Why Booking Holdings May Take the Air Out of Airbnb’s Lofty Valuation

Quality Growth Boutique

When Airbnb Inc. IPO’d on December 10th, its stock soared 112% in its first day of trading. Its market capitalization skyrocketed to $86 billion, almost 5x its last valuation round. Since then, its valuation has soared 47% to $126 billion. Yet, the company is still in the red: Sell-side analysts don’t expect Airbnb to reach GAAP profitability until 20241.

Airbnb’s meteoric rise shows how investors – in today’s exuberant stock market – can chase a fast-growing upstart, while ignoring an established leader with a proven business model and a more earth-bound valuation – in this case, Booking Holdings Inc. In fact, Airbnb’s capitalization exceeds that of its chief rival in the online travel agency (OTA) space, even though Booking’s 2019, pre-COVID net profits alone exceeded Airbnb’s annual revenue. Airbnb’s valuation also underscores how investors can disregard poor fundamentals in favor of a rosy narrative.

We see two major threats to Airbnb: Increased competition and maintaining sufficient rental supply to meet demand. Airbnb’s biggest competitive threat comes from Booking itself. From its core business as a marketplace for hotel rooms, Booking has been moving into the so-called alternative accommodation market, which Airbnb brought into mainstream awareness. The battle shows that Airbnb lacked sustainable competitive advantages. Booking, meanwhile, is starting from a position of strength. It operates the dominant online marketplace for hotel rooms. Booking has a 70% market share in Europe and only trails Expedia Group Inc. in the US. Further, it posted a compounded 10-year, pre-Covid GAAP net income growth rate of 26%. And, it remained profitable in 2020, the year of the pandemic, despite the crash in the hospitality industry.

We believe these negative forces will, at minimum, delay Airbnb’s path to profitability and at worst keep it from reaching profitability altogether. Either way, Booking should continue to take share in both hotel and alternative listings in the coming years, making it the more solid investment. In our view, it has demonstrated predictable results, high returns on capital and strong competitive moats.

Competitive Threat

When Airbnb was founded in 2009, it was the only player in the alternative accommodation market. Through its unique model, it created an online marketplace where individual homeowners could rent their properties, from a room in a house to an apartment or an entire home. Airbnb acted as the middleman, connecting guests to hosts and taking a fee for this service. Airbnb had a clear first-mover’s advantage. It was also difficult for large OTAs, like Booking and Expedia, to replicate this informal marketplace. Airbnb’s individual listings were costly for big OTAs to aggregate. It was far cheaper for them to get blocks of hotel rooms than individual properties, one by one. And easier to manage – a hotel guest does not have to wait for the apartment owner to drop off the keys.

Airbnb’s advantages were not long lived. As the market for alternative listings evolved, so did hosts. A growing class of professional property managers developed. They acquired and ran multiple properties for the sole purpose of listing on the likes of Airbnb and other OTAs. Most of these properties were entire homes and condominiums that were available all year long, not the home-sharing arrangement Airbnb started with. In 2017, as individual homeowners became more difficult to recruit, Airbnb aggressively began to seek professionals to boost property supply. By doing so, it opened the door to competition from the big OTAs because they were both relying on the same type inventory.

The large OTA’s poured in to snap up professional hosts. Software companies, such as Hostfully, spurred the inflow by developing products that allowed professional rental groups to manage their properties across multiple OTAs. One needs to look no further than Booking to understand the severity of this competitive threat to Airbnb. By 2020, Booking grew the number of alternative accommodation listings on its platform to 6.7 million, or 91% of Airbnb’s size2.

Airbnb’s model proved easy to attack, allowing numerous start-ups to enter the market, many with substantial venture capital backing. These start-ups have targeted specific market niches, such as mid-term leases or fully- furnished apartments for relocating professionals. For example, NomadX, founded in 2017, offers mid-term “home-sharing” for tech workers with temporary gigs and no permanent homes. Others include Sonder, HomeLike, HouseTrip and OneFineStay, to name a few. We believe these niche players will chip away at Airbnb’s guests by offering a more finely tuned experience to meet their needs. They also increase competition with Airbnb for rental properties.

Sustainability of Supply

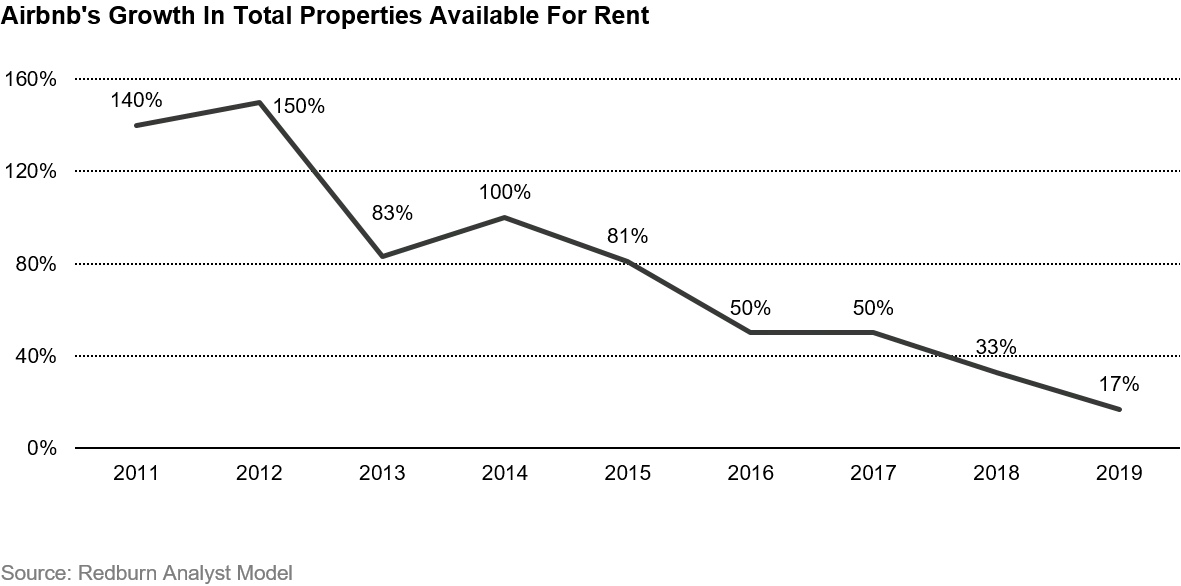

This rising competition is contributing to another threat to Airbnb – a declining growth rate in rental supply. So is the maturation of the OTA rental market. Most hosts who want to rent out their properties on OTAs are already doing so, according to a survey conducted by HomeAway/Savills. On the margin, this makes adding supply more difficult. As a result, Airbnb’s annual growth in supply peaked at 150% in 2012. Since then it has steadily dropped to 16.7% in 2019.

The problem this creates for Airbnb is that its overall growth is just as dependent on property supply as it is on generating guest demand. The greater the supply, the greater the selection and the more likely guests are to rent from Airbnb. It will be very difficult for Airbnb to meet consensus, annual revenue growth rates of 30% for the next five years, if property supply is growing at half that rate. The weaker sales growth, the more difficult it will be to gain the scale necessary to reach profitability. The reduced selection is already hurting customer retention. Airbnb’s revenue from recurring guests declined by 9% in 2019, a percentage that has declined sequentially since 20163.

Airbnb’s management is clearly concerned about growth of supply. It has taken significant steps in recent years to boost it – to no avail. These efforts include creating software tools professional rental groups needed to join the platform in 2017; acquiring HotelTonight to add hotel supply to the platform in 2019; and boosting marketing spending by 71% in 2019 to mainly increase the number of hosts on the platform4. The result: Airbnb’s cost to acquire new supply rose by 250% that year. To reduce acquisition costs, Airbnb’s CEO Brian Chesky said recently that the company would pivot away from trying to recruit professional property managers and turn back to recruiting individual hosts, where it started5. But, this is the slowest growing category of hosts, rising just 12% in 2020, versus 36% for professionals6.

Regulation of Supply

The supply situation is only going to get more challenging. Many cities have begun to clamp down on Airbnb and other OTAs with regulations on professional, short-term rentals. Residents argue that these rentals would lead to rising housing prices, gentrification of local communities and crowding.

In response, cities are increasingly passing ordinances that eliminate full-time, short-term rentals by limiting the number of days a unit can be rented a year. Roughly 70% of the top 200 cities where Airbnb operates have implemented restrictions regarding such rentals7. To force compliance, they are beginning to add steep fines. Tokyo, for example, imposed a fine on usage limits of $9,500 per violation8. Berlin: $120,0009. Consequently, the number of Airbnb properties available for rent in these cities fell by 41% and 37%, respectively10. While this hurts all OTAs, Airbnb is particularly vulnerable. That’s because it is more reliant on urban rental supply than competitors, with 40% of overnight stays in urban locations11.

The Case for Booking

We believe that Booking can offer a more attractive investment opportunity for investors. It can target the alternative market without taking substantial risk. Booking delivered a 5-year average Return on Equity of 30% (2016 -2020 per FactSet), and has historically delivered predictable earnings growth, unlike Airbnb, which is in negative territory on both fronts. In our opinion, Booking also trades at a much more reasonable valuation, giving investors a greater margin of safety.

We believe it is also attacking the alternative market from a greater position of strength. Booking’s dominant position in the hotel space provides substantial barriers to entry. It is far easier for it to enter the alternative market than for Airbnb to expand hotel listings. In addition, hotel customers remain the greatest source of untapped demand for alternative listings. For that reason, Booking intentionally mixes hotel rooms with alternative listings on its website. Hotel rooms also drive traffic to alternative listings. In the second quarter of 2020, 40% of new guests to the Booking platform chose alternative accommodations12. Then there is Booking’s size advantage. Its marketing budget is 4x as big as Airbnb’s, which gives Booking a huge edge in attracting supply and demand for properties. It shows. Booking has nearly 10x more web traffic a month than Airbnb13.

This growing brand awareness gives Booking another advantage over Airbnb. It drives more direct traffic to its website. This reduces its reliance on online advertising, such as search-engine marketing on Google, to attract customers. As a result, Booking’s ratio of total marketing spending to sales has fallen from 36% in 2017 to 33% in 201914. We believe this trend will be an important driver of margin expansion going forward that is not fully appreciated by the market. In comparison, Airbnb has had to increase advertising spending, causing its marketing to sales ratio to rise by 100 bps during the same period15.

Finally, there is a lot of alternative accommodation market share for Booking to grab. Most of its properties in this category are in Europe. It is only now starting to target North America, which for Airbnb exceeds the size of the European market in revenue. North America is Airbnb’s largest market, accounting for 41% of its revenue16. That implies Booking has the potential to double its alternative accommodation business.

Conclusion

From a risk/reward perspective, investors can see the advantage of Booking over Airbnb. Taking everything into account, investors should prefer the company with a historical track record compared to what – under closer examination – is essentially a speculative bet, in our opinion. We don’t think investors fully appreciate the challenges Airbnb faces from increasing competition and declining growth in supply. Both make Airbnb’s path to profitability more difficult, if not impossible, in our view.

1.Source: FactSet Research

2. Source:

https://skift.com/2020/09/22/booking-holdings-ceo-sees-greater-traveler-awareness-in-alternative-accommodations-as-a-long-term-boon/

3.Source: Airbnb S-1, Filings

4. Source: Airbnb S-1, Filings

5. Source: Airbnb 4Q 2020 Earnings Call Transcript

6. Source:

https://www.theinformation.com/articles/influx-of-professional-hosts-tests-airbnbs-message

7. Source: Wolfe Research Initiation Report on Airbnb, 10th December 2020

8. Source:

https://www.japantimes.co.jp/news/2018/06/06/business/airbnb-drops-nearly-80-percent-private-home-listings-ahead-new-peer-peer-rental-law/#:~:text=Homeowners%20will%20only%20be%20allowed,not%20more%20than%20¥30%2C000.

9. Source:

https://www.washingtonpost.com/world/europe/berlin-had-some-of-the-worlds-most-restrictive-rules-for-airbnb-rentals-now-its-loosening-up/2018/03/27/e3acda90-2603-11e8-a227-fd2b009466bc_story.html

10. Source: AirDNA Data

11. Source: Redburn Initiation Report on Airbnb, 3rd December, 2020

12. Source:

https://www.phocuswire.com/Bookingcom-long-term-accommodation-strategy

13. Source: semrush.com, as of March 18th 2021

14.Source: Booking Holdings Filings

15. Source: Airbnb S-1, Filings

16. Source: Airbnb S-1, Filings

Disclaimer:

Certain of the information contained in this viewpoint is based upon forward-looking statements or information, including descriptions of anticipated market changes and expectations of future activity. Adviser believes that such statements and information are based upon reasonable estimates and assumptions. However, forward-looking statements and information are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements and information.

This presentation is not an offer to sell or the solicitation to buy any security. It does not constitute a recommendation to buy or sell any security. Past performance is not necessarily indicative of future performance, future returns are not guaranteed. There is no assurance that the adviser will make any investments with the same or similar characteristics to the investment presented.