How to Net Zero – seeking to achieve our goal and the goal

Quality Growth Boutique

Extreme heat in the Northern Hemisphere this year and wildly hostile climate conditions everywhere have finally gotten the attention of investors. Climate change due to unlimited greenhouse gas (GHG) emissions has caused economic and social damage. And a large proportion of these emissions are released by listed companies1 which are in effect controlled by minority shareholders.

Recently, there has been an acceleration of emission abatement plan launches by investors. The number of investors signing up to alliances such as the Net Zero Asset Owners Alliance (NZAOA), and the Net Zero Asset Managers (NZAM) Initiative have become substantial. The NZAM Initiative alone has 273 signatories representing US$61 trillion of AUM. While we are not signatories of these alliances, we should note upfront: the Vontobel Quality Growth Global Equity strategy currently has a carbon intensity level below its benchmark2.

Beyond these global initiatives, there are fundamental imperatives that dictate why portfolio managers must make emissions reduction a priority based simply on the risks to profit. One example is the Carbon Border Adjustment Mechanism (CBAM) – in effect a carbon tax on imported emissions – that was approved by the European Parliament in June 2022. This requires exporters to the EU to buy carbon import permits for each associated ton of CO2, unless there is a similar tax system in their home market. The initial targets are: cement, iron and steel, aluminum, fertilizers, and electricity. This could be particularly challenging for lower value-add products (low margins and price sensitive) that require high amounts of energy to produce and that are manufactured in coal dominated economies. To date, 46 national jurisdictions have some form of a carbon-pricing mechanism in place covering an estimated 23% of global GHG emissions3.China launched its emissions trading system in 2021.

As a result, the time has arrived for portfolio managers to figure out how to track and reduce emissions underlying their portfolios. In this article, we cover some of our views towards tracking emissions as well as how our Quality Growth Global Equity strategy measures up both against the benchmark—but importantly against its own glidepath towards net zero.

The starting point is the need to align our investment philosophy and approach to emissions reduction. We want to enable portfolio managers to align with climate goals while maintaining as many investment choices as possible. Of course, we need to deliver performance and reduced emissions.

There are two basic approaches a manager can take to target portfolio emissions:

Rebalancing – This approach sells higher carbon intensity holdings and buys lower carbon intensity. In terms of managing the portfolio for emissions reduction, a ‘rebalancing’ method is a reliable tool for achieving a set goal. But the manager may need to sell down preferred holdings and thus risk performance to achieve it. Furthermore, and importantly, it may lead to no change in the real world.

Rate Of Abatement – This approach focuses on the average rate of emissions reduction from the companies held. This way has the benefit of keeping first choice holdings; however, it is accompanied by lower predictability of emissions abatement. An important positive is the need to reduce emissions in the real world, which is a direct incentive to the manager.

Emissions are separated into three buckets or Scopes. Scope 1 is the closest to home, and covers emissions made directly by a company’s operations, such as the fuel burnt from driving a company-owned delivery van. Scope 2 is the next step away and covers emissions from power generation, mainly electricity, bought from a third party. Scope 3 is the broadest and includes all the emissions up and downstream in the company’s value chain. For instance, this covers the full range of touchpoints involved in the company’s products stretching from raw commodities, components, and transport (considered upstream) of the company, through to its customers using and disposing of its products (downstream).

There is another set of issues a manager needs to consider that we tackle later in this article, including engagement, managing Scope 3, and accounting for the distortion of inflation on revenue-based carbon intensity measures.

Tracking progress

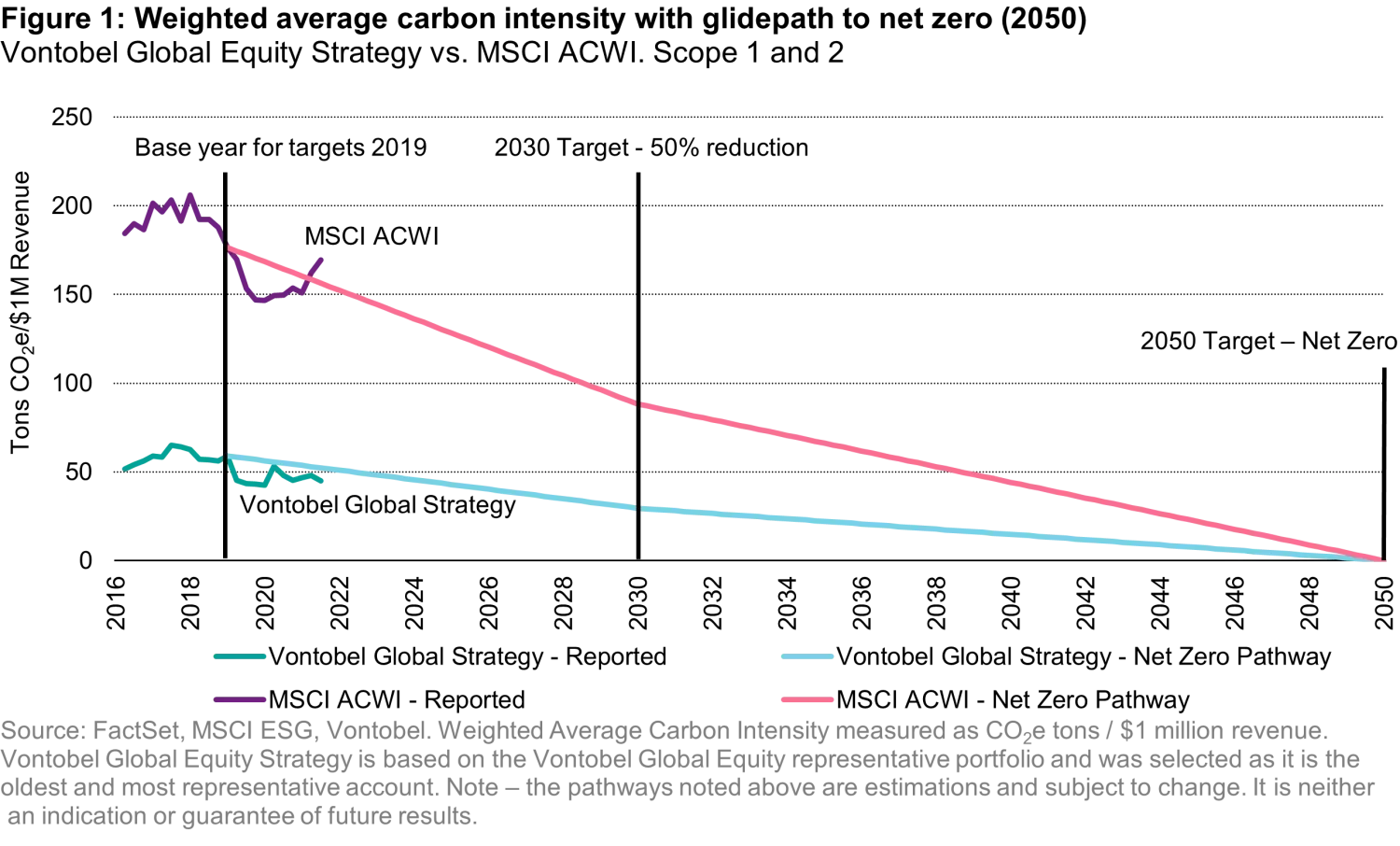

Figure 1 shows the carbon intensity4 history and emission reduction glidepaths of the Quality Growth Global Equity strategy against the MSCI All Country World Index (MSCI ACWI). While the Quality Growth Global Equity strategy historically has had lower emissions, it has its own directive with similar proportional reductions as the more emission intense MSCI ACWI.

The undulating purple and dark green lines on the left side of Figure 1 show the historically recorded emissions. The straight lines outline the emissions glidepath as outlined by the NZAM Initiative. These paths start at year end 2019 from each portfolio’s respective starting point. The NZAM is targeting a 50% reduction5by 2030, and on to net zero by 2050 or sooner. This is to match an IPCC6 pathway aimed at limiting average temperature rises to 1.5°C by 2100. A 50% cut to portfolio emissions versus 2020 over eight years is a heavy lift.

Which emissions are tracked matters a lot, as the more that come directly from a company’s operations, the more control a management team should have, and the less reliant they will be on persuading suppliers or customers to change practices. Currently we are tracking Scope 1 and 2 emissions due to the lack of reporting of Scope 3. With time we will look to include Scope 3.

Portfolio emissions – where they are heading

As mentioned, our Quality Growth Global Equity strategy currently has a carbon intensity level below its benchmark. That’s because how we invest tends to shun the less predictable nature of commodity prices and the drag on shareholder returns that can come from capital intensity. Thus, we tend to hold underweight exposures to the high GHG emitting energy, utilities, and materials sectors. While our portfolios tend to have carbon intensities below their benchmarks, this does not negate the need to track and estimate emissions as reduction is often paired to an emissions goal relative to a fund’s own starting point, however high or low.

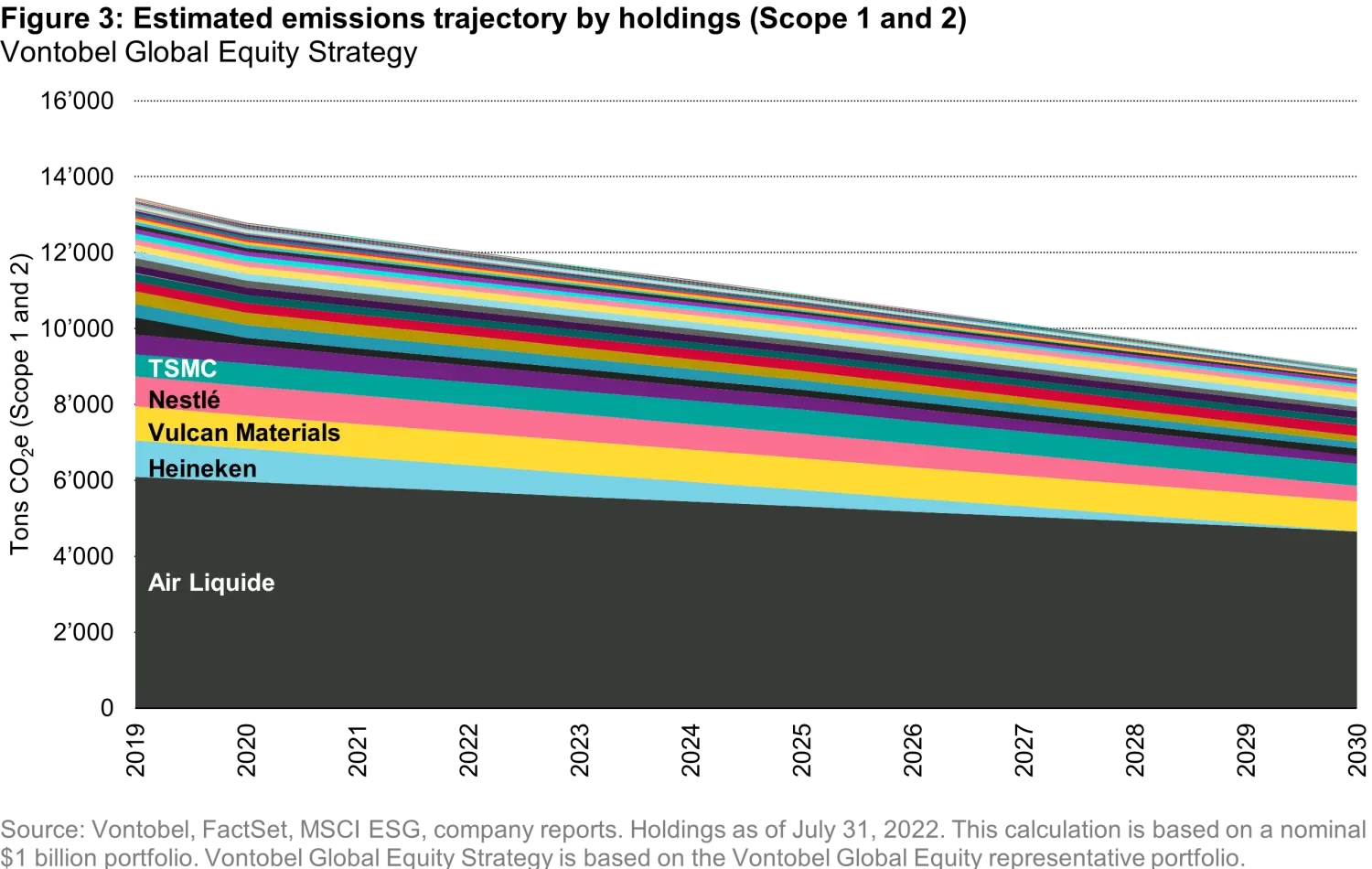

Looking out into the future we have worked to illustrate the rate of abatement within the portfolio implied by announced emissions plans by our holdings. The table below outlines our estimates of the long-term rate of reduction for Scope 1 and 2. This is based on announced abatement programs from investment companies along with the dilutive effect of companies that have no announced target. Our default assumption for companies without a plan (or after the end date of the announced plan) is that carbon intensity remains flat going forward.

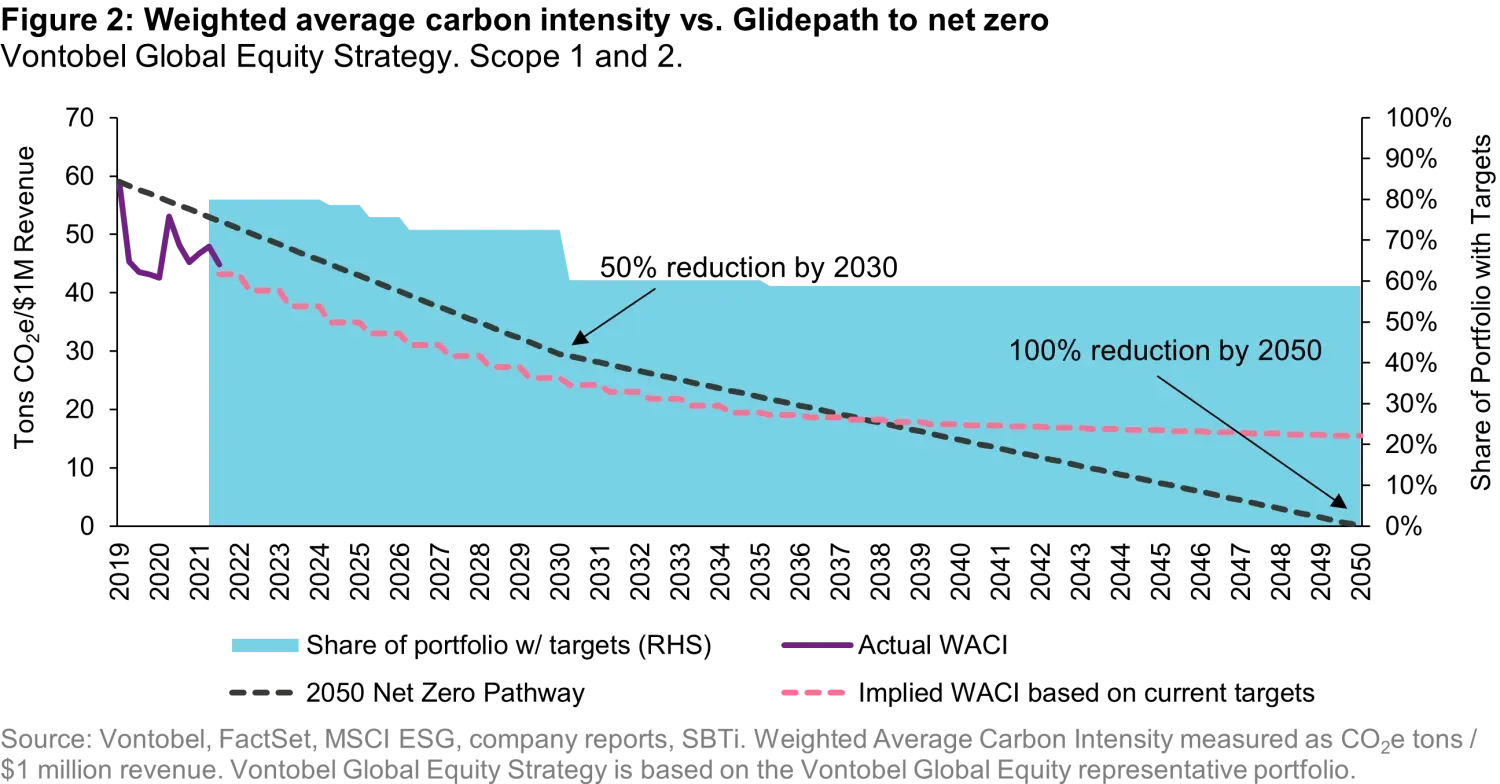

The portfolio’s historic weighted average carbon intensity (WACI) is tracked by the solid purple line and the estimated emissions intensity is shown by the dotted black line. The background blue (right-hand axis) outlines the proportion of the portfolio that has abatement plans announced for each year – there is a drop after 2030, the medium-term goal.

Further out, fewer companies will have programs announced and, as a result, the overall portfolio carbon intensity stops falling (dotted red line). While net zero 2050 is the headline goal, it is important to have an achievable intermediate target that companies can track against. We would rather see a sensible intermediate target feeding a path to net zero, compared with a distant long-range target floating in the ether. In this chart above, we have taken a conservative approach and assumed emissions stay flat at the end of a program rather than continue to further fall with future programs yet to be announced.

When the emissions within the portfolio are broken down it is apparent that while the portfolio has low emissions overall, there are some companies that stand out as relatively high emitters. Notably the French industrial gases company Air Liquide, Heineken, Vulcan Materials, Nestlé and Taiwanese semiconductor giant TSMC.

The risk is that heavy carbon intensity companies will act as a carbon piggy bank, sold piece by piece as the manager needs to lower their overall profile. There is no benefit we can think of when a manager avoids or sells out of a holding just because it’s a heavy emitter when it has an effective abatement plan in place - or could do. This kind of company can move the needle for reducing emissions in the real world, which we view as vitally important. An emissions reduction structure encourages owner/manager interaction and investment—and that leads to change and impact.

We have launched an engagement program across a number of our holdings. The primary goals at this stage are to strongly encourage disclosures and to discuss and understand what rates of abatement that may be possible from companies still working through the process. We also want to know what it will take in terms of time and investment. Finally, we will continue to engage and encourage action from companies that have been slow out of the blocks.

Challenges of the emerging markets (EM)

We recognize that it is far more challenging to encourage change with some EM companies given fewer tools at managers and investors disposal. But making sure progress is evenly spread means putting resources towards EM engagements. Any success in Europe or the US would be greatly diluted if emissions from the EM continue to rise rapidly without realistic abatement plans in place – or at least an acknowledgement of what’s needed to allow them to work. Our approach is to engage in the same way but recognize that the progress is often slower and can take more resources than dealing with some European or US based companies. However, we believe this is every bit as important even against stronger headwinds.

Inflation impact

We recently published a blog ( Inflation’s Illusion on Carbon Intensity – Don’t be Deceived ) on the impact of inflation on tracking carbon emissions across a portfolio if you use carbon intensity based on revenues (CO2e tons/ $1 million revenue). With inflation, sales prices rise for the same volume of goods produced. The end effect is a fall in carbon intensity, which could easily mislead you on the state of play. This is not an issue if you track emissions in absolute tons, which tracks physical activity.

For a sense of impact, consider if we adjusted the revenue figures in the carbon intensity estimates for the lift they got from inflation. Using inflation rates of 8.5% in 2021 and 8.0% in 2022, the WACI of the portfolio moves from a two-year fall of -11% (unadjusted) between 2020-22, to a rise of +3% (adjusted). The 14% difference is notable for investors following a glidepath goal. Eventually net zero is reached, but inflation distorts the rate of perceived change. As GHGs can last for many years in the atmosphere (CO2 can last 1,000 years), each year that a reduction is pushed back equates to more tonnage – accumulating and warming.

The reason investors use revenue as an underlying yardstick to track emissions is to provide a more consistent view. The trajectory is clear for companies with announced goals, but not for companies without a plan. To estimate those, the choice is to either try to figure out absolute emissions to 2050 (not really sensible given the range of possibilities) or normalize for business size, which carbon intensity provides.

It is important to stress that we track individual company emissions in absolute tons. Carbon intensity is only used to build-in the dilution to overall portfolio progress stemming from companies without emission reduction targets.

Scope 3 – Important, but early

Scope 3 draws the emissions, from its supply chain and use of its products, into a company’s sphere of responsibility. Conceptually, this is similar to the way Nike’s Asian low-cost supply chain became the brand’s (i.e., the company’s) responsibility back in the 1990s. It’s a mechanism that extends the decarbonization effort from listed companies into the private market upstream (supply chain) and downstream through product design and disposal (consumer use). It also offers a competitive edge to suppliers with lower carbon footprints that sell into listed enterprises.

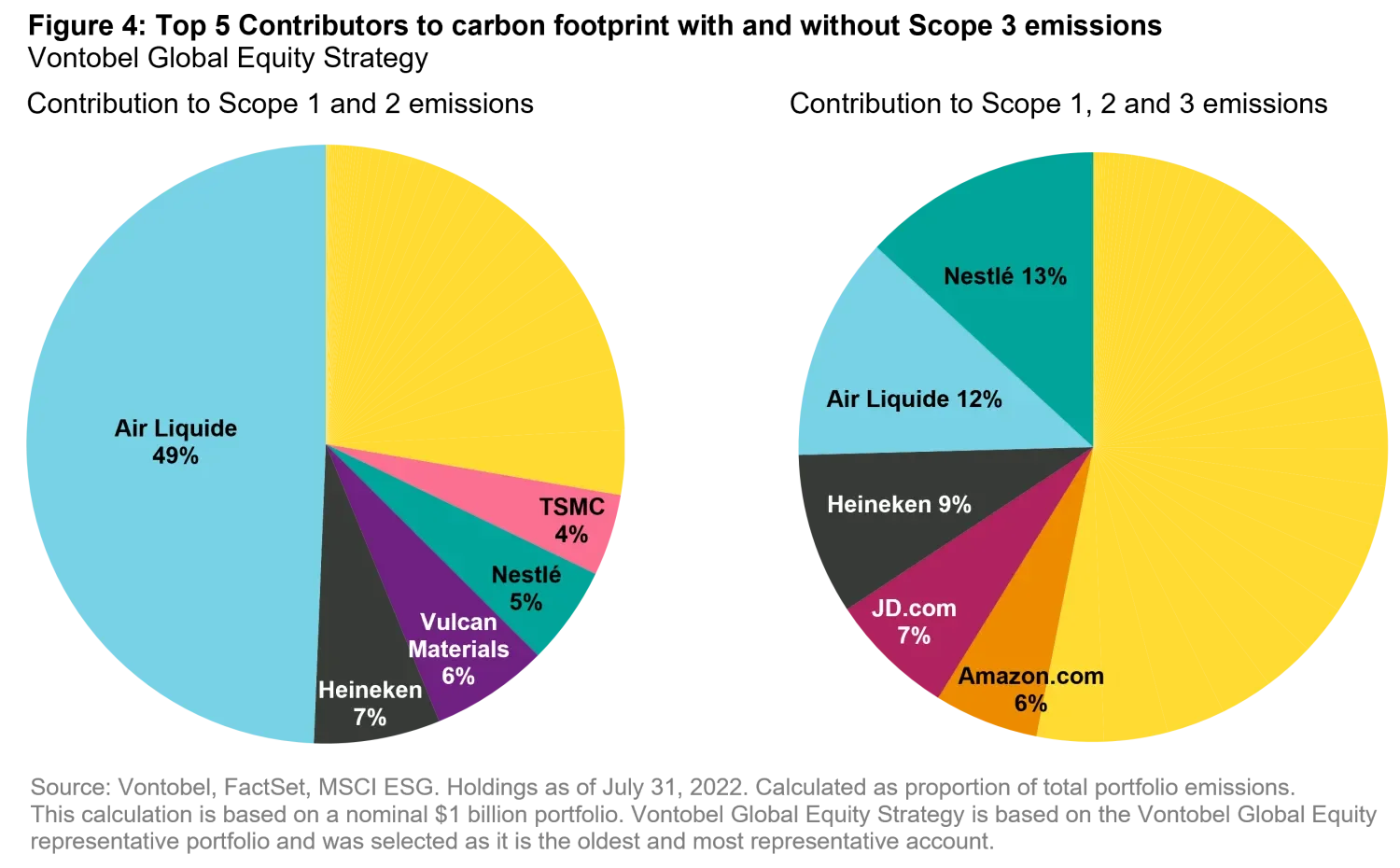

To illustrate the difference adding Scope 3 has, the following chart shows the top-5 companies by contribution to total portfolio emissions for the Quality Growth Global Equity strategy. It is notable how the significant Scope 3 emissions from agriculture increase the contribution from companies such as Nestlé and Heineken.

While we are currently focused on Scopes 1 and 2, we must not lose sight of Scope 3. For investors pulling from their carbon piggy bank to lower Scope 1 and 2, it is important to remember that their emissions store will likely look quite different when Scope 3 is added. Again, for us we use it as another opportunity to engage.

Running the data is laborious

A quick word on pulling the forecast emission data together: Currently, it is a laborious process as each company announces and structures their abatement programs individually. A notable help comes from those that have followed the SBTi (Science Based Target Initiative) route and been approved. These all are easy to find on the SBTi website7 and have short-, medium- and long-term plans on a relatively consistent basis. However, we have not yet found a third-party system that we like that brings the data together for those without SBTi. Currently each company needs to be investigated separately.

Conclusion

Tracking, encouraging, and delivering rates of GHG abatement is important for many investors to manage. While our portfolios start from a base well below the benchmark, simply due to our investment approach, not all of our holdings have low emissions, particularly when you consider Scope 3. We strongly believe in the benefit of investors working with management teams in partnership to encourage change, but to also listen to what they need from us in return. Some will require our votes, and we will vote for plans as long as they appear sensible, and we regard them to represent the best long-term interests of our clients. There is work to be done, but as always, it’s about finding the smartest path to achieve our mutual goals.

1. Please see recent blog on this subject:

Carbon Emissions: Does engagement carry a punch

?

2. Benchmark is the MSCI All Country World Index (MSCI ACWI), source FactSet, MSCI ESG

3. Source: The World Bank. Proportion of global GHG emissions that would be covered in 2022.

https://carbonpricingdashboard.worldbank.org

4. CO2e stands for CO2 equivalent. This is the weight of CO2 that would equal to the emissions of a range of greenhouse gases.

5. Scope 1 and 2, and material portfolio Scope 3 emissions to the extent possible.

https://www.netzeroassetmanagers.org/commitment/

6. Intergovernmental Panel on Climate Change (IPCC) is a body of the United Nations (UN) in charge of the scientific understanding of climate change, its drivers, and risks.

7. https://sciencebasedtargets.org/companies-taking-action, scroll down to Target dashboard.

Disclosure

The discussion of any companies in this paper is for illustrative purposes only and were selected based on topics related to our environmental research and the evaluation of this activity as part of our investment process. The investments identified and described do not represent all of the investments purchased or sold for client accounts. There is no assurance that the adviser will make any investments with the same or similar characteristics as any investments presented. The reader should not assume that an investment identified was or will be profitable. There is no assurance that any investments identified will remain in client accounts at the time you receive this document.

Environmental, social and governance (“ESG”) investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate ESG components may vary across providers and issuers as ESG is not a uniformly defined characteristic. ESG investing may forego market opportunities available to strategies which do not utilize such criteria. There is no guarantee the criteria and techniques employed will be successful. Unless otherwise stated within the strategy's investment objective, information herein does not imply that the Vontobel strategy has an ESG-aligned investment objective, but rather describes how ESG criteria and factors are considered as part of the overall investment process. Diversification does not assure a profit or protect against loss.

Certain information ©2022 MSCI ESG Research LLC. This report contains “Information” sourced from MSCI ESG Research LLC, or its affiliates or information providers (the “ESG Parties”). The Information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. Although they obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness, of any data herein and expressly disclaim all express or implied warranties, including those of merchantability and fitness for a particular purpose. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such, nor should it be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein, or any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

This material does not constitute specific tax, legal, or investment advice to, or recommendations for, any person. The views and opinions herein are those of Vontobel and may change at any time and without notice. Past performance is not a reliable indicator of current or future performance. Some of the information provided may contain projections or other forward-looking statements regarding future events or future financial performance of countries, markets and/or investments. These statements are only opinion and actual events or results may differ materially. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.