Planets align for emerging market local currency bonds

Fixed Income Boutique

Key takeaways

- Local currency bonds have been the undoubted outperformers in fixed income so far this year, with a 7.8 percent total return.

- We are growing increasingly confident that the underperforming decade of emerging market local currency has come to an end.

- As more stars align for emerging market local currency bonds, waiting on the sidelines may no longer be the smartest approach.

After a tumultuous decade, the current planetary alignments seem to favor emerging market local currency bonds again. The 7.8 percent total return of the JP Morgan Government Bond Index-Emerging Markets Broad Diversified delivered during the first half of 2023 makes it the undoubted outperformer in fixed income year-to-date, and there are good reasons to believe this wasn’t just a one-off lucky shot.

Many investors could be excused for missing it, as it has not been the center of attention for some time. But it is not like it came out of the blue. One year ago, we published 4 reasons why EM local currency debt could be the phoenix of fixed income, and these remain valid today.

Given current enticing valuations, still-attractive forex, and easing inflation, we believe the asset class has turned the corner on 2022 – a year in which it suffered one of the largest sell-offs in two decades. Additionally, we’re now seeing the back of some large, long-term headwinds that were holding back emerging market local currency bonds for nearly a decade.

Why the stars are smiling again at local currency bonds

Inflation in developed markets reached heights not seen in four decades last year, the result of a combination of factors including the war in Ukraine, pandemic-linked supply chain disruptions, geopolitical frictions, and strong consumer spending amid hot labor markets.

Increases by major central banks resulted in tightened financial conditions in developed and developing countries alike. Emerging countries, faced with similar challenges and being more susceptible to volatile food and energy prices, began hiking earlier and, in most cases, faster.

However, the impact of some of 2022’s negative supply shocks has been fading for a while now. Most countries have moved beyond peak inflation, and central banks are now preparing to – or have already begun to– ease their monetary policies.

This positive shift, coupled with relatively low bond issuance, is expected to drive down yields in emerging markets. It's worth noting the extra wiggle room emerging markets’ central banks have to maneuver on the way down, given their actions got aggressive earlier on the way up.

And, while neither the US Federal Reserve nor the European Central Bank are done hiking yet, hawkish surprises are much less likely going forward given the growing signs of disinflation, slowing economic growth, and tightened financial conditions for different reasons than monetary policy. As a result, the likelihood of risk-off situations, like those witnessed in recent months, is materially lower now.

Also supporting the favorable planetary alignment is the fact that major emerging economies reduced their vulnerabilities in past years by running much healthier current accounts through improved terms of trade and relying less on external financing compared to the previous decade.

And, finally, expectations almost unanimously point to a widening growth differential between emerging and developed countries in the coming years. With the US and European economies slowing down while emerging economies pick up momentum, the growth differential is expected to increase for many more major emerging markets than before.

Partial de-risking from China into other emerging economies brings a larger spread of the predominantly China-driven emerging market growth we grew accustomed to in the past. General emerging market forex can only profit from this.

Anyone active in financial markets for the last 10 years will recognize “increased differential growth” as the eternal justification for investing in emerging market local currency assets, only to be disappointed by subsequent returns. Why did it not work for so long?

Planets align after a decade of underperformance

A close look at the current positioning of institutional portfolios reveals that invested amounts in emerging market local currency assets have shrunk drastically. Cross-over investors are nearly absent, and dedicated investors hold only a fraction of what they had back in 2013.

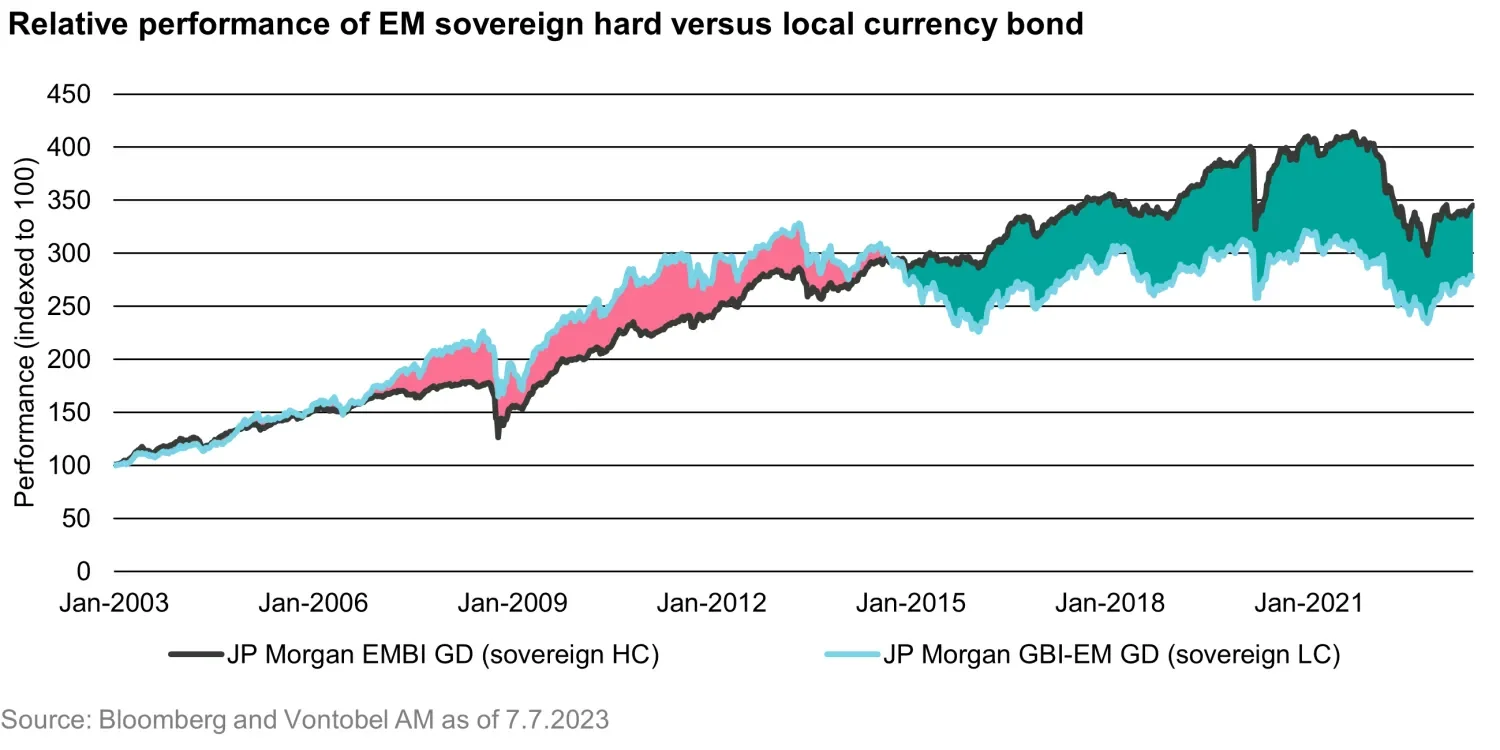

Driving the persistent decline in assets under management in this asset class was the underwhelming absolute performance of local currency bonds over the last couple of years and, probably to a greater extent, the relative underperformance vs. emerging market hard currency. We are coming out of almost a decade of underperformance, which immediately begs the question, 'Will this continue?'.

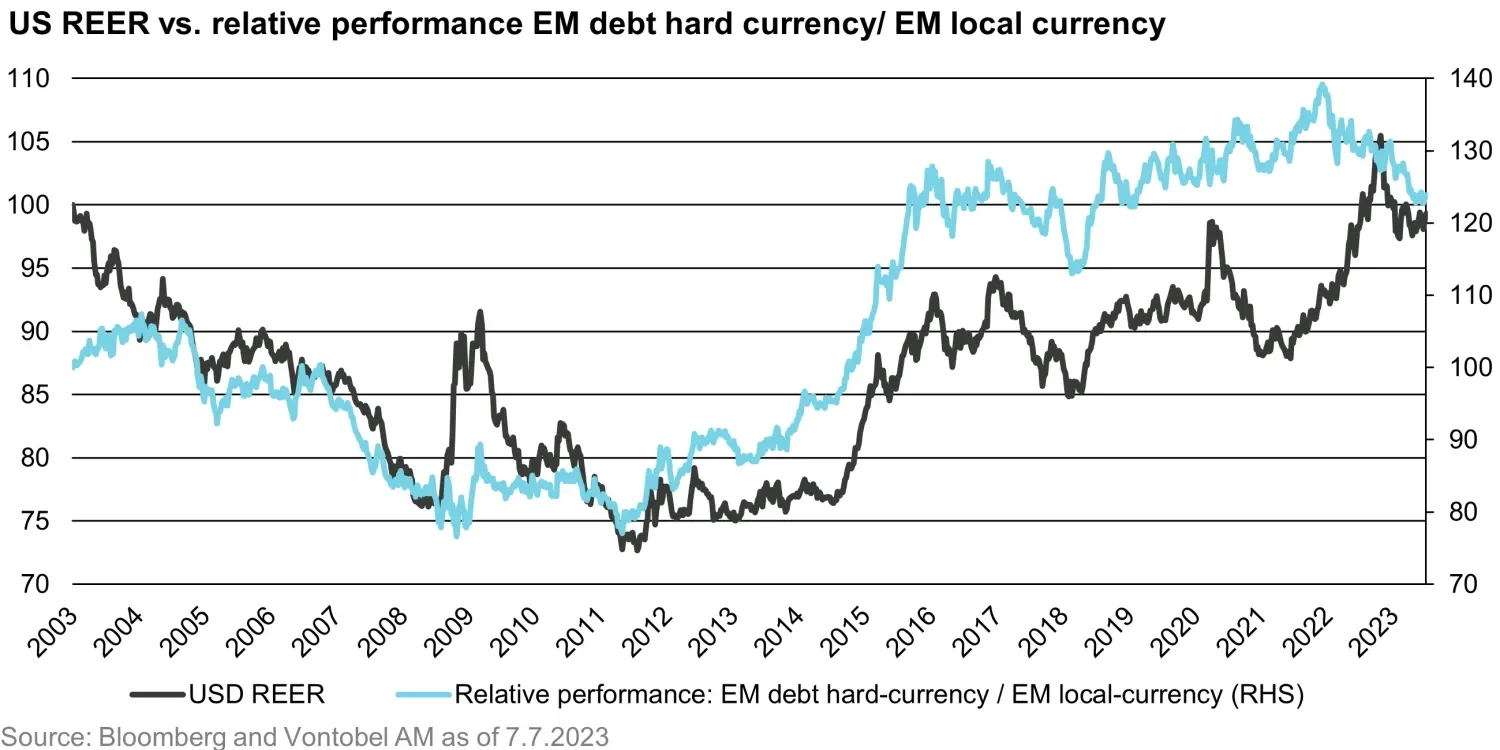

To answer this question, we need to examine the main drivers behind the outperformance of emerging market hard currency debt, which aligns neatly with the fluctuations of the US dollar's real effective exchange rate (REER). Why look at the REER? Because it offers a sharper insight into the overall strength of a currency beyond bilateral exchange rates, such as the one between the euro and the US dollar.

When we look at the historical performance of the US dollar REER over 20 years, we can spot two, possibly three, regimes: overall weakness from 2003 to 2011, a period of favor from mid-2011 until October 2022, and the growing likelihood that last year will be seen as a major turning point that sparked the third regime.

A remarkably similar pattern can be seen in the relative performance of hard and local currency in emerging markets: The relative outperformance of local currency topped out during 2011 when hard currency took over the baton, only to return it at the end of 2021 just before the US dollar REER peaked.

A second long-term driver behind the underperformance of emerging market local currency bonds is quantitative easing (QE) in developed economies during the 2010s. If we picture global QE as a big, shining sun warming up all asset classes, the closer you are to the sun, the more you feel its warmth. This means that, while developed market assets bought directly by central banks would feel the strongest heat, emerging market hard currency – intrinsically a US dollar asset class – would be much closer to the sun than emerging market local currency.

Looking ahead, it’s unlikely that these two major headwinds will persist.

Quantitative easing in developed markets seems out of the question for the foreseeable future. Even the Bank of Japan, which faced nearly zero cumulative inflation for the two decades through 2017, is expected to end QE over the next 12 months. A different inflation background and the political repercussions of rising inequality have outweighed the sometimes questionable benefits of balance sheet expansion.

While QE will remain part of any central bank’s toolbox, blanket liquidity expansion seems to be a thing of the past. As for the dollar, as always, it's difficult to be as conclusive, but the odds for the uptrend to extend beyond the October 2022 high appear quite low.

With both primary drivers clearly in the backseat, we are growing increasingly confident that the underperforming decade of emerging market local currency has come to an end.

What’s the forecast for local currency bonds in 2023?

Predicting the exact moment when central banks in emerging markets start reacting to more benign inflation, the Fed stops hiking, and sentiment turns outright positive towards risk assets is nearly impossible.

Yet, it is reasonable to expect that all these things will occur at some point in 2023 and that they will do so in a context of long-term headwinds receding and a very light positioning on the asset class.

Waiting on the sidelines may have been the best strategy in 2022, but it has proven to be a suboptimal decision so far this year. And as more stars align for emerging market local currency bonds, it may not be the smartest approach in the coming years.

The second edition of our global investor study, surveying more than 200 investment decision-makers in Europe, the Americas and Asia Pacific, gives deep insights into investors’ EM fixed income views and expectations.

Discover what your peers are thinking and what, and why, they're planning on investing in over the next two years.

Why invest in local currency bonds with Vontobel

Vontobel’s offering in emerging market local currency presents a unique approach that combines sustainability with long-term performance metrics. This is consistent with our long-held view that the choice for sustainability, given a properly tuned environmental, social and governance framework, should not come at the expense of performance. Our strategy is typically more broadly diversified than the reference index and our peers, improving our overall value proposition.

Important Information: Forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions; not guaranteed; and actual outcomes may differ materially. Neither asset allocation nor diversification assure a profit or protect against loss in declining markets. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.

Environmental, Social, and Governance (“ESG”) investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate ESG components may vary across providers and issuers as ESG is not a uniformly defined characteristic. ESG investing may forego market opportunities available to strategies which do not utilize such criteria.