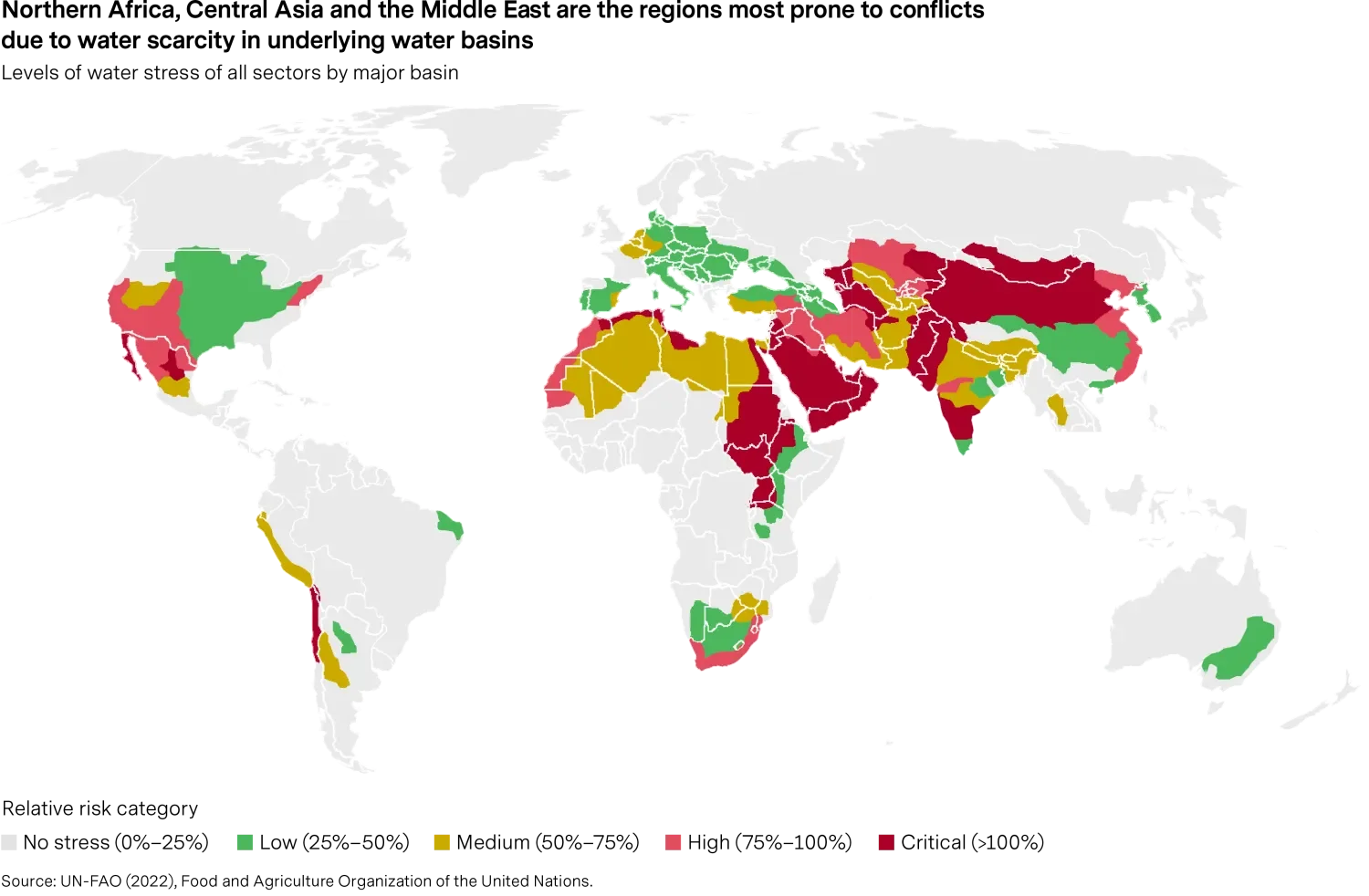

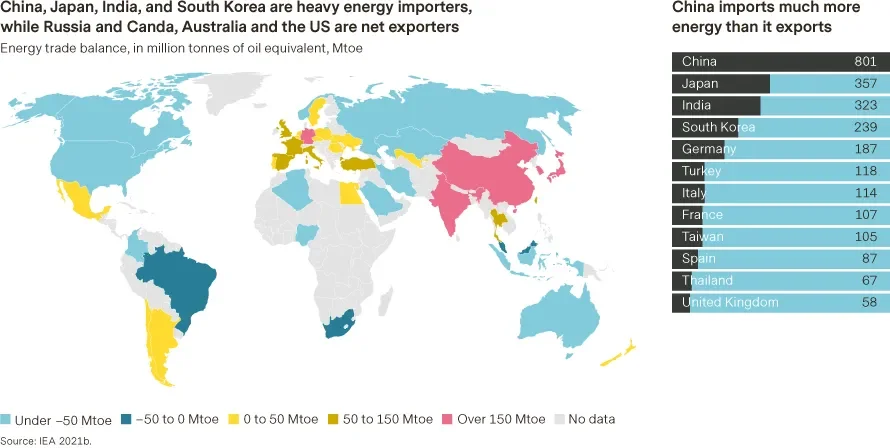

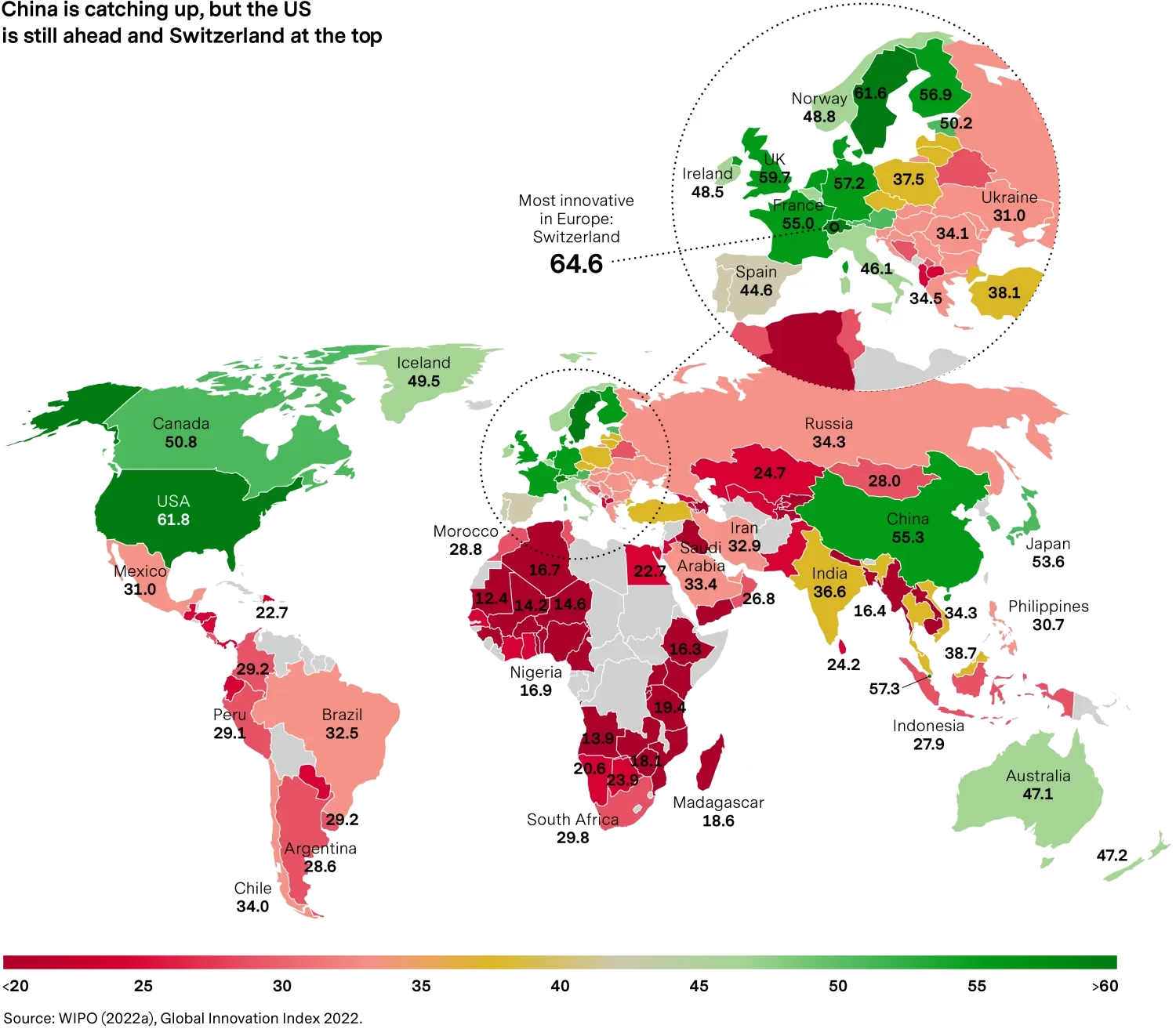

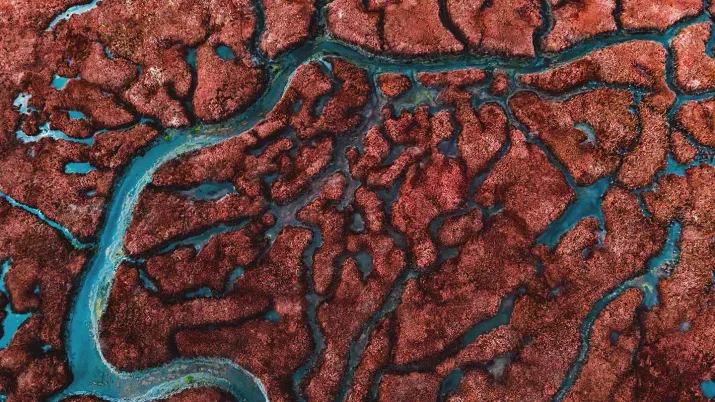

Scarcity

Resource scarcity will remain a key topic in geopolitics, substantially affecting financial markets and investing as geopolitical considerations disrupt economic principles of supply and demand. The availability of resources is key to investors across the globe as it has the potential to substantially affect the value of investments.