In times of panic, investors need a dose of healthy optimism

Quality Growth Boutique

Key takeaways

- In our view, the best line of defense in today’s challenging macro environment is to invest in a business with attractive underlying economics that has a sustainable and predictable earnings stream. Then, ascribe to it a valuation that is both realistic and conservative.

- While short-term volatility can lead to choppy performance, we believe our Quality Growth approach has been successful over the long term and can outperform in various conditions, including periods of high inflation.

- As economic resilience becomes increasingly important, high-quality companies in the consumer staples, health care, technology, and industrials sectors should provide portfolio protection.

- Difficult markets require optimistic resolve and a clear investing roadmap. The best investment returns are conceived in down markets, only to be realized during more buoyant times.

Decades of experience and a love of numbers get you only so far in the investing business. A successful history of managing money through cycles and a disciplined research process – that’s essential, of course. But what gets you over the finish line is enduring, healthy optimism. The conviction that truly great businesses will contribute to durable, compounded returns. Oddly enough, healthy optimism is difficult for even the most sophisticated investors to apply judiciously. In rising and euphoric markets (case in point: the last few years), optimism was distorted and woefully misplaced. SPACs, cryptocurrency, and hyper-growth companies with no earnings were wildly in fashion.

But with the doom-and-gloom headlines this year, markets have swung collectively towards pessimism. Inflation is at a 40-year high, and economic growth looks to be slowing. The World Bank says that the global economy may in fact suffer 1970s-style stagflation. Jamie Dimon, CEO of the largest US bank, warns of an “economic hurricane,” while Goldman Sachs’ CEO is bracing for “unprecedented…shocks to the system.” No doubt in eager anticipation, Black Swan investor Mark Spitznagel says to expect a “catastrophic market failure” when a record $300+ trillion in global debt and the mother of all current credit bubbles pops. The enduring pandemic. War. Rising food prices. Persistent supply chain woes. A weakening consumer.

What’s an optimist to do? Well, if you’re Warren Buffett and Charlie Munger of Berkshire Hathaway, you’re buying a net $41 billion in equities in Q1 of this year, despite myriad challenges we might face. Our research team, as we’ve done every year for nearly 30 years (two years during Covid lockdown aside) traveled to Omaha for the annual “Woodstock for Capitalists,” and a back-to-basics reminder from The Sage of Omaha of how to tune out the noise. Remember, Buffett made his first investment at age 11 on the eve of WWII. He’s said of those initial investments, to “just think of all the things that have happened since then, you know? Atomic weapons and major wars, presidents resigning, and all kinds of things... massive inflation at certain times. To give up what you’re doing well because of guesses about what’s going to happen in some macro way just doesn’t make any sense to us.”

To us neither. My team at Quality Growth knows that real life is more nuanced than a CNBC headline, and like Buffett says, you can’t make money paying attention to weathervanes. Even most wars, despite the tragic and devastating human toll, don’t have much of an impact on stock markets: Since 1941, including Pearl Harbor, the Vietnam War, the first Gulf War and so on, the market was up on average 7.2% in the following six months and 12.7% in 12 months. Moreover, history has shown that higher oil prices eventually beget lower ones. It’s a self-correcting solution in and of itself. And realistically, the core inflation issue is still Covid-19 normalization, which is bound to happen in fits and starts, and over time, until China finally rejoins the world economy.

As fundamental investors, our job is not to peg business cycle turns, predict what global GDP will look like in 2022 or 2052 or whether inflation is here today and gone tomorrow. The best line of defense for an optimist like me is to dig in and find a business with attractive underlying economics that has a sustainable and predictable stream of earnings. Then, ascribe to it a valuation that is both realistic and conservative. To quote Thomas Edison: “Opportunity is missed by most people because it is dressed in overalls and looks like work.”

Experience

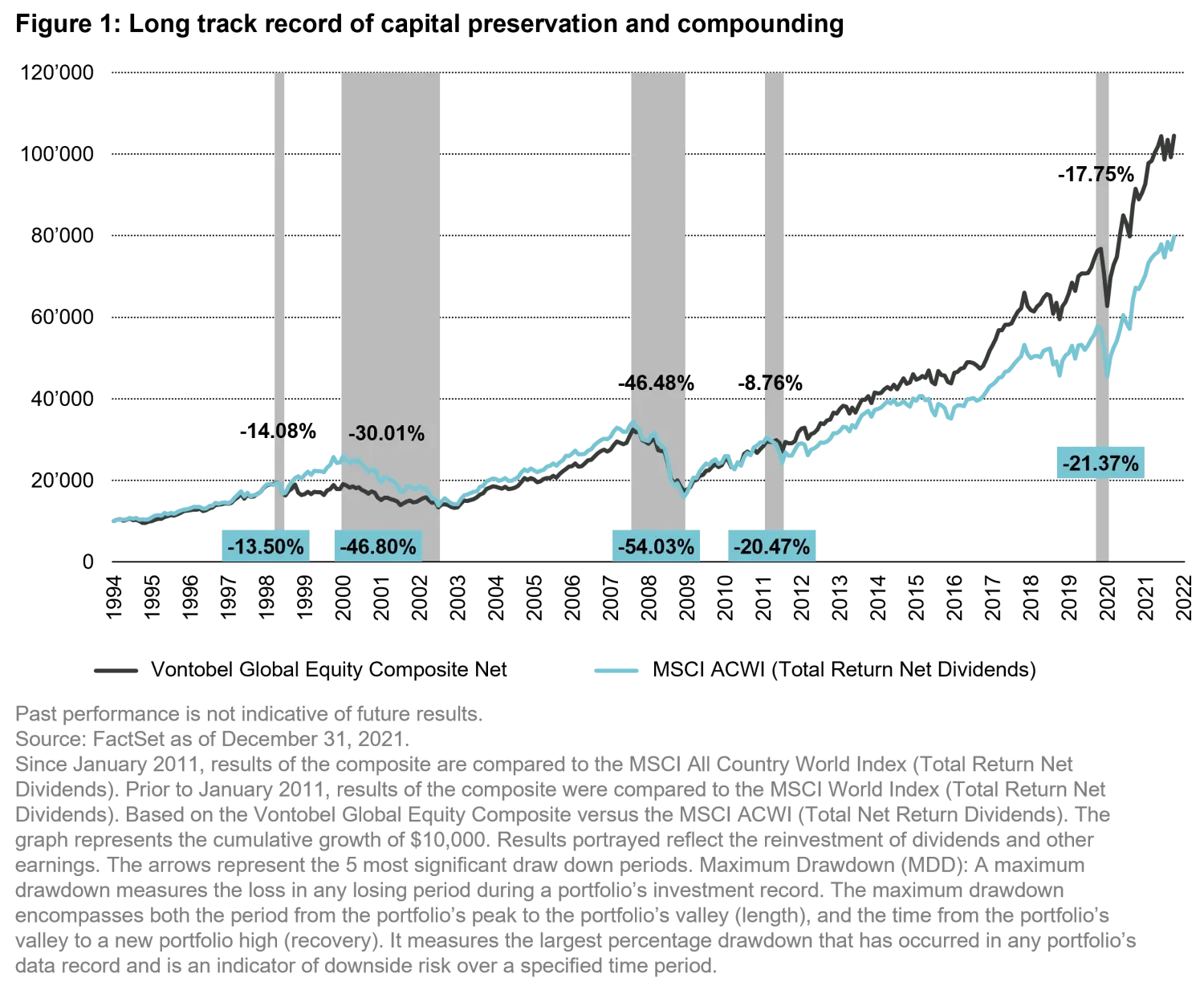

Since 1984, Vontobel Asset Management’s US-based investment boutique has managed money with a portfolio aimed to handle the whole variety of potential scenarios that can unfold in life and economics. We don’t predicate our positioning to any one outcome – and we don’t make aggressive predictions of the inherently unpredictable. As a result, we seek to deliver attractive long-term, risk-adjusted returns for our clients. Inevitably, against various backdrops, we can have differing returns of under/outperformance compared with our relevant index benchmark. That also includes against our peer group (who never have the same exact investment philosophy/approach as our unique one), as well as against generic “value” or “growth” cohorts. We never get swept up in constantly looking out of our side windows or rear-view mirror during the journey though, we stay focused on the road ahead and the end destination on our map.

Over the long term, we think it’s a proven strategy, although short-term fluctuations can make performance choppy.

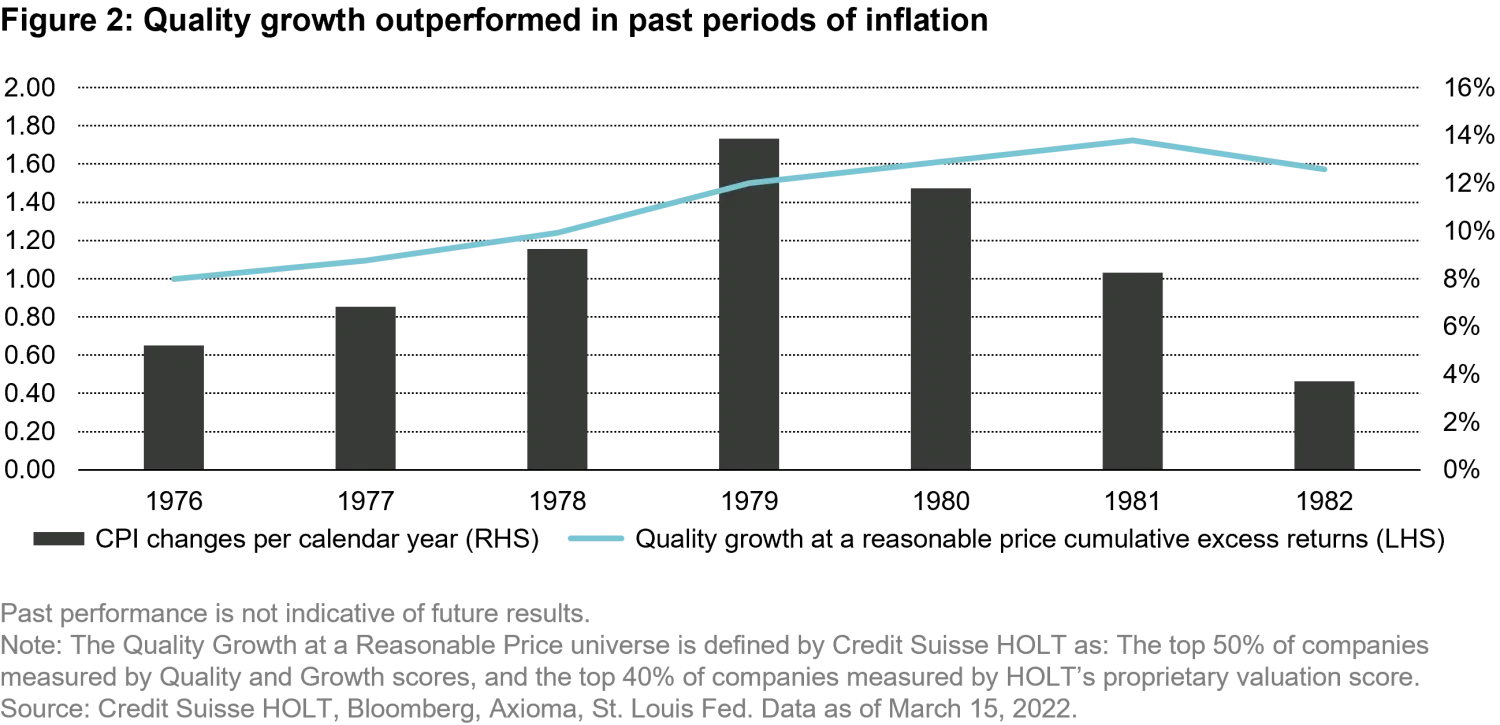

Today’s panic du jour is over the potential for prolonged, late 1970s-style hyper-inflation, and its implication for equity markets. As bottom-up investors, we are not making a bet on a specific inflation forecast; we need our holdings to do well in a variety of plausible macro-economic scenarios. Nevertheless, it’s worthwhile to review the empirical evidence of what happened during the period of the late 1970s-early 1980s – the last time the US experienced high inflation. Although the stock market as a whole did not do well in late 1970s, there was notable outperformance by quality-growth stocks trading at reasonable valuations. The chart below was generated by HOLT/Credit Suisse in a study that examined the relative performance of different investment styles during that time. If history is a guide, quality growth stocks trading at reasonable valuations – the types of names we own – can perform much better than the market overall during inflationary periods. This empirical result makes intuitive sense, as more profitable companies, with pricing power, and lower leverage are better able to cope with cost pressures. Also, avoiding stocks trading at exorbitant multiples lessens the vulnerability to de-rating as a result of higher discount rates.

Quality research

First and foremost, we seek to invest in companies that have powerful economic returns – high returns on equity, high returns on invested capital, high free-cash flow conversion and so on. Equally as important is the predictability of these returns. We believe our holdings are driven by long-standing secular growth and have demonstrated they are less vulnerable to economic headwinds. We shy away from cyclicals, a bias which has also historically reduced our volatility. An important point for current times is that higher financial leverage exacerbates the earnings impact of cost hikes. So, we steer clear of over-indebted companies as a matter of basic prudence.

The great news: The market today versus just a year ago is starting to offer better value which we can use to our clients’ advantage to help improve their portfolio’s potential returns.

With economic durability mattering more than ever, high quality companies within sectors such as consumer staples, health care, technology, and industrials should continue to be particularly resilient. We prefer companies that are selling mission-critical products with high-value creation for customers, like Adobe, with its digital marketing products and robust subscription model, which keeps customers locked into automatic payments. We believe our companies have brand power and demonstrate consistent improvements to products and services to maintain their value proposition. That includes the Franco-Italian eyewear conglomerate and world’s largest company in the eyewear industry, The Essilor Luxottica Group.

If inflation is rising, our experience demonstrates that higher margin businesses have more cushion to withstand cost pressures, even before offsetting price increases. It’s just a matter of simple math. Companies with pricing power can also pass on higher input costs to customers, which can provide better earnings downside protection. The best businesses can raise prices without losing customers to competitors. Take Sherwin Williams: Because paint is only around 10% of the cost of a professional paint job, even a 20% price increase for coatings boosts the cost for consumers by just 2%.

Sometimes in-depth research feels like a masochistic exercise. We work intensely every single day but ultimately most often “do” the wisest investing thing: nothing and stay the course patiently. As the saying goes, time is the friend of a good business and the enemy of a bad one.

Additionally, our portfolio construction philosophy and the constituency of our companies within certain buckets is important to our long-term journey. Let’s use a soccer analogy: Our portfolio companies are like Defenders who have the key role and critical responsibility in the portfolio to defend—but they also score goals. Generating investing returns requires offense alongside defense, after all. But in this context, we don’t expect those Defenders to be outscoring our Forwards, whose position on the field is more focused on scoring goals at a faster pace, i.e., high rates of compounding capital over long periods of time. So, it’s important that we have the right positions covered on a field as in a portfolio, and that we focus on monitoring our players to ensure they are fulfilling the intended portfolio position. If not, we do have to react and make substitutions. A good investment manager, like a successful coach, must be mindful of improving the overall performance of the team by putting the best lineup on the field.

Healthy optimism

Our optimism and outlook will always be grounded in deep company research, portfolio construction and the disciplined application of our demonstrated investment philosophy. While our heads are in the books, they aren’t in the sand: Extreme excesses continue to distort valuations and drive animal spirits. Jason DeSena Trennert, CEO of Strategas Securities, a policy research firm in New York, recently reminded me that “investing in an era of free money is like playing golf on the moon. Everyone has a chance at winning the long drive contest.” He notes that higher interest rates have the possibility of creating a “bezzle,” a word coined in the 1950s by economist John Kenneth Galbraith that describes how inflated values can create so-called psychic wealth. Because investing is very much a behavioral exercise, we are mindful of the environment around us. Situational awareness is helpful in making buy and sell decisions.

Unprecedented stimulus and prolonged low rates sparked a feeding frenzy in private lending contributing an illusion of riches across the board. Charlie Munger has also described a bezzle to be any time the reported market value of an asset or portfolio temporarily exceeds both its real economic value and its productive capacity. Asset prices eventually converge to a value that represents true intrinsic value, either up or down, which is one reason I’m particularly optimistic about the outlook for quality growth.

The best investors are patient, look through near-term weakness and keep an eye on the long-term prize. If you’ve done your homework on valuation and long-term earnings predictability; you’ve separated fact from speculation in a systematic and analytical way, the rewards will come. Difficult markets are not to be feared. As uncomfortable as it might feel in the moment, and as dire as the outlook might seem, you will always be better off with optimistic resolve and a clear investment roadmap.

Indeed, the best investment returns are conceived in down markets, only to be realized during more buoyant times.

Any investments discussed are for illustrative purposes only and there is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable.

The views and opinions herein may change at any time and without notice. Such information is not intended to predict actual results and no assurances are given with respect thereto. Certain information herein is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity of countries, markets and/or investments. We believe such statements, information, and opinions are based upon reasonable estimates and assumptions. Actual events or results may differ materially and, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.