Gold rally may herald a rebound for emerging market local currency bonds

Fixed Income Boutique

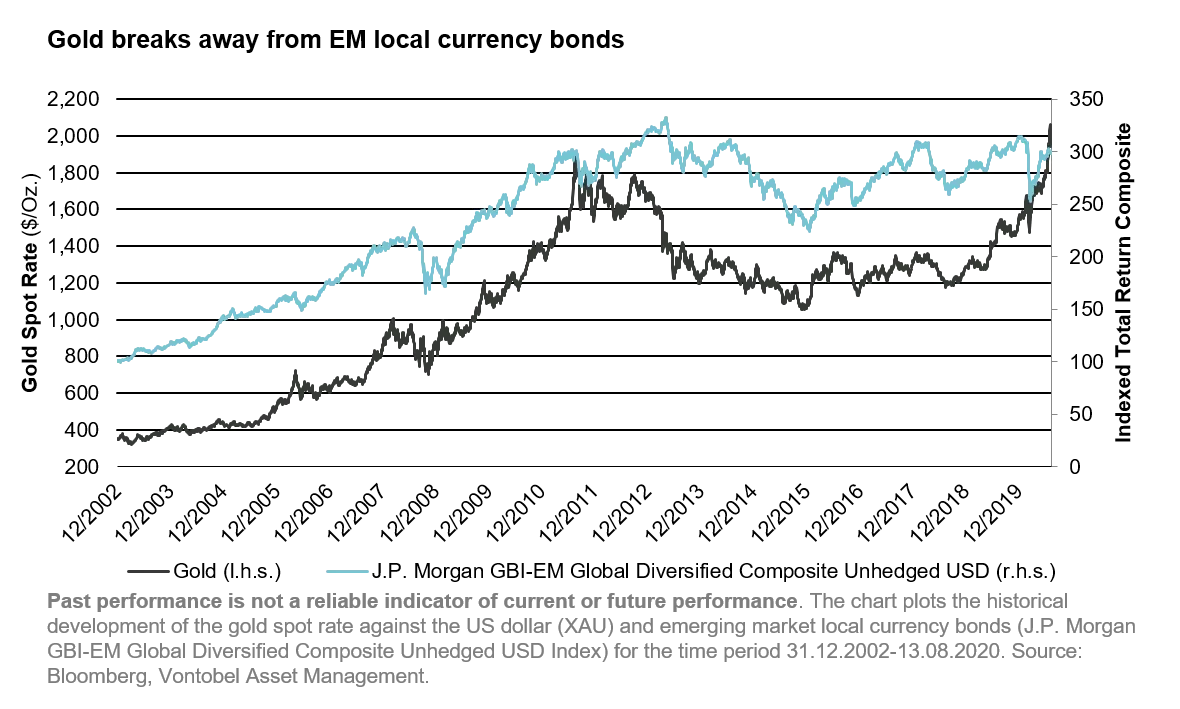

Gold and emerging market (EM) local currencies tend to move together but recently the pattern was broken in an unusual occurrence as gold has taken off and EM currencies have remained flat. This phenomenon also applies to EM local currency bonds as most of their risk and return is driven by foreign-exchange effects. However, the divergence in relative performance is not justified and is unlikely to persist in the long run.

Gold and emerging market currencies have something in common: they are both anti-dollar trades. Gold is an alternative to fiat money, being defined as a legal tender without intrinsic value. So, as long as the US dollar remains the world reserve (fiat) currency, buying gold will be considered the ultimate anti-dollar trade. In fact, gold tends to be a good investment in periods of monetary expansion and negative real interest rates.

For two main reasons, an environment of low real yields is also favorable to emerging market currencies, which makes them tactical anti-dollar trades. This is important for investors in EM local currency bonds as, on average, the foreign-exchange (FX) effect drives about 2/3s of the risk and return of their performance.

- When the US dollar falls, the macroeconomic fundamentals underlying the currencies tend to improve: as opposed to developed countries that have a highly developed domestic debt market, emerging market economies are often significantly indebted in US dollars. A weaker US dollar coupled with low interest rates therefore strengthens the income statements of developing economies due to the lower cost of servicing their external debt.

- A weaker US dollar, paying low real yields, could motivate global investors to seek higher yields elsewhere and could make returns in emerging economies relatively more attractive. This is in turn very important for the developing countries that do not have enough domestic savings to finance their current account deficits and therefore depend on foreign capital flows.

A brief historical overview of gold and EM currencies shows how their fates are often driven by the same factors: demand for the US dollar, appetite for commodities, and real interest rates.

| EM Currencies pegged to USD | Unpegged | |||

| 1970-1980 | 1980-2000 | 2000-2010 | 2010-2019 | |

|---|---|---|---|---|

| Gold |

Gold’s stellar performance in the 1970s was fueled by the two oil shocks of 1973 and 1979. However, the real driver was the artificial peg that kept the metal forcibly undervalued, from the Gold Reserve Act of 1934 until the breakup of the Bretton Woods system in 1971. Indeed, from 1934 to 1972, gold to US dollar parity was set and guaranteed at $35 per troy ounce. |

Two lost decades for gold, as the world experienced a long period of declining oil prices and high real interest rates. Holding gold was such a poor investment that central banks started to flood the markets with their own reserves. The US dollar had regained its role as the main store of value, and there was no point in holding a “non-yielding relic” from another era. | Gold came back with a vengeance in the 2000s, in the wake of the commodity boom that started when China joined the World Trade Organization in 2001. Only between the second half of 2008 and the summer 2011 that gold had its own moment of glory without the help of other commodities. The reason was a combination of massive monetary stimulus crushing real interest rates, and fears that the euro would lose its reserve currency status amidst the crisis in the so-called PIIGS countries. | Gold should normally have skyrocketed with the Federal Reserve flooding the markets with US dollars through their Quantitative Easing monetary policy. However, this policy had the very counterintuitive effect of boosting the demand for the US dollar as US equities were acting as a magnet for global investors. In addition, the demand for commodities in general became subdued and even collapsed in the second half of 2014. |

| EM FX | Over that period, less-developed currencies were pegged to either the US dollar, the pound sterling or the French franc. | Until the end of the 1990s, most emerging currencies were still pegged to hard currencies, which lead to notorious crises in the most prominent emerging countries such as Mexico, Thailand, Russia and Brazil. | For the same reasons as gold, emerging currencies did well until the Global Financial Crisis. After that however, they failed to catch up with gold, like most risk assets at the time. | Net-net, emerging currencies had a similar performance as gold. |

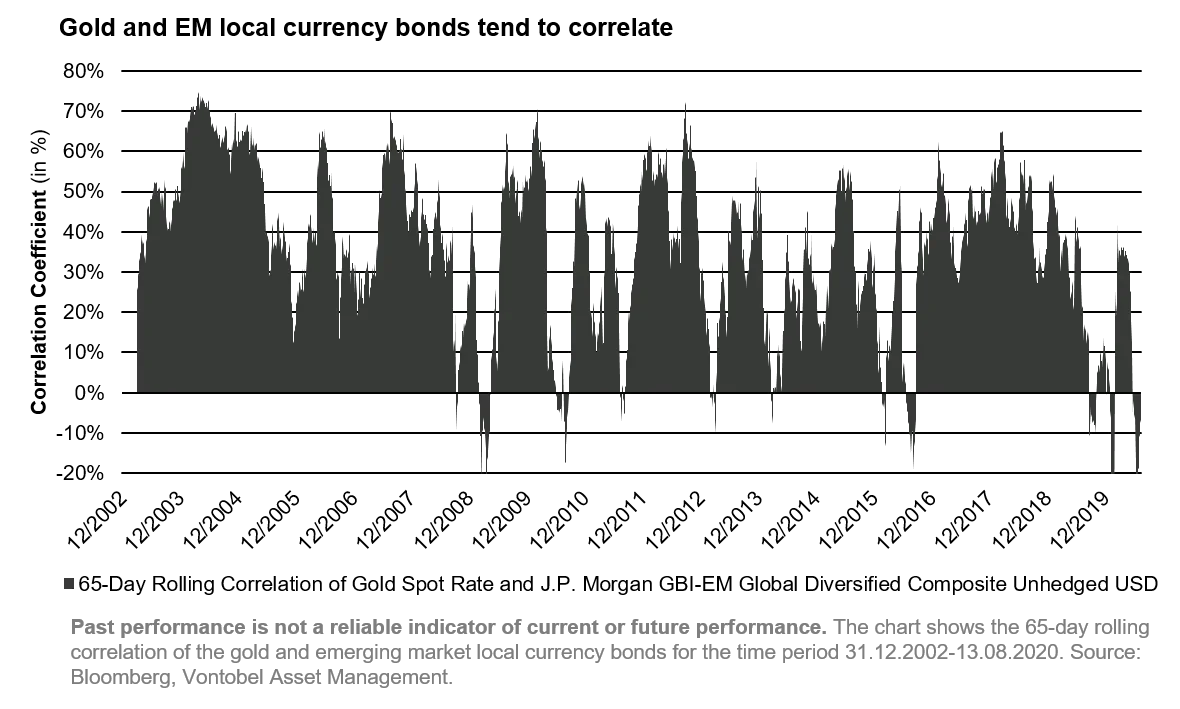

As the charts below show, the correlation between EM currencies and gold is positive on average. Until now, the correlation pattern has only been broken a limited number of times and only for short time periods. From the above observation, it emerges that the extreme divergence witnessed between both assets since the end of May is not justified by any of the factors that usually dictate their respective behaviors. So, it seems it will only be a matter of time before investors see a reversion back to “normal” and EM currencies finally catch up with gold with the potential of significant gains.

However, since COVID-19 has brought on extraordinary times, there are a few considerations that could weigh on investors’ minds. Based on past episodes of crisis, some EM central banks, especially the ones in countries with current account deficits, would normally have hiked rates to maintain the attractiveness of their currencies. Yield advantages help attract foreign capital flows that alleviate external imbalances. This time, however, the prospects of recession and deflation prompted EM central banks to embark on an unprecedented wave of rate cuts, which has had a negative effect on some EM currencies. Other central banks in (largely Asian) EM countries with current account surpluses, intervened by buying a devalued US dollar to maintain the competitiveness of their currencies with the aim of preventing their exports from becoming too expensive.

In a historical comparison, EM local rates are on average still at decent levels vis-à-vis their developed markets peers which could start attracting yield-hungry investors who may wish to opt for a more efficient way to express their anti-dollar sentiment than stocking up on gold.