Time for Quality in US Equities

Quality Growth Boutique

Key takeaways

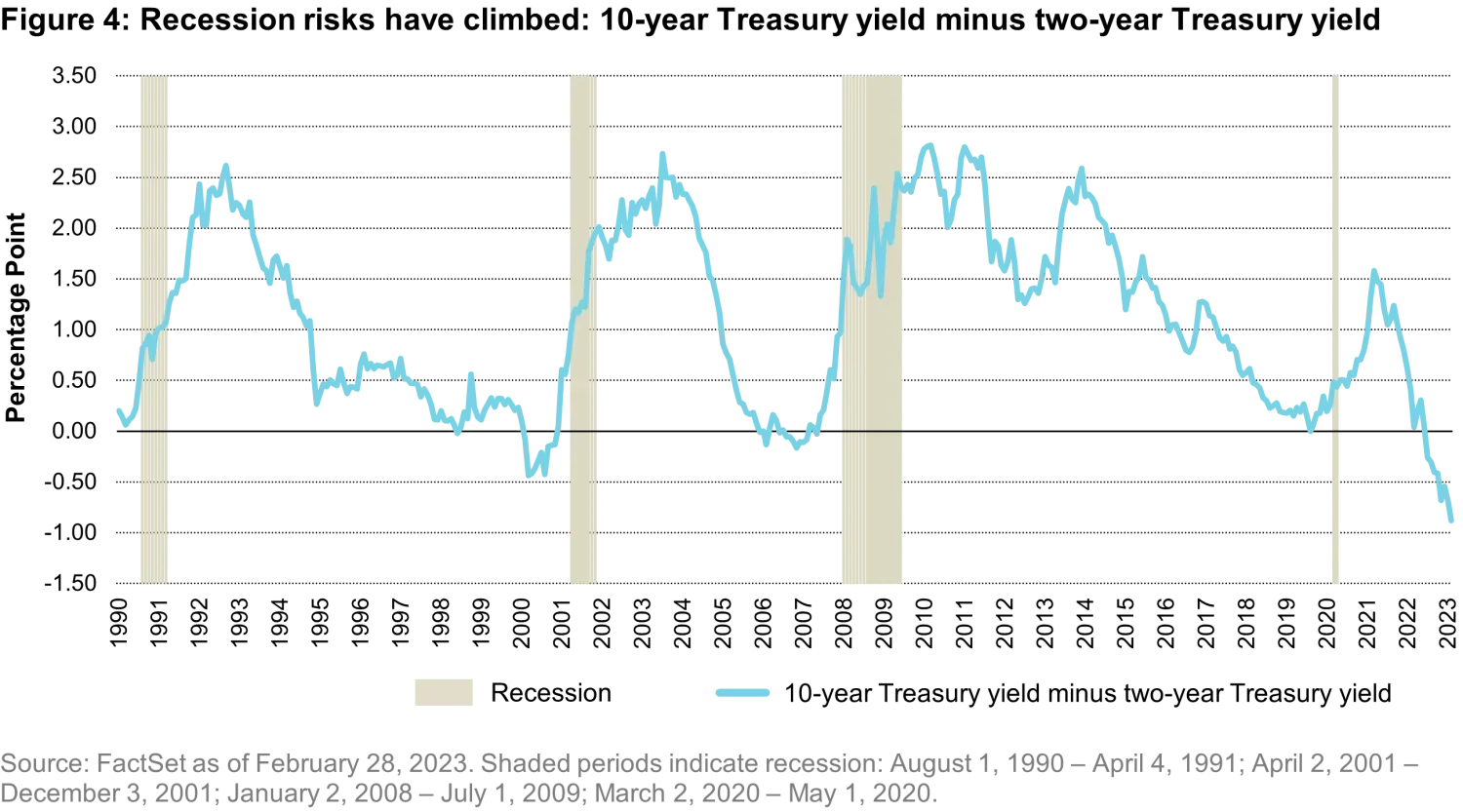

- The abrupt shift to increasing rates to fend off inflation while also decreasing the size of balance sheet assets potentially portends a more difficult environment ahead, as indicated by the current inverted yield curve.

- As bottom-up investors, we do not make bets on specific inflation or recession forecasts, but rather look for companies that can perform well in a variety of plausible macroeconomic scenarios.

- To prepare for what’s ahead, we seek to invest in companies that have powerful economic returns – high returns on equity, high returns on invested capital, and high free-cash flow conversion. Equally as important is the predictability of these returns, driven by long-standing secular growth.

- We believe concentrating exposure into high-quality businesses whose value will be determined through consistent earnings compounding rather than external support drivers is an attractive option for investors.

Most major equity markets suffered in 2022, and the US was no exception – the three major US indices posted their worst year since 2008. It was a perfect storm of persistently high inflation, slowing economic growth, aggressive rate hikes, high and volatile energy prices, war in Ukraine, and rising tension between the US and China. While 2023 had been off to a somewhat solid start, the recent failures of Signature Bank and Silicon Valley Bank (SVB), as well as the merge between Credit Suisse and UBS, have called into question the stability of the financial system and the health of banks around the world. Markets are on edge as investors continue to wrestle with uncertainty. Is a recovery in US stocks feasible? Will the Fed navigate a hard or soft landing? Have earnings bottomed out?

Rather than answering questions that keep investors awake at night, we believe the best line of defense in difficult times is to focus on fundamentals, maintain a long-term perspective, and prepare for the worst. As such, we seek to invest in quality companies – businesses with attractive underlying economics that have sustainable and predictable earnings streams. We continue to find companies in the US that meet our strict criteria for investment, and in our view, a quality approach to US equities will be necessary to successfully navigate the markets this year.

US equities – tried and true

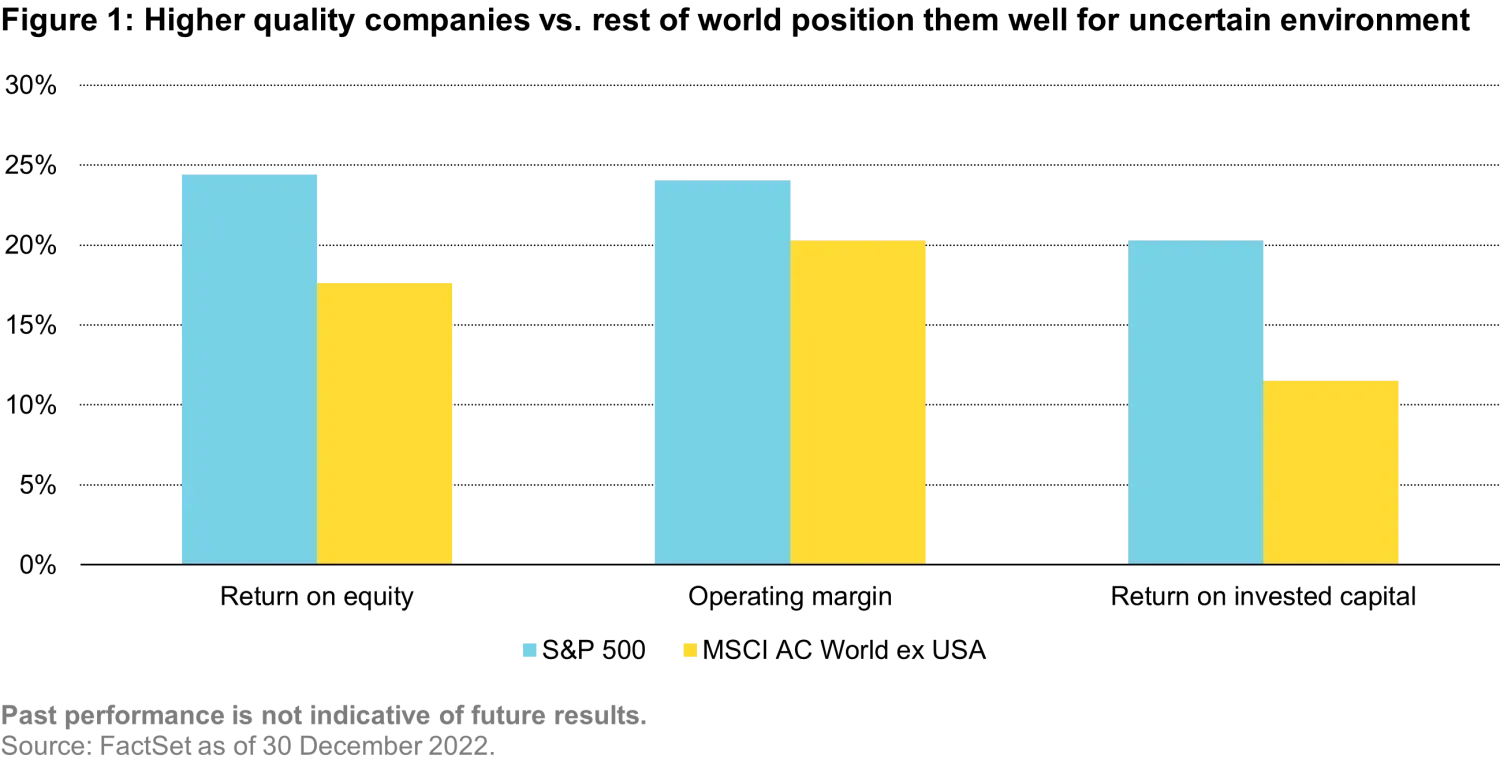

The US stock market remains the most liquid and largest in the world. It is home to many global leading companies, like Amazon and Alphabet, that have a mindset of innovation and can turn their ideas into successful products and services on a global basis. With many US-listed companies, investors can gain access to international markets. In fact, the top 10 US companies by market capitalization in the S&P 500 Index generate an average of about 44% of their revenues outside the US1. Importantly, US companies are more profitable than their peers, in aggregate, as measured by broad market indices (Figure 1).

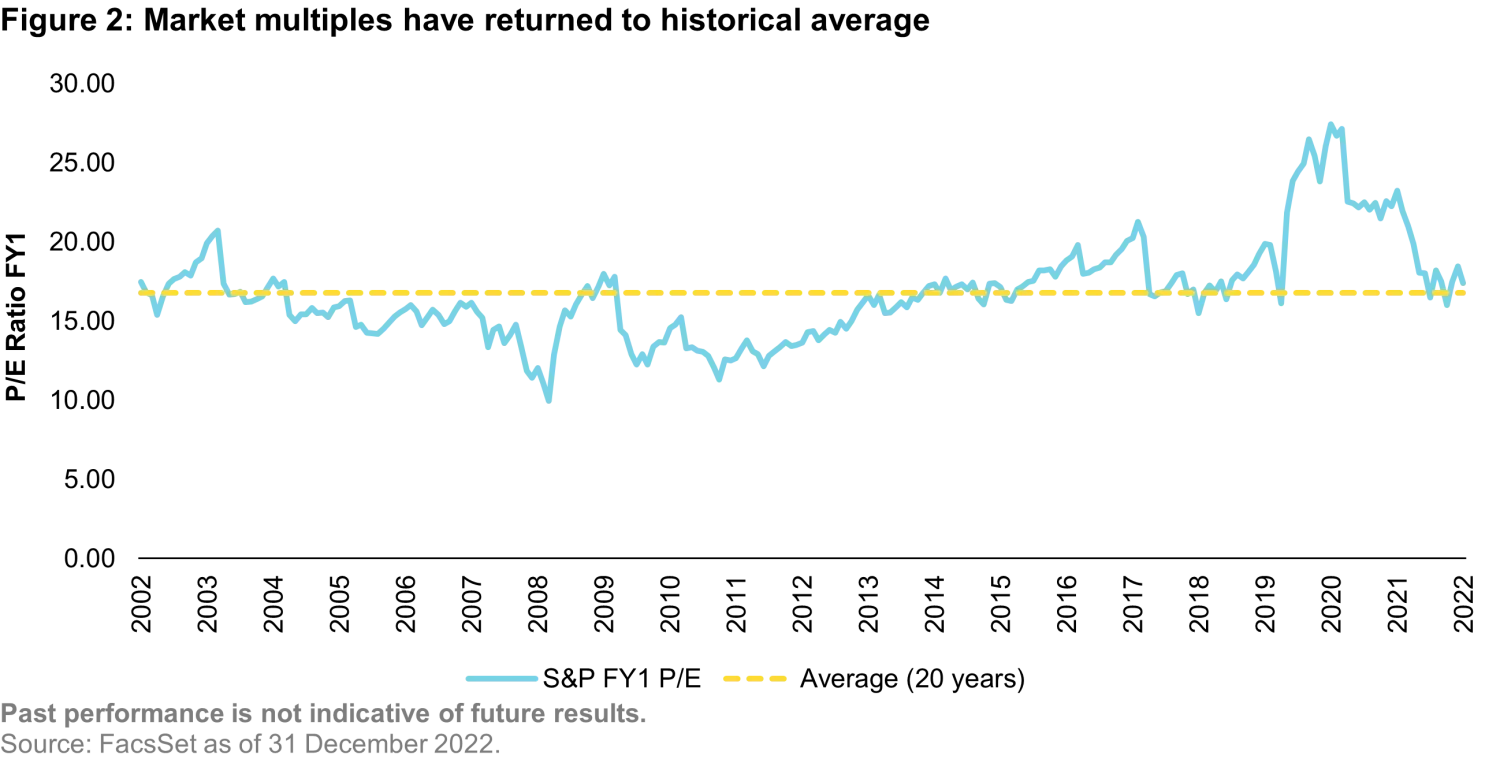

US equity valuations have come down significantly. This swift correction has provided a promising backdrop for managers focused on quality to find better entry points. The sell-off in the tech space has rightly punished many speculative, lower-quality companies, but it has also indiscriminately impacted the valuations of some very high-quality tech companies. Such dislocations provide opportunities to add to quality investments at better prices. It is unclear whether markets are nearing an end to valuation compression, but economic weakness will start to filter into earnings pressure on companies this year.

Markets can no longer rely on artificial support

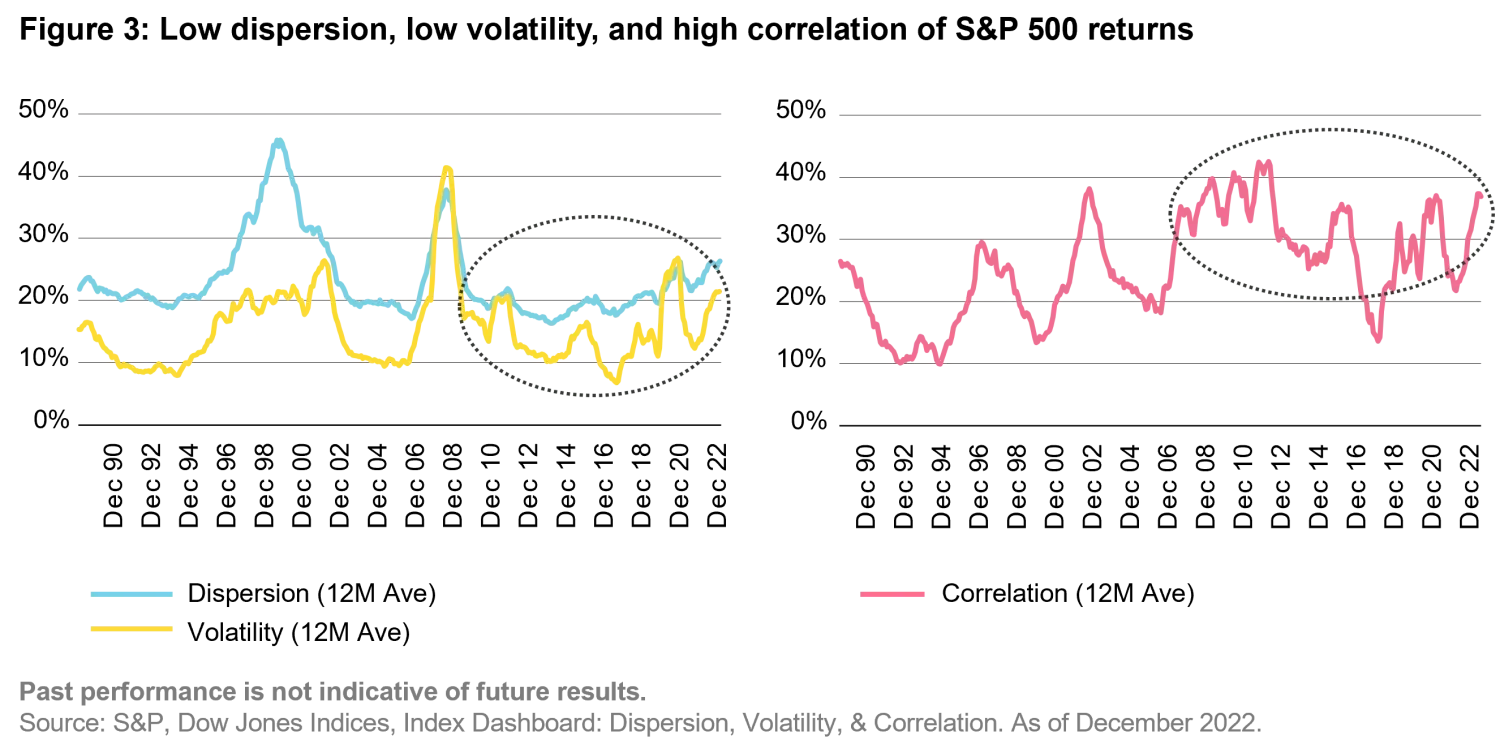

Since the Global Financial Crisis, the US and other large, developed economies have aided financial markets as their central banks kept rates at historically low levels. They also expanded their balance sheets, which supported fixed income markets and provided fiscal stimulus when necessary. This strong cocktail led to a market characterized by low volatility, low dispersion, and hence a high correlation of returns among S&P 500 constituents and the consistent growth of passive dominance for investors seeking US exposure.

The result has been strong market returns over this period. However, going forward, persistent inflation, bloated central bank balance sheets, and government indebtedness look to be less of a tailwind, at best. The abrupt shift to increasing rates to fend off inflation while also decreasing the size of balance sheet assets potentially portends a more difficult environment ahead, as indicated by the current inverted yield curve. We are already starting to see the effects of this abrupt change with SVB’s forced recognition of impaired fixed income assets triggering the need for more capital, a run of deposit withdrawals, and eventual collapse with reverberations being felt around the industry and the world.

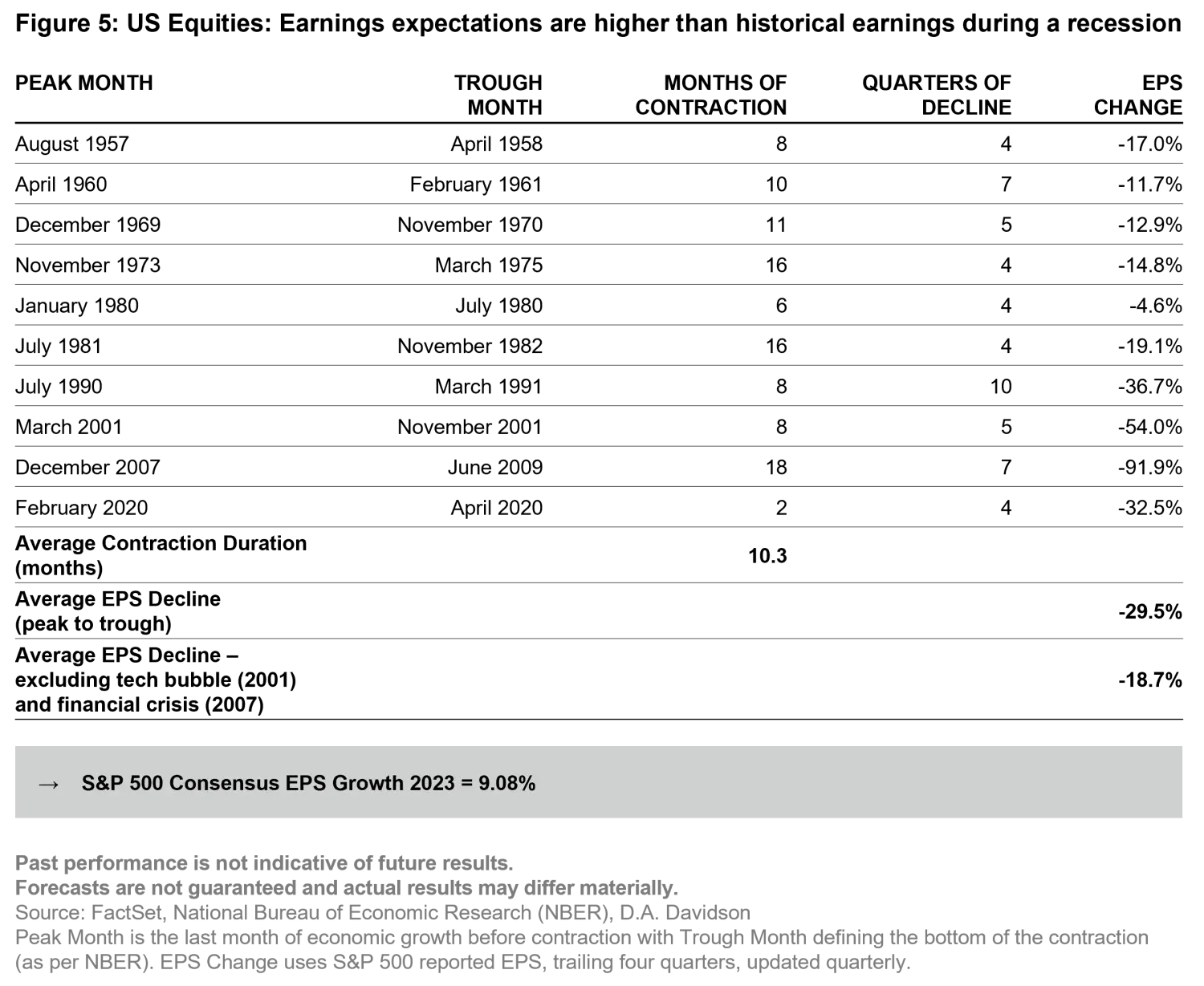

US equity markets began pricing in this scenario with negative returns in 2022. However, going into 2023, there is still a disconnect between market earnings expectations and the typical earnings experience during recessions.

Prepared for what lies ahead

In a recession, not all companies are impacted equally. As bottom-up investors, we do not make bets on specific inflation or recession forecasts, but rather look for companies that can perform well in a variety of plausible macroeconomic scenarios. Also, avoiding stocks trading at exorbitant multiples lessens the vulnerability to de-rating as a result of higher discount rates.

In the Vontobel Fund – US equity, we seek to invest in companies that have powerful economic returns – high returns on equity, high returns on invested capital, and high free-cash flow conversion. Equally as important is the predictability of these returns, driven by long-standing secular growth. We shy away from cyclicals, a bias which has also historically reduced our volatility. An important point for current times is that higher financial leverage exacerbates the earnings impact of cost hikes. So, we steer clear of over-indebted companies as a matter of basic prudence.

On a sector basis, we tend to invest in consumer staples businesses with strong market shares, consistent demand, and pricing power. Our information technology exposure tends to consist of subscription-based software businesses as opposed to more cyclical exposure. In health care, our holdings consist of equipment businesses benefiting from demographic drivers with more stable market shares vs. more volatile pharmaceuticals. In financials, we have more exposure to monopolistic financial exchanges and have had no exposure to banks, and we prefer niche auction site businesses instead of traditional cyclicals in the industrials sector. That said, here are three ways we are preparing for what lies ahead:

- Mitigate risk. We stress test every holding for earnings downside and balance-sheet risks for a recession scenario. We expect our portfolio companies to demonstrate greater earnings resilience, in aggregate, compared to a potential decline in aggregate earnings for the S&P 500 benchmark. The Fund’s overweight to consumer staples and lack of exposure to energy can protect against volatility. Household names in the strategy, like Walmart, the go-to destination for grocery and personal health-related products, or Becton Dickinson, which has leading positions in medical supplies, life science research and diagnostics with demand less correlated to the macro economy, have outperformed in past economic downturns due to strong market share, consistent demand, and pricing power.

- Focus on pricing power. As consumers deplete their excess savings and the economy weakens further, there will be a greater differentiation among firms in their ability to protect margins. Thus, we seek companies with pricing power. One example is Keysight, which manufactures electronic test and measurement equipment that is critical for product research and development. Its high-quality and differentiated solutions deliver value for users that translate into pricing resilience. Pricing power also comes from strong brands, which can be seen in our consumer staples companies, particularly Coke and Pepsi, both of which have delivered “sticky” price increases and stable margins in the current inflationary environment. Pricing could also come from businesses with strong “moats”, like the local monopoly Vulcan Materials has with its quarries. Given the difficult economics to transport aggregates (the building blocks of infrastructure spend) as well as the lengthy process and necessary environmental demands associated with obtaining a permit for a new quarry, Vulcan is able to keep up with cost inflation and generate more profitable gross profit dollars.

- Don’t mistake a great story for a quality company. Some of the most popular stocks in recent years declined significantly last year. A company with an interesting business model but without a clear track record of profitable growth is, in our view, just another story. Sometimes a great story turns out to be a Google, sometimes it’s a Yahoo. Along with owning Google that now dominates search, we own Intuit, which dominates the well-known Do-It-Yourself tax franchise “Turbo Tax” and is also becoming a mission critical operating system for small and medium-sized businesses with “QuickBooks”, all the while delivering significant cash flow.

The US market has corrected over the last year but navigating into an uncertain future with different characteristics than the past will require an adept skillset. We believe concentrating exposure into high-quality businesses whose value will be determined through consistent earnings compounding rather than external support drivers is an attractive option for prospective investors.

The Vontobel Fund - US Equity Offers (as of 30/11/22):

- Experienced and well-resourced team: The 3 PMs have an average experience of >30 years. The overall Quality Growth team has 27 professionals (thereof 4 dedicated ESG analysts).

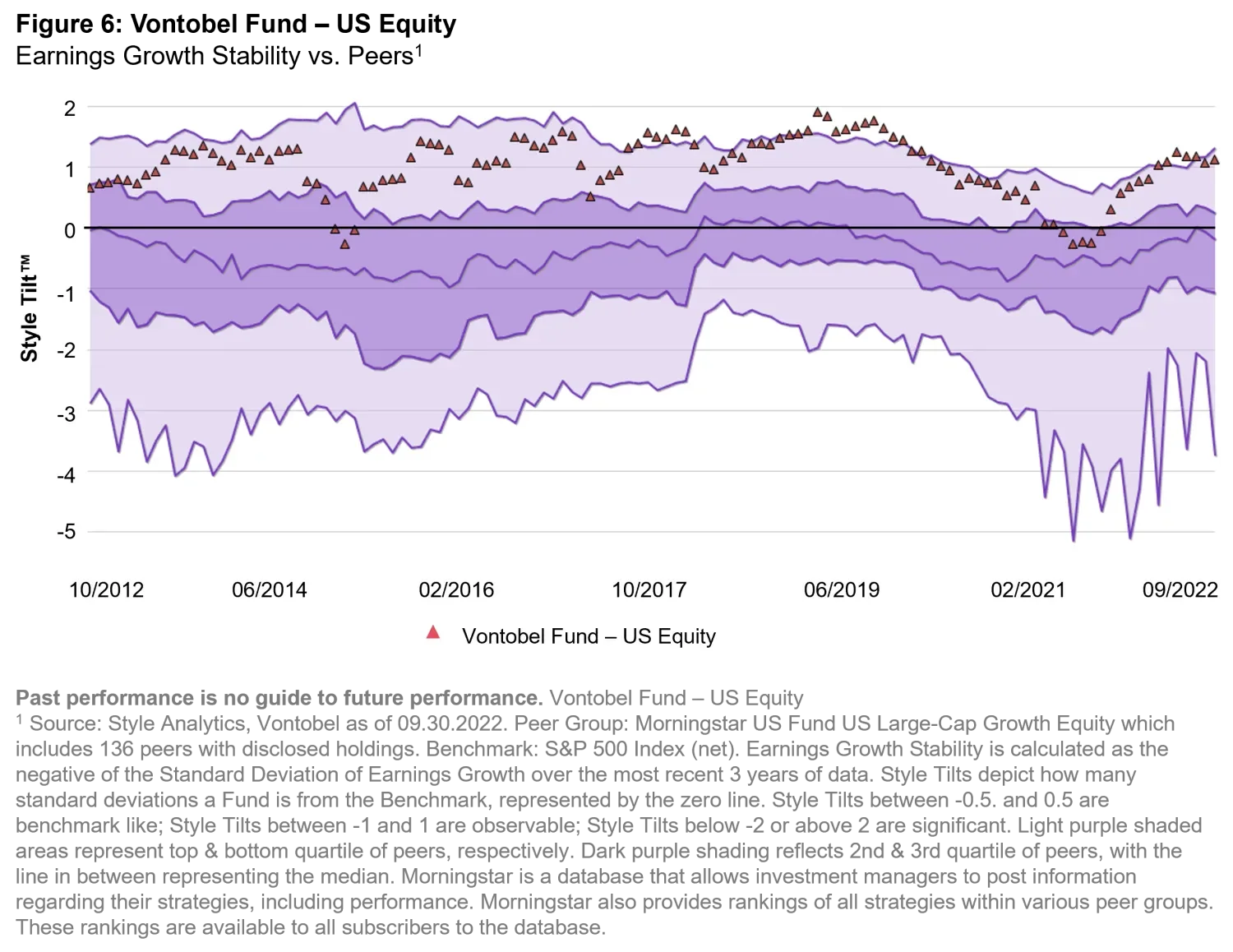

- Quality Growth & wide economic moat: Due to focus on 40-50 quality companies with higher earnings growth stability the Fund has a much higher economic moat ratio (74%) than its peers (median: 58%).

- ESG integration and active ownership: ESG is an integral part of the investment process. The Fund is classified as Article 8 (SFDR) and has an AAA MSCI ESG Rating as well as 3 Morningstar globes (as of 30/11/2022).

- Consistently lower volatility: 3-year rolling volatility consistently in 1st quartile and lower than the reference index. Additionally, the fund has a low beta and max. drawdown compared to peers.2

- Risk-adjusted performance: Strong performance resulted in 1st quartile Sharpe Ratio over 10 years.2 Fund outperformed historically in periods of uncertainty, i.e., 1st decile performance in 2022.3

1. Source: FactSet. Most recent reported fiscal Year-end revenues of the top 10 companies by market capitalization in the S&P 500® Index (excluding Berkshire Hathaway, a holding company) as of 12/30/22.

2. Source: Morningstar Direct, as of 30.11.2022. Refers to 10-year period. Peer Group: US Large-Cap Growth Equity. Number of funds in peer group: 163. Fund percentile ranking for volatility/beta/max. drawdown/Sharpe ratio over 10 years: 2nd/7th/1st/4th.

3. Source: Morningstar Direct, as of 30.11.2022. Refers to 2022 YTD data as of 30.11.2022, Percentile rank: 2nd.

Past performance is not a reliable indicator of current or future performance. Performance data does not take into account any commissions and costs charged when shares of the fund are issued and redeemed, if applicable. The return of the fund may go down as well as up due to changes in rates of exchange between currencies. The value of the money invested in the fund can increase or decrease and there is no guarantee that all or part of your invested capital can be redeemed. Source: Vontobel Asset Management, as of 30.11.2022.