TwentyFour

Why Gilts Are More Vulnerable to Inflation Than Treasuries

We believe UK government bonds are ultimately most vulnerable to a rise in inflation, and the 10-year Gilt currently trading at 0.73% does not come close to compensating for this.

TwentyFour

Credit Fundamentals Set to Improve Further

Frustratingly for fixed income investors looking to buy bonds, the data seem to fully justify the high valuations we see in so many parts of our market at the moment; it really would not make sense to be able to buy bonds cheaply when conditions are so good.

TwentyFour

Fed Sales a Drop in the Bucket, but Watch the Ripples

While we don’t expect any material spread widening in the near term, we remain extremely wary of higher duration bonds given our view that the potential persistent inflation suggested by recent data isn’t priced into US Treasury yields, which currently sit around 1.58% at the 10-year point.

Quality Growth Boutique

Where is Your Umbrella?

High-growth, high-momentum stocks were among the best performers of 2020, then value stocks rallied into the first quarter of this year. We are cautious of valuations, as some stocks have already priced in a recovery. Investing in quality companies with predictable earnings power at reasonable valuations can help investors prepare for a rainy day.

TwentyFour

Investors Should Fight Weakened CLO Docs

2021 looks set to become a post-financial crisis record year for European CLO issuance and refinancings, but amid the rush of activity we are seeing a concerning trend for weaker documentation in refinanced deals that in our view investors need to fight against.

Quality Growth Boutique

Is now the time to buy value stocks?

Strong momentum across many markets has increased investors’ concerns about inflated valuations. As the “growth-at-any-price” trade seems to be fading, many believe a rotation out of growth stocks and into value may continue to outperform the broader market. Before you rearrange your portfolio in light of the current rotation, here are a few things to consider.

TwentyFour

Central Banks Get Ready to Talk Tapering

After unleashing the strongest combined emergency package we have ever seen in 2020, central banks are now entering perhaps the most challenging phase of their COVID-19 response, trying to balance the economic recovery while at the same time having to reassure the markets they can control the threat of runaway inflation.

TwentyFour

Your Lufthansa Coupon Has Been Delayed, But Not Cancelled

Last week there was a rare occurrence in the high yield market as German airline Lufthansa announced it would be deferring the coupon on a hybrid bond issued in 2015.

Quality Growth Boutique

A Prudent Approach to Navigating Equity Markets in China

Chinese equities can offer an exciting and dynamic opportunity, but investors must navigate a complex regulatory environment and quickly changing competitive dynamics. Our research team sheds light on the outlook for e-commerce giant Alibaba, how to approach the A-shares universe and pressing issues investors face in China today.

TwentyFour

What Does US Wage Data Say About Inflation?

From our perspective, the potential wage pressures we see make us uncomfortable with 10-year Treasury yields at current levels, despite their significant rise since the start of the year.

Quality Growth Boutique

Investing in China: Uncovering Growth Opportunities in the Post-COVID Economy

Even as the broader geopolitical environment and global economic uncertainty continue to impact the headlines on China, strong growth prospects underpin several sectors and companies.

TwentyFour

Reaching For The Risk Dial as Valuations Stretch

Having witnessed the most remarkable turnaround in risk markets over the last 14 months, it makes sense to take stock as fundamentals look to us to be approaching optimal levels. Credit spreads have ground into levels not far from the prior cycle’s tights, and while we remain confident in the underlying fundamentals and a good technical backdrop, recent developments mean that despite this constructive view, our risk appetite has ticked down slightly.

TwentyFour

What’s Really Going On With US Jobs?

At 8.1m, the number of job openings as of March 31 was the highest it has been since the data series began some 20 years ago.

TwentyFour

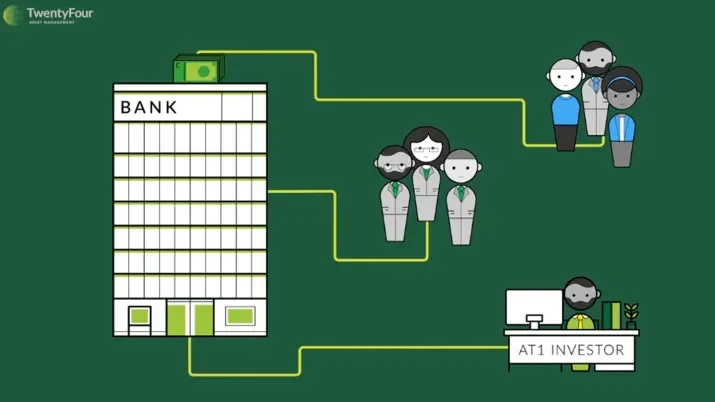

What are AT1 bonds, and how do they work?

Additional Tier 1 bonds, or AT1s for short, are part of a family of bank capital securities known as Contingent Convertibles or ‘Cocos’. They are bonds issued by banks that contribute to the total level of capital they are required to hold by regulators.

TwentyFour

Classic Late-cycle Issuance…in Mid-cycle

Markets can often be tricky for investors in May as bond issuers take advantage of a window of opportunity following the Q1 earnings season and ahead of the typical summer lull. This often results in heavy supply in late April and early May, hence the old trader adage of “sell in May and go away”.

Quality Growth Boutique

5 Reasons International Equities Are a Compelling Opportunity

While the US is home to many global leading companies, it is not the be-all and end-all for investors. Actively allocating to international equities can bring the benefits of diversification. We believe a portfolio that combines the best of domestic and international quality growth equities is the right choice for long-term investors today.

TwentyFour

Is Shunning Coal a Good Policy for Capital Markets?

As long as coal usage is not illegal, a private buyer of any origin will be able to purchase these assets cheaper and run them for as long as possible with no regard for ESG matters.

TwentyFour

What's Happened to the Brexit Premium?

There has been a lot of focus on the performance of the high yield markets since the start of the year, particularly in Q1 when many rates markets were selling off aggressively.

TwentyFour

Beware a Second Wave of Treasury Selling

Crucially while the Fed may wait to see the evidence, markets won’t, and we therefore expect a ‘second wave’ of Treasury selling to happen well before then.

TwentyFour

CoCo Re-rating Underway as Euro Banks Prove Mettle

Having been at the heart of the GFC and then contributing to the Eurozone sovereign crisis, we have long argued the European banking sector would have to prove its newfound resilience to investors by successfully navigating a challenging period.

Quality Growth Boutique

Why Booking Holdings May Take the Air Out of Airbnb’s Lofty Valuation

Airbnb’s stock soared after its IPO, but it is not yet profitable and faces many competitive threats. Meanwhile, its rival Booking Holdings is an established leader with a proven business model and a more earth-bound valuation. We think Booking is a true quality company with a solid track record, not a speculative bet.

Quality Growth Boutique

100 days Biden: Economic recovery and growth now have to be the market’s tailwind

While higher interest and inflation rates may more predominantly impact owners of long-duration assets in a variety of ways, they are also simply a positive signal of strong economic growth, which is a good thing. They also should enable for a more generally healthy pricing environment for risk assets. Higher interest rates are not necessarily something terrible to be only feared.

TwentyFour

Tobacco Bonds Volatile as Investors Chew On ESG Risks

Tobacco company bond spreads were volatile last week on news that the Biden administration is exploring a ban on menthol cigarettes and may pursue a policy to reduce nicotine levels in all cigarettes to non-addictive or minimally addictive levels. Rumours about an increased tobacco tax also surfaced, further shaking up the industry.

TwentyFour

A Taper Without a Tantrum

Had this happened a month ago, we suspect the move would be materially more pronounced, and the muted reaction indicates to us that markets are now quite comfortable with the current levels of expected growth, forecast inflation, and yields.