What's Happened to the Brexit Premium?

TwentyFour

There has been a lot of focus on the performance of the high yield markets since the start of the year, particularly in Q1 when many rates markets were selling off aggressively. High yield bonds are not immune to movements in rates but they are typically less correlated than investment grade bonds, given they tend to trade on a price basis rather than a pure spread over the risk-free rate, and they also have more spread to help mitigate any negative impact from the rates move.

Despite this, given the speed and scale of the negative rates moves we saw in early 2021, it would not have been a surprise to see high yield being more heavily impacted by market contagion; the sterling and euro HY indices both turned in positive total returns of around 1.5% for Q1, with US HY lagging slightly at 0.9%. The biggest surprise for many investors was the performance of sterling HY, which marginally outperformed the euro index despite 10-year Gilts dropping over eight points in Q1 compared to 10-year Bunds only losing around three points.

Sterling HY’s strong showing has continued into Q2 and does beg the question whether the Brexit premium, a theme we persistently tried to take advantage of after the UK referendum, is helping to drive its performance. The answer appears to be yes – since the UK-EU bilateral trade deal was announced in December last year, sterling credit’s spread to euro credit has been narrowing, benefiting the former’s performance.

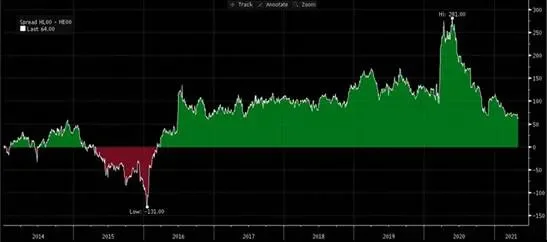

The graph below shows the spread to governments for the ICE BofA £ HY index over and above the Euro HY index. It clearly shows a significant premium developed after the UK referendum was first announced, and that premium stayed at around 100-120bp for much of the period until the Brexit agreement was finalised. The premium then spiked higher during the worst of the COVID-19 pandemic due to concern that the UK was underperforming the Eurozone in its handling of the crisis, but after the success of the UK’s vaccine rollout and the signing of the actual post-Brexit trade agreement, this underperformance has disappeared and the actual Brexit Premium is now beginning to narrow as well.

Of course, the lines are blurred given the recovery from the pandemic, with the UK and Eurozone at different stages of their vaccine programmes and their emergence from lockdowns, and this has also impacted performance. However, the Brexit premium was first created when European investors shied away from sterling credit in the aftermath of UK’s decision to leave the EU, not wanting to take either sterling currency risk or UK economic risk with the threat of a hard Brexit on the horizon. So the question is, are these investors now returning to the sterling market? Again the answer appears to be yes, judging from our conversations with investment bank syndicate desks, which tell us European investor interest in new sterling bond issues began to pick up at the end of last year and has continued to grow in 2021.

Comparing high yield indices is not an exact science, but after adjusting for rating and maturity differences, on a like-for-like basis we estimate that sterling HY spreads tightened by 84bp over Q1 versus only 15bp for euro HY (US HY incidentally achieved 56bp of tightening). However, even after this outperformance sterling spreads generally remain wider than their euro counterparts, suggesting the Brexit premium trade still has further to run and sterling credit is still an interesting place to look for relative value.