TwentyFour

Strategic Income Quarterly Update – April 2021

George Curtis discusses how credit markets have performed in Q1 2021 and provides his outlook for the year ahead.

TwentyFour

Credit Suisse Pulls Levers to Shore Up Capital

What is most interesting about the CS situation though is that to us it illustrates the ability of large banks to bolster capital when such events occur, and the range of options they have to do it.

TwentyFour

Where Buffett and Dalio are wrong on bonds

TwentyFour Asset Management CEO, Mark Holman, explains why the likes of Warren Buffett and Ray Dalio are warning investors away from fixed income, and points out where he thinks they’re wrong.

TwentyFour

Are bonds still the answer to the income problem?

TwentyFour Asset Management CEO, Mark Holman, explains why he believes investors should still be starting their search for income in bonds, and how they can look to combat further rates weakness by looking globally and targeting the right areas in credit.

Quality Growth Boutique

Will US stimulus spending lead to greater inflation and higher interest rates?

With US President Biden’s $1.9 trillion Covid relief package, alongside the recently proposed $2.25 trillion in infrastructure projects, there is growing concern about the impact these programs could have on inflation and interest rates globally. In the investment world, we have been operating amid declining rates and low inflation for so long that few may realize the impact rising rates would have on investment returns.

TwentyFour

Barclays' Prison Break

ESG conscious investors, ourselves included, of course, are applauding this brave decision by Barclays to put their conscience before profit, but they are not the first to do so.

Quality Growth Boutique

Fight the Parasites – How to Avoid Fraud

Stop fraud bleeding returns. Fraud from related party transactions, kickbacks and fiddling the books can run for years. The steps to minimize risk are based on 3 governance structures – independence from management is key. Amazing how often they are not in place, especially in some markets.

TwentyFour

Short Term Bond Quarterly Update – April 2021

TwentyFour partner and portfolio manager Gordon Shannon looks at the developments we saw in investment grade credit in the first quarter of 2021 and provides his outlook for the rest of the year.

TwentyFour

Volatility in Rates Eased For Now

This recent stability in the rates curve suggests to us that for now the market is listening to the Fed’s rhetoric and as a result the UST market feels better balanced.

TwentyFour

Asset-Backed Securities – Quarterly Update – April 2021

TwentyFour AM partner and portfolio manager Douglas Charleston discusses how ABS markets have performed in the first quarter of 2021 and provides his outlook for the rest of the year.

Quality Growth Boutique

Rather Be Lucky Than Good?

All-star New York Yankees pitcher Lefty Gomez once said: "I'd rather be lucky than good.” Successful investing over time is, however, not a game of luck. It requires discipline, skill and a focus on quality. Investors can prepare for a downturn by focusing on quality businesses with predictable earnings growth.

TwentyFour

Negative ‘Bond’ Headlines Belie the Reality of Credit’s Strong Performance

With treasury yields moving aggressively higher this year, anyone reading or listening to the financial press will have become very accustomed to headlines highlighting the negative performance of “Bonds”.

TwentyFour

How bond managers can invest responsibly

TwentyFour Asset Management partner and portfolio manager, Chris Bowie, looks at the specific challenges faced by investors wanting to invest sustainably in the bond markets and considers two controversial examples in Tesla and Coca-Cola.

TwentyFour

Sustainability To the Fore as SFDR Kicks In

There are many other aspects of SFDR to discuss and we expect the market to take some time to fully adjust.

TwentyFour

A New Low for Investor Protection in Euro High Yield

Primary deals launched in the European high yield market over the last two weeks have been diverse, and at times opportunistic.

TwentyFour

Brass Builds Momentum in ESG ABS

In terms of execution, it is difficult to assess any ‘ESG premium’ in Brass 10 given the overall strong demand, and in our view it’s still early to weigh the importance of a ‘social’ label for ABS investors.

Quality Growth Boutique

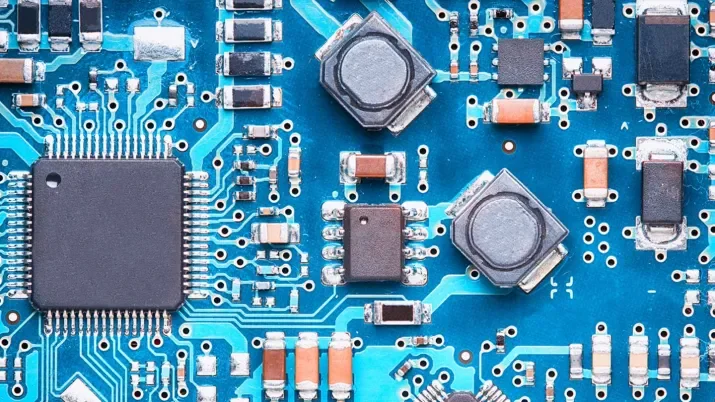

Semiconductors: A Coming of Age Story

What makes the internet high-speed, a phone smart and many other consumer products safer and more efficient? Semiconductor chips. They are at the heart of emerging technologies. We believe the industry has entered a new phase of growth that is characterized by higher profitability and lower earnings volatility.

TwentyFour

The Fed Shows Little Resistance to Higher Yields

The Fed maintained its dovish stance on Wednesday and offered very little in the way of resistance to the ongoing rise in US Treasury yields.

TwentyFour

Green RMBS Is No STORM in a Tea Cup

For most investors this deal would likely be considered a liquidity position, and at a spread of 15bp this is certainly not the sexiest proposition the European ABS market has to offer, but what is interesting about this latest instalment from the STORM platform is what makes the deal ‘Green’.

TwentyFour

Are Markets Getting Ahead of the Fed?

The bear steepening of the US Treasury curve has undoubtedly been the story of 2021 so far for fixed income investors, many of whom will have felt the adverse impact of the broad rates sell-off on their portfolios.

TwentyFour

Inflation Concerns Put ABS in Focus

For fixed income investors, we think floating rate European ABS bonds could be an allocation consideration to help improve return prospects and reduce volatility.

TwentyFour

Why TIPS Aren’t as Generous as They Seem

In a developed country such as the US, a scenario of rising inflation expectations is usually accompanied by a bear steepening across maturities of the underlying yield curve.

TwentyFour

Fed Not Playing Backstop for Treasury Yields

Our year-end forecast of 1.50% for the 10-year is already looking very out of date, and it would be a brave person right now to suggest that 2% won’t be touched any time this year as the recovery gets into full flow with the Fed holding its tongue.

TwentyFour

Securitisation Written Out of UKAR Success

Last week UK Asset Resolution (UKAR) announced the sale of its final mortgage loan portfolios, bringing to a close a decade long chapter of state ownership.