ESG and Emerging Market Debt: Lower Volatility, Solid Returns

Fixed Income Boutique

Emerging market debt remains an underinvested asset class: it is viewed as somewhat risky, and illiquid. However, we see fundamentals moving in favor of emerging markets, with attractive valuations (elevated yields) and clean technicals. Indeed, our 2023 Fixed Income investor survey clearly shows an increased interest by investors in the Emerging Market (EM) sector in all regions. Based on the results, in the next 24 months, fixed income investors plan to allocate more to EM than to Developed Markets across the board, from corporate bonds to sovereigns.

But we also observed that while FI investors value ESG, it is a lower priority for those focused on EM investments. Following the third anniversary of our Sustainable Emerging Market Debt (SEMD) portfolio*, it’s a good time to highlight the opportunity ESG can provide to those interested in the EM debt space but avoid it nonetheless due to political and other risks.

First, we believe investors may not realise how available ESG criteria are in the world of EM investment. Most observers may associate ESG primarily with high grade corporates in the developed world, as ESG may at first appear to be an outcome of stricter regulation in major industrialized economies. However, ESG can be used strategically in the emerging market space as well. A good illustration of this would be the enormous effort and financial resources that the Gulf countries are ploughing into promoting the ‘green economy,’ as recently showcased during COP 28 hosted by Dubai.

But besides that, ESG can also be an effective tool to improve risk-adjusted returns by limiting volatility. A wider risk landscape when compared to the DM space is often the major concern for emerging market investors. Thus, promotion of ESG-related characteristics can be paralleled with the purely pragmatic objective of improving financial performance.

Our ESG Approach

A typical discussion of ESG investment has primarily focused on the “E” or environmental element of the acronym. While we fully support that approach and use corresponding factors in our decision making, we strongly believe that in the world of emerging markets, the other parts of the acronym are also an essential aspect of our strategy. The “G” or governance element is the cornerstone consideration for our SEMD portfolio*, at least when it comes to our investment in sovereigns.

The investment universe of the SEMD portfolio is made up primarily of emerging sovereigns, EM quasi sovereigns and supranationals, with the possibility to diversify into EM corporates. Given the different utility functions of, for example, a sovereign compared to a corporate, it is difficult from an ESG angle to apply a "one size fits all" approach, as similarly you cannot have the same approach for fundamental credit analysis of these different types of issuers either.

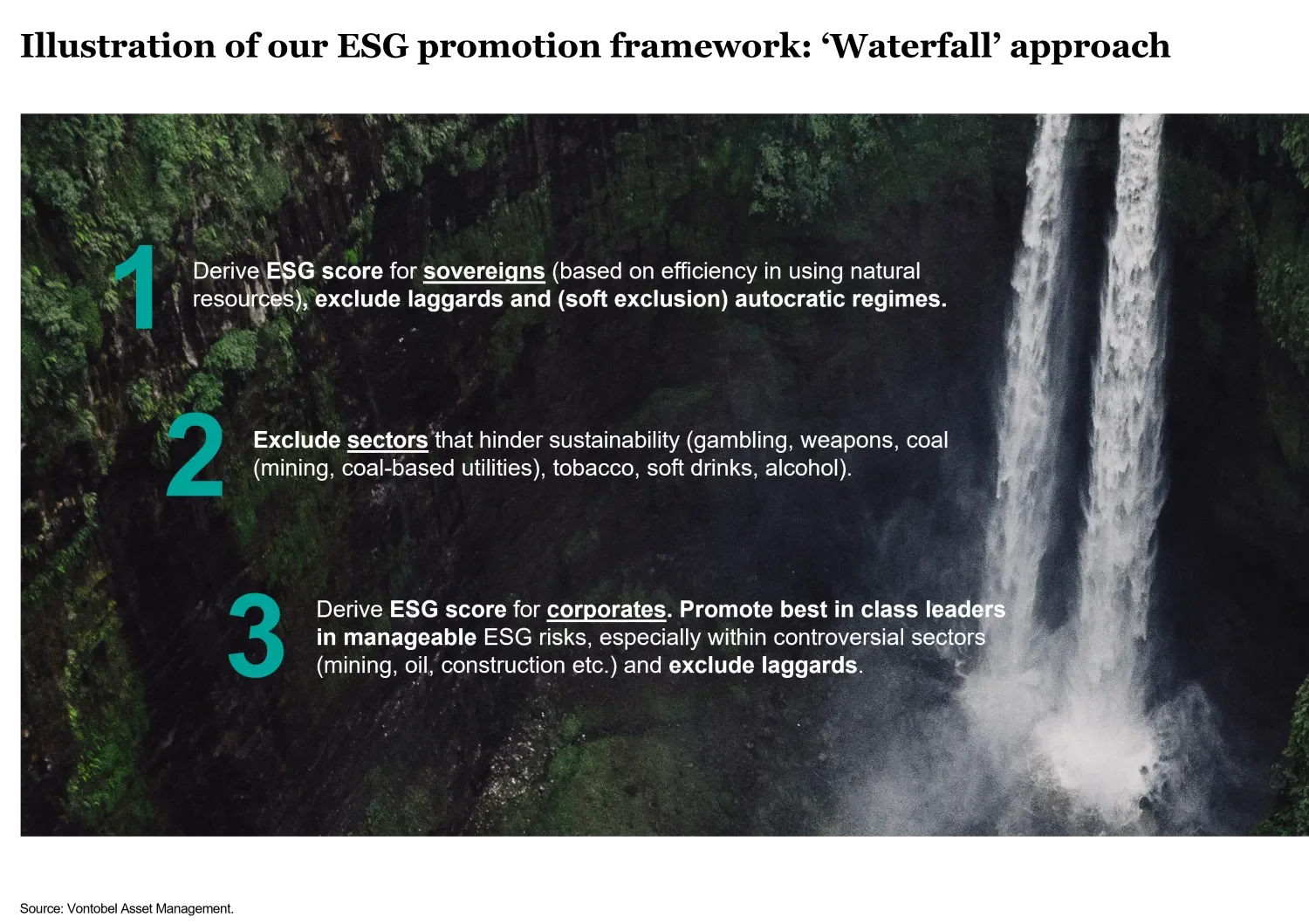

Consequently, we established the notion of a "Waterfall,” signifying several layers in a cascade, in order to analyze the types of issuers according to their utility function from an ESG point of view. The so-called “waterfall approach” flows from the top, scoring and ranking sovereigns through an intermediate stage while prioritizing and demoting certain corporate sectors, all the way to the ‘bottom’ (i.e. understanding how we treat individual corporate issuers). Thus, we score sovereigns based on how efficiently they use their scarce resources, but also apply a binary exclusion for non-democratic countries. For corporate sectors, we favor those that explicitly focus on sustainability, and at the same time exclude sectors that go against common understanding of ESG promotion (for example, gambling, weapons, and coal). Finally, for individual corporates, we explicitly prioritize those with the ‘best in class’ ESG risk management and outright exclude the worst performers.

For example, we allocate more towards renewables and supranational institutions whose mandate it is to promote social and infrastructure projects, often in the poor countries that cannot afford to do them on their own, or would likely to do it much less efficiently at the state level. We believe these investments help nourish global progress while providing decent financial compensation to bond investors.

As one important overarching theme, we do believe the issuers (sovereign and corporate) that progress on the ESG front deserve to be considered for sustainability-minded investors. Specifically in emerging markets, where standards are understandably lower, direction of travel is more important than the starting point. Otherwise one risks focusing only on something that is already ‘not broken’ and deprives economic actors of any incentives to engage on such matters.

The "double dividend"

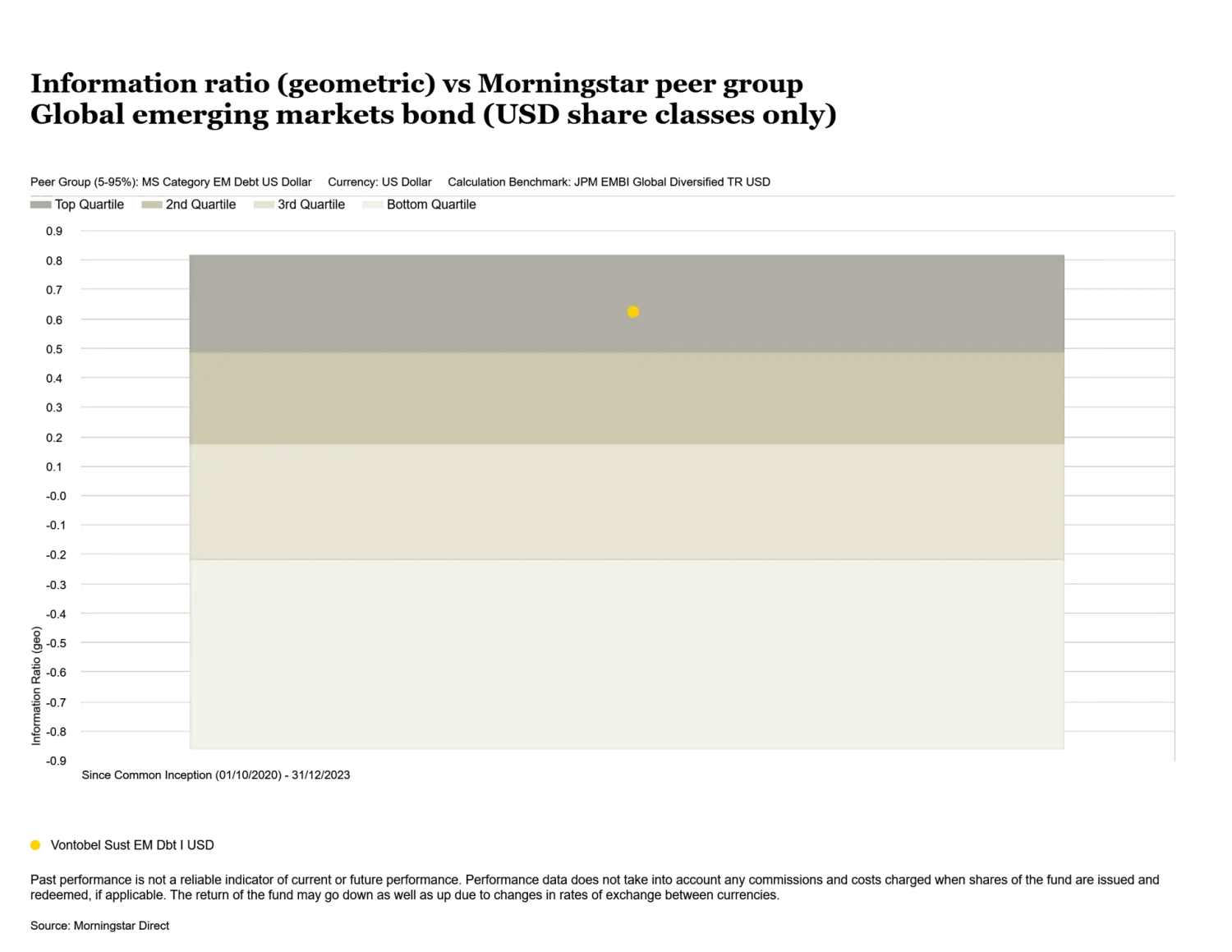

Based on our results, we’ve observed that applying ESG criterion has not resulted in a trade-off of returns for the benefit of a more ethical portfolio. Indeed if we compare the risk-adjusted returns of the Vontobel Sustainable Emerging Markets Bond strategy* to the Morningstar category for mainstream emerging market hard currency sovereign portfolios (a category with in excess of $100bn of assets under management), we can observe that the information ratio since the inception of this strategy just over three years ago is solidly top quartile.

Past performance is not a reliable indicator of current or future performance. Investing involves risk, including possible loss of principal and there is no guarantee that all or part of your invested capital can be redeemed 1. Peer group determined by Morningstar’s methodology and criteria for rankings. Source: Vontobel Asset Management, Morningstar Direct, as of 31.12.2023.

Let us illustrate how ESG works in practice in this strategy and how it can help or, at times, distract. A country – El Salvador – is a democracy, so is formally eligible for the strategy, although in practice its millennial President Nayib Bukele has changed the way the country is governed on several occasions. Early in 2021, upon his resounding victory in the elections, he first shifted away from the IMF program, replaced a number of Constitutional Court judges and also embarked on a controversial introduction of the Bitcoin as a legal tender currency. We sold that position entirely back in June 2021 (at what appeared to be the peak of prices – about 105 cents on the dollar for ELSALV 52). Coincidentally, the sovereign bonds have repriced to as low as low the 30 cent level in a matter of less than a year. Consequently, exiting this position due to a deterioration in the democratic landscape proved to be a notable positive contributor to relative performance in 2021.

In the quasi-sovereign space, we invested in Air Baltic, an airline owned by the Latvian government. Air Baltic appears to be positioned fairly high on ESG scale within this a priori controversial sector, and its sustainability efforts have been recognized by high rankings in multiple European and local indices.1 It survived the double whammy threat from the Covid-19 pandemic and subsequently, the volatility from the Ukraine war. The war specifically hit the company as its model had partly been focused on transiting Asian and European passenger traffic, which was upended by the closure of European airspace for Russia and vice versa. Regardless, the company has been going through a EU-supervised privatization blueprint and is consistently and successfully streamlining its operations (including ESG elements of the business model).

Investing sustainably is an increasingly important topic for investors of different kinds. Overlooking emerging markets in this debate is a mistake in our view, given how much importance EMs have both in terms of economic contribution to global growth, but even more so on the environmental side as well as other aspects of ESG. This was illustrated most recently in the COP28 discussions where emerging markets, many of whom will be most affected by climate change, took the lead in a number of key discussions surrounding an energy transition. Investing in ESG-friendly bonds does NOT have to be counterproductive for your performance metrics. Similarly, avoiding ESG hostile issuers can also bring down volatility that is unacceptable for some fixed income investors, and will arguably become even more objectionable as Net Zero and other initiatives progress, like the most recent COP28.

1. European Sustainable Brand Index 2022; Corporate Sustainability and Responsibility in Latvia

Important Information: Environmental, social and governance (“ESG”) investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate ESG components may vary across providers and issuers as ESG is not a uniformly defined characteristic. ESG investing may forego market opportunities available to strategies which do not utilize such criteria. There is no guarantee the criteria and techniques employed will be successful.

Where indicated (*), portfolio characteristics and activity discussed based on the strategy’s representative portfolio. The representative portfolio presented for discussion purposes only and basis for selection is this is the account we believe most closely reflects current portfolio management style of the strategy. Performance was not a consideration in the selection of the representative account. Investments discussed should not be viewed as a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or decisions we make in the future will be profitable.

Investments discussed herein for illustrative purposes only to elaborate on the subject matter under discussion. Information provided as an example of ESG activity and our evaluation of such as part of our investment process. References to holdings and/or other investments should not be considered a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of any security associated with them.

Holdings and characteristics subject to change and your portfolio may not have the same characteristics and allocations. Securities discussed do not represent the entire portfolio and, in the aggregate, may represent only a certain percentage of the portfolio’s holdings. There is no assurance, as of the date of publication, that the securities referenced remain in the portfolio or that securities sold have not been repurchased. Additionally, it is noted that securities discussed do not represent all of the securities purchased, sold, or recommended for the period referenced.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.