4 reasons why EM local currency debt could be the phoenix of fixed income

Fixed Income Boutique

Key takeaways

- EM local-currency debt has shown resilience in H1 2022

- Local-currency bonds offer an attractive interest rate differential (carry)

- The carry is not an illusion as inflation in emerging markets is around the same level as developed markets

- While the global context is challenging for emerging markets, we think the resilience of EM local-currency debt will continue, eventually turning around to deliver significant positive returns when global market sentiment improves

Contrary to the experience of the last few years, emerging markets’ local currency debt has been particularly resilient to this year’s fixed income sell-off.

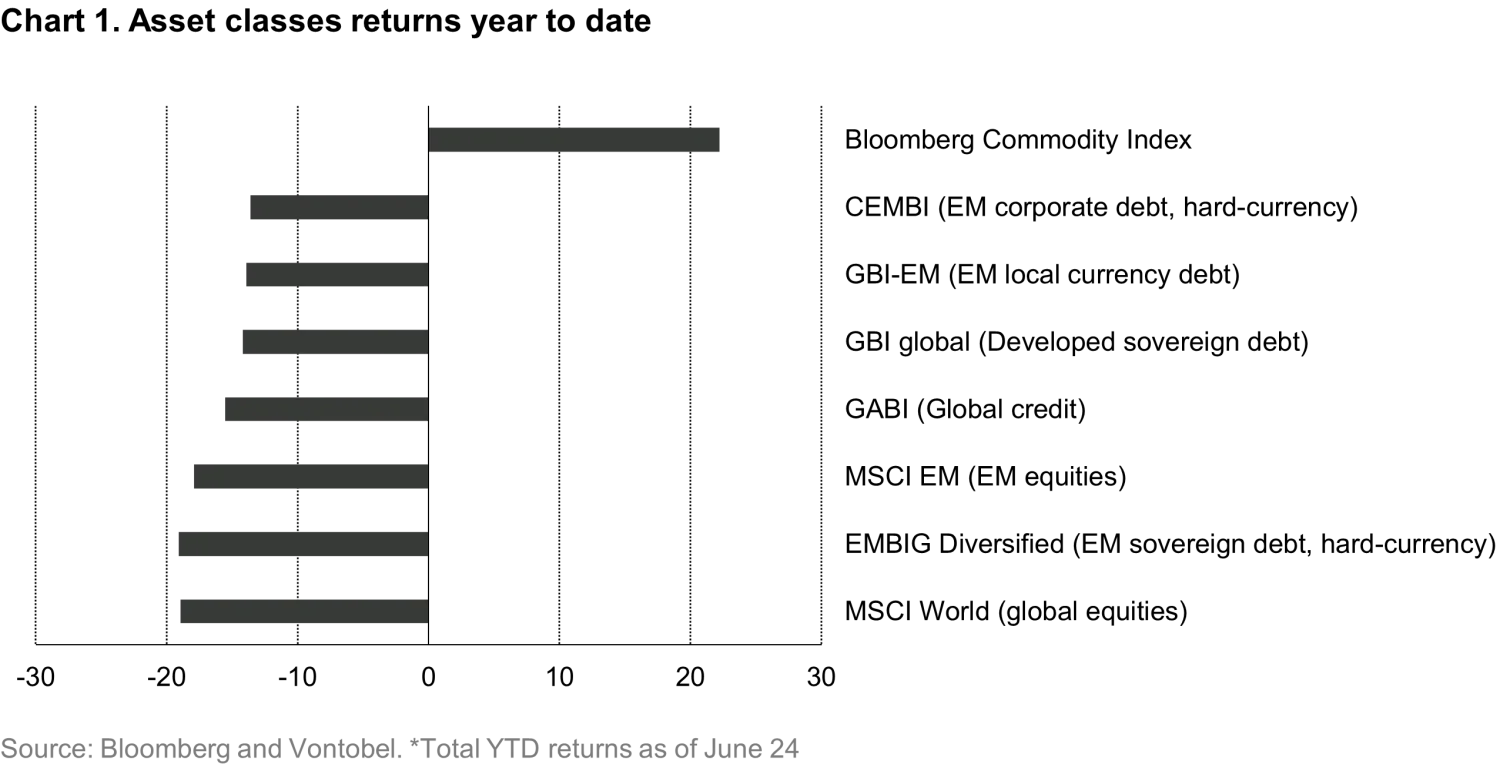

The key word here is “sell-off” because there’s no getting around the fact that bonds markets across the globe have tanked. Traditional safe-haven developed market sovereign debt and global credit has led the rout by dipping 15.3% and 16.2%, year-to-date respectively. Local-currency bonds have not been spared the slide either, but they have performed better than most other fixed income asset classes (see chart 1), which is all the more surprising when considering that Russia had a weight of 7.2% in the GBI-EM as of end-2021 and the value of these assets had dropped by almost 95% when Russia was kicked out of the index at the end of March. Excluding Russia, the asset class has lost just 7.2% year-to-date, leaving commodities as the only asset class to beat local currency bonds. Adding to this apparent puzzle is the fact that EM currencies have only lost 1.8% YTD while the US dollar has strengthened by 9.4% against major global currencies.

Let’s now look at the main reasons for the resilience of this asset class in the first half of 2022 and why we think this resilience is likely to continue. Moreover, there are good reasons to think that the asset class will soon turn around after years of underperformance and will start delivering positive returns.

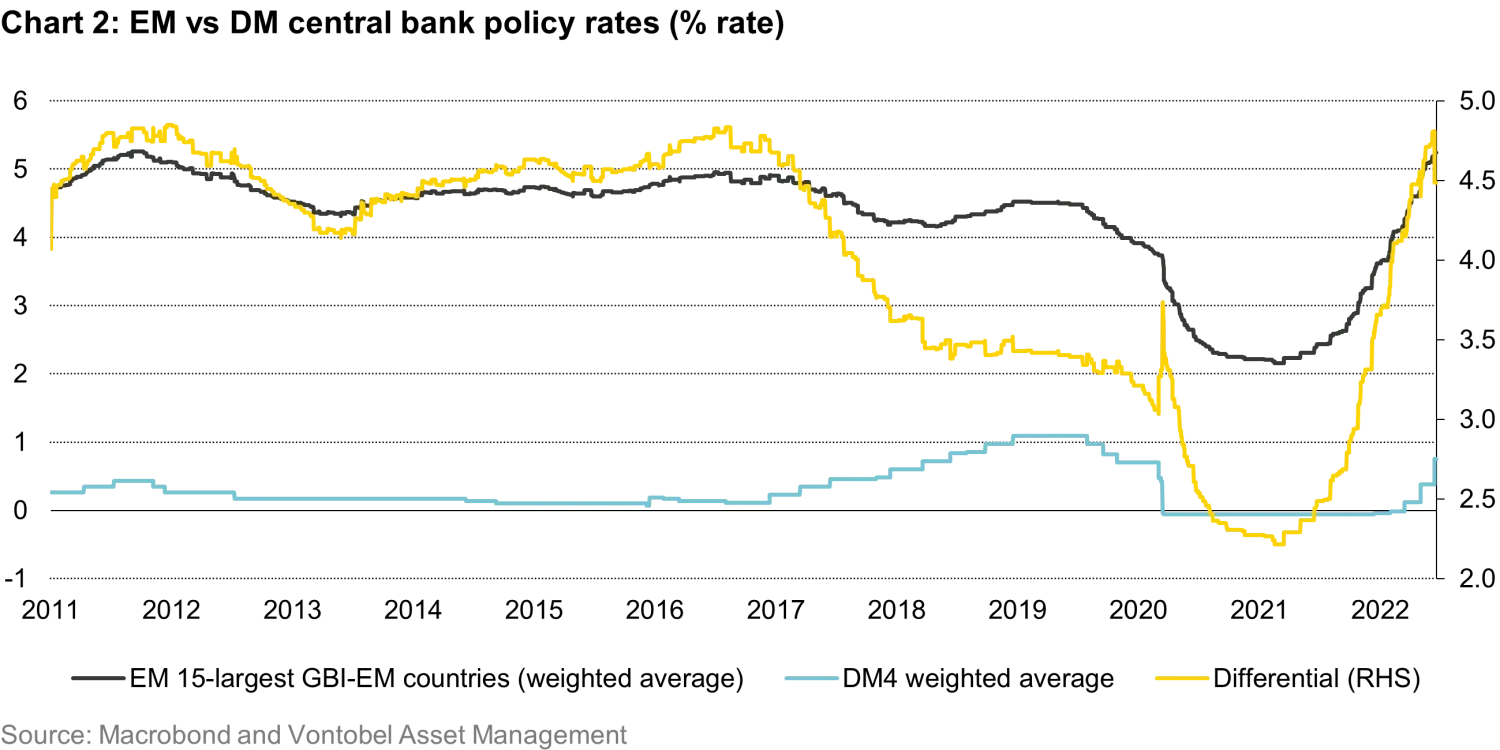

1. EM central banks have been much more aggressive at hiking rates than DM central banks. During previous US Federal Reserve hiking cycles, a significant share of EM central banks tended to follow the Fed to maintain a relatively attractive interest rate differential (carry), but this time it has been different.

Developed market central banks only recently started to withdraw the monetary policy stimuli introduced in 2020 to counter the effects of the Covid pandemic. It’s now a consensus view that DM central banks are behind the curve in fighting inflation. In contrast, many EM central banks (particularly in Latin America) have been much more aggressive at hiking rates.

Chart 2 shows the weighted average interest rate differential between the largest 15 members of the GBI-EM index and the four largest DM central banks (Fed, ECB, BoE, and BoJ). The yellow line (RHS) shows that carry is back to the pre-2017 average following a two-year pandemic hiatus in which EM central banks behaved in an unusually counter-cyclical manner that resembled the usual behavior of developed market central banks, i.e. they cut rates aggressively during the Covid crisis to stimulate the economy instead of hiking rates in a procyclical manner to defend their currencies as in previous crises.

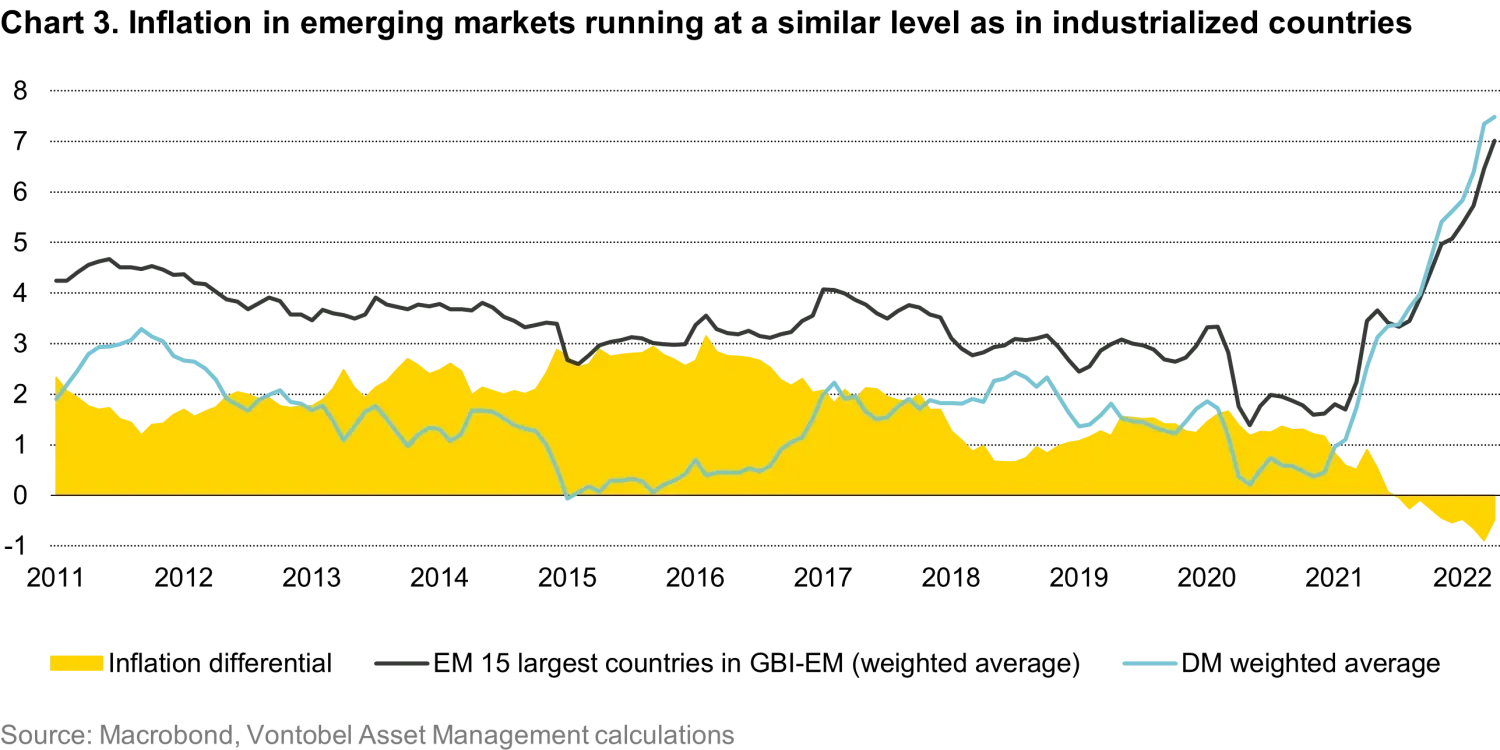

2. Inflation in EMs is at about the same level as in DMs, so the carry is not just a nominal illusion. Inflation tends to be about 2 percentage points higher in EMs when compared to their DM counterparts – as per the weighted average of 15-largest countries, which comprise more than 98% of the index. However, this isn’t the case at present. Global inflation is exceptionally high, but it has increased more in developed countries than in emerging markets (on average).

Chart 3 shows that inflation in EM is (on aggregate) slightly lower than in DM for the first time for as long as we have available data. Of course, this isn’t true for all countries. Inflation in Latin America is averaged 9.2% in May compared to 7.9% in the four largest DMs. Meanwhile, central Europe’s average inflation reached 13.9% in May. In several Latin American countries, interest rates are sufficiently high to compensate for their higher inflation, while in central Europe (Poland, Hungary, and Czech) interest rates are not yet high enough. So active management remains key when investing in EM local currency debt.

3. EM currencies appear cheap relative to fundamentals. On aggregate, EM currencies tend to fluctuate in a range between 3% overvalued to 3% undervalued as per behavioral equilibrium exchange rate (BEER) models. Whereas today, EM currencies are about 8% undervalued on aggregate. Of course, currencies can remain undervalued for a long time – as demonstrated by the Turkish lira, which we exclude from our aggregate, time and again – because there are relevant variables like market sentiment and political risk, among many others, that are difficult to model. Moreover, currency valuations vary a lot across countries even within the same region. Nevertheless, we find that today’s EM currency valuations provide investors with a relatively cheap entry point into the asset class, in our view.

4. Positioning is light. After years of underperformance, most institutional investors have low or no exposure at all to EM local-currency debt. This implies that when global risk appetite eventually increases there will be potentially large gains to be made in the asset class once investors dip their toes back into EM local debt. This may not happen in the short-term amid fears of recession in the developed world and high global inflation still prevalent, but in the meantime, EM local debt can continue to show more resilience than most asset classes and, we believe, be amongst the first to bounce back when it comes to fixed income asset classes.

One of the main concerns investors have is a fear that when the US hikes rates, it will dampen local-currency debt returns. This is a myth as total returns in EM local-currency debt are not even slightly correlated with US interest rates ( as explained by our EM local currency PM Thierry Larose ). The logic behind this myth is the misguided belief that when the Fed hikes rates, higher yields in safe-haven assets should make EM debt less attractive. However, as shown in the charts above, interest rates in EMs have increased even faster than in DMs while inflation in EM has not increased faster than in DMs.

If the world economy turns sour, as many expect, cheap FX valuations, attractive carry, and light positioning from investors implies that the sell-off will probably be more limited in the EM local currency bond asset class than in others where valuations remain frothy and positioning heavy. Hence, we think EM local-currency debt will remain resilient and could prove to be the phoenix of fixed income and rise from the ashes.