Vescore Global Market Outlook June 2023

Quantitative Investments

Key takeaways

- Risk in equity and bond markets point in different directions

- Global economy surprisingly resilient

- Equity overweight largely unaffected by debt ceiling turmoil

- Bonds don’t call for a positive position just yet

- Current topic: Will the housing market prove the Achilles heel of the global economy?

Keeping calm and stick to equities

Conventional wisdom says the US congress will strike a deal ahead of the deadline. However, the closer the deadline looms, the more nervous markets become, in particular if the deadline lapses without a solution as it did in 2011. Even then the government was paying the coupons, but they cut the salary checks of senators, which quickly brought them back to the negotiation table, and the debt ceiling was lifted. Consequently, our models are currently relatively relaxed regarding the nearing debt ceiling deadline for talks. Our equity allocation model recommends an overweight equity position – the high likelihood of a Fed policy pivot drives the overweight via a high contribution of the term spread. The Wave is supportive of this outcome as well, confirming economic resilience and a low risk of a near-term recession.

Risk environment: Risk in equity and bond markets point in different directions

The divergence between volatility in bond markets (Move index) and equity markets (VIX index) remains at historically high levels. While the VIX has come down to 16% and is trading again at pre-2022 levels, the Move Index still signals heightened risks on account of continuously elevated volatility levels. Calm remains elusive to the bond market because the economic resilience in combination with sticky core inflation shrouds the answer to the question whether the Fed can really switch to a loser monetary policy later this year in much uncertainty.

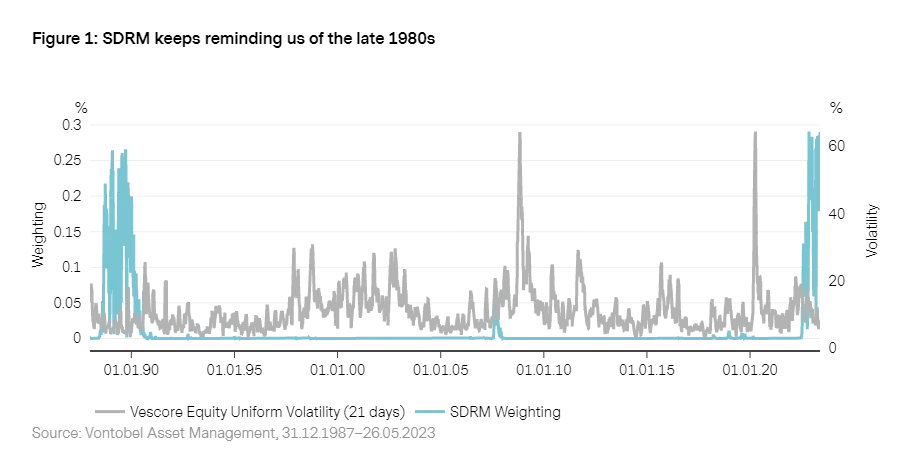

Uncertainty lingers on also in our models which still cannot dismiss the possibility of market volatility remaining above average going forward. Over the last quarters, the comparison of our SDRM1 model of the current risk environment with the late 1980s has been spot on. Back then, an aggressive tightening cycle triggered a broad-based credit crunch leading to the default of many loan and saving associations. Even though the number of banks defaulting in 2023 remains small, more regional banks in the US loaded up with commercial real estate could follow at a later stage. However, banking sector risks on a systemic level seem limited, as banking regulation in the 2010s led to a de-leveraging of systemically relevant banks2. This means that even if there is a possibility for further defaults in banking, they should remain confined to certain areas of the sector.

1. More information on our SDRM model can be found in “

Risk Management: Forward on calm seas, adaptive and agile in stormy phases

”.

2. See “

Vulnerabilities in the banking sector are below historical averages

” in the April 2023 edition of the Global Market Outlook.

Economic outlook: Surprising economic resilience

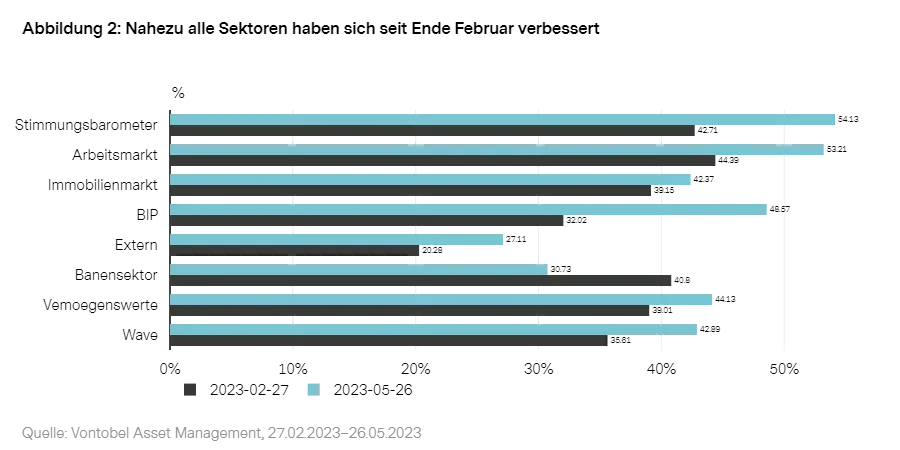

Our global business cycle model Wave remains in recovery, with only 24% of the 50 countries under coverage still in contraction - the lowest share since August 2022. Or in other words the share of countries entering recovery or even expansion continues to rise.3 In addition, the number of Wave sectors which are improving is on the rise as well. Over the last couple of months all segments of the Wave have been improving, except for banking sector activity. While all of this is good news, real money supply is shrinking by 6% on a year-on-year basis, which keeps the probability of a fallback to contraction at 50%.

Developed markets: Housing Market poses an economic headwind

Considering the historically high speed of real liquidity tightening in developed markets, the economic resilience of developed markets is surprising, especially in Europe. Economic sentiment data recovered in recent months and labor markets remain historically tight in the majority for G7 countries. Except for Italy, unemployment rates remain close to their 30-year lows. In the US, the unemployment rate has even reached a 50-year low. But other parts of our business cycle model still point to economic risks for the second half of 2023 and a possible recession later, either this or next year. Especially the weak banking sector and housing market activity in connection with tightening liquidity conditions could turn out to be the Achilles heel of many economies which may push the global Wave to take a turn for the worse again in the coming months. Banking and housing are sectors that are particularly interest-rate- and liquidity-sensitive and therefore the contraction probability remains close to 50%.

Emerging economies: APAC awakening

The emerging market Wave remains in expansion with Asia leading the global business cycle. While data in China came in a bit weaker recently and the Chinese Wave stalled in May after months of an astonishing growth acceleration, Taiwan kept the momentum alive last month enabling the Wave to gain another 8%-points. Contrary to developed markets, the housing sector is recovering in emerging markets, especially in China. Therefore, Chinese authorities have little incentive to further increase policy stimulus that has already shown strong effects in terms of Chinese liquidity improvement.

3. For further inside into the Wave business cycle model we refer to our white paper “ The Vescore Wave – a superior business-cycle model ”

Equities: positioning rather unaffected by debt ceiling debate

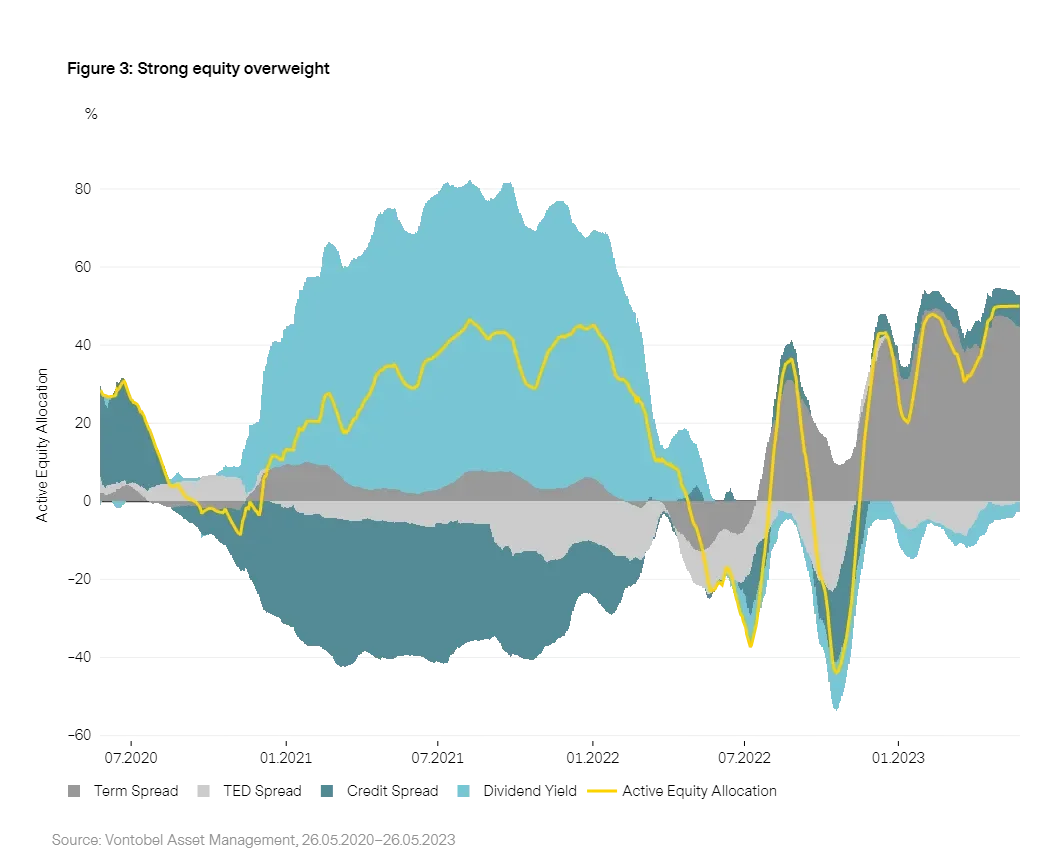

Equity volatility increased slightly in late May as we are getting closer to the debt ceiling deadline in the US. However, this increase in market volatility led only to a negligible decrease of the strong equity overweight that our equity allocation model keeps running. More than once the US got close to the deadline and the congress reached finally a deal and increased the debt ceiling. Therefore, statistical evidence suggests that market stress may rise temporarily only and that a deal would finally trigger a relief rally.

The main contributor of the sizable overweight remains the term spread which builds on the assumption that the nearing debt ceiling deadline may lead to an at least temporary tighter fiscal budget which in turn would make a Fed pivot more likely over the upcoming months. The negative contribution of the TED spread, a gauge of liquidity in the banking sector, reverted back to almost zero as the stress in the banking sector eased over recent months.

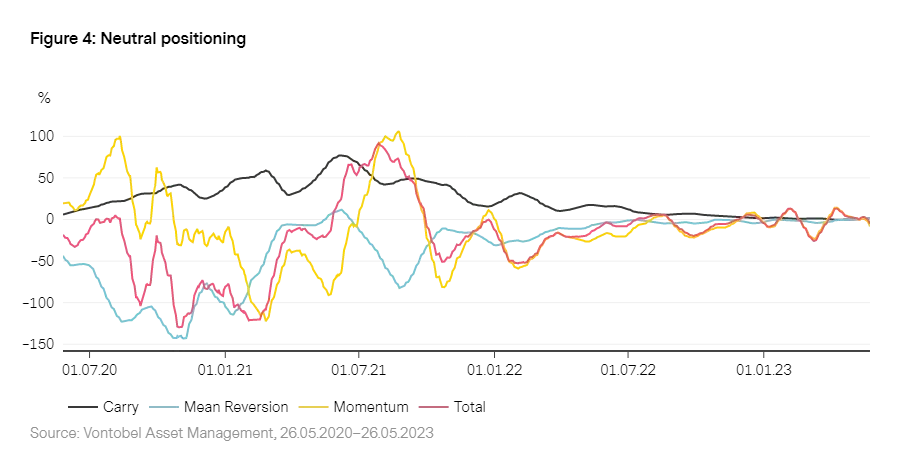

Bonds: Models still on neutral

Our bond allocation model is still not ready to take a position and remains neutral. On the one hand, the anticipation of a Fed pivot remains supportive for bonds and the futures market is already pricing in one cut in the US later this year and eight 25 basis point cuts in 2024. On the other hand, sticky core inflation in the US continues to weigh heavily on bonds. These opposing forces translate into a negatively contributing momentum component in the model which neutralizes the slightly positive contributions of the mean reversion and carry components.

Current topic: Will the housing market prove the Achilles heel of the global economy?

The housing market activity remains, in combination with a wobbly banking sector, the weak spot within our business cycle model Wave. In this article, we put housing activity in a historical perspective with the purpose of assessing if we are likely to see another Great Financial Crisis scenario.

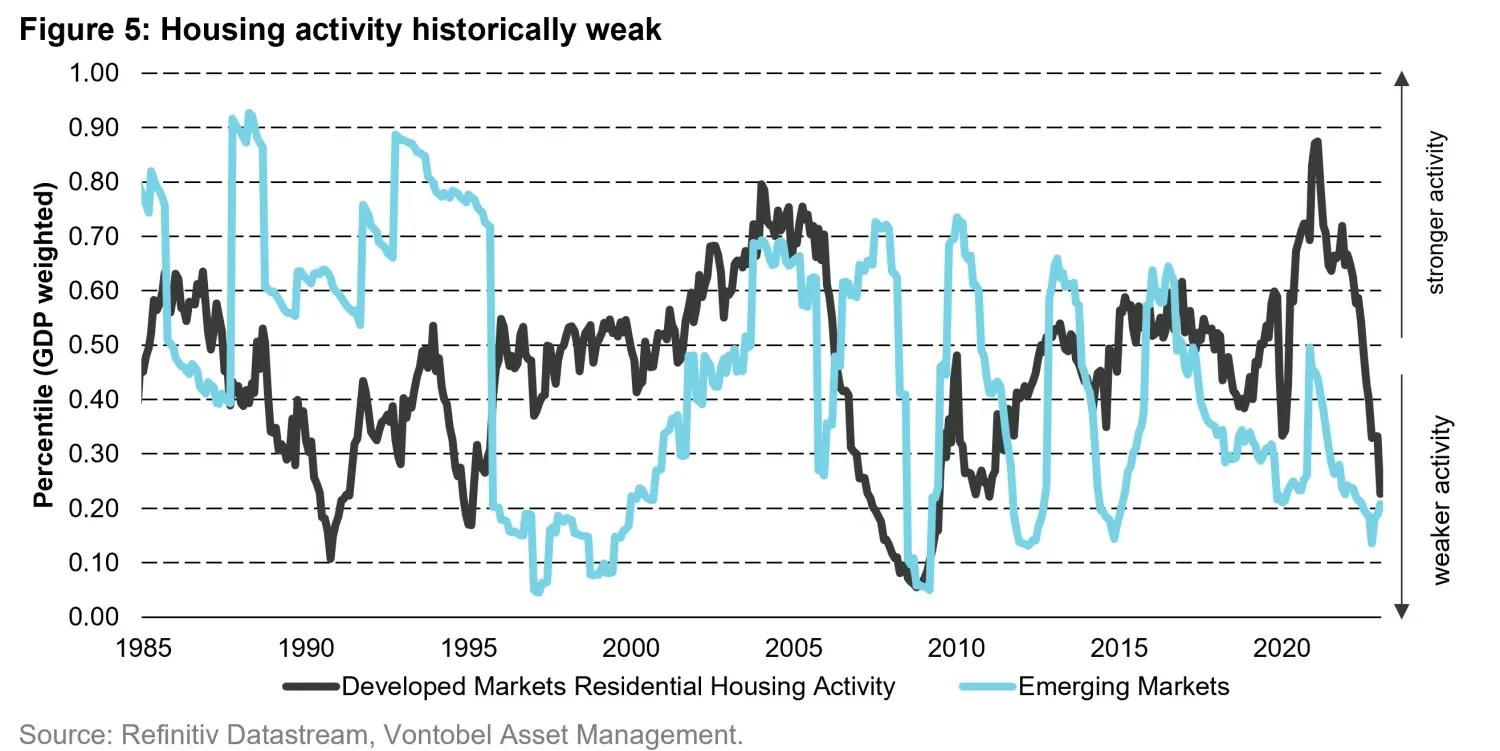

Figure 5 shows the residential housing activity for emerging and developed markets. Our activity indicator consists of the following four variables4:

- Annual growth or residential house prices

- Annual growth of residential housing investments

- Annual growth of residential house or apartment sales

- Annual growth of mortgage growth

These indicators allow us to analyse the activity from different perspectives which gives rise to two observations: Firstly, activity is historically weak in both regions and close to 2007/08 levels during the US housing market crises. Secondly, in emerging markets the activity indicator is already recovering. Especially the Chinese housing market has found a bottom according to the Wave. Digging deeper on a country level shows that the weakest activity can be found in Scandinavia, Australia and New Zealand. We have highlighted in several publications the relatively high probability of an approaching recession, even though resilient economic data has postponed its onset probably into next year at least5. However, what is clear from the above observations is that a continued deterioration of the housing market could not only fuel recession fears but also accelerate a potential downturn.

Nevertheless, there are good reasons to believe that the weak housing market activity will not have similar consequences as in 2007/08. First, the activity level in key countries such as the US and the EMU is currently not worrisome. Second, as reported two months ago, the balance sheets of systemic relevant banks in developed markets are much more solid than during the Great Financial Crisis6. Third, there are no clear signs of an oversupplied residential housing market in key countries which could exert downward pressure on prices. Fourth, the duration of mortgages is on average significantly higher than during the Great Financial Crisis with the exception for some Scandinavian and Baltic countries. Finally, the leverage of households is significantly lower than during the Great Financial Crisis.

4. The 10-year moving percentile of each indicator is aggregated to a country residential housing activity indicator with equal weights. For the developed and emerging market region GDP weights are used for the aggregation.

5. See “

What do our models think about US recession risks?

”

6. See “

Vulnerabilities in the banking sector are below historical averages

” in the April edition of the Global Market Outlook

Important Information: Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index

Any projections or forward-looking statements herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.