Donald Trump is back: What it means for investors

Multi Asset Boutique

Key takeaways

- Republicans have reclaimed control of the US Senate. It’s quite possible that they could secure more than 52 out of 100 seats, which would increase the likelihood of a Republican majority beyond the 2026 midterms.

- A Trump presidency could stimulate growth through expansive fiscal policy and deregulation, which may favor stocks over bonds.

- However, excessive growth carries risks, potentially leading to higher interest rates, which could eventually weigh on both the economy and stock markets.

What we know so far

Donald Trump is returning as US President, with the Republican Party reclaiming control of the US Senate. It’s quite possible that they could secure more than 52 out of 100 seats, which would increase the likelihood of a Republican majority beyond the 2026 midterms.

An outstanding question is which party will gain control of the House of Representatives. This chamber often goes to the same party as the presidency, but the race remains undecided.

What contributed to Trump’s victory?

Since Joe Biden took office, high inflation has weighed on the economy, and many blame his economic policies. Discontent with Biden's immigration stance may have further fueled Trump’s support. Additionally, a global trend of distrust in major institutions has intensified since the pandemic. Criticism of sitting administrations is common, even when the economy is performing relatively well.

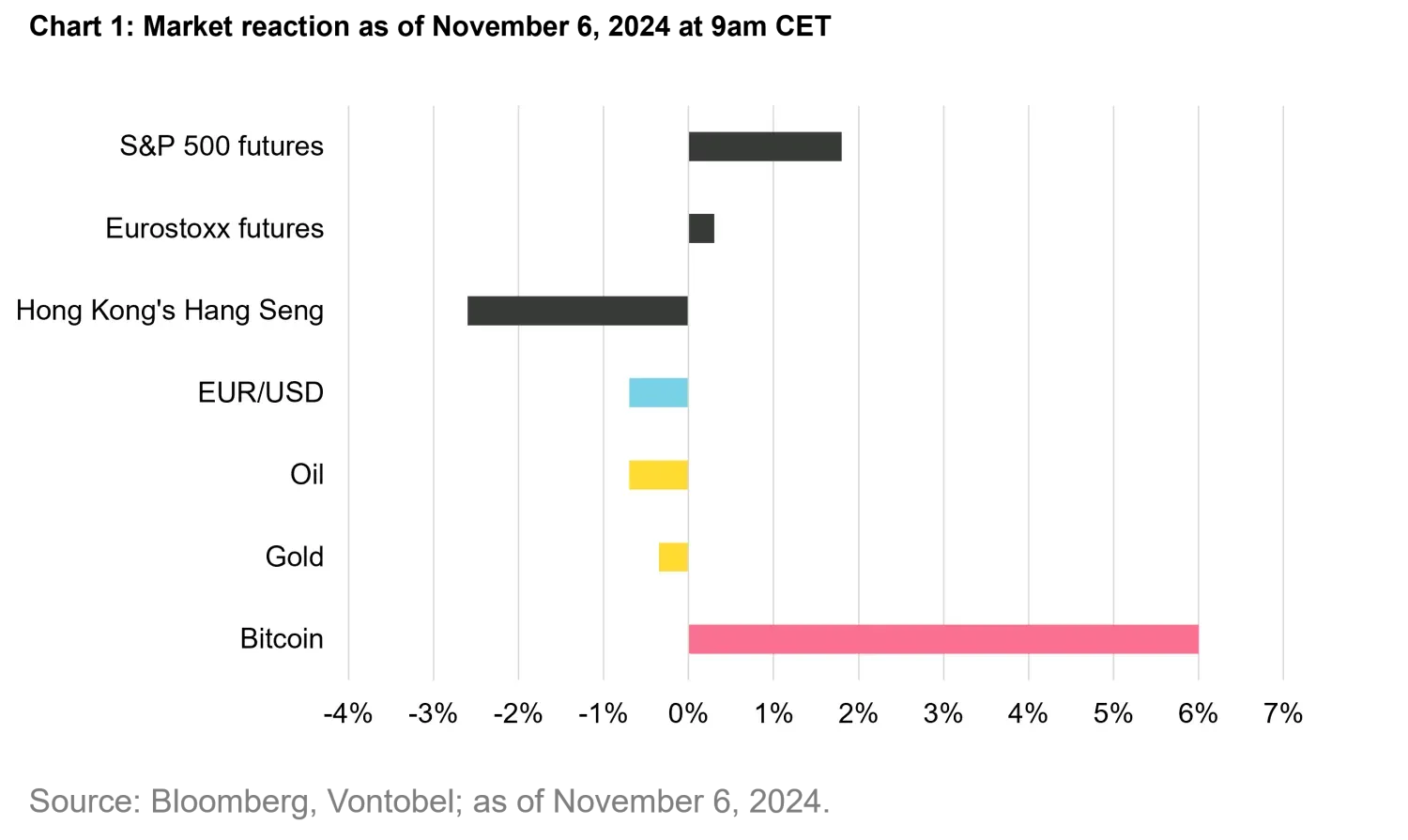

How did markets react?

Market reaction to Trump’s victory has been as expected: broadly positive but with less volatility than in 2016, as Trump’s win was anticipated this time. US stock futures are trading about 1.8% higher, while European and Chinese markets are reacting cautiously. The yield on 10-year U.S. Treasury bonds rose above 4.4%, which also strengthened the US dollar by about 1% on a trade-weighted basis. Oil prices saw a slight decline, gold traded lower, and Bitcoin and other cryptocurrencies showed notable gains (see chart 1).

Key economic implications

The most significant economic impact may come from fiscal policy: lower taxes and higher spending could increase the budget deficit, providing a fiscal boost for the economy.

Trump may also introduce incentives to encourage more companies to manufacture in the US, particularly through higher tariffs, which could add to trade policy uncertainty. His policy priorities could shift depending on whether he secures a congressional majority. With a "Red Sweep" (Republican control of both chambers of Congress), he may prioritize immigration and tax policies. Without that majority, he might focus on tariffs and deregulation.

Foreign policy changes could also be on the horizon. A shift in Iran policy, in particular, could pose substantial risk to financial markets.

Even before the election, both candidates were likely to continue a protectionist economic stance, particularly toward China. Increased military spending also appears probable. Additionally, rising debt levels and associated servicing costs may require a fiscal policy shift in the medium term.

What does it mean for investors?

A Trump presidency could stimulate growth through expansive fiscal policy and deregulation, which may favor stocks over bonds. However, excessive growth carries risks, potentially leading to higher interest rates, which could eventually weigh on both the economy and stock markets. Sector-wise, energy and financial stocks may benefit from lighter regulation.

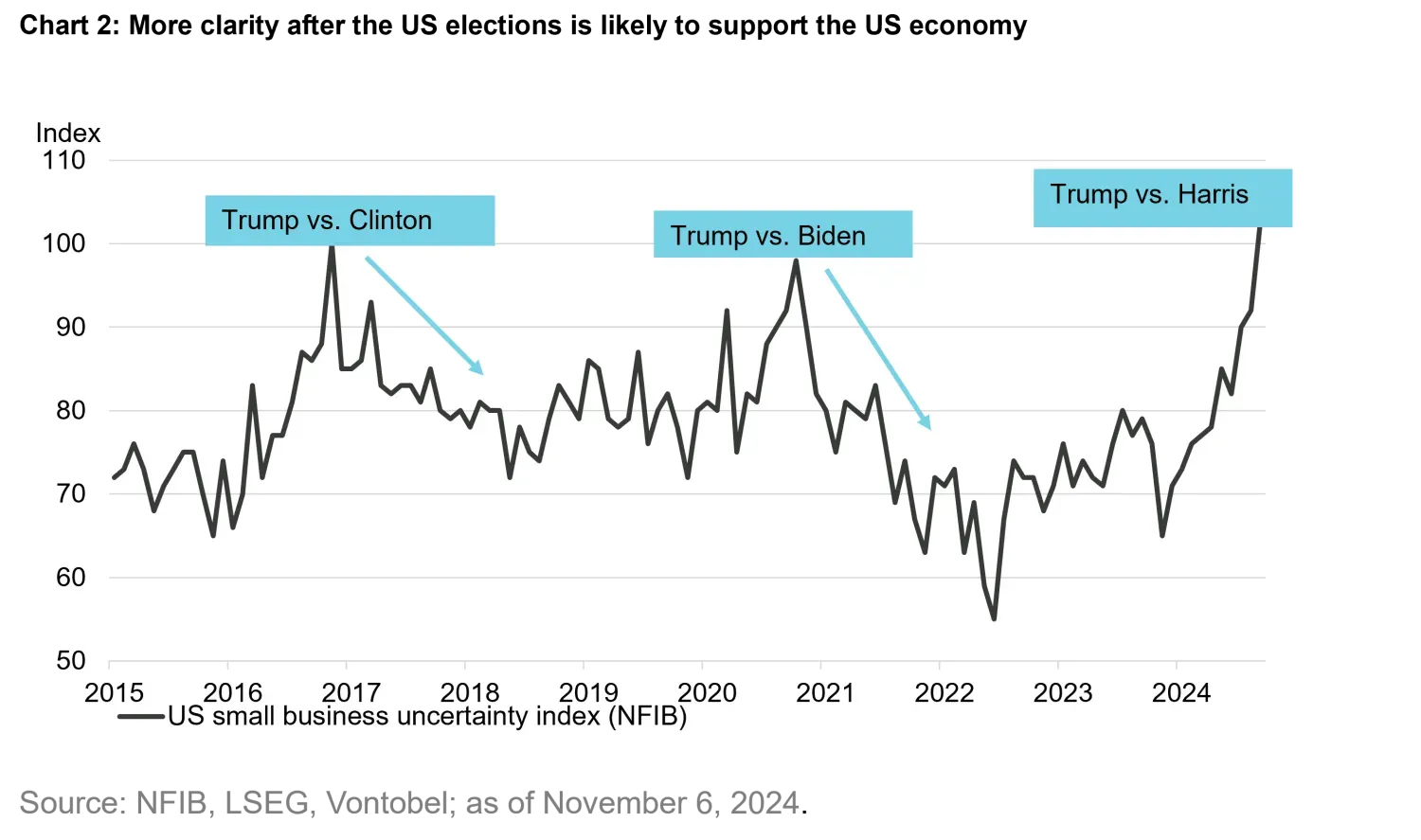

Generally, economic uncertainty tends to decrease after elections, as shown in chart 2. However, the US elections are only one factor for investors to consider. Other crucial considerations include the progress of the US labor market, consumer resilience, whether the US Federal Reserve continues rate cuts, and potential economic stimulus from China.

Investment strategy

Today, we decided not to make changes to our asset allocation. Amid high economic uncertainties, we remain neutrally positioned on equities, with an overweight in gold and an underweight in bonds. Within bonds, we prefer emerging market bonds over high-yield bonds.

We are closely monitoring key political and economic developments and will keep you informed as new investment decisions are made. We also invite you to join our Vontobel Livestream on the US elections tomorrow, Thursday, Nov. 7 at 9:30am CET.

This article does NOT express any political views or endorsements, but rather aims to objectively analyze the economic factors and implications. The analysis is based on publicly available information as of 6 Nov 2024 and is for informational purposes only and should not be construed as investment or political advice.

Important Information: Past performance is not a guarantee of future results. Any projections or forward-looking statements herein regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such.

“BLOOMBERG®” and the Bloomberg indices listed herein (the “Indices”) are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the Indices (collectively, “Bloomberg”) and have been licensed for use for certain purposes by the distributor hereof (the “Licensee”). Bloomberg is not affiliated with Licensee, and Bloomberg does not approve, endorse, review, or recommend the financial products named herein (the “Products”). Bloomberg does not guarantee the timeliness, accuracy, or completeness of any data or information relating to the Products.