When evaluating Chinese tech, focus on action, not intent

Quality Growth Boutique

As pressure has been building on Chinese technology stocks given growing regulatory threats, some of the key players in the Chinese internet sector are shifting to a more prudent strategy, pulling back to focus closer on the core business rather than investing in new growth areas.

For example, Tencent recently indicated it will moderate headcount growth and marketing expenses, though this likely will not go into effect until 2023. Alibaba has indicated that it will focus more on monetizing existing users as opposed to aggressively going after new user growth. Pinduoduo (PDD) also reported better-than-expected margins by cutting back on subsidies, while Meituan is pulling back from areas such as ride hailing. We think this should lead to slower top line growth, but potentially better margins for the sector over the next 18 months.

However, as of now, we have yet to see real, long-term action on these strategies. The only key player that has consistently showed investment discipline over several quarters has been JD. It has been more cautious in growing its international business, as well as cautious in investing in areas like Community Group Buy, which has become increasingly popular among Chinese tech giants.

As background, Community Group Buy is a new segment that brings grocery directly from farmers and packaged food companies to consumers via Community Group Buy “leaders”, often at a discounted price as it cuts out the grocery-store middleman. Thus far, all players are generating losses as the commission that platforms earn has been insufficient to offset the subsidies, logistics costs and the amount paid to Community Group Buy leaders. The bull case is that these users can be cross sold into other categories and that the infrastructure can be leveraged into other businesses like food delivery. We think the business case is yet to be proven, particularly since the average ticket price of these consumers is very low as they are price sensitive. Hence, the more cautious approach that JD has taken makes sense.

In terms of assessing this broad shift in strategy, we are more constructive on companies like JD that have already displayed investment discipline as opposed to those that are intending to, like those listed above. For comparison, in Community Group Buy, we estimate Alibaba has been losing RMB 9-10B in recent quarters, Meituan RMB 7B, while JD is only RMB 1-2B. It’s difficult to know at this stage how aggressive or committed players like Meituan are in pulling back on investments, and hence cutting back on loss making businesses.

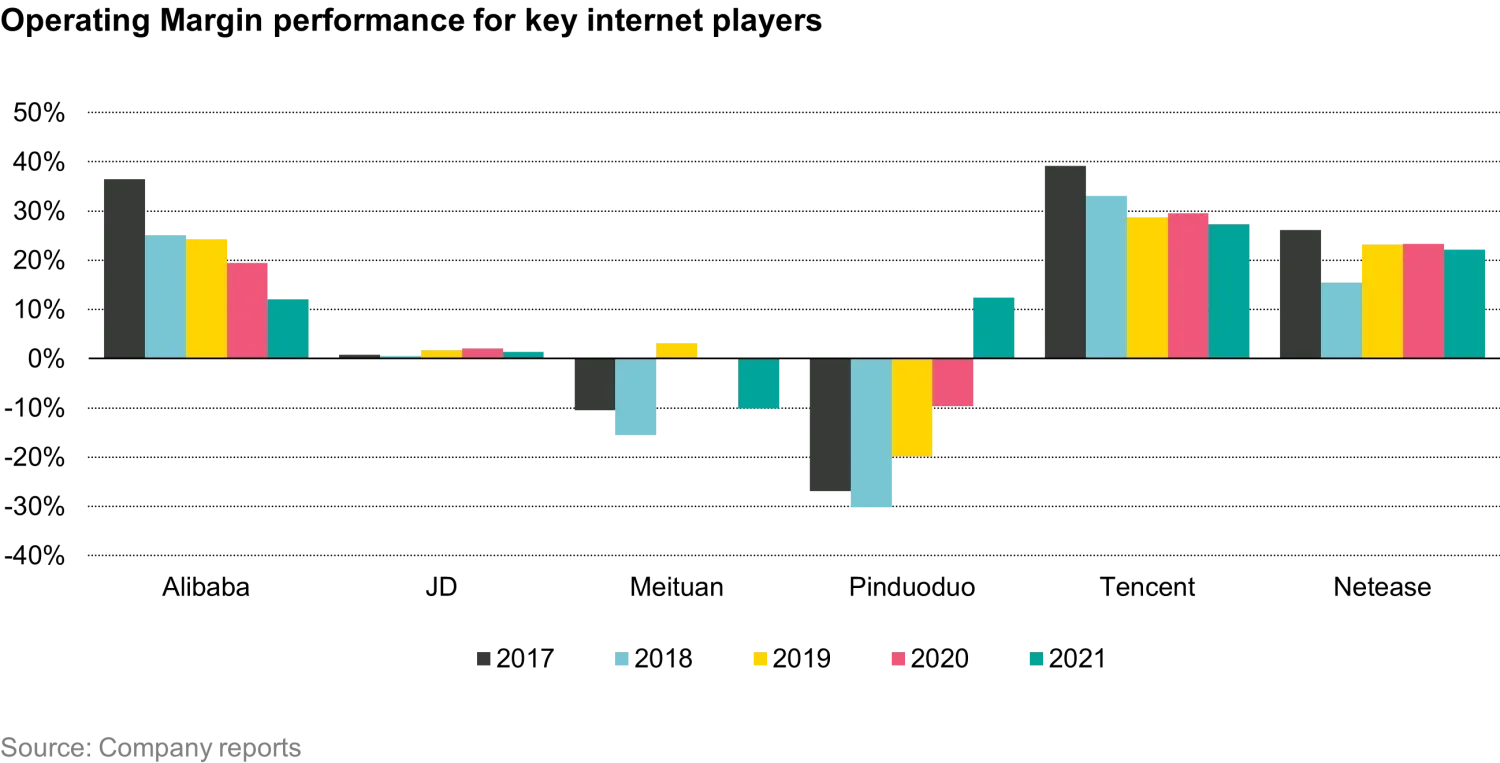

JD’s investment discipline can also be seen in terms of longer-term performance, with operating margins improving from 0.8% to 1.4% over the last four years ending December 31, 2021. On the gaming side, we believe Netease has protected margins well, falling only 400 basis points to 22% for the same period. PDD has surprised positively on margins, but we think there is a question mark on sustainability.

On the other hand, Alibaba has seen much bigger falls, i.e., by two thirds to 12%; Tencent by close to one third to 27.3%; while Meituan has remained loss making at similar levels of -10% OPM.

Predictable and attractive growth prospects amid regulation

For these companies we still see growth in terms of users, but more importantly we see some moderate room for monetization improvement. For players like JD we still see plenty of room for margin expansion as it shifts further away from its first-party business and more toward third-party merchants, and gets better scale on its inhouse logistics investments.

As the margin outlook becomes clearer and growth shifts more to sustainability, we think earnings predictability should improve. Pulling back on subsidies in areas like Community Group Buy should be better for reducing losses across the sector, as all the players in e-commerce have been investing in this space to a greater or lesser extent. Further, we think the broader regulatory concerns are behind us in sectors like e-commerce, and there are some clear winners of regulatory actions such as JD.

In a broad sense, while this means slower revenue growth of closer to the 10-20% range for the sector (down from 20-30%), the profitability should be more predictable if we see a more rational approach to investments, which should give us more confidence in calculating the intrinsic value on these businesses. As mentioned, however, only a few players have already displayed a track record of investment discipline and the others still need to deliver. As the market sees better delivery on earnings growth, there is room for the multiples on these businesses to rise if they can follow through on disciplined capital allocation.

Disclaimer:

Any investments discussed are for illustrative purposes only and there is no assurance that Vontobel will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. Further, the reader should not assume that any investments identified were or will be profitable or that any investment recommendations or that investment decisions we make in the future will be profitable. Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Vontobel believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

The views and opinions herein are those of the individuals mentioned above and do not reflect the opinions of Vontobel Asset Management or Vontobel Group as a whole. The views may change at any time and without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.