Three trends key for thematic investing in 2025

Conviction Equities Boutique

Key takeaways

- Our specialists in thematic investing continue to keep a close eye on the trends they believe will dominate the AI landscape throughout 2025.

- The team is convinced that, besides the famous technology giants, innovative companies from various other sectors are well-positioned to benefit from these developments.

- The team adheres to the philosophy that thorough company research and disciplined active management are indispensable for the success of thematic investments.

1. Productivity gains through artificial intelligence

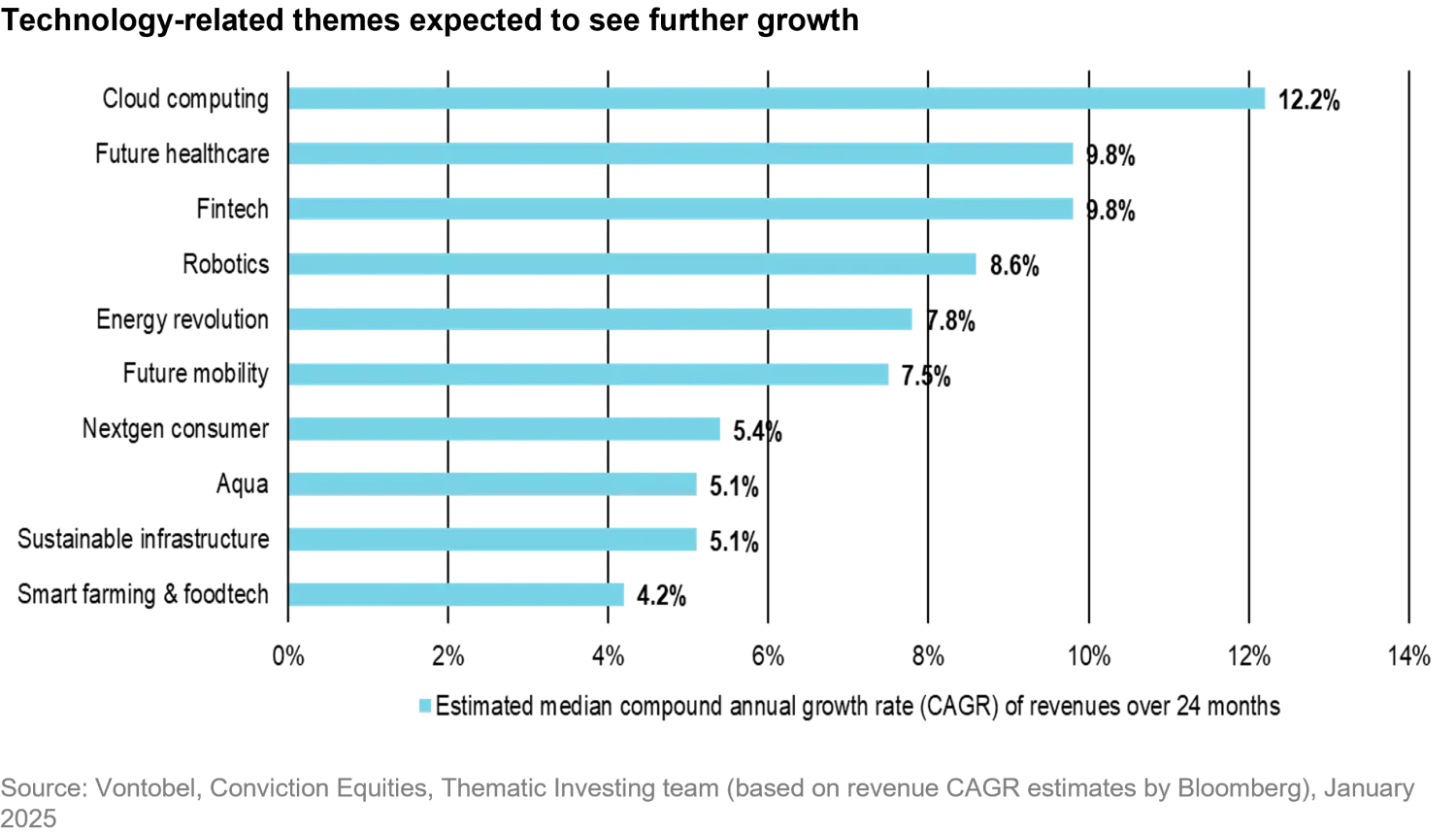

As artificial-intelligence (AI) infrastructure expands, its benefits will extend beyond hyperscalers and semiconductor firms. Companies active in sectors like finance, mobility, and healthcare are strongly positioned to see productivity gains from adopting AI, boosting growth and margins.

Exposed themes: fintech, future mobility, future healthcare, smart farming & foodtech

Since the debut of generative AI in November 2022, market capitalization of the leading US equity index S&P 500 has grown by more than USD 8 trillion, fueled by expectations of productivity gains and thus economic growth in the US. Some industry estimates suggest that AI could save 15% of US labor costs by automating 20% of tasks performed by 80% of the workforce, with potential productivity gains nearing USD 2 trillion.1 However, realizing this potential will require over USD 1 trillion in capital expenditures, with an increasing number of applications in the areas of software, autonomous vehicles, and healthcare reaching the market.

Combining AI with oversight by humans

Generative AI adoption is a natural extension of cloud technology, with advancements accelerating innovation. Microsoft forecasts over USD 10 billion in annual AI-driven revenue by 2025. Key use cases, like the automation of customer support, already deliver return on investments (ROI) by combining AI capabilities with human oversight.

The swift adoption of AI since the launch of the chatbot ChatGPT (Generative Pretrained Transformer), developed by US software company OpenAI, has spurred significant capital investments in data centers to further train large language models at scale. Within the data-center ecosystem, this trend has primarily benefited the so-called picks-and-shovels players, i.e., those AI tooling companies that benefit from the overall AI boom without being dependent on the success of any specific application.

Particularly, chip manufacturers specializing in graphics processing units (GPU) – these are indispensable for AI – have experienced exponential growth, whereas software companies are lagging the broader technology sector, because their AI models take longer to monetize. We from the Thematic Investing team within Conviction Equities expect 2025 to be the turning point for leading software firms to reap substantial revenues from their AI-related activities.

AI applications in the fields of Software as a Service (SaaS, which allows users to connect to and use cloud-based applications over the Internet), fintech, autonomous vehicles, and healthcare are evolving rapidly and deserve close attention in our opinion. While the overall economy will feel the full impact of AI through productivity gains in the long term, its applications are advancing faster than in any of the past technological breakthroughs.

Enhanced data analysis in finance

In the financial sector, where data is central to operations, AI has the potential to significantly boost productivity. For instance, AI models can improve credit products like personal loans by assessing a borrower’s probability of default more accurately than traditional methods. We have observed a significant increase in demand for financial software that incorporates AI functionality. After an already strong rise in fintech stocks, we expect 2025 to see sustained AI adoption and growth in this space.

More safety in driving

AI innovation is also making its way into the physical world, albeit less speedily than in the services industry. Autonomous vehicles (AV) have recently gained more attention, with Google reporting that over a distance of 22 million miles its Waymo driverless car caused 73% fewer crashes with injured than cars driven by humans2 – a major step forward in road safety.

Public policy strongly endorses AV adoption, given that worldwide car accidents count 50 million injuries and 1.35 million fatalities each year, according to road-safety statistics by the United Nations. AV fleets utilize sensors, cameras, and collective data to continuously enhance safety and efficiency. Cities like Phoenix, San Francisco, and Los Angeles see increased AV adoption, with Tesla aiming to deploy two million robocabs by 2026. Partnerships with Uber, Lyft, and delivery platforms reduce costs, hence boost operating margins, while consumers pay less.

Advantages for medical research and patients

AI is also transforming healthcare through advancements in drug discovery, diagnostics, and patient care. According to industry projections, AI tools may diminish costs for research and development by up to 70%, streamlining complex data analysis and alleviating repetitive tasks for scientists.3

Biosimulation company Certara, for example, leverages AI technology to help researchers model and simulate complex biological systems, enhancing the prediction of drug behavior and accelerating the process of bringing medications to the market.

In patient care, AI refines radiology and diagnostics, enabling earlier detection and treatment. For instance, US-based RadNet Inc. provides outpatient diagnostic-imaging centers with an AI-driven mammography technology capable of identifying potential lesions within a day. It is already in use with over 300 screening sites.4

Smart-farming solutions to address labor and climate challenges

AI and robotics are transforming agriculture, making it smarter, more sustainable, and more efficient. This traditionally labor-intensive sector is adopting technology to tackle issues like labor shortages and unpredictable weather.

According to John Deere, a US firm specializing in agricultural machinery, agriculture in the US is falling short of 2.4 million workers each year. John Deere and its Japanese counterpart Kubota have showcased AI-driven solutions at the 2025 Consumer Electronics Show (CES) in Las Vegas in January. Both companies envision farms with machines handling repetitive work, allowing the farmers to focus on strategic tasks. Kubota, for instance, presented its Smart Plant Imager, which can assess the ripeness of blueberries, and John Deere its 9RX autonomous tractors, which are already in use across the US Midwest.

1. https://www.tdsecurities.com/ca/en/themes-2025#

2. https://waymo.com/blog/2024/09/safety-data-hub

3. https://mrdc.health.mil/index.cfm/media/articles/2024/artificial_intelligence_can_help_researchers_develop_new_drugs_MRDC_regulatory_experts_forecast?utm_source=chatgpt.com

4 .www.deephealth.com

2. Surging power demand

Power supply is becoming an increasingly competitive battleground for data-center operators. Demand for energy infrastructure, power management solutions, and data-center cooling will continue to create key areas for investment.

Exposed themes: cloud computing, energy revolution

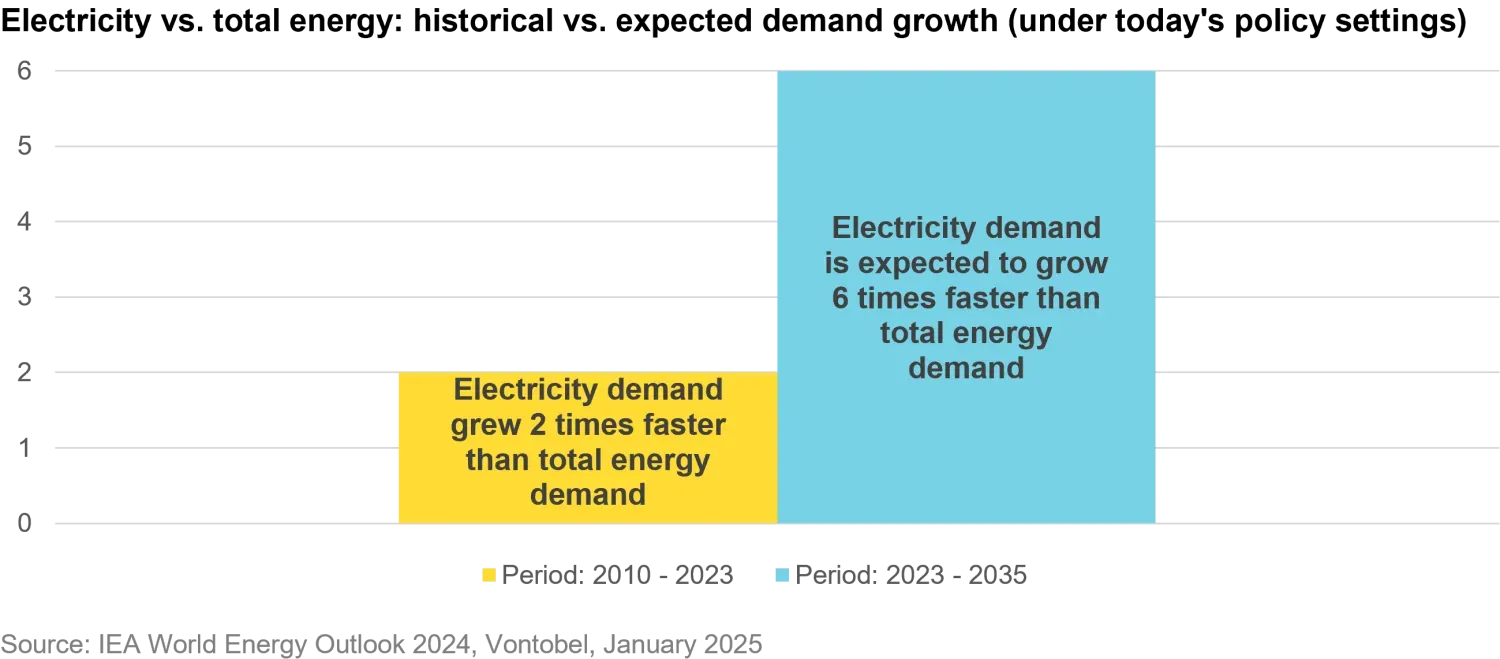

Rapid growth in worldwide electricity demand, fueled by the expansion of data centers supporting generative AI, is creating significant power constraints. According to industry estimates, third-party US data centers could account for 7% of US electricity consumption by 2028, up from 1.5% in 2018, and 3% of global electricity consumption, up from 0.8% in 2018. Lead times to secure utility power for new hyperscale data centers spans 2.5 to 7 years in the US and 3 to over 10 years in major European markets.5

When the Chinese start-up DeepSeek recently launched its energy-efficient AI model, many market participants initially questioned the expected rise in power demand. In our opinion, however, the model’s reported efficiency gains, enhanced performance, and reduced costs could accelerate AI adoption, and ultimately drive power consumption higher. This is the so-called Jevons paradox, in which a more resource-efficient application due to increased usage ends up consuming more resources.

Energy-infrastructure modernizers required

Consulting firm McKinsey in its base-case scenario expects global AI data-center capacity, measured in gigawatts, to grow at a compound annual growth rate (CAGR) of 22% until 2030, more than tripling from 2023 levels.6 Energy infrastructure is becoming a highly competitive arena for data-center operators.

Major technology companies are competing to secure next-generation power sources – including modular mini-reactors, fusion, and geothermal energy – to meet the electricity demand anticipated to double by 2026 driven by AI workloads. Early investments and strategic partnerships in energy technology will play a critical role in determining which companies can scale their AI capabilities effectively.

Ample opportunities along the energy-supply chain

Answering the increasing power demand of data centers will require substantial investments across the entire energy-supply chain. In the short to medium term, strategies such as migrating non-latency-sensitive workloads, upgrading transmission infrastructure, and leveraging natural-gas solutions will be vital. In the long term, we expect nuclear energy to be crucial to sustain the capacity expansion of data centers.

Modular mini-reactors could serve captive/behind-the-meter power generation, i.e., embedded in the data centers, allowing their operators to bypass the complexities of grid interconnection. Renewable energy will continue to gain share as an indispensable element of decarbonization. However, wind and solar due to their intermittency are not suitable for powering data centers.

Energy-management specialists, cooling technology innovators, and high-capacity utilities needed. The multi-year expansion of data centers and their power demand is poised to benefit several sectors: Grid-infrastructure spending will foster the growth of companies specializing in project-management and engineering services with expertise in complex energy-transmission and distribution projects. The anticipated surge in demand for energy-management devices, such as switchgear and circuit breakers, may create supply bottlenecks.

Moreover, given next-generation AI chips produce more heat than traditional ones, advanced cooling technologies will be in demand. This could induce a shift from air cooling to liquid cooling and immersion cooling, where servers are submerged in liquid to maintain stable temperatures. Utility companies are also well positioned to benefit from the increase in power demand, which they will answer by capacity expansion.

5. https://www.tdsecurities.com/ca/en/themes-2025#

6. https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/ai-power-expanding-data-center-capacity-to-meet-growing-demand

3. Re-industrialization and critical infrastructure investments in the US

Modernizing US infrastructure and reshoring production align with policy support and structural trends. Upgrading aging water-systems and expanding domestic semiconductor-manufacture will be pivotal. Moreover, population aging requires a stronger social infrastructure. Companies active in these fields are set to benefit.

Exposed themes: sustainable infrastructure, aqua, robotics

In the US, manufacturing and infrastructure investments will remain a key focus of the new Trump administration. From our perspective, this will benefit companies active in automation or robotics solutions, water infrastructure, and critical social infrastructure going forward.

The USD 1.2 trillion Infrastructure Investment and Jobs Act (IIJA) launched in 2021 has already started to drive momentum for infrastructure projects, with roughly USD 700 billion still to be allocated. In our eyes, a change in administration should not impact budgets, as there is a broad consensus across both the public and private sectors on the need to rebuild the physical economy to stimulate economic growth.

The US is undergoing a significant re-industrialization, driven by reshoring initiatives and major legislative actions. Central to these efforts are the Inflation Reduction Act (IRA) and the CHIPS and Science Act, which focus on clean energy, semiconductors, and strategic industries like biotechnology and defense. Over USD 200 billion in manufacturing investments have been announced since 2022, contributing to a record 350,000 reshoring jobs created in 2023.

Investments fostered by new US administration

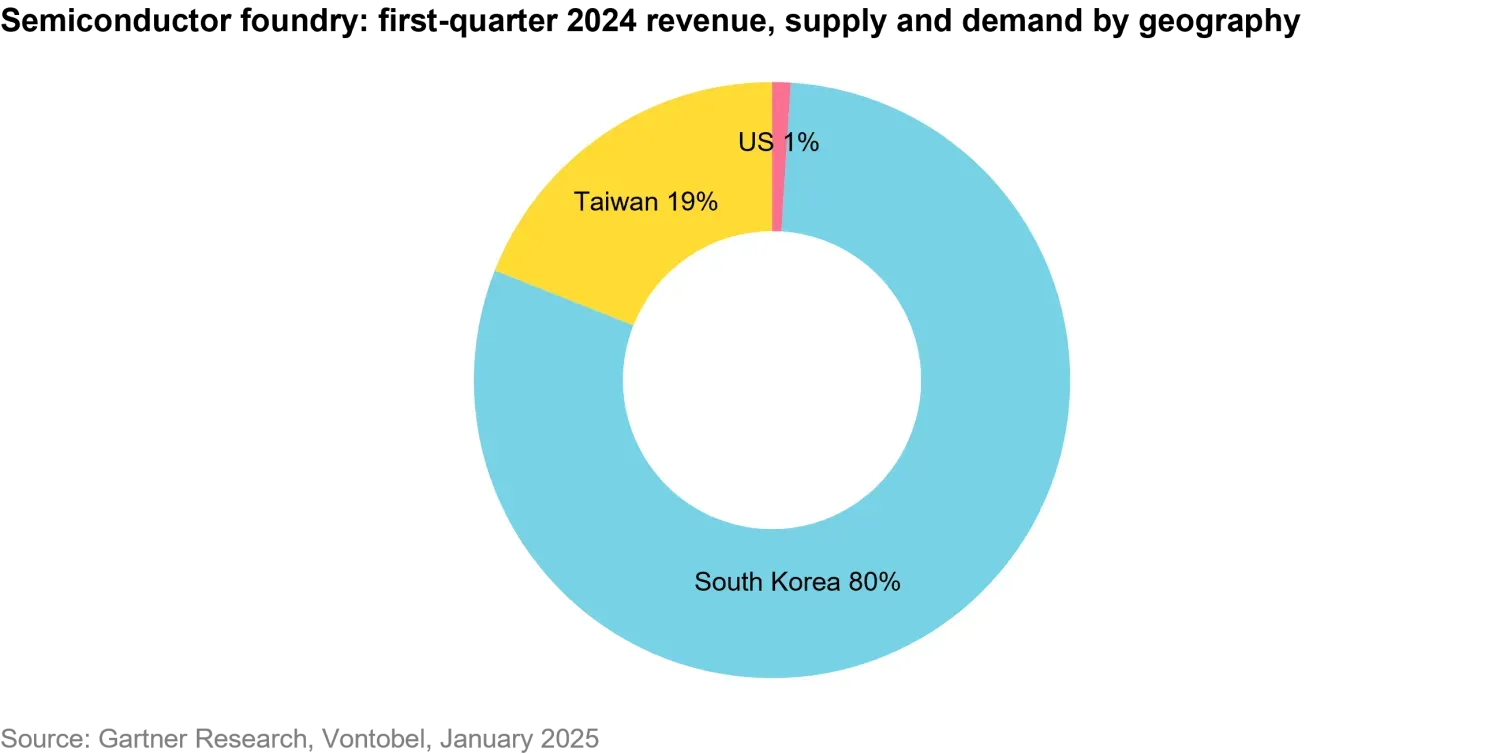

A key objective of these initiatives is to reduce reliance on China by reshaping supply chains to prioritize national security and by expanding domestic capacity in critical industries such as semiconductors and pharmaceuticals. North American supply-chain integration is also progressing, with Mexico recently surpassing China as the largest source of US imports. Investments in semiconductor manufacture stimulated by the CHIPS Act include high-tech facilities of companies like US-based Intel and Taiwanese TSMC.

These efforts address the rising demand for US semiconductors in the US, while mitigating economic risks associated with global supply disruptions. Currently, only 1% of worldwide semiconductor-foundry revenue is generated in the US, with Taiwan dominating the production of advanced chips used in data centers and smartphones.

Trade policies, including potential new tariffs under the Trump administration, may further encourage reshoring by addressing US-China trade imbalances and bolstering critical industries. Such measures, alongside bipartisan support for supply-chain resilience, infrastructure investment, and foreign direct investment, will contribute to position the US as a leader in strategic manufacturing.

Water-infrastructure innovators wanted

Another growth area is investment in water infrastructure. The substantial increase in water demand from new data centers for cooling will exacerbate existing water-scarcity issues. Innovations in water-filtration and recycling technologies are improving water quality and promoting sustainable usage. High-precision membranes and eco-friendly designs are at the forefront of these developments.

We expect support for water infrastructure to continue under the Trump administration. Related initiative examples include replacing lead pipes across the US with a budget of USD 18 billion to ensure safe drinking water for all communities within 10 years, and modernizing stormwater infrastructure to mitigate flooding and improve water quality.

Providers of smart-healthcare services welcome

Another area that will see surging demand is social infrastructure, given the industrialized nations’ aging population requires more healthcare services. In the US, a record 4.1 million citizens turned 65 years old in 2024, with the 65+ age group now representing 18% of the US population. The US Census Bureau projects this age group will increase further. The pace and scope of such demographic changes will have profound investment implications. We expect population aging to provide a tailwind for industries catering to elderly services, including senior housing, home care, and rehabilitation.

Conclusion

In our opinion, the structural trends described above will benefit many more companies than the well-known leading technology giants. However, the unpredictability of future geopolitical and global economic developments as well as company-specific events harbors risks that could adversely affect the business success and stock prices of companies. With this in mind, we strive to identify potential future winners through our disciplined active investment approach, which takes a longer-term perspective and places in-depth company analysis at its core.

Applying AI in finance, mobility, and healthcare enhances productivity, but consumes more energy and water. At the same time, our aging population requires more healthcare. These shifts call for robust and sustainable infrastructure, hence innovative solutions. Their providers should be rewarded with accelerated growth and higher margins in the future.

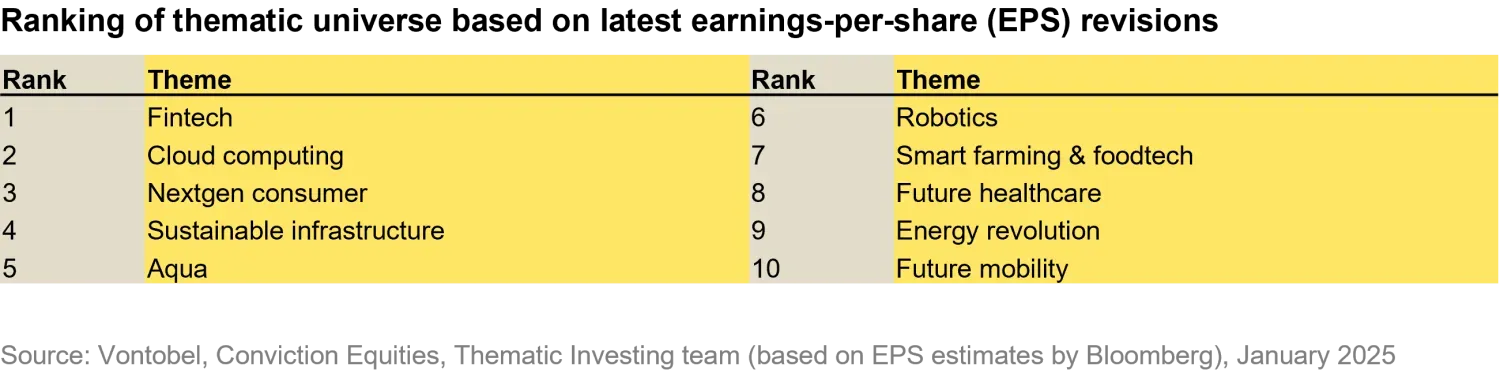

The above themes are ranked differently when looking at how many companies related to them recently have revised their earnings upwards.

Important information: References to companies are provided for illustrative purposes only to address the subject matter discussed. References to these companies should not be considered research, or a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of security associated with them. You should not assume that any investment is or will be profitable.

Opinions expressed herein may be those of individuals and may differ from the views and opinions expressed by Vontobel. The views expressed were current as of the date indicated and are subject to change. This material may contain forward-looking statements, which are subject to uncertainty and contingencies outside of Vontobel's control. Recipients should not place undue reliance upon these forward-looking statements. There is no guarantee that Vontobel will meet its stated goals. Past performance is not indicative of future results. Investment involves risk, losses may be made.

The material is based on information that is considered correct, and any estimates, opinions, conclusions, or recommendations contained in this communication are reasonably held or made at the time of compilation. However, no warranty is made as to the accuracy or reliability of any estimates, opinions, conclusions, or recommendations.

“BLOOMBERG®” and the Bloomberg indices listed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the distributor hereof (the “Licensee”). Bloomberg is not affiliated with Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products named herein (the “Products”). Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.