5 Reasons International Equities Are a Compelling Opportunity

Quality Growth Boutique

History is full of surprises and the events of 2020 caught most investors off guard. We expect volatility to remain high due to economic uncertainty and the fiscal and monetary stimulus that continues to drive equity markets. But while the future is hard to predict, it’s not impossible to prepare for.

The US is one of the most dynamic economies in the world and home to global leading companies like Amazon and Alphabet, but it is not the be-all and end-all for investors. We believe that actively allocating to international equities can bring the benefits of diversification, and a portfolio that combines the best of domestic and international equities is the right choice for long-term investors today. Here are 5 reasons why:

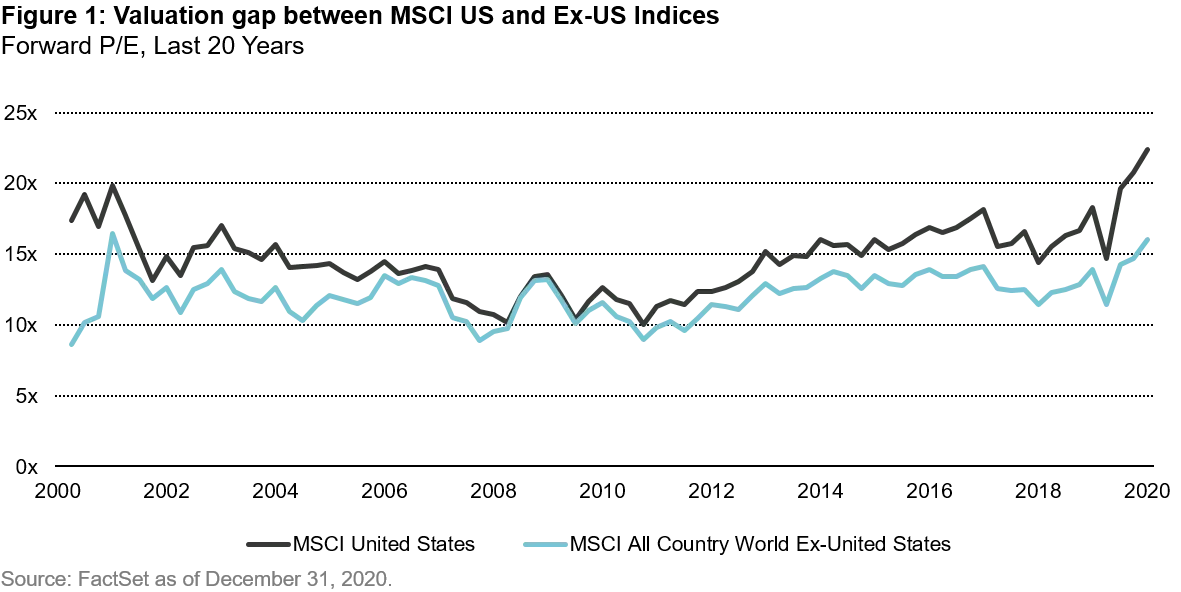

1. Attractive Valuations

Following Covid-19, US equities have become relatively expensive, with the MSCI US trading at an average of over 20x forward earnings. As a result of that run up in valuations, international benchmarks are trading at the widest discount to US indices of any point in the last 20 years.

2. Diversify Idiosyncratic Risks

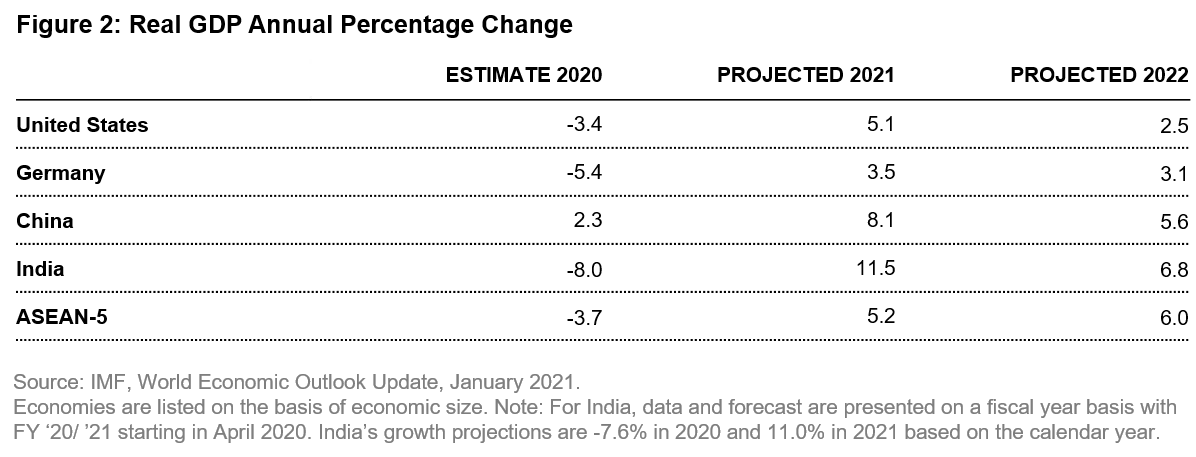

The Covid-19 pandemic demonstrates just how severe unknown risks can be, not to mention how greatly the effects can vary. While the pandemic is global in nature, not all countries have been impacted to the same extent and the global recovery will be uneven.

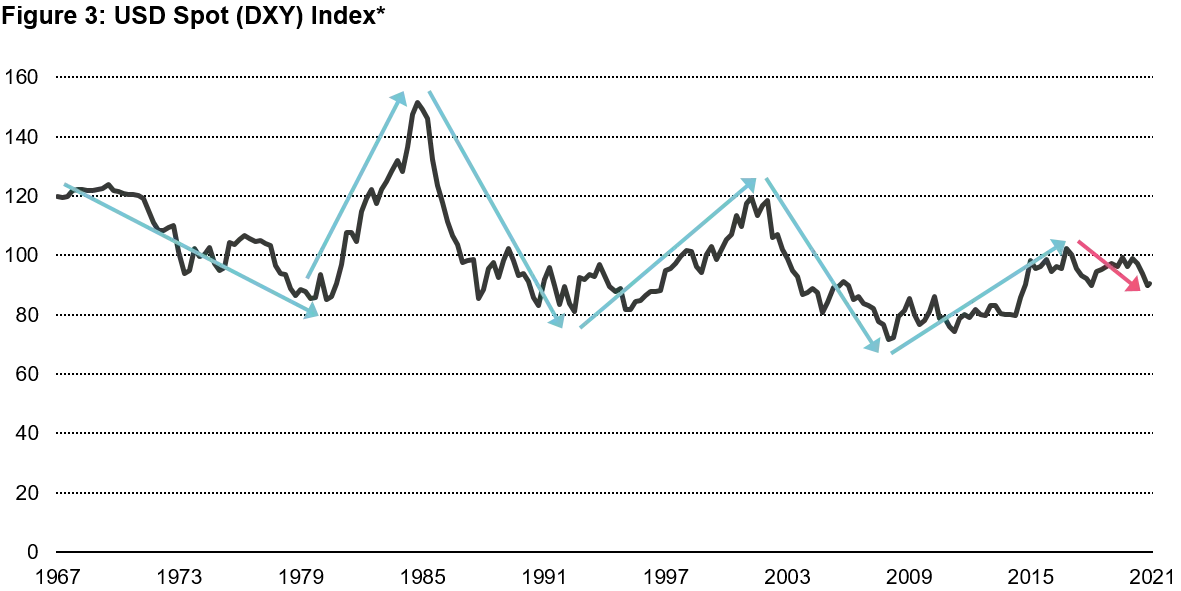

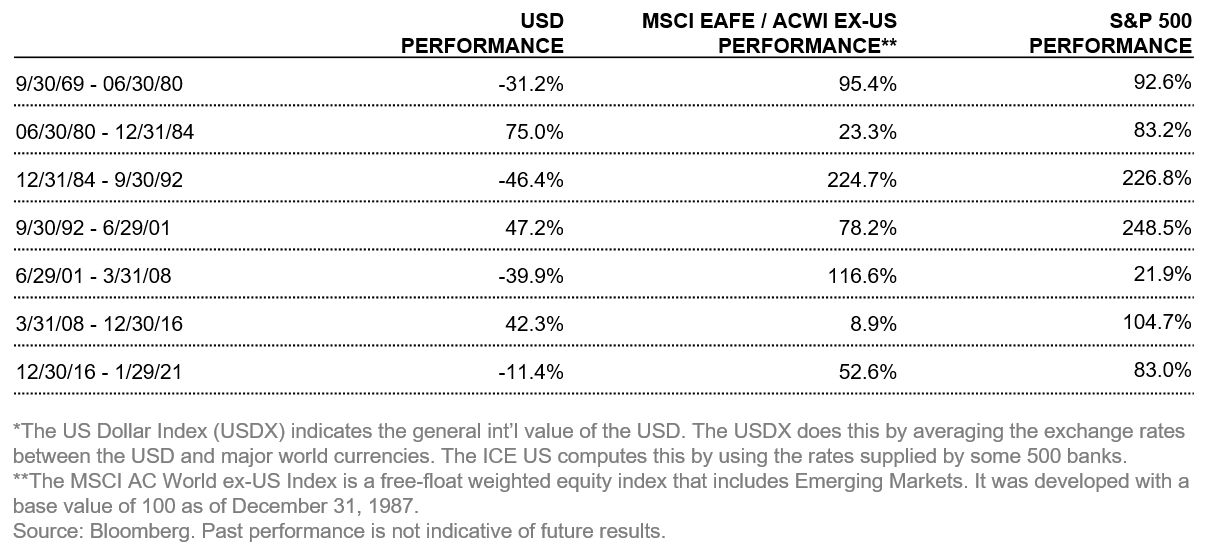

3. Diversify Currency Exposure

Exposure to international equities can be a good hedge against the risk of US dollar depreciation. Over the past 50 years, US stocks have performed well during periods of dollar strength, outperforming international equities by 108.7% on average. But during periods of dollar weakness, international equities have outperformed domestic equities by an average of 31.8%. The dollar peaked at the end of 2016 and has since weakened by approximately 11%. This suggests a good entry point given the average length of US dollar cycles is 7 years and 9 months. It is reasonable to expect that the currency’s decline may continue for another few years and international equities have actually lagged so far in the current cycle.

4. Non-US Companies Dominate Certain Sectors

The US is home to many top performing companies in the information technology and communication services sectors, but some of the world’s most compelling investment opportunities in consumer staples, consumer discretionary and industrials can be found in Europe, thus providing business diversification for the US-biased portfolio. For example, consider the performance of French luxury conglomerate LVMH or Hong Kong-based hand and power tools manufacturer Techtronic versus their US peers.

5. Complements US Equity Performance

A handful of stocks are increasingly driving performance of the S&P 500 Index. With increased working from home and a rise in e-commerce due to Covid-19, this established trend has accelerated even further. As the US market narrows and the S&P 500 continues its seemingly unstoppable climb, a large number of international equities can sensibly complement domestic exposures. It is worth considering that:

- Without the benefit of the FANGMAN (Facebook, Amazon, Netflix and Alphabet (formerly known as Google), Microsoft, Apple and NVDIA) stocks over the past decade, the S&P 500's return would have been substantially less, from 267% to 207%.

An Active Approach to International Equities

Through an active, bottom-up approach, the Vontobel Quality Growth Boutique looks for those great international businesses that can complement portfolios of domestic stocks. Our international strategy seeks superior alpha capture with lower risk than the market over a full cycle. By diversifying both idiosyncratic risks and currency exposure, we believe the strategy can offer investors lower overall portfolio volatility and a potential hedge when the US is lagging the market.