerging markets have witnessed an acceleration in growth momentum in recent months, with all regions currently in expansion. China's fresh autumn stimulus not only supported the Chinese wave in recent months but has also garnered increased confidence from economic forecasters, with consensus growth estimates aligning with China's 5% growth target. Beyond Asia, growth momentum has been even more robust in emerging markets, particularly in Latin America, which has experienced the most solid growth trajectory within the emerging market space in 2023. A significant contributing factor for the entire region has been proactive policy tightening between 2020 and today, fostering currency stability and providing regional central banks with room to consider easing measures in the upcoming quarters.

3. For further detail see “ The Vescore Wave – a superior business-cycle model ”

Equities: Overweight reduction stopped in October

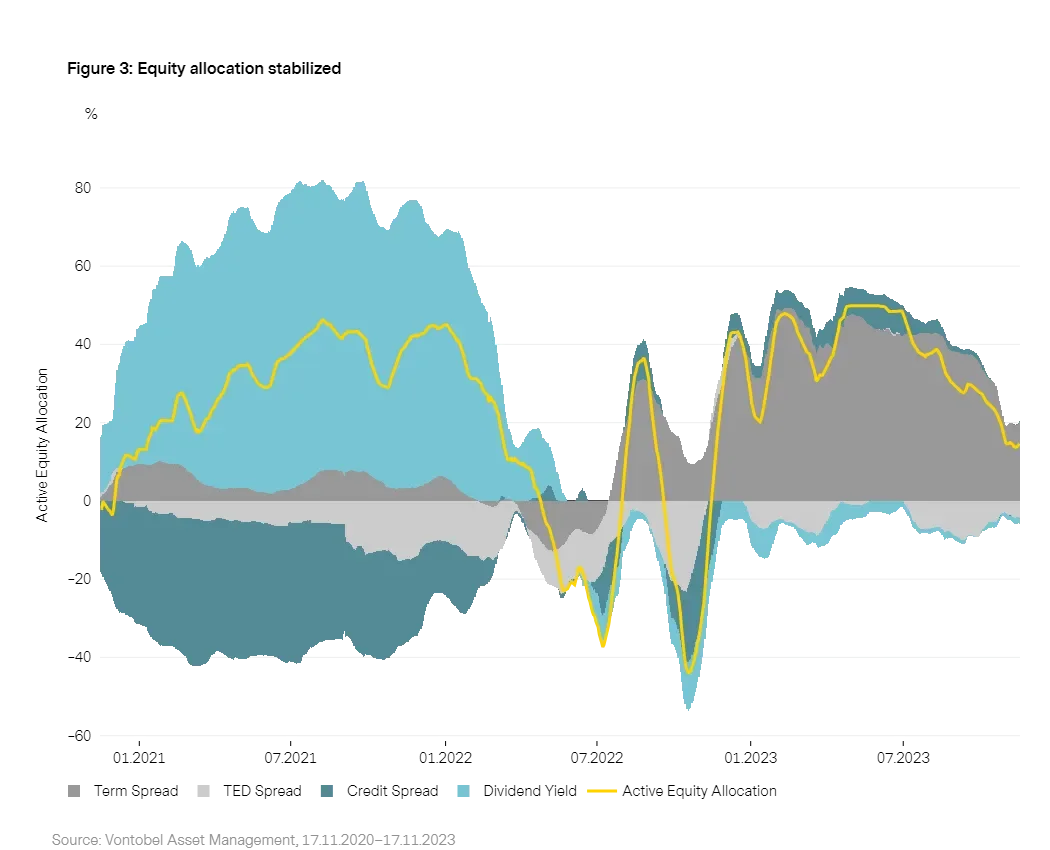

After steadily reducing the equity allocation since July, transitioning from a high to a moderate equity overweight, this trend came to a halt in early November (see Figure 3). Over the past months, the diminishing equity overweight can be attributed to a declining positive contribution of the term spread. This observation is noteworthy given the backdrop of negative economic news flow in developed markets during November, which led to a renewed decline in the term spread—a development traditionally associated with a negative economic market sentiment.

Interestingly, market sensitivities to the term spread became even more negative during the same period. This suggests that the market is interpreting the increasingly negative term spread as an even more positive development4. Indeed, following the November 1st Fed meeting that was more dovish than anticipated, coupled with weaker economic data in November, the Fed communication gained credibility, resulting in support for riskier assets and a cessation of the reduction in equity allocation.

4. Simply speaking the equity allocation contribution of the term spread (currently positive) is the product of the currently negative term spread and the currently negative market sensitivity to the term spread.

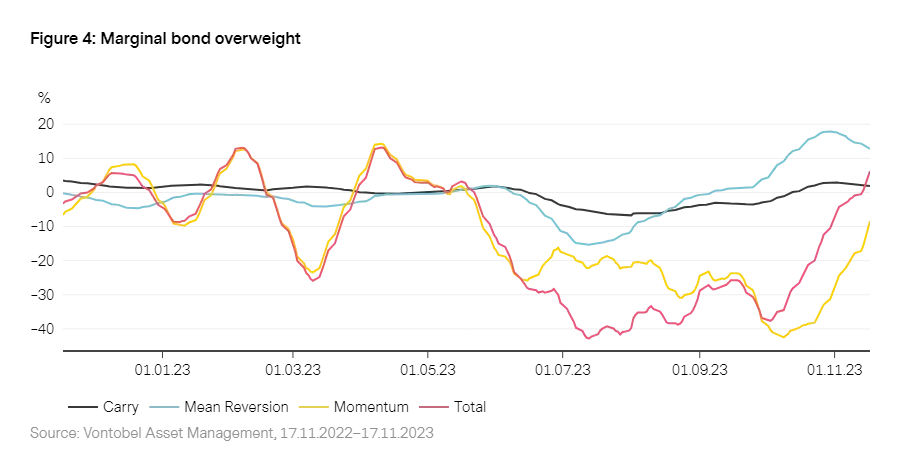

Bonds: Overweight for the first time since May

In a notable shift, our bond allocation model has turned constructive on government bonds for the first time since May 2023 (see Figure 4). The impetus behind this significant allocation increase has been the forceful momentum component, which has outweighed the comparatively less positive mean reversion contribution. This adjustment comes amid a bond rally since mid-October, while the slightly positive carry contribution has remained relatively stable. Geographically, the model maintains a pronounced underweight position in North America but favors an overweight position in Europe, including the UK.

The momentum component of our bond allocation model reflects the prevailing market sentiment since the last Fed meeting in early November, which proved to be more dovish than anticipated. Weaker economic data in developed markets, coupled with downside surprises on the inflation front thereafter, has bolstered the market narrative of an increasingly dovish policy stance of the Fed and momentum.

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index. Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.