Judgment Call: Looking behind the numbers to identify real quality

Quality Growth Boutique

Key takeaways

- We believe the best investment decisions are made by using financial metrics combined with fundamental research.

- In our view, using only a data driven approach can miss unseen risks and overlook the underlying quality characteristics of companies.

- Structural shifts in industries and macro dislocations can drive companies further into or away from quality territory. Judgment is necessary to understand what is supporting a business or weighing it down.

- As market conditions change, we expect opportunities may be created for active investors who use judgment-based assessments of underlying quality.

In quality investing, crunching numbers can only get you so far. It can be hard to understand the sustainability of a company’s growth trajectory or how wide a company’s competitive moat might be, based on its financial statements. Historical financial metrics, while useful, will not provide much insight into the cohesiveness of the management team or the real potential of its latest technological development. These are assessments that require judgment and conviction.

Judgment can sometimes be mistaken for intuition or gut instinct, but in our view, it is a nuanced skill honed with experience and expertise. It’s the ability to take analysis of pure financial metrics as a starting point for a research-intensive process that gets under the hood of a company and the ecosystem in which it operates.

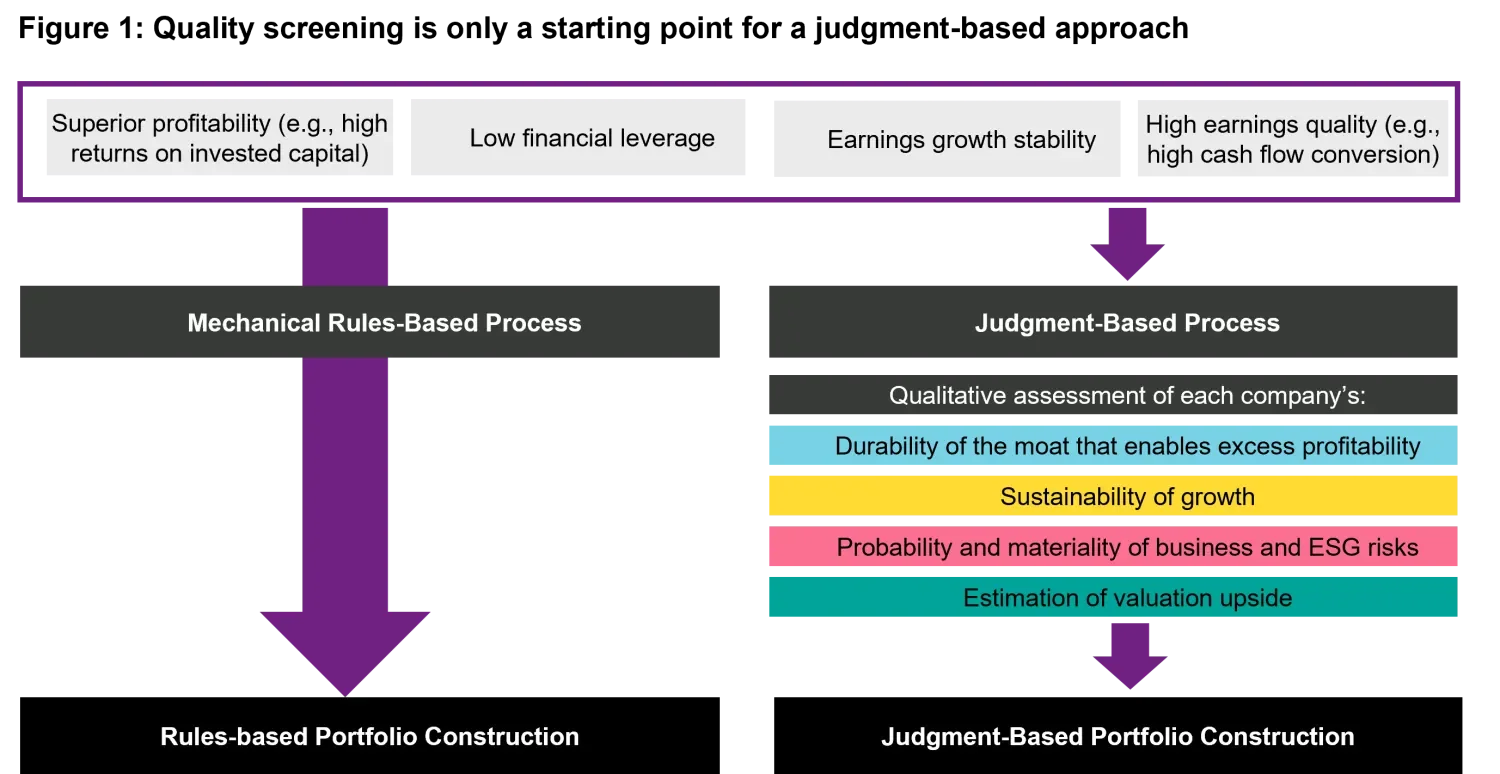

The result is a decision based on the evaluation of all available information – both quantitative and qualitative. That’s why we think this active approach is the best way to invest and seek to compound clients’ capital. In contrast, a mechanical rules-based approach is predominantly based on historical financial performance (Figure 1).

Judgment can answer questions to help reduce risks

A pure focus on quantitative data can identify high-performing companies but can also miss the warning signs that an investor exercising good judgment would recognize. An inherent flaw of a rules-based methodology is that it does not attempt to forecast bad outcomes, while a judgment-based approach uses bottom-up research to weed out companies that may lose their ability to earn excess profits in the future.

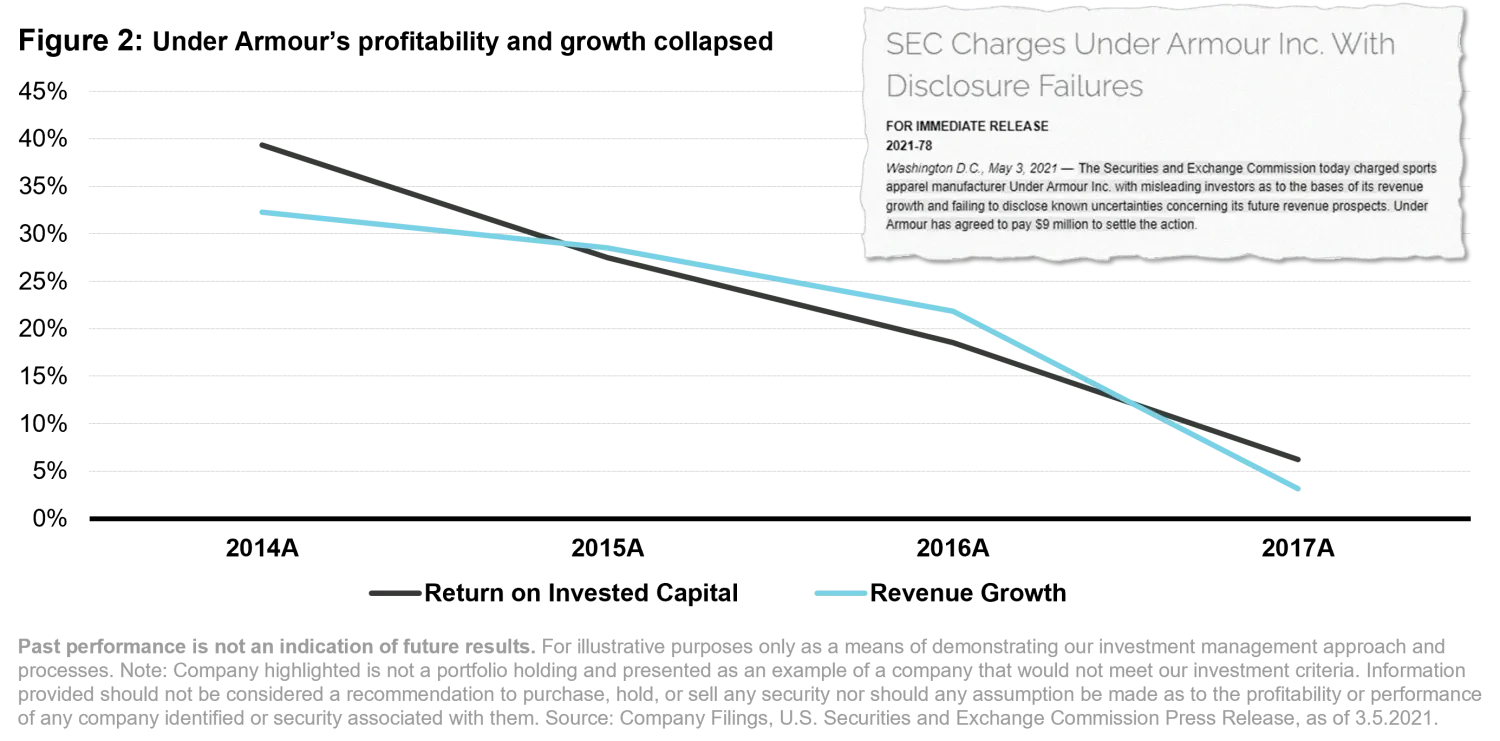

A good example is sporting goods and apparel company Under Armour. Between 2010 and 2014, the company had an impressive average return on invested capital of 38 percent, average revenue growth of 29 percent, and net debt to equity of only 10 percent. From a purely mechanical standpoint, Under Armour was a standout performer with the quantitative hallmarks of quality.

However, from 2014 to 2017 (Figure 2), the company’s profitability and growth steadily collapsed. Why did a company that looked good on paper then struggle?

As a fashion company, Under Armour, by definition, is subject to fluctuations in style preferences. The rapid growth it experienced, hitting USD 4 billion in revenue and a mid-single-digit market share, was difficult to sustain. Its growth slowed due to intensifying competition from other sportswear brands, including market leaders like Nike, Adidas, as well as emerging brands such as Lululemon. There were also question marks over management competence, as Under Armour entered footwear and fitness apps, taking focus away from its core apparel business. Lastly, signs of aggressive accounting gave us pause as to whether Under Armour could maintain its position as a quality company.

Under Armour is a classic example where using judgment was essential to help us avoid the risks that were lurking below the surface.

Judgment can identify quality companies that may not pass through a screen

If a focus on company data can miss the unseen risks, then the inverse is also true: a mechanical approach to analysis can sometimes overlook the underlying quality characteristics of companies.

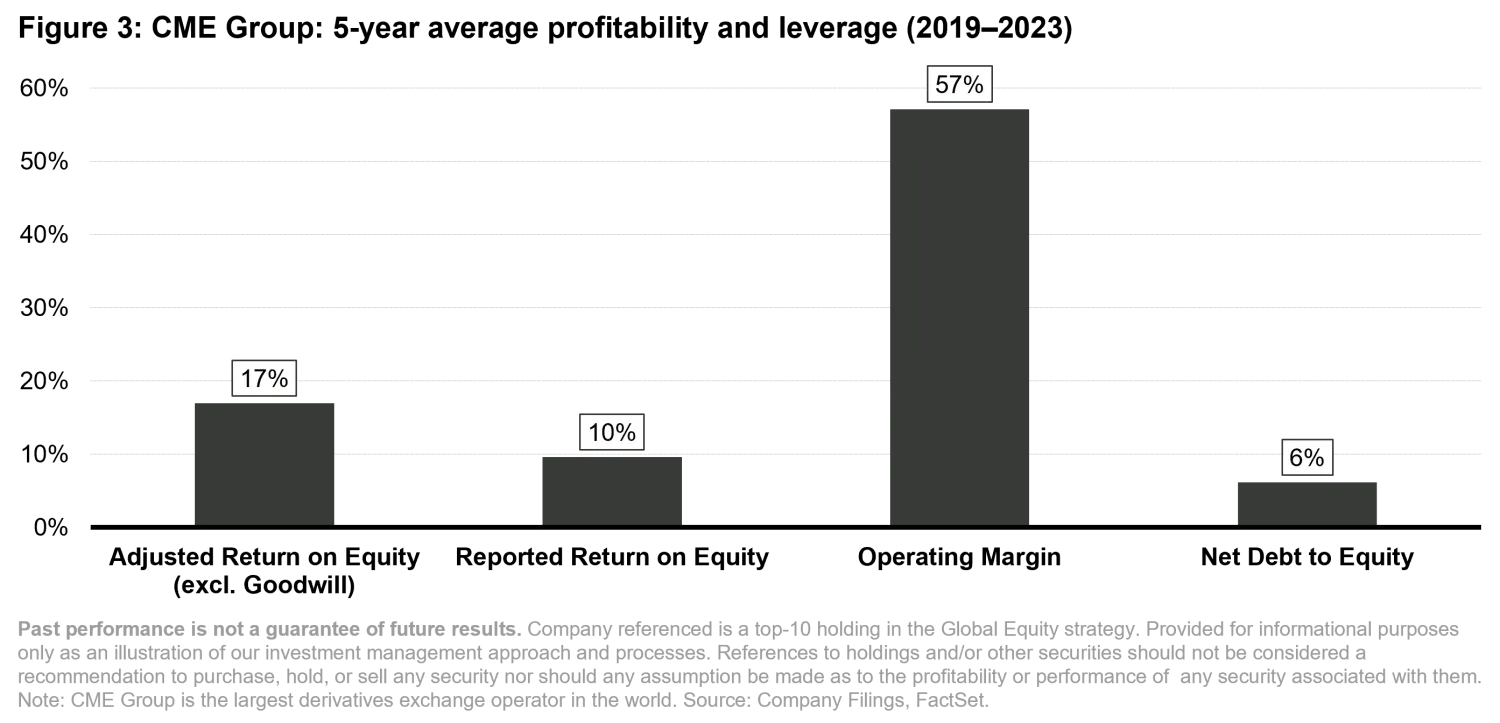

CME Group is a financial services company that operates derivatives exchanges. Its virtues do not shine through in the basic raw accounting data used by a mechanical screen. For instance, reported accounting ROE is low at 10 percent.

A diligent investor has to roll up their sleeves and take a closer look at what the company does and how it operates. The equity on CME’s balance sheet is intangible as a result of past acquisitions. The company’s’ return on tangible equity is very high because it has a dominant position in many of the contracts traded on its platform.

Judgment enabled us to conclude that CME Group is a quality company with a wide competitive moat that can be resilient when other businesses are struggling.

Quality transitions over time can present opportunities for active, judgment-based investors

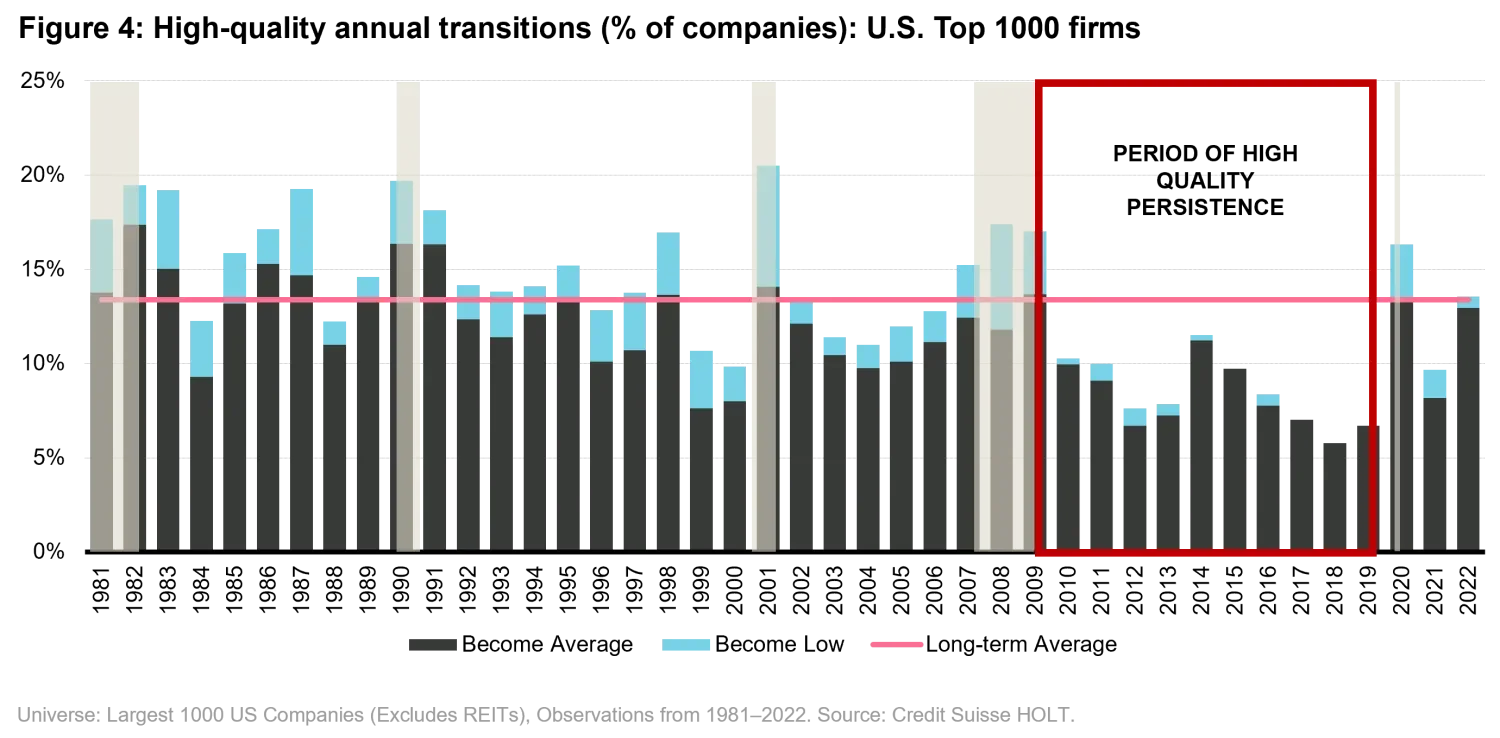

Risks and opportunities affecting a company’s quality are frequently not within its control. Structural shifts in industries and macro dislocations can drive companies further into or away from quality territory. One example is mainstream media companies that were considered quality businesses until they became less relevant and less profitable with the proliferation of the internet. Judgment is necessary to understand what is supporting businesses or weighing them down.

Between 2010-2019, there was a noticeable downshift in the number of high-quality companies that became less high-quality over time (Figure 4). This coincided with a period of low interest rates combined with low and stable inflation. There was a lack of major economic shocks, and few structural shifts in industries over this period. As a result, companies remained in the quality category due to artificial support, and the value of judgment appeared less important.

The monetary policy backdrop did not let the laws of economics play out naturally. Companies spent less on R&D because they focused on share buybacks and therefore took less risk. The regulatory regime was also more relaxed with less antitrust enforcement.

But now market conditions and dynamics are changing. That means a potentially better environment for active investors as it creates the opportunity for judgment-based assessments of underlying quality.

Using judgment involves paying close attention when markets look past valuations

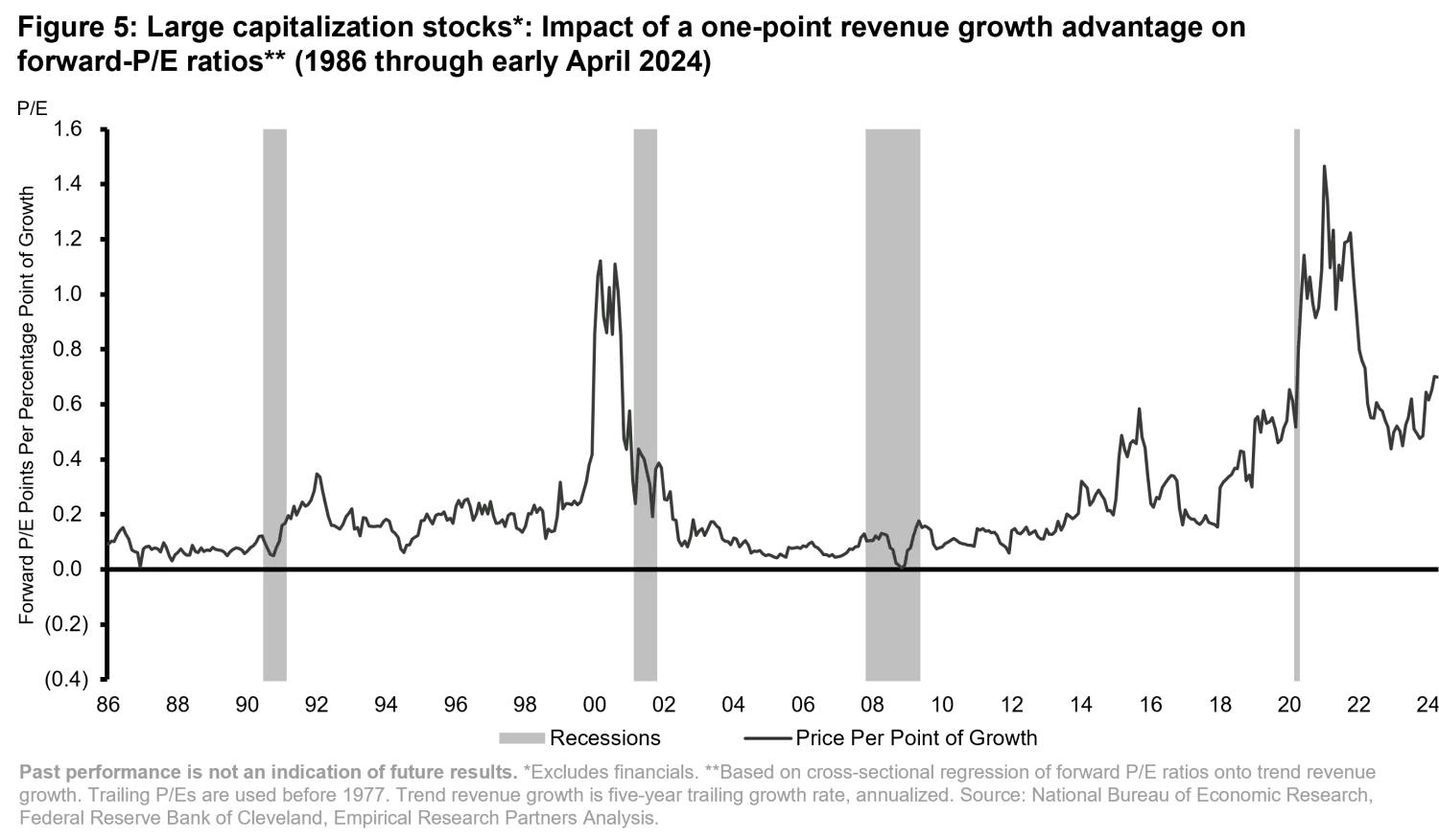

The irony of a data-based approach is that it does not always concentrate on the numbers that really matter. In periods of high growth, methodology-focused investors can look past valuations. As a consequence of exuberance in the COVID recovery and persistently low interest rates, markets were paying more for growth at the start of 2022 than during the tech bubble. The premium for growth is still high by historical standards because investors expect rates will decline to previous levels. Investors who do not employ judgment may become vulnerable if interest rates are not brought down significantly.

Navigating challenging markets requires paying close attention to the numbers, assessing earnings and revenue trends, and digging into balance sheets. Yet judgment is sometimes underappreciated. Active investors can understand industries, companies, and markets, and many have been through boom-and-bust cycles. A combination of quantitative and qualitative analysis can help identify quality companies that can avoid hidden risks and benefit from overlooked growth drivers in order to seek to protect and compound clients’ capital.

Important Information: For educational, informational purposes only. Companies referenced should not be considered a recommendation to purchase, hold, or sell any particular security. No assumption should be made as to the profitability or performance of any company or security associated with them. There is no assurance that any securities discussed are or will remain in the strategies managed by Vontobel. Securities discussed do not represent the entire portfolio and, in the aggregate, may represent only a certain percentage of the strategy’s holdings. Investments discussed should not be considered a reliable indicator of the performance or investment profile of any composite or client account. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such.