Commodities reloaded

Quantitative Investments

After navigating the tumultuous period for commodities throughout the 2010s, it’s worth asking: what is the potential for lucrative returns in the sector in today's climate?

In this article, we try to answer this crucial question by examining historical events and analyzing the pivotal impact of the U.S. shale boom in the last decade. We take a look at the potential future drivers of commodity demand, including the renewable energy transition and the robust growth in emerging markets. We also cover the future of oil and gas demand, spotlighting key factors that are set to sculpt the landscape of the commodities market in the forthcoming years.

We argue that the investors of today should not overlook the potential for substantial returns in commodities. This potential is fueled by the market dynamics and enduring demand drivers that are currently at play, detailed below.

Attractive Returns Ahead?

Many may question the notion of attractive returns in commodities, especially given the memories of the 2010s, the longest and deepest drawdown for commodities on record.

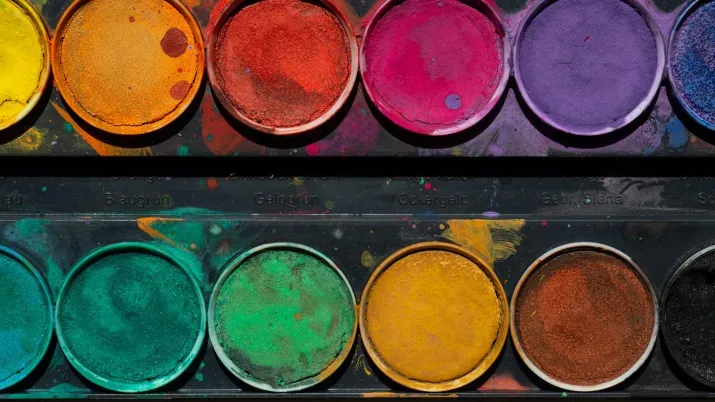

However, Figure 1 shows the history of commodity prices and reveals that commodities have shown positive returns in previous decades. The 2010s commodities drawdown was due to very specific factors which are highly unlikely to be repeated in our view.

From 2011 to 2015, the Bloomberg Commodity Total Return Index fell by 50 percent (-13 percent annually) [Bloomberg, 31.12.2010-31.12.2015] . All sectors were down, with natural gas and petroleum the hardest hit. The following years, 2016-2020, did not see a significant recovery in commodities either. This drawdown was primarily due to the shale oil boom in the United States. Hydraulic fracturing, or “fracking”, combined with horizontal drilling, significantly increased U.S. oil production, marking it one of the most substantial growth periods in the industry's history.

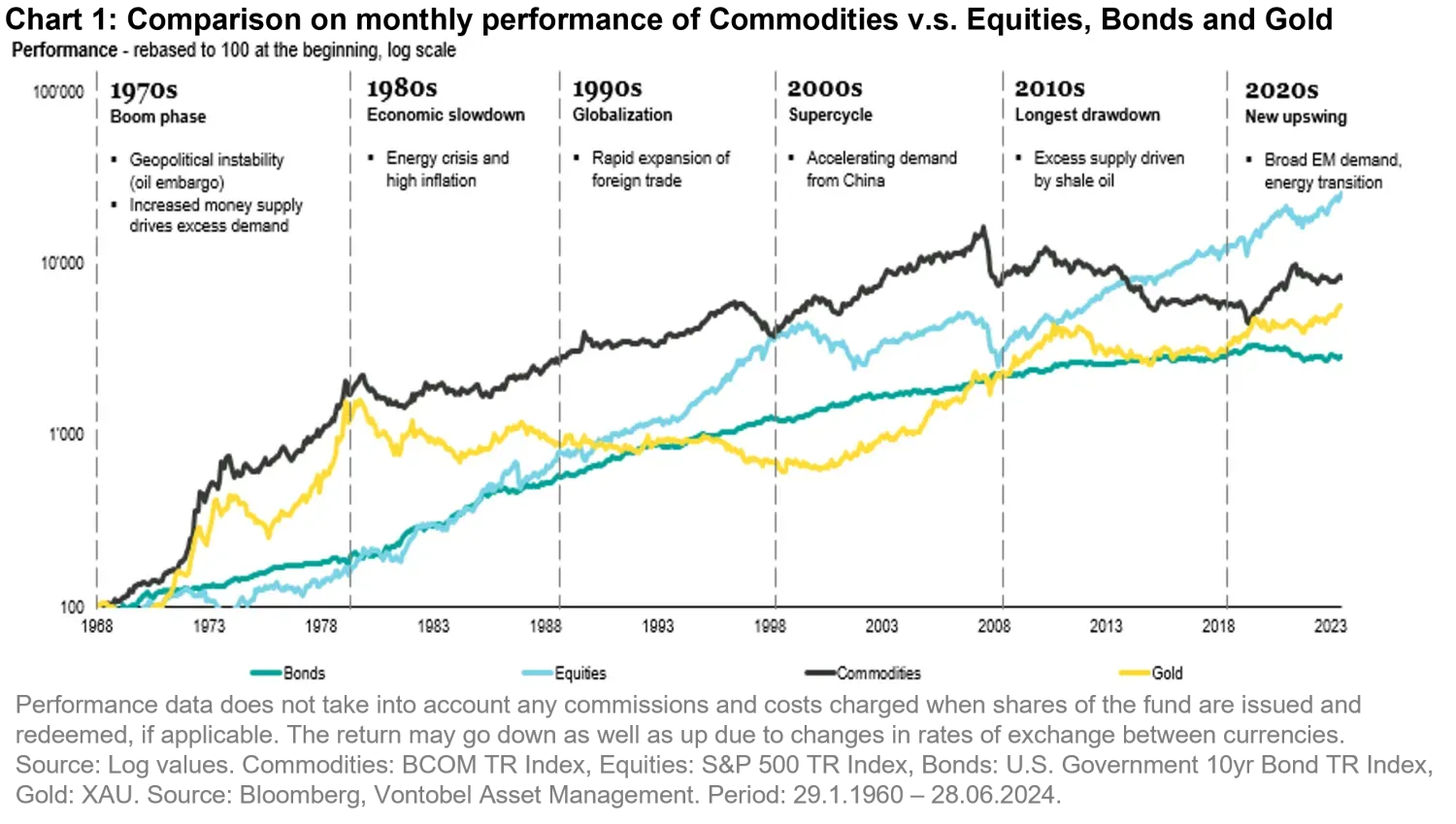

Gas production grew 50 percent from 2005 to 2015, making the United States the largest natural gas producer, while U.S. oil production nearly doubled between 2008 and 2015 as shown in Figure 2:

This surge in production altered the global energy supply landscape. Between 2012 and 2019, the U.S. added oil production equivalent to Saudi Arabia's entire export market [Bloomberg]. With this massive production growth, the U.S. began exporting crude oil and oil products, causing oil prices to plummet from USD 125 per barrel in 2012 to USD 30 by January 2016. The U.S. oil boom had significant implications for other sectors and commodities, as energy is a fundamental input for production processes. Oil prices impact metals production, industrial goods production, and agricultural prices, as these processes are highly energy intensive. [Bloomberg].

Low energy prices were a dominant source of low inflation in the last decade1. However, this situation is unlikely to repeat as despite slogans like Trump’s “drill baby drill,”, producers are hesitant to invest similarly due to the uncertain outlook on oil demand amid the green energy transition and Net Zero commitments.

New Drivers of Commodities Demand

While the 2010s drawdown will probably not repeat itself, the commodities supercycle of the 2000s, driven by China's rapid industrialisation and urbanisation, is also unlikely to recur. However, new drivers of commodities demand are arising, fuelling the next commodities cycle: namely, growing demand from emerging markets and the green energy transition.

Emerging Markets Demand

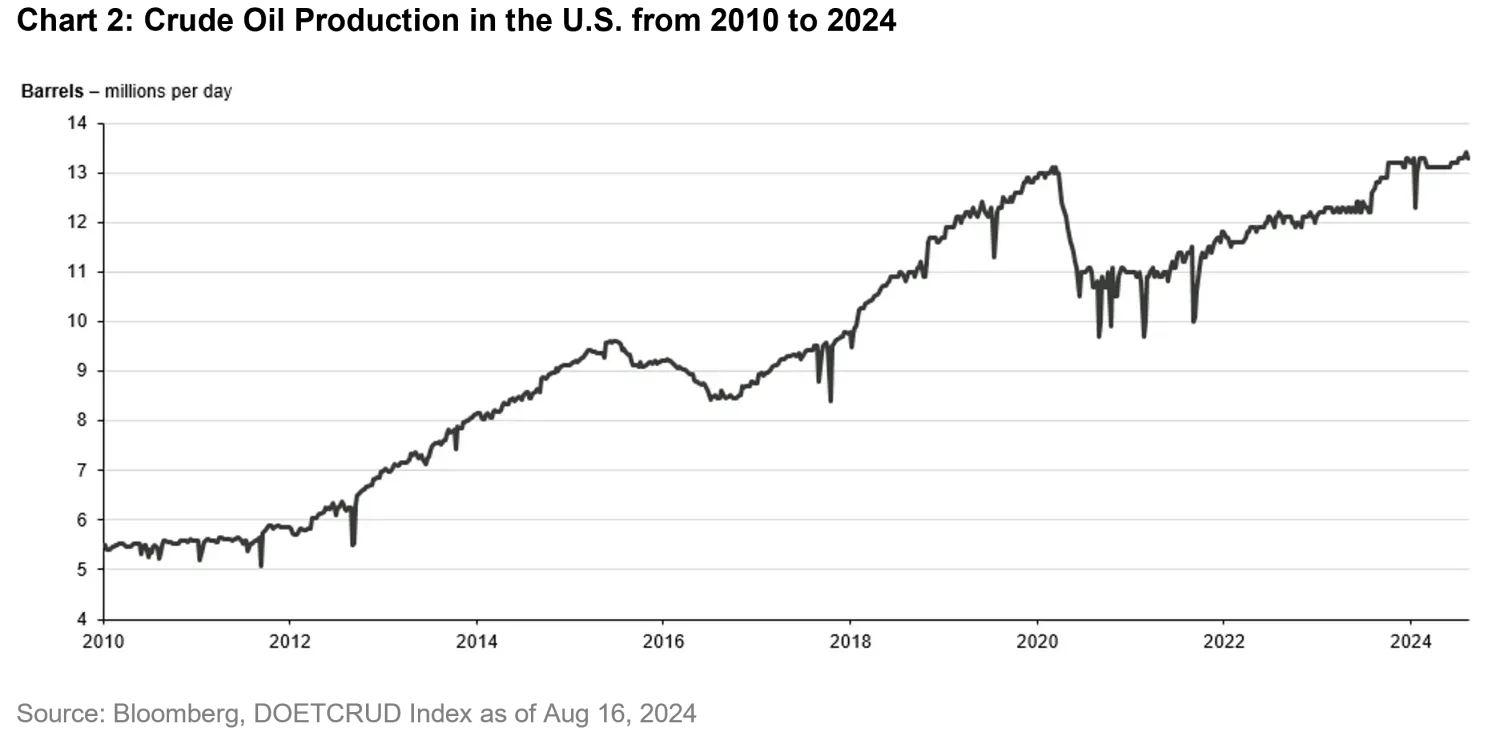

The United Nations expects the world population to increase from the current 8 billion to 9.8 billion by the 2050s, concentrated in emerging markets, which will translate into more resources to satisfy the global population’s food, goods consumption and travel needs. Not only will population growth keep commodities demand growth up, but the potential for rising GDP per capita in these developing countries may be a main driver. As shown in Figure 3, rising living standards up to a certain level go hand in hand with rising energy consumption.

Furthermore, by 2050, 2/3 of the population will be living in cities or urban centers, with a predicted increase of 2.5 billion people living in cities when compared to today, creating “mega cities.” This development will create extra demand on resources and services in urban areas (housing, transportation, energy systems and other infrastructure), primarily in emerging markets2. The massive urbanization projects in China in the last two decades, one of the greatest construction booms in history, are an example of how these developments can drive commodities demand. As a result of these projects, China consumed around half of global metals supply to build this physical infrastructure, and became the biggest oil importer of the world. 3

With urbanization growth in China currently slowing, and the property sector slumping, commodities demand growth will increasingly be driven by other countries. We believe that India and Southeast Asia will be the main drivers in the decades to come due to rising population and a rising middle income class. The European Union estimates that global middle income class is expected to rise from 4 billion in 2021 to 5.2 billion in 2030, with 88 percent of the additional middle class population living in Asia. Spending growth from middle income countries in developing markets is strong (around 12.5 percent annually between 2005 and 2015) and this growth is pushing demand for goods as well as commodities. India could soon be the world’s largest middle class consumer market, surpassing both China and the USA4.

Emerging market growth fuels more than metals and energy demand: it also correlates with an increase in meat consumption and demand for agricultural products. The rise of the middle-income population of China and India is driving food consumption in those countries.

Composition of food consumption changes as consumer income rise. When people can afford to improve their nutritional level they usually upgrade their daily diet from basic grains towards higher protein food. Per capita meat consumption in high-income countries is double that of middle-income countries and nearly six times the amount consumed in low-income countries. Rising population and potential for rising per capita meat demand means more grains are needed to feed farm animals.5

Energy Transition

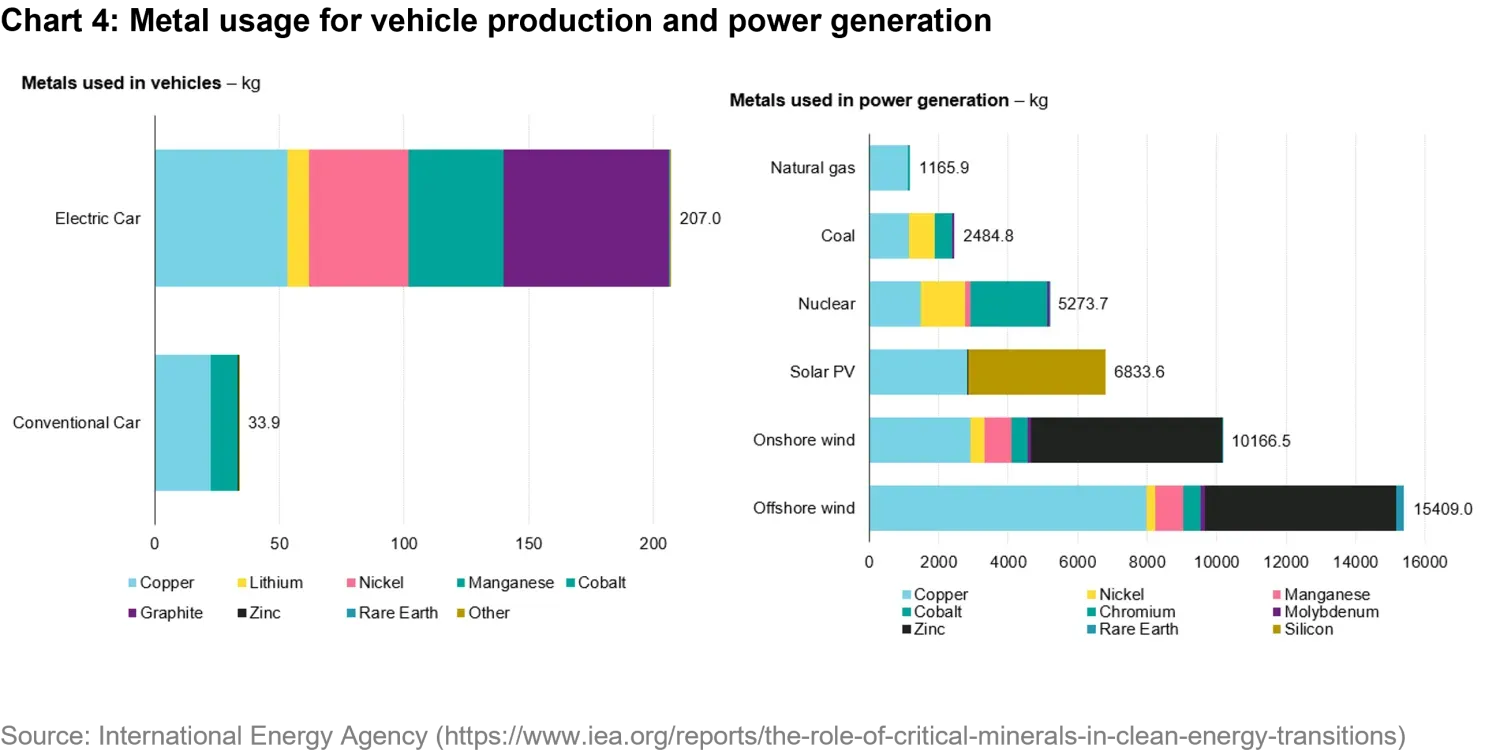

As noted above, while many oil producers see the green energy shift as a cause for uncertainty, we also see near-term good news for commodities consumption because of the switch to Net Zero. Scaling up solar, wind and storage technology, as well as expanding and upgrading the transmission grid to manage the flow of renewable resources involves enormous amounts of infrastructure buildouts, all of which depends on significant commodities usage, as shown in Chart 4. Technologies aiding decarbonisation, such as electric vehicles (EVs) and renewable energy, are metal-intensive. EVs require 7-10 times more metals than internal combustion engine (ICE) vehicles, and power generation from decentralised sources increases metal demand.

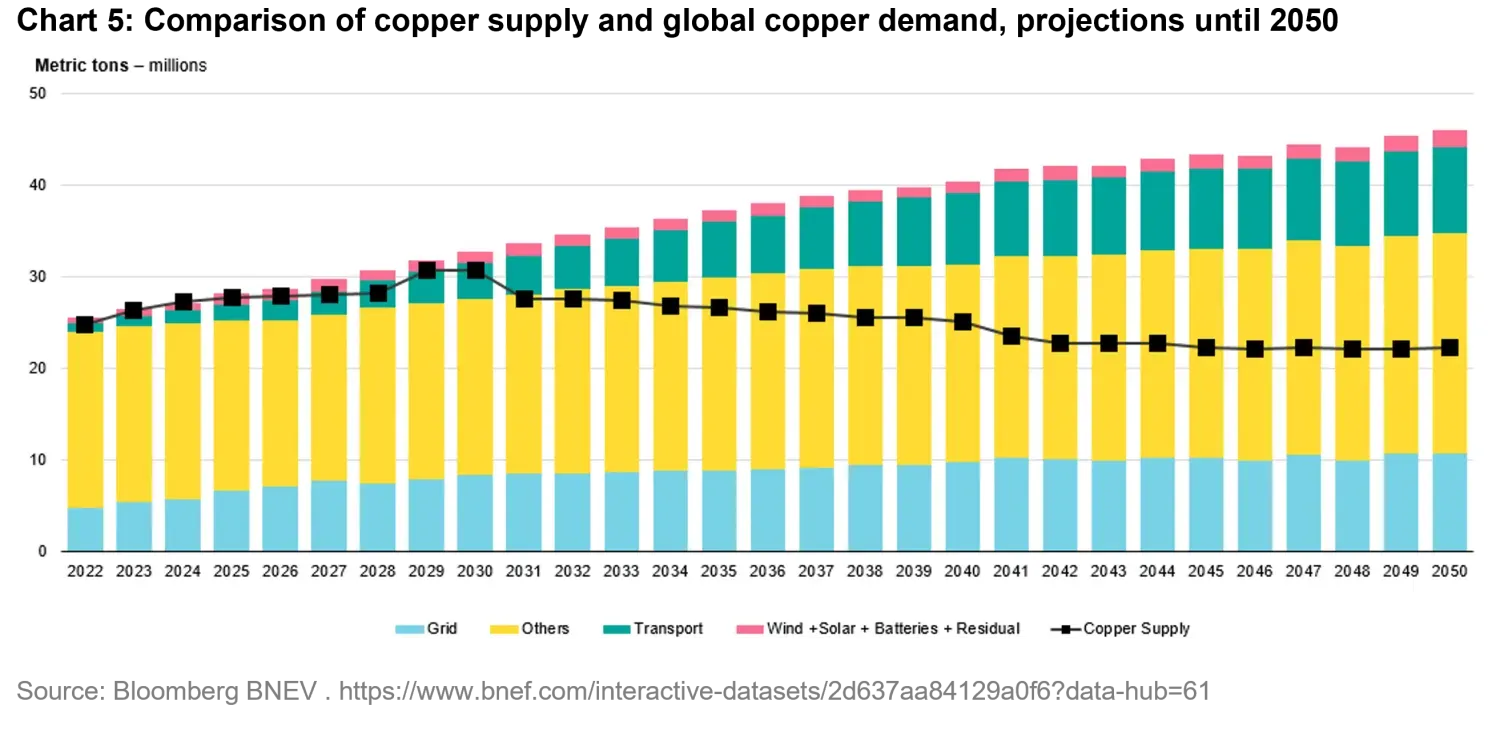

As Chart 5 depicts, significant focus is on copper`s emerging supply gap as demand growth is driven by renewables. Prices need to materially rise higher from current levels to incentivise more supply. The supply side struggles with factors like falling ore grades, local communities revolting against mine buildouts due to environmental reasons, cost overruns due to inflation, and water shortages. Building a mine or moving it from open pit to underground are multiple year projects. If supply is not stimulated, prices will balance the market on the demand side, reducing demand, which would delay the energy transition.

Future of Oil and Gas

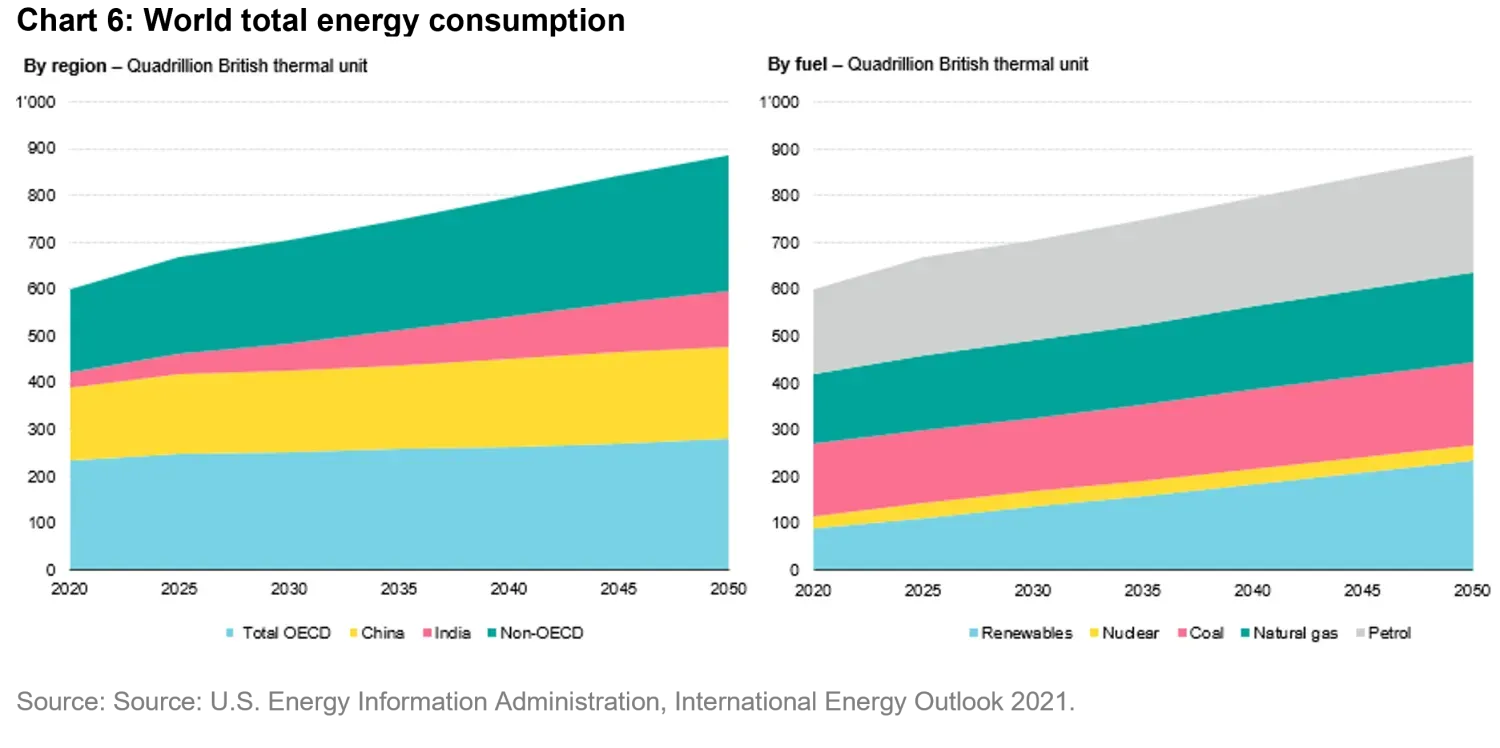

Despite the move by some countries to a Net Zero future, oil and gas demand will remain significant in the coming years, as shown in Chart 6. Many economists anticipate that peak oil demand is likely to occur in the mid-2030s, followed by a long plateau6. While EVs will gain market share, replacing the entire car fleet will take time, particularly in emerging markets. The global increase in vehicles in an overall sense will offset the decline in oil use in the next decade in countries enacting Net Zero policy (Goldman Sachs). And while renewables will become more and more important in terms of energy consumption source, the energy mix will probably remain dependent on fossil fuels for at least the next few decades. The reason is that energy consumption will grow 50 percent until 2050 led by emerging markets, and renewables growth cannot fully fill this gap alone.7

While oil demand will peak at some point in 2030s, the same is not likely for natural gas. As natural gas is emitting around 50 percent less CO2 than coal, it will serve as a transition energy source for many emerging markets that are unable to switch from cheap coal directly to high-cost renewable energy. Therefore, European Union classified natural gas as sustainable source.8

Conclusion

Considering all the above, the stage is set for a promising outlook in commodities, powered by key drivers like emerging market demand, the heavy material demand of the energy transition and the near-term continued need for oil and gas. After riding the tumultuous wave of the last decade, investors should take a close and fresh look at the asset class, which appears to offer attractive returns ahead. It could prove to be a highly strategic and rewarding move.

1. https://www.worldbank.org/en/research/brief/global-inflation

2. https://www.un.org/en/desa/around-25-billion-more-people-will-be-living-cities-2050-projects-new-un-report

3. https://www.eia.gov/todayinenergy/detail.php?id=61843#:~:text=China%2C%20the%20world%27s%20largest%20importer,according%20to%20China%20customs%20data

4. European Union, https://knowledge4policy.ec.europa.eu/foresight/topic/growing-consumerism/more-developments-relevant-growing-consumerism_en#:~:text=By%202030%2C%20Asia%20might%20represent,the%20world%20middle%20class%20population.&text=By%202030%2C%20over%2070%25%20of,both%20China%20and%20the%20USA.

5. https://ourworldindata.org/meat-production

6. e.g. Goldman Sachs: https://www.goldmansachs.com/insights/articles/peak-oil-demand-is-still-a-decade-away.

7. Source: U.S. Energy Information Administration, International Energy Outlook 2021. https://www.eia.gov/outlooks/ieo/tables_side_xls.php

8. https://www.trade.gov/market-intelligence/eu-sustainable-finance-taxonomy-delegated-act-nuclear-energy-and-natural-gas#:~:text=Gas%20power%20plants%20would%20be,per%20kW%20over%2020%20years.