Vescore Global Market Outlook September 2023

Quantitative Investments

Key takeaways

- Risk environment: Limited systematic risk in China

- Economic outlook: Recovery on shaky ground

- Equities: Equity reduction continues

- Bonds: Negative momentum still intact

How forceful will the Fed fight inflation?

It has been a rough August for investors with the S&P 500 giving up 25% of its 2023 gains. Surging bond yields have been the main sources of risk aversion. However, it is not the near-term monetary policy outlook, but the medium to longer term, as the repricing of rate expectations has been much more aggressive for 2024 and 2025, with end 2024 Fed Funds Futures rising to a new high of 4.6% from 2.6% in May 2023 (current policy rate: 5.5%). Two developments are currently driving this shift in rate expectations:

First, recession risks have fallen in countries such as the US. This does not mean that the recession is not coming1 and cracks in the regional US banking sector in March and China’s real estate woes in August have shown that tighter global monetary policy conditions are slowly biting into the world economy. But the resilience of the consumer2 and the fallen vulnerabilities of systemic relevant banks3 over the years argue for a rather mild recession.

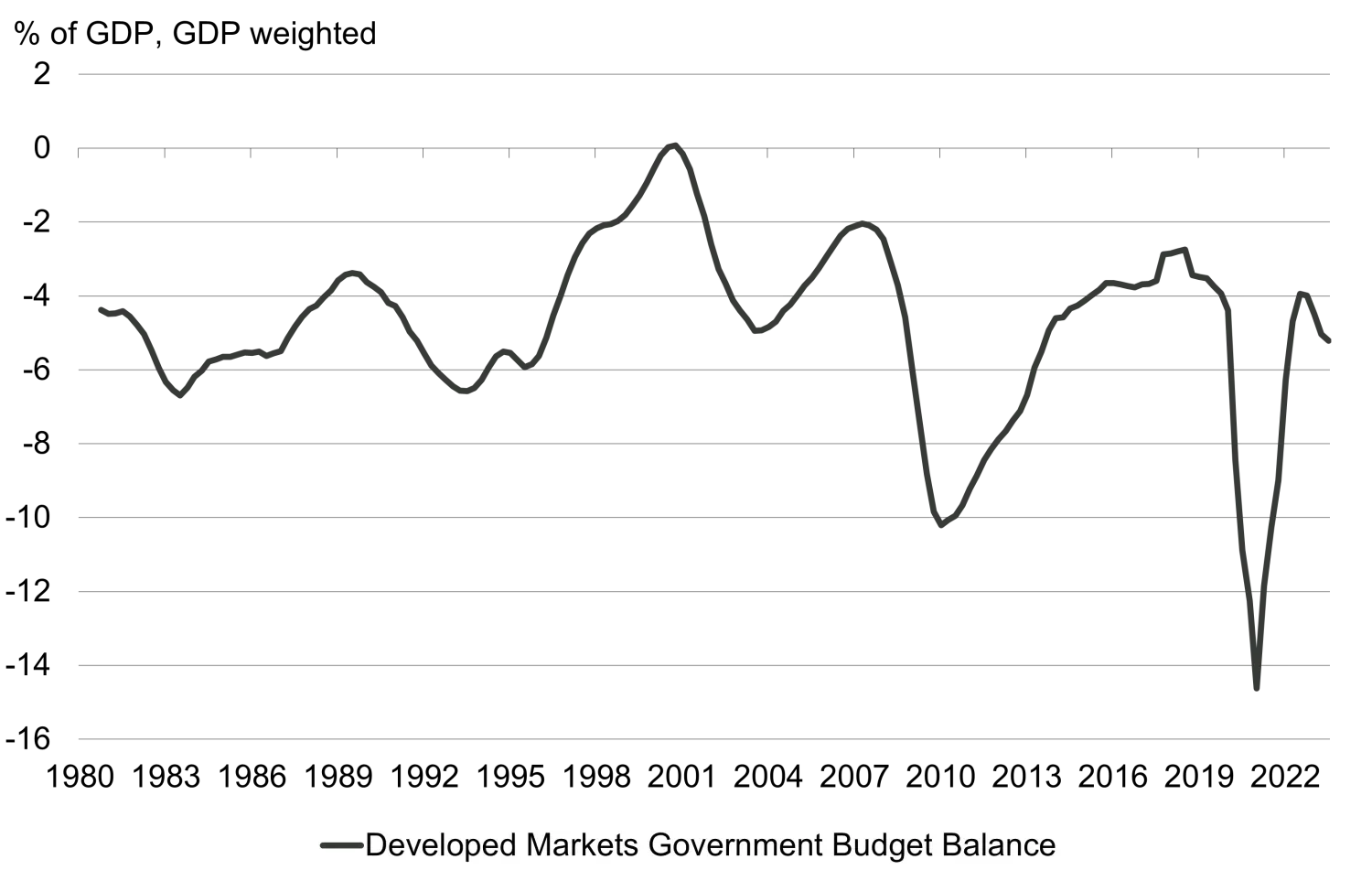

Second, the emergence of a positive fiscal impulse makes Central Banks’ fight against inflation a daunting task4. In the US, the rising budget deficit (currently -6.7% of GDP) and rising Treasury issuance are raising investors’ concern that inflation will remain higher for longer5. Moreover, as higher budget deficits and debt issuance come at a time of already high debt levels and a higher yield environment, questions regarding debt sustainability are justified. One possible way to get down from debt mountains is to allow for a bit higher inflation6, therefore reducing the real debt burden.

Both economic trends have affected our bond and equity allocation model. While our bond allocation model has increased its underweight even a bit further in August, the reduction of our equity allocation model came from an overweight position. The reason for the models’ more constructive equity outlook comes from the fact that a lower recession risk comprises not only the equity negative element of a rising discount factor (higher yields) but better growth prospects – reflected by our Developed Market Wave – as well. As recession risks have fallen and are not imminent, our models prefer equities over bonds.

Source: Vontobel Asset Management

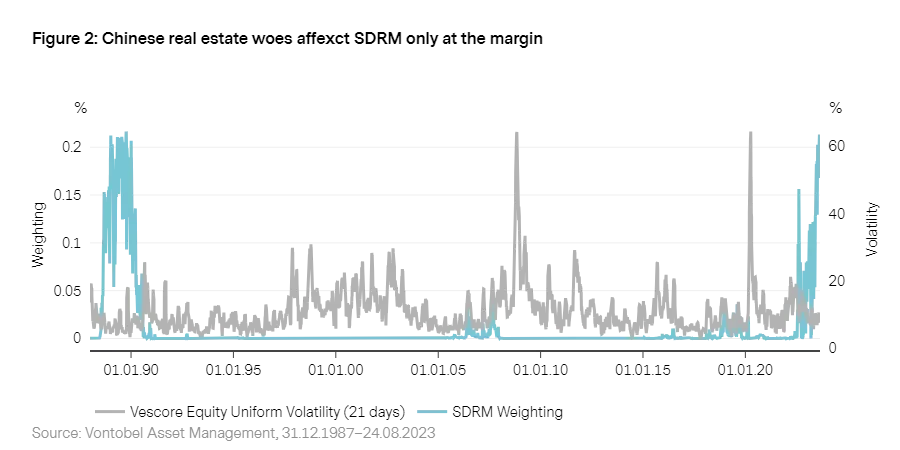

Risk environment: Limited systematic risk in China

Our risk model, SDRM,7 sticks to the comparison of the current environment with the late 1980s. However, similarities with the 2007/08 period increased slightly in August. Like March 2023, when rising banking sector stress in the US and Europe triggered the comparison, stress in the Chinese real estate market and shadow banking system contributed to the comparison this time.

What has happened? Cracks in Chinese real estate and the shadow banking industry came to the surface in August. Not only the potential Country Garden default – the company is still in the so-called grace period – made it in the headlines and undermined sentiment. But spillovers from real estate woes into the shadow banking system gained more attention as well. In this regard, suspended payments on its products by the Wealth Management arm of the privately owned Zhongzhi Group raised questions about the sustainability of real estate developers’ debt and possible contagion risks into the banking sector. However, the still small flare up suggests that our risk model attaches only a small probability to systematic banking sector stress comparable to 2007/08.

7. More information on our SDRM model can be found in “Risk Management: Forward on calm seas, adaptive and agile in stormy phases”

Economic outlook: Recovery on shaky ground

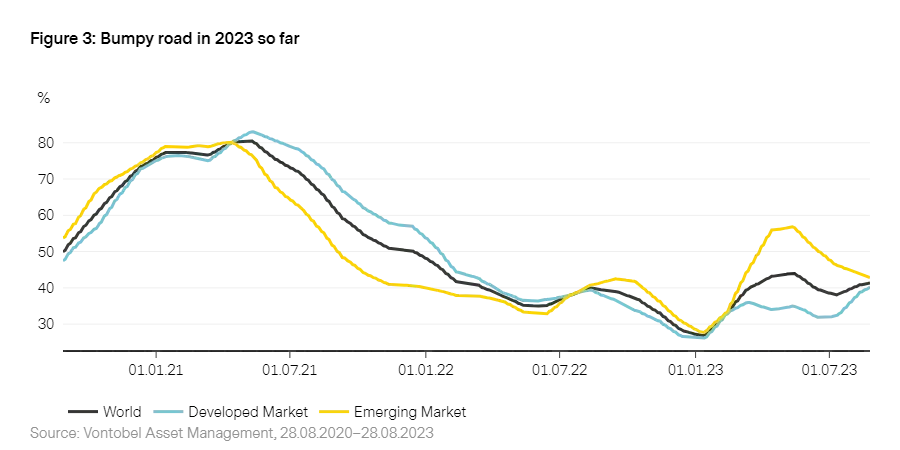

2023 has been a roller-coaster so far in economic terms. After a good start and broader based recovery signals, data deteriorated during the second quarter on the back of banking sector stress in developed markets and the clogged monetary policy transmission channel in China (Figure 3). While the Chinese economy keeps struggling to transmit stimulus into growth and therefore dragging emerging markets into contraction, developed countries seem to be getting back on their feet again. With 41% of processed economic time series improving, the world economy re-entered a recovery state. But as our preferred measure of global liquidity still points to tight monetary conditions, the probability of the world economy to relapse into contraction (49%) and therefore recession risks8 remain high. In other words, the economic recovery is on shaky ground.

Developed markets: US emerges from a technical recession

Developed markets seem to have recovered from banking sector woes in late March and re-entered a recovery state. However, from a country perspective the picture remains mixed with the Euro Zone and in particular the US (+9%-points) among the winners and Asia Centric countries such as New Zealand and Australia among the weaker countries. An in-depth analysis of the underlying indicators reveals that soft or sentiment data has been in the driver’s seat of the fresh recovery signal. After historically low readings, all countries – except for the UK and Australia – experienced rising consumer sentiment. This is surprising, considering rising real financing costs, but should be seen as a reflection of the still high consumer resilience9. Despite deteriorating labor market conditions in developed markets, indicators such as unemployment rates remain close to historical lows.

Emerging economies: Stronger growth momentum in LATAM and EMEA

Diverging growth trends do persist within emerging markets, with Asia (Contraction) underperforming EMEA (Recovery) and LATAM (Expansion). China remains a headwind for the Asian region. Despite monetary and fiscal policy support, Chinese data releases remain disappointing, with real estate and banking activity once again weaker after an improvement earlier this year. In addition to weaker demand from developed markets, weak private sector demand for credit makes policy stimulus less efficient. The housing market downturn, which started approximately three years ago, undermined balance sheets of corporates and households, to some extent weighing on consumption and investments.

8. Details on recession probabilities derived from our models can be found in the

August edition of the GMO

9. Details on our analysis of the consumer resilience can be found in the

July edition of the GMO

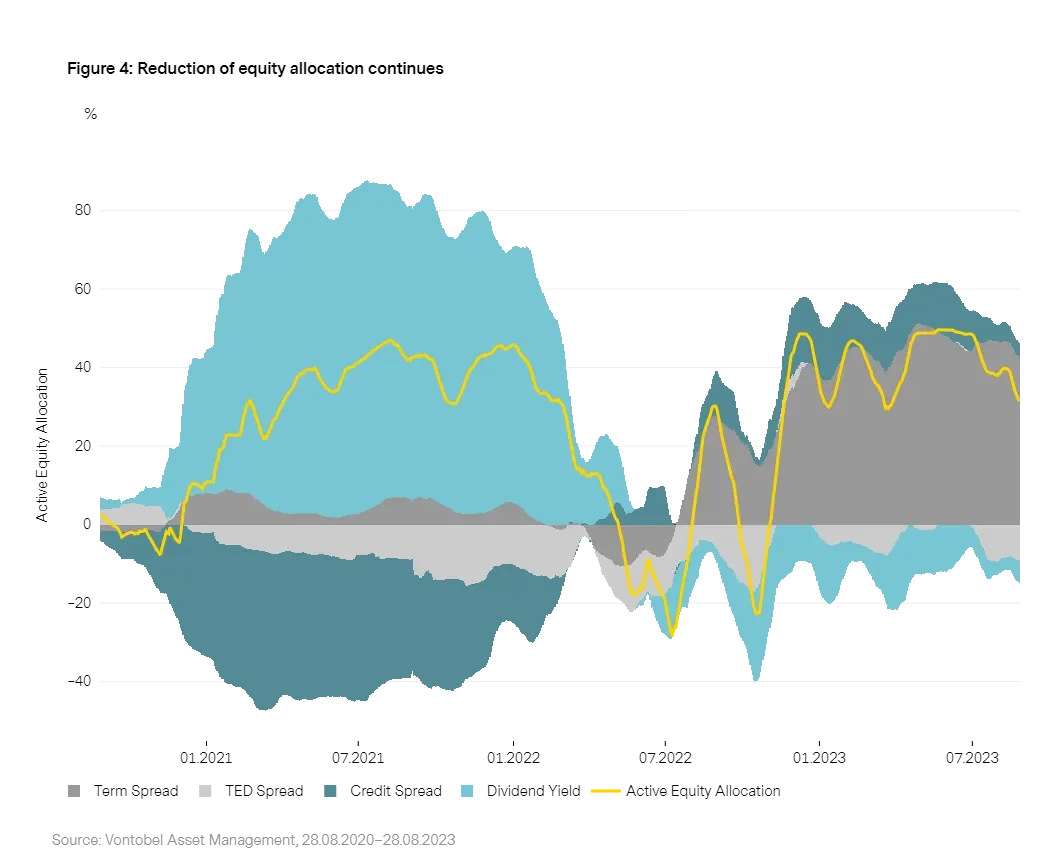

Equities: Equity reduction continues

Our equity allocation model, GLOCAP, has reduced its equity allocation further over the last few weeks (Figure 4) after running a maximum equity allocation until late June 2023. The reduction has been driven by all four (Term Spread, Ted Spread, Credit Spread and Dividend Yield) factors. Interestingly, the reduction can be attributed to a lesser extent to changes in the indicator level, but rather to the change in underlying sensitivities. Falling sensitivities can be interpreted as a lower conviction of the model.

Two developments have undermined risk sentiment, and therefore correlations and sensitivities, lately: First, the release of disappointing economic data out of China and policy response to it. Second, investors’ rising concern that Central Banks are subject to the temptation of living with above 2% inflation, as this would be one way to deal with high government debt. The rise in Treasury issuance in an environment of higher US yields are the fertile soil of these concerns.

Bonds: Negative momentum still intact

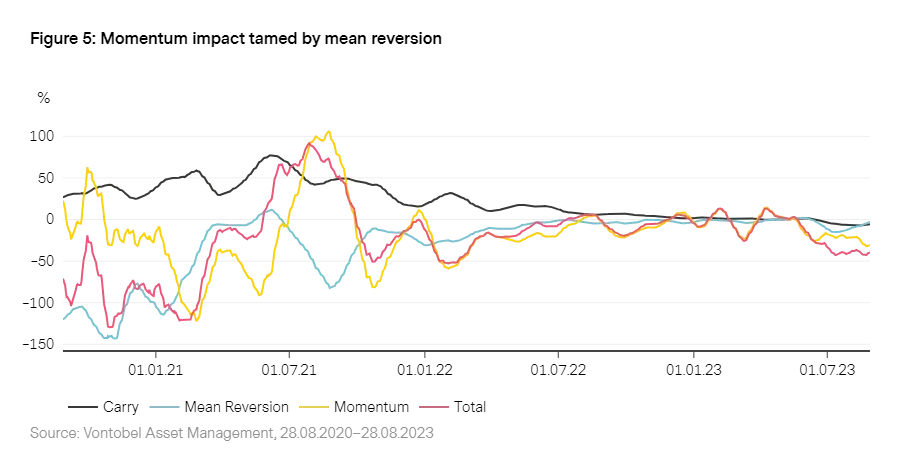

Our Bond allocation model, FINCA, has reduced its bond allocation since May. However, recent reduction has been driven mainly by the momentum model (see Figure 5). As yield levels are rising to more extreme levels compared to recent history, the mean reversion element of our bond allocation model is moderating the effect of the momentum element. From a country perspective, two thirds of the underweight are currently taken in US and Canadian government debt.

In addition to Investors’ concerns that Central Banks may allow higher inflation in the future in order to deal with debt burdens, the economic resilience of the US has moved recession risks to the background and therefore lowered recession risks driven flight to safety. Thereby supporting the positive yield momentum, which is currently driving the underweight. The aim of BRIC countries to decouple from the US Dollar is another longer-term subliminal trend, which however made it in the headlines again in August as the BRIC summit took place in South Africa in late August.

1. In the

August edition of our GMO

we showed that most of our models signal that we are slowly approaching the phase in which a recession becomes more likely.

2. See the

July edition of our GMO

.

3. In the

April edition of our GMO

we showed our Developed Market Banking Sector Vulnerability model and concluded, that systemic risks have significantly fallen since the Great Financial Crisis in 2007/08

4. A sustainable victory over inflation usually requires synchronicity of monetary and fiscal policy.

5. In a

2022 research report

we have highlighted that structural inflationary pressure has increased and that the sustainable return to the 2% target within 2-years seems unlikely without a recession.

6. See Vontobel (2019)

“Modern monetary theory – how do we get down from the debt mountain?”

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index

Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.