Conviction Equities

Concentrated and fundamentally driven high-conviction equity portfolios managed by four teams specialized in emerging markets, impact investing, thematic investing, and Switzerland.

By the end of this historical election year, nearly half of the world’s population is expected to have voted for their respective leaders. In the world’s biggest economy, the race has yet to be decided. What might a second Donald Trump term mean for net zero if he were to be re-elected?

The Republican and Democratic parties in the US hold contrasting stances on climate change, the energy transition, and ESG. Trump’s first presidency saw significant actions against climate policies: withdrawal from the Paris Agreement on climate change, rejection of the National Climate Assessment’s finding1 that climate change is primarily caused by human activities and risks negative effects on the economy2, rollback of numerous climate-related regulations3, and attempts to ban ESG considerations in private-sector retirement plans4 among them. Trump characterized ESG as “radical-left garbage5 and has vowed to continue opposition6.

For investors, this underscores the importance of thorough analyses of both politics and policy. That may help distinguish rhetoric from political reality. While Trump’s campaign may signal a rollback on ESG initiatives, the reality is often more nuanced. We believe that once the dust settles, drastic changes are poised to be less common than feared.

For one, the conservative think tank "The Heritage Foundation" has pledged to advance its “Project 20257", aiming to roll back President Joe Biden’s environmental policies, including the landmark Inflation Reduction Act (IRA). While some investors worry about the potential reversal of green policies, we think the substantial financial commitments already made by both the US government and the private sector render dismantling these initiatives challenging. Billions of dollars have been spent under the IRA, which stands as established law, and undoing such firmly settled policies would likely encounter significant backlash and logistical hurdles.

We believe Biden’s IRA law will remain intact. Notably, many Republican states have reaped the benefits of ESG investments. Texas is the No. 1 US state for clean energy production, according to the Environment Texas Research & Policy Center8, demonstrating that renewable energy’s economic benefits can cross party lines.

Some three-quarters of the investment in clean energy manufacturing pledged since the IRA was passed is slated for states with Republican governors, according to a JPMorgan analyst note dated May 7, 20249. In fact, the JPMorgan analysts point out that Republican states lead the way in clean energy implementation, receiving 80 percent of all funding, with Georgia, Texas, and Oklahoma as top recipients. Texas counted the most new solar installations in 2023, surpassing California for the second time in the last three years, followed by Florida, the note said. Texas, Oklahoma, and Iowa ranked in the top three states for wind installations.

Another reason we believe it’s unlikely that Trump will change the IRA is that a big portion of the IRA’s incentives are tax credits (uncapped, in many cases), so reverting them back would imply increasing taxes, which is not usually something Republicans like to do.

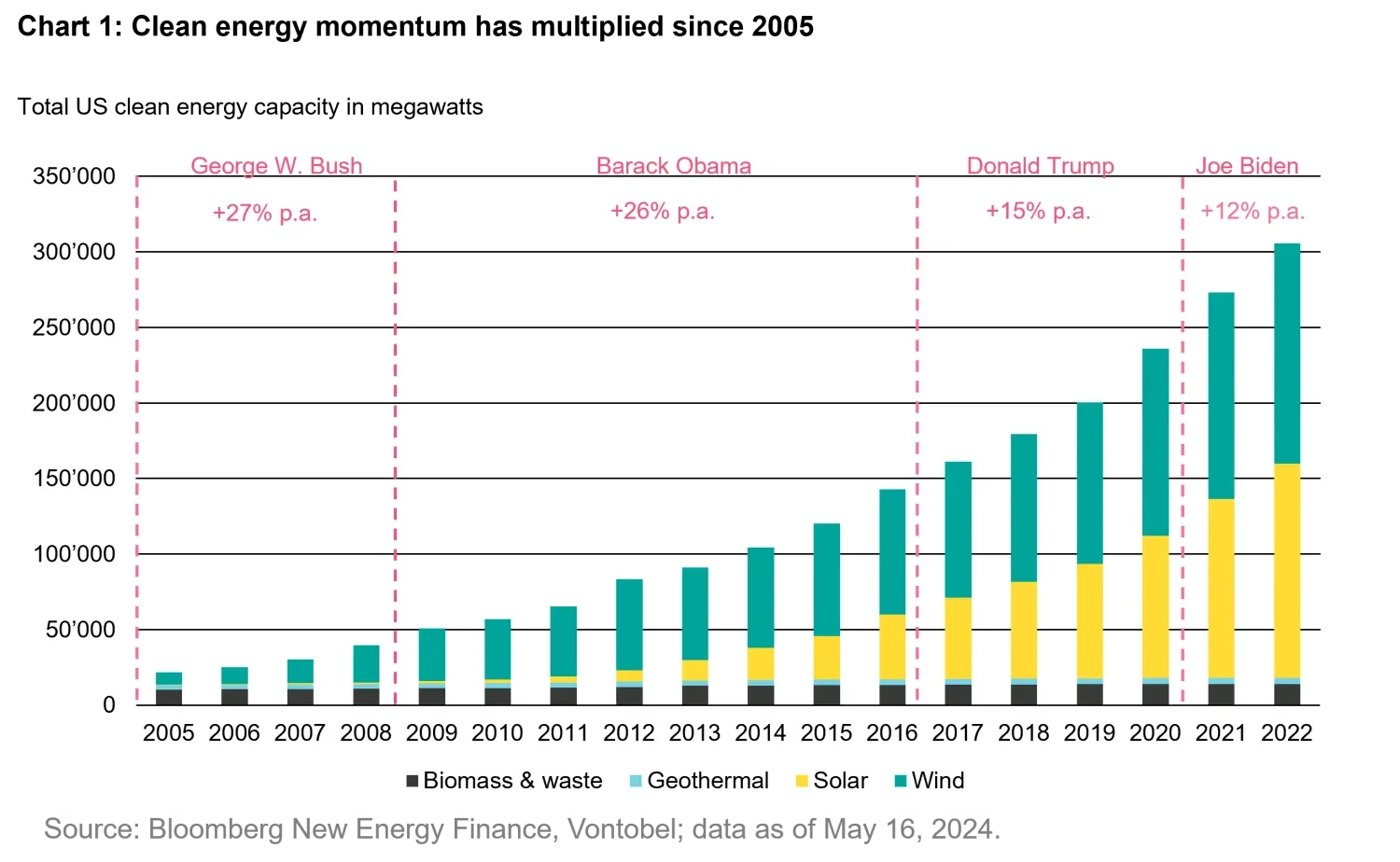

In addition, history shows that strong drivers for the energy transition persist, no matter which party is in power. US clean energy capacity grew during both Republican and Democratic administrations, with slightly stronger growth rates under Trump compared to Biden (see chart 1). This suggests that market forces and technological advancements, rather than political agendas, primarily drive clean energy adoption.

The trend towards electrification, clean energy, and energy efficiency will likely prevail as a long-term force even if policy support and subsidies were to fall by the wayside. And new technologies related to renewable power, building solutions, and electric vehicles are competitive: Over the past decade, the cost of solar and onshore wind energy has plummeted by more than 80 percent and nearly 70 percent, respectively10", making them viable options regardless of federal policy. Solar is even poised to overtake fossil fuels as the main electricity source in the world by 2050, according to a study published in Nature Communications in October 2023, which called it an “irreversible tipping point.”11

Indeed, there is evidence of exponential change across the energy system, with renewables, electrification, and energy efficiency as the main drivers, according to a Jefferies analyst note dated June 13, 202412. Cumulative solar installations have doubled 10 times since the 1970s and wind has doubled six times over the past two decades, according to the note. It also added that for every doubling in deployment, cleantech costs have fallen by about 20 percent, with prices down by some 80 percent in this decade alone. This economic shift translates into a long-term growth driver for companies working on scalable environmental solutions, in our opinion.

Current election uncertainty may bring market volatility, but also investment opportunities. Temporary market disruptions can create favorable entry points for long-term investments in clean energy and transition technologies. In our view, the growth and expansion of renewable energy infrastructure is poised to continue regardless of the election results. We believe the economic advantages of renewables—such as lower operational costs and technological advancements—are significant, and hence we consider them difficult for any administration to ignore.

So while some investors might come under more political pressure to tone down their ESG commitments, the overall momentum towards a cleaner economy is strong. The entrenched nature of current green policies, significant financial investments already made, and the economic viability of renewable technologies suggest that the trend towards low-carbon solutions will continue, making the potential impacts of a second Trump term less dramatic than the rhetoric might suggest.

1. Source: BBC article published November 26, 2018. https://www.bbc.com/news/world-us-canada-46351940

2. Source: Fourth National Climate Assessment, https://nca2018.globalchange.gov/downloads/

3. Source: New York Times article published January 20, 2021. https://www.nytimes.com/interactive/2020/climate/trump-environment-rollbacks-list.html#:~:text=The%20bulk%20of%20the%20rollbacks,wetlands%3B%20and%20withdrew%20the%20legal

4. Source: Morningstar article published December 15, 2022. https://www.morningstar.com/portfolios/retirement-plans-become-new-battleground-esg

5. Source: Donald Trump’s social media post on Truth, February 24, 2023. https://truthsocial.com/@realDonaldTrump/posts/109920978509261496

6. Source: Bloomberg article published February 25, 2023. https://www.bloomberg.com/news/articles/2023-02-24/trump-adds-his-voice-to-republicans-condemning-esg-investing

7. Source: Project 2025 Presidential Transition Project, Mandate for Leadership – The Conservative Promise, https://static.project2025.org/2025_MandateForLeadership_FULL.pdf

8. Source: Environment Texas Research & Policy Center, October 11, 2023. https://environmentamerica.org/texas/center/media-center/clean-energy-continues-meteoric-rise-in-texas/

9. Source: JPMorgan analyst note, “2024 US Election Watch – Implications for Commodities”, published May 7, 2024.

10. Source: International Renewable Energy Agency, published August 29, 2023. https://www.irena.org/News/pressreleases/2023/Aug/Renewables-Competitiveness-Accelerates-Despite-Cost-Inflation#:~:text=Between%202010%20and%202022%2C%20solar,the%20cheapest%20fossil%20fuel%20globally.

11. Source: Nature Communications, «The momentum of the solar energy transition”, published October 17, 2023. https://www.nature.com/articles/s41467-023-41971-7

12. Source: Jefferies analyst note, “Harnessing the power of S-curves across the energy transition w/ RMI”, published June 13, 2024.