Where is Your Umbrella?

Quality Growth Boutique

2020 was a highly unusual year in the equity markets, to say the least. After a brief sell-off during the early stages of the pandemic, global equities quickly recovered despite the crippling effects of Covid-19 on the economy. In the first phase of the market recovery, high-growth, high-momentum stocks were by far the best performers. In the second phase, starting in the fourth quarter of 2020, value stocks, many of which were disproportionately impacted by Covid-19, e.g., airlines and commodities, rallied and are now trading close to pre-pandemic levels.

The market seems to have reached a verdict: The pandemic is last year’s problem and the global economy is now on a firm path to recovery. We hope so, but at the same time, such an outcome may be overly optimistic.

The pandemic is still a global problem. Even though the US and the UK are doing a great job vaccinating their populations, it does not offset the other countries, such as Brazil and India, which are behind the curve. The end of the global pandemic hinges upon vaccinating the majority of the world population. Furthermore, it is too early to discount the lingering effects of the pandemic on the economy – weakening of government balance sheets, widening of current account deficits and ramping inflation from excess liquidity.

Coupled with uncertainty around the health of the global economy, we are cautious of valuations, as some stocks have already priced in a recovery. Against this backdrop, a return to fundamentals – companies with predictable earnings power at reasonable valuations – can protect investors from a storm on the horizon. We believe that carrying an umbrella when leaving home, while inconvenient when the sun is shining, is a sensible approach.

A Tale of Two Markets

When we dig deeper into recent market performance, we generally find two categories of stocks that have rallied particularly hard – high growth and value. In the first three quarters of last year, high growth stocks disproportionately benefited from a fall in interest rates, as the lowering of the discount rates mattered more for perceived high-duration assets. Afterwards, “value stocks”, those trading at low P/Es, did well, as investors started to bet on a speedy recovery of the global economy.

1. The High Growth Stocks Rally

Figure 1 shows that through December, the S&P 500 Index advanced 18%, while the growth component of the broad benchmark was up 33%. It was not a phenomenon confined to the US – growth stocks led the MSCI All Country World Index by a similar margin. Last year, momentum had been one of the most powerful factors and there is a significant overlap between growth stocks and momentum stocks.

What caused this massive divergence in performance between growth stocks and the rest of the market?

Lowering of interest rates that began at the onset of the COVID pandemic was a key factor. It was followed by central bank guidance that rates would remain low for an extended period of time, which in turn led the market to factor in meaningfully lower discount rates. This benefited equities in general, and valuations of growth stocks in particular, as they are seen as longer-duration assets.

While the market’s reaction was not irrational, we think it is important to consider a portfolio’s aggregate exposure to this group of stocks. Although it is difficult to predict when rates may rise again, loose fiscal policy could produce inflationary pressures, necessitating rate increases sooner than consensus expectations. In that scenario, growth stocks would suffer a reversal of fortune, as they are more vulnerable to rising interest rates.

Trends accelerated by the pandemic also contributed to the outperformance of some growth stocks. Many of these stocks are technology companies that benefited from an increase in e-commerce and a shift to cloud computing. The market rewarded those stocks, which again was rational directionally. However, the magnitude of some of the stock moves may prove excessive. Investors should be careful not to extrapolate the acceleration of trends too far as some of the COVID-related changes may reverse and the pace of adoption may shift back as the pandemic fades.

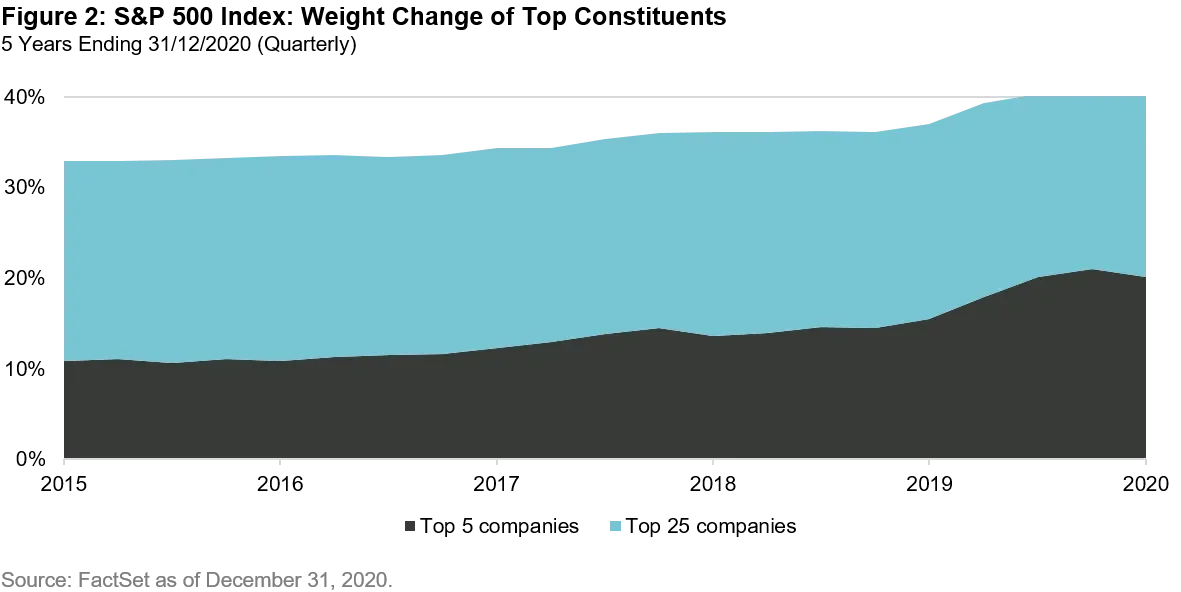

The narrowing of the market is another related development. A limited number of tech names drove much of US equity gains in 2020. Indeed, the combined weight of the top constituents rose significantly as a percent of the S&P 500 Index’s total market capitalization (Figure 2). A similar phenomenon has been seen in other markets.

Many growth stocks that massively outperformed the market in 2020 are good companies with attractive business models and growth prospects. But if the goal of an investor is to accumulate wealth without excessive volatility, then high growth businesses, even quality ones, cannot be bought at any price. A lack of valuation sensitivity may expose investors to an external shock. We will never know precisely what will cause the next correction to “high growth at any price” stocks. But as Covid-19 has reminded the investing world, always be prepared for the unexpected – know where you left your umbrella.

2. Value is in the Eye of the Beholder

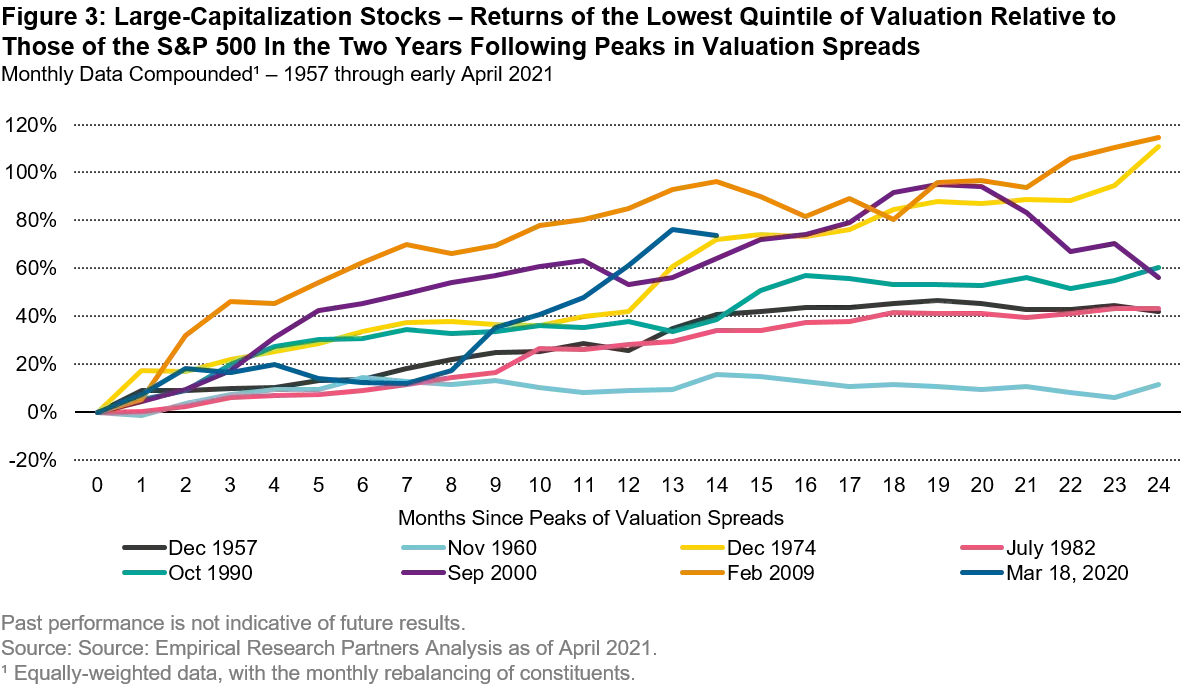

The rally in value stocks was the second most powerful value rally over the last 60 years (Figure 3). Truth be told, value stocks have underperformed the overall market for the last decade (Figure 4), and a correction of the valuation discount was long overdue.

At this point, relative valuation between value stocks and the rest of the market has nearly reverted back to the historical trend. This does not mean that the value rally cannot overshoot, and the extension of the value rally is up for debate.

Nevertheless, by definition, a value stock rally has an expiration date. The reality of the underlying businesses of low P/E stocks will not change after the economy gets back on its feet. Banks, for the most part, will continue to be regulated and prone to cyclical deterioration in the quality of their loans. Automotive companies will compete fiercely to deliver more and more value to consumers at thin margins. Similarly, airlines will fight for that extra passenger to improve load factors and to dilute fixed costs, while taking risk on volatile fuel prices.

Sometimes, a low P/E stock is just what it looks like: a low P/E stock. Value, on the other hand, is more subtle. It is the outcome of real return on investment from a company’s free cash flow. This requires a deep understanding of the long-term performance of a business; as such, we believe that the best way to capture real value is to invest in predictable businesses.

Take caution and be prepared, so you don’t get drenched

We do not know when or why the market may turn. In 2020, investors with greater exposure to faster-growth stocks would have enjoyed better performance, largely courtesy of lower rates. However, towards the end of the year, and into 2021, low multiple stocks outperformed. Investing is ultimately an optimist’s game – it necessitates taking some risks in search of rewards. But we do not believe that it means blindly following the crowd or swallowing every bullish story. Investors should only make decisions based on facts; the story stock that sounded like a fairytale when purchased may turn out to be a horror movie. Many things can make the markets swing – from discounting that inflation will be forever low, to inflation will come roaring back, from Covid will destroy the economy, to Covid is no longer an issue, from a company can do no wrong to a company can do no right. The protection – the investors’ umbrella – we believe is to invest in high quality companies, with stable, predictable businesses, bought at sensible prices.

The views and opinions herein are those of the individuals mentioned above and do not reflect the opinions of Vontobel Asset Management or Vontobel Group as a whole. The views may change at any time and without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.