Through the prism: how investigative journalists can enhance equity research

Quality Growth Boutique

Key takeaways

- The skill of looking at the same picture as everyone else and seeing something different is a strength that investigative journalists can transfer to investing. Over the last fifteen years, Quality Growth has incorporated this into our assessment of stocks.

- Investigative analysts strive to uncover material and actionable information – identifying new information and risks or opportunities – that together with fundamental analysts can improve the portfolio manager’s decisions.

Breaking the cycle of groupthink

Common among many successful investors is the foresight to get ahead of the curve or the courage to go against the grain. This underlies the value of independent thought and looking beyond the information sources typically relied upon by traditional financial analysts.

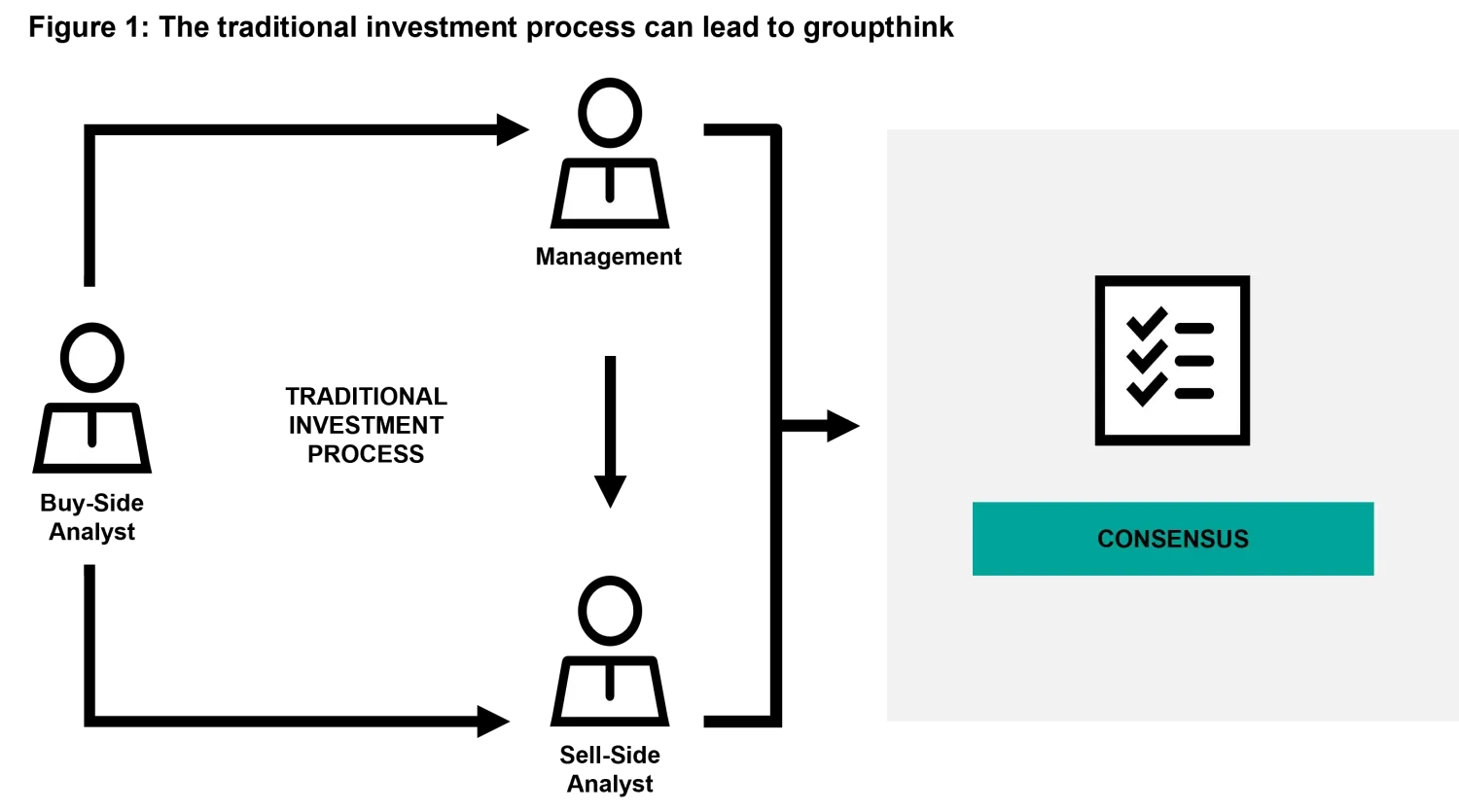

A traditional research process starts with a buy-side analyst contacting a company’s management to learn about its business model and create a thesis about it. This analyst usually contacts a sell-side colleague to test their thesis. But, because both the buy-side and sell-side analysts receive the same information from the same people, they almost always agree.

Unfortunately, this process can tend to generate groupthink, a social phenomenon which creates conformity and rubberstamps opinions. Groupthink can often cause investors to miss the red flags that should make them think twice. To break this cycle and look at global equity investment opportunities through a unique lens, an alternative approach is needed.

This article outlines why Vontobel Quality Growth decided fifteen years ago to hire journalists as investigative analysts, and how they work alongside our fundamental analysts to improve the investment research process. Four case studies are used to highlight how this approach has been shown to help identify trends ahead of the market, avoid potentially costly investment mistakes, and use new perspectives to test investment rationales.

A unique skill set can open doors to new sources of information

Traditional investment analysts are skilled at digging into financial statements and interacting with management to glean insights about companies and their operations. Investigative analysts use their experience as journalists to go off the beaten path and gather intelligence from non-traditional sources in the field, ranging from customers, suppliers, former executives to industry lawyers, oftentimes to people who may not necessarily want to disclose it.

The high-profile world of journalism means that interviewees and sources can be quoted in newspapers and magazines, which can open doors for the investigative journalist. Even though Vontobel sources will never end up in print, our investigative analysts have honed their skills for approaching people over many years. This, combined with doing detailed homework on the company or topic, can help engage people quickly, gain their trust, and garner actionable information and insights.

Fifteen years ago, we hired Mara Der Hovanesian, a journalist who in her former role at BusinessWeek spotted trends and broke news ahead of the pack in the run up to the financial crisis. The experiment worked so well that we hired two more investigative analysts, Robert Berner also in the US, and Zhen Li, based in Hong Kong.

Empowered to dig-deep and venture off the beaten track

As journalists, our investigative analysts are trained to work in fast-paced environments and look at a situation through a unique lens. The difference when applied to investment analysis is that it’s not just about opinions or a point of view – the information has to be material and it has to be actionable. But it still requires the skill of looking at the same picture as everyone else and seeing something different.

If the team agrees on an investment idea that doesn’t make sense to our investigative analysts, they are empowered to investigate, pursue their own angles, and develop an independent view. In that process, they might uncover a new avenue to explore. Because investigative analysts do not cover specific sectors or stocks, their analysis is more top down and less tied to portfolio construction than fundamental analysts. This is one way we avoid groupthink and is aligned with Vontobel’s culture that encourages employees to take ownership of their performance.

Avoiding investment blind spots

Before an investment decision is made, our investigative analysts provide an independent perspective. The aim is not to seek consensus, but rather to identify new information and risks or opportunities that our fundamental analysis might not see. While the portfolio manager is tasked with the final decision, the often-differing opinions between our fundamental and investigative analysts provide a healthy debate that we believe leads to a better process for investment decision making.

In September 2023, such a debate led us to rethink our portfolio holding Alimentation Couche-Tard1, a Canadian convenience store chain which operates the Circle K business in the US. When our investigative analyst Robert Berner visited multiple Couche-Tard stores, plus those of its competitors, he found them to be under par, untidy, and in some cases dirty. He observed that some individuals appeared reluctant to enter the stores, and that staff seemed unmotivated. While our fundamental analyst acknowledged some of these issues, he also argued that the business had the ability to improve. Ultimately, our portfolio manager assessed that Couche-Tard did not have the predictability we look for in our stocks. Further, our investigative analyst highlighted the risk of making a mistake and, as a result, we sold our position and reallocated the capital to what we believed was a better opportunity for our portfolios.

Case study 1: Investigative trip to China reveals trouble in the real estate sector

In 2011 and 2012, Robert Berner made several trips to China with the aim of gaining insights into the soaring Chinese housing market, which was driving the overall economy at the time. On his first trip, Robert found a translator who took him to see a housing riot in downtown Shanghai. Buyers who had paid large deposits for condominiums in a development of residential towers a year earlier had broken into the sales office. The door was smashed, glass shattered everywhere, and models of the project were destroyed. It turned out that the developer had run out of money before finishing the project. That was the first red flag.

The next stop was a visit to the translator’s brother, who was an unofficial moneylender. Robert met with him and 12 other lenders – effectively loan sharks. Their customers were small and medium-sized businesses that were forced to resort to moneylenders that charged inflated rates because they could not access funding from banks as real estate developers and other state-owned enterprises (SOEs) were soaking up most of the banks’ liquidity. That was a second red flag.

Over the course of his extensive travel throughout China – on one occasion clocking 2,500 miles and 15 cities – Robert developed numerous other sources among manufacturers, academics, and economists. Through meetings with an economist for the People’s Liberation Army, the military wing of the Chinese Communist Party, Robert learned that many small businesses and SOEs were investing in real estate rather than their core businesses – and many were defaulting on their loans. That was a third red flag.

By 2012, long before Evergrande’s collapse and news about it had reached the international press, we were questioning China’s real estate market. We heeded early warning signs and, as a result, we were more cautious about investing in China.

Case study 2: Investigative trip to Colombia is a catalyst for exiting a position

One of Quality Growth’s long-standing portfolio holdings is French-based Teleperformance2, with global operations that deliver advanced digital business services to its clients. It is the largest employer in Colombia, with 40,000 people operating call centers for large airlines, retailers, and financial companies. Teleperformance’s work for tech companies in content moderation was one of the most controversial parts of its business.

Content moderators are frontline workers that digitally scrape elicit content before it is published on the web. A November 2022 article in Time magazine3 raised serious questions about working practices for those individuals at Teleperformance’s Colombia operation. Claims of intolerable conditions went viral when Colombia’s Deputy Minister of Labor retweeted the story.

In its defense, Teleperformance invited investors to Bogota, Colombia to see its facilities. Mara Der Hovanesian made the trip on behalf of Vontobel. ESG Analyst Marci Richburg accompanied Mara on the trip. The ESG-related goal was to investigate the issues from a human and labor rights standpoint and determine the magnitude and weight of any proven claims.

Before and during her visit to Colombia, Mara spoke with labor economists and historians, the U.S. State Department, Columbia’s Deputy Minister of Labor who had made that tweet, and others. She discovered workplace issues running much deeper than content moderation after speaking locally with three union groups. In fact, the government was inundated with complaints about pay and surveillance. Further, the political situation in Colombia was highly strained, with ongoing tensions between the new left-wing government, right-wing paramilitaries, and union agitators.

While other buy-side and sell-side analysts who visited Colombia were receptive to Teleperformance’s message, what Mara saw struck her as a carefully staged exercise where analysts met content moderators who had been pre-selected for the meetings. She had concerns about the contradictions between what she saw with the company and the situation on the ground.

Armed with firsthand knowledge from the Colombian government and other well-placed sources, we formed an opinion about management creditability and concluded that even if the antagonism between Teleperformance and the union was solved, content moderation issues in other countries and discord with corporate technology customers would continue. This led to our decision to exit the position and the stock price subsequently fell by some 50 percent.

Case study 3: New evidence changed portfolio manager bias on a stock

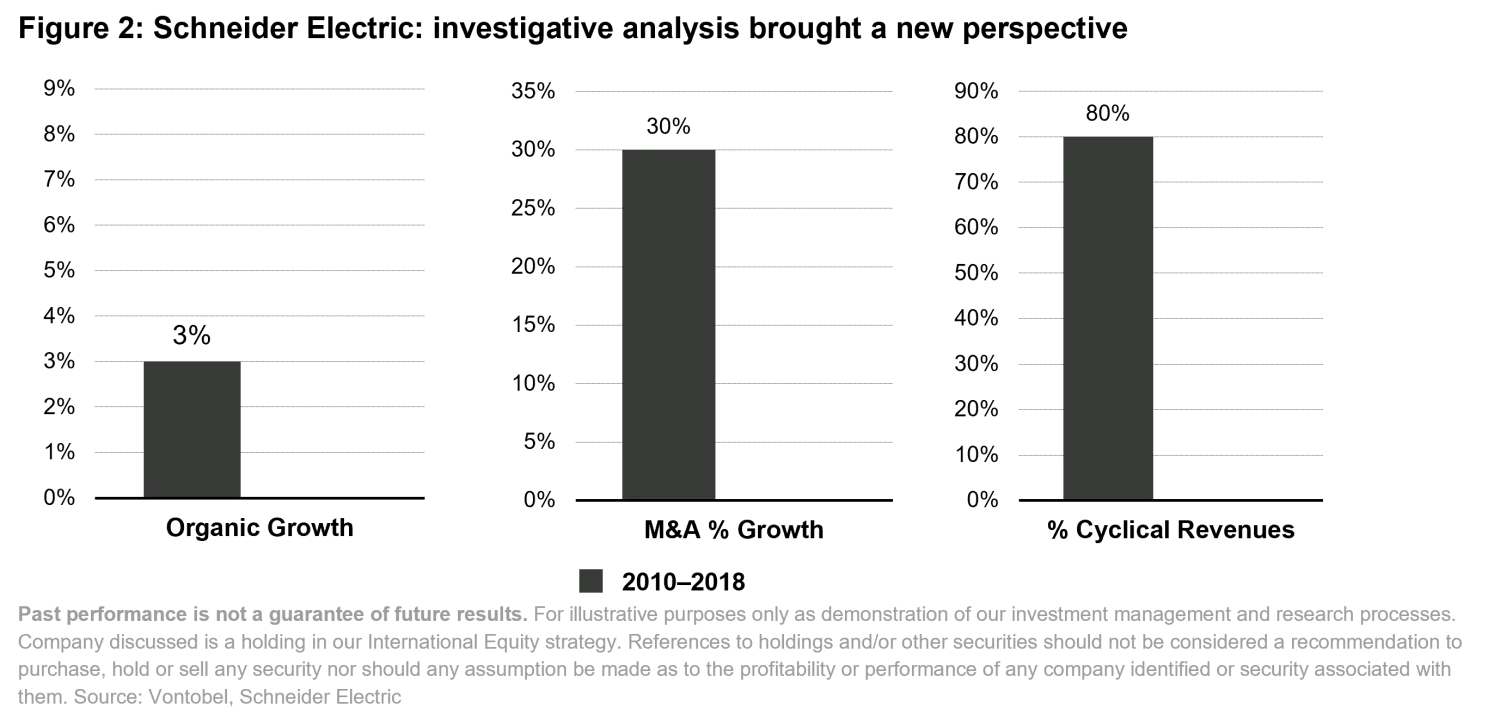

When assessing Schneider Electric, a French-based global manufacturer of low and medium-voltage equipment, Vontobel’s industrial analyst initially viewed the company as not worthy of investment. However, over the past few years, Schneider’s growth accelerated from three percent to eight percent, it became less reliant on mergers and acquisitions, and its business became less cyclical because it reduced exposure to residential construction and became more focused on software. Schneider had become a major provider of equipment and technology for data centers, a fast-growing segment driven by cloud adoption and artificial intelligence, and it warranted closer investigation.

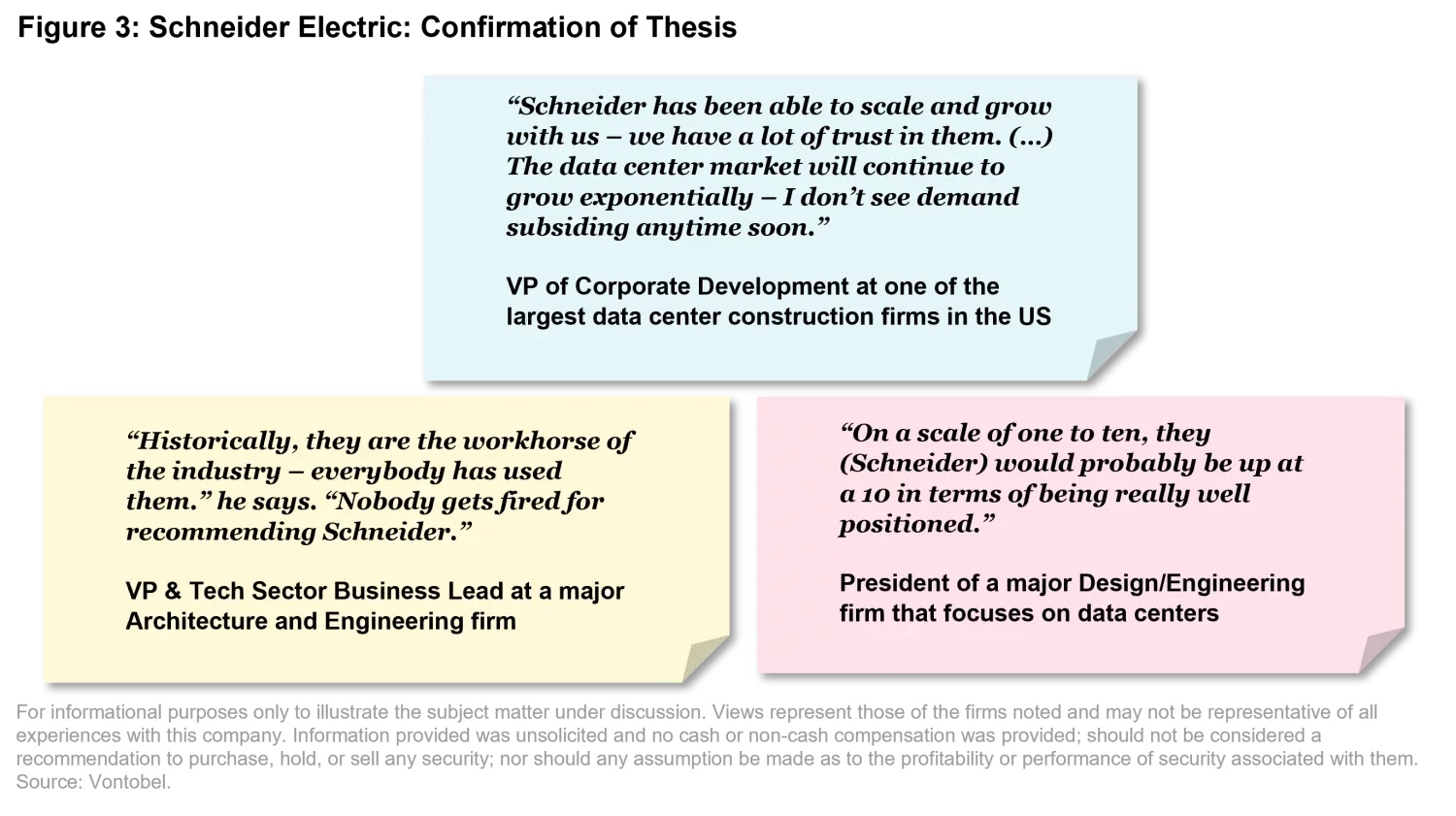

At the request of the portfolio manager, our investigative analyst Robert Berner contacted executives at major data center operators and engineering firms to understand Schneider's competitive position. He discovered that, with a long track record in the industry and a reputation for delivering quality products, Schneider’s biggest advantage was trust. Schneider’s key products were transformers, interruptible power supplies, switches, and panels – in short, mission-critical equipment for data centers. If these pieces fail, the data center shuts down, and Robert found that Schneider was not prone to failures.

In a booming market for data centers, developers can wait up to two years for essential power equipment. Schneider had a reputation for delivering on time. It constructed an assembly facility at the site of a client’s hyperscale data center to ensure even faster delivery. Robert painted a picture of a highly regarded manufacturer in a space that makes up over 50 percent of company sales.

What about the sustainability of end demand? Robert learned that, particularly because of AI, data generation was far outpacing capacity. Not one industry executive anticipated a slowdown in data center construction during this decade. In addition, data centers were struggling to access electricity from the grid and had to wait for new power infrastructure to be built. This slowed data center construction and stretched the demand curve out even further into the future.

Our investigative analyst not only confirmed that Schneider was a strong player, but it also had visible and strong long-run potential, which helped turn an interesting investment case into a compelling one.

Case study 4: Investigating supply chains in China led us to pass on a seemingly quality opportunity

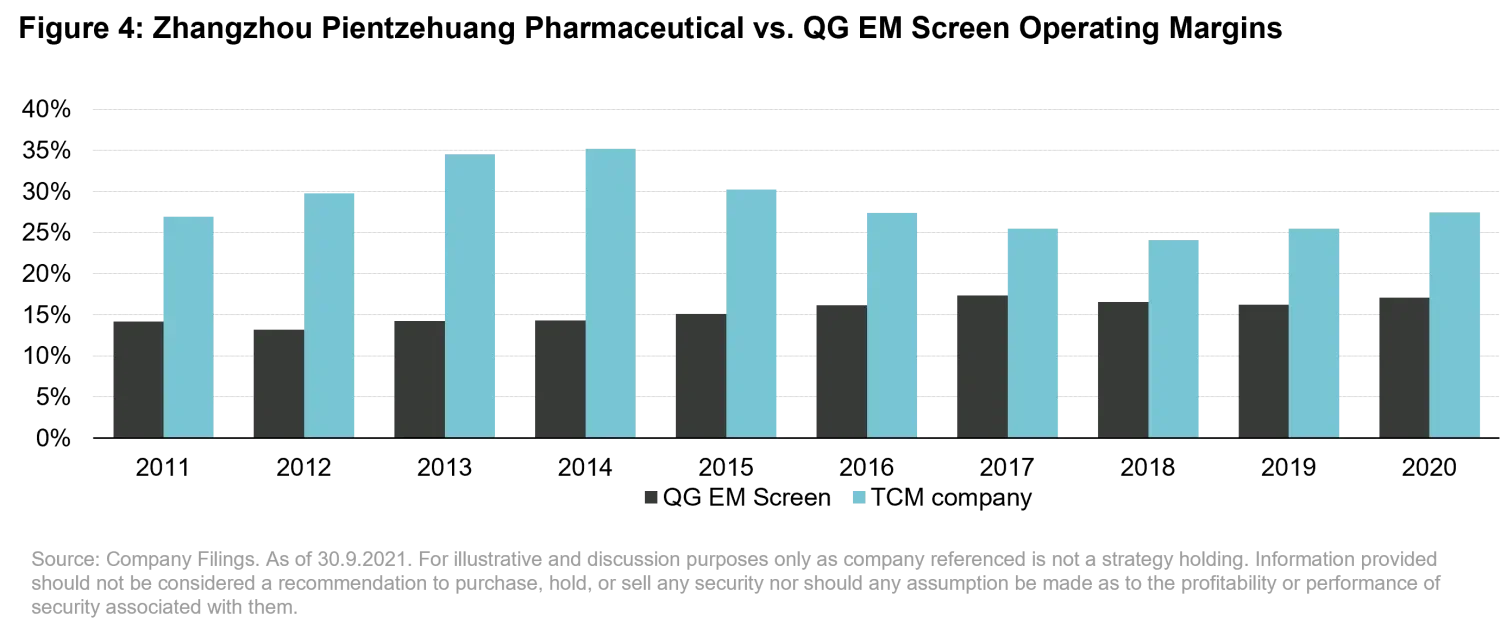

Zhangzhou Pientzehuang Pharmaceutical is a well-known traditional Chinese medicine (TCM) company with a proprietary formula for treating liver disease, pro-inflammatory conditions, and cancer in China for hundreds of years. The company enjoys access to a rare ingredient – natural deer musk – that is sanctioned by the state. Deer musk is almost impossible to acquire in the open market and the company has the pricing power to pass on the increasing cost of musk to its consumers, whose demands for premium and branded TCM have grown exponentially in recent years. With a trusted and highly valued product, it is an attractive high-margin business with above-average return on equity. It therefore seemed like a high-quality business.

Concerned with the legitimacy and sustainability of the procurement of natural musk, our investigative analyst Zhen Li spoke with a TCM industry professional, a government official, a wildlife conservation NGO, an environmental lawyer, and some deer musk breeders to check the integrity of Pientzehuang’s supply chain and to understand how the musk trade is regulated.

The government banned the harvesting of musk in 2002, introduced a ration system, and started a breeding program that would become the only legal source of musk. However, poaching of wild musk deer, an animal on the brink of extinction, still exists.

We had reasonable suspicion that some illegally harvested musk has made its way into Pientzehuang’s supply chain due to regulatory and enforcement loopholes.

We did not have high conviction that musk from deer breeding farms would fully meet the fast-growing market demands. The company would face considerable supply constraints when old musk inventory is depleted, and poaching activities are further curtailed. We decided not to invest in the company.

“When we all think alike, no one thinks very much.” Albert Einstein’s words of wisdom describe the concept of groupthink, which leads to suboptimal decision making. Since a traditional research process can result in groupthink, former investigative journalists can help break the cycle of groupthink and help make better investment decisions. Investigative analysts also measure intangibles and to what extent those impact a company’s fortunes. After nearly two decades of refinement, we have reached the point where investigative analysts have a meaningful impact on our investment decisions.

1. For illustrative purposes only as demonstration of our investment management and research processes. Company discussed was a prior holding in our International Equity strategy. References to holdings and/or other securities should not be considered a recommendation to purchase, hold or sell any security nor should any assumption be made as to the profitability or performance of any company identified or security associated with them. Source: Vontobel

2. For illustrative purposes only as demonstration of our investment management and research processes. Company discussed was a prior holding in our Global Equity strategy. References to holdings and/or other securities should not be considered a recommendation to purchase, hold or sell any security nor should any assumption be made as to the profitability or performance of any company identified or security associated with them. Source: Vontobel

3. https://time.com/6231625/tiktok-teleperformance-colombia-investigation/