Asset management

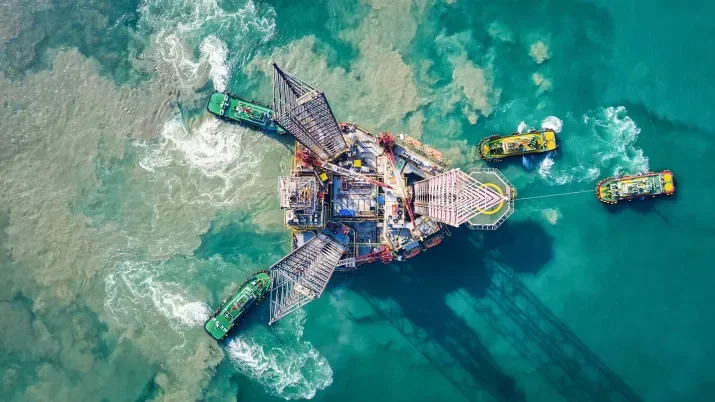

The quest for resources

A thorough consideration of resources, and their pricing, is a key element to a sound investment strategy. Future-proof investing requires an understanding of the world we operate in today and will inherit tomorrow. Resources, quite literally, shape that world.

TwentyFour

Global headlines aplenty but trends continue

For the fixed income fanatics amongst us, June was always going to be one for the books with all three of the major central banks meeting, elections, and continued data.

Fixed Income Boutique

What Mexico’s elections could mean for markets

From the potential for maintaining a status quo that has delivered stability and decent returns in the last few years, to the risks of renewed volatility during a potential second Trump presidency, our latest article from Fixed Income on the upcoming elections in Mexico provides a comprehensive analysis.

TwentyFour

The duration deliberation - to extend or not to extend?

TwentyFour Asset Management’s Chris Bowie, takes a closer look at how he is thinking about duration within fixed income portfolios and shows how following conventional wisdom on duration might prove costly for some investors this year.

Quality Growth Boutique

Supply chain risks in India: can multinationals affect change?

Child labor and imposing unnecessary medical procedures on women were recently identified in the sugar industry in India. While multinationals such as Pepsi and Coca-Cola are not directly linked to poor labor conditions, they can affect change. As active investors, we engage with our portfolio companies on these important issues.

TwentyFour

Finding quality in fixed income

Quality investing in the fixed income sector is as much about making sure that we avoid the losers as it is about trying to pick the winners.

TwentyFour

ECB wage data - can I get a raise?

The European Central Bank (ECB) will almost certainly start their rates cutting cycle next month. Supportive inflation data and clear guidance from the governing council has driven market implied probabilities of a June cut to almost 100%, with little in the way to derail that.

TwentyFour

Don't miss out on scarcity premium in AT1s

The first four months of this year have seen €11.6bn in gross Additional Tier 1 (AT1) issuance from European banks, across euros, dollars and sterling markets.

Multi Asset Boutique

Is a golden era for quality investing upon us?

Quality companies can keep pace with bull markets due to above-average profitability and consistent growth prospects. In bear markets, investors flock to quality companies as their stable earnings and strong balance sheets can minimize drawdowns. While now may be the time for quality, this style can perform well in different market regimes.

Multi Asset Boutique

Market update: Israel-Hamas conflict

With its most recent escalation, the Israel-Hamas conflict now threatens to spread and become a broader conflict in the region.

What are corporate hybrids and how do they work?

Corporate hybrids are bonds issued by companies that combine characteristics of both debt and equity.

Asset management

Mind over matter: behavioral finance and quality investing

The beginning of a new year is often when we look to change the way we behave, but how we invest can also influence our behavior. From inspiring confidence to encouraging discipline, our Chief Economist, Dr Reto Cueni examines how investing in quality can have positive effects on investor behavior.

Asset management

AI’s transformative role in asset management and ESG

The increasing capabilities of Artificial Intelligence (AI) have made the technology one of the most hotly discussed and debated topics in the public discourse, and its impact on multiple facets of business and society is indisputable. An open question remains: will it be a net positive or negative overall?

TwentyFour

AT1s caught in the crossfire but junior bank debt is here to stay

Over the course of last week, we saw several headlines around Additional Tier 1s (AT1s). First, the Dutch Finance Ministry indicated it is exploring the possibility of modifying or abolishing the asset class.

Asset management

World Water Day 2024: Will water scarcity threaten global stability?

Fresh water is an essential but scarce resource, plentiful in some regions and sparse in others. On World Water Day, our Chief Economist Reto Cueni examines the global risk landscape related to water scarcity, and possible solutions to alleviate a growing problem.

Conviction Equities Boutique

Do we need to put a Q in ESG?

Is ESG simply a different label for quality or could quality stand as a less controversial and politically sensitive description of highly sustainable companies? The question of whether ESG characteristics of listed companies form a new independent factor and a distinctive source of returns is an important one to address.

TwentyFour

The opportunity in global credit

The end of rising interest rates in Europe and the US, attractive yields, and lower-than-expected default rates mean investors can get higher income without taking on as much risk as they had to in the past. In our view, less volatile, high quality fixed income products are poised for strong performance in 2024.

Quality Growth Boutique

Economic moats: growing and defending modern day empires

A company’s competitive advantages are referred to as its moat. Far from castles and the countryside, it is important to analyze the strength and durability of a company’s moat before investing. Since moats can be wide or narrow and change over time, competitive advantages must be constantly monitored.

Quality Growth Boutique

Looking at international markets through a new lens

Many US investors are overweight domestic versus international strategies for the wrong reasons – home bias and benchmark anchoring. In our view, investors should focus on great companies, regardless of where they are domiciled. An active international strategy can help US investors expand their opportunity set, diversify risks, and improve their portfolio returns.

Multi Asset Boutique

Is China’s “Japanification” on its way?

Japan’s economic success story after World War II was like a phoenix rising from the ashes. But it didn’t last, resulting in the “Lost Decade” and China subsequently taking its place as the world’s second-largest economy. Comparing the Japan of yesteryear with today’s China raises the question whether China could soon face a similar fate.

Quality Growth Boutique

From diversity to dividend: increasing women on corporate boards

Adding women to corporate boards can improve the impact a board has on company performance. Yet progress has been slow. Companies that recruit former CFOs and CEOs simply cannot find enough female board members. Expanding talent pools can bring more women into the fold.

Fixed Income Boutique

Are Emerging Market Local Currency Bonds in Your Portfolio?

Over the last decade investors have been forced to broaden their horizons, but many investors continue to overlook Emerging Market Local Currency Debt. Our Fixed income team offers five reasons why you should think about giving emerging markets local currency a more permanent allocation in your investment portfolio.

TwentyFour

One year on from the collapse of Credit Suisse - and what a year it has been for AT1s

Almost a year ago to the day, we were in the midst of banking sector turmoil, which started off with regional banks in the US and spilled over to Europe, eventually culminating in the forced merger between Swiss banks UBS and Credit Suisse.

Quality Growth Boutique

From waistlines to bottom lines – investment implications of weight-loss drugs

We believe answers to critical questions about weight loss drugs will help determine the sustainability of success that some pharmaceutical stocks have enjoyed: How many people will be on the drug, and at what price? Which pharma company will be the winner of the R&D race?