mtx perspectives: Mind the gap: Latin America's digital revolution takes shape

Conviction Equities Boutique

Key takeaways

- Millions of people in Latin America made their very first online transaction at the beginning of the Covid-19 pandemic. With this mindset shift, e-commerce penetration in the region is predicted to see healthy growth.

- Nevertheless, a large proportion of the region’s population remains unbanked or underbanked. The growing influence of FinTech could help bridge the gap to the rest of the world.

- Tackling this gap also addresses socioeconomic issues that come from inadequate access to financial services, such as no access to consumer credit, having no savings upon retirement, or the collection of taxes.

Welcome to this year’s first edition of mtx perspectives!

Throughout the year ahead, we will publish these Viewpoints as a way of highlighting interesting developments in industries and regions across the world of global emerging markets. At mtx, we are bottom-up fundamental investors with a clear focus on industry-leading companies that have the potential to enhance their levels of profitability over time. For this reason, we spend a significant amount of our time analyzing industry positioning and the potential drivers of future profitability for companies. As part of the mtx perspectives series, we intend to share some of these learnings with our readers on a regular basis. As always, we welcome feedback and questions, so please get in touch if you would like to discuss in more depth.

Mind the gap! How the digital revolution in Latin America can help bridge the gap with the rest of the world

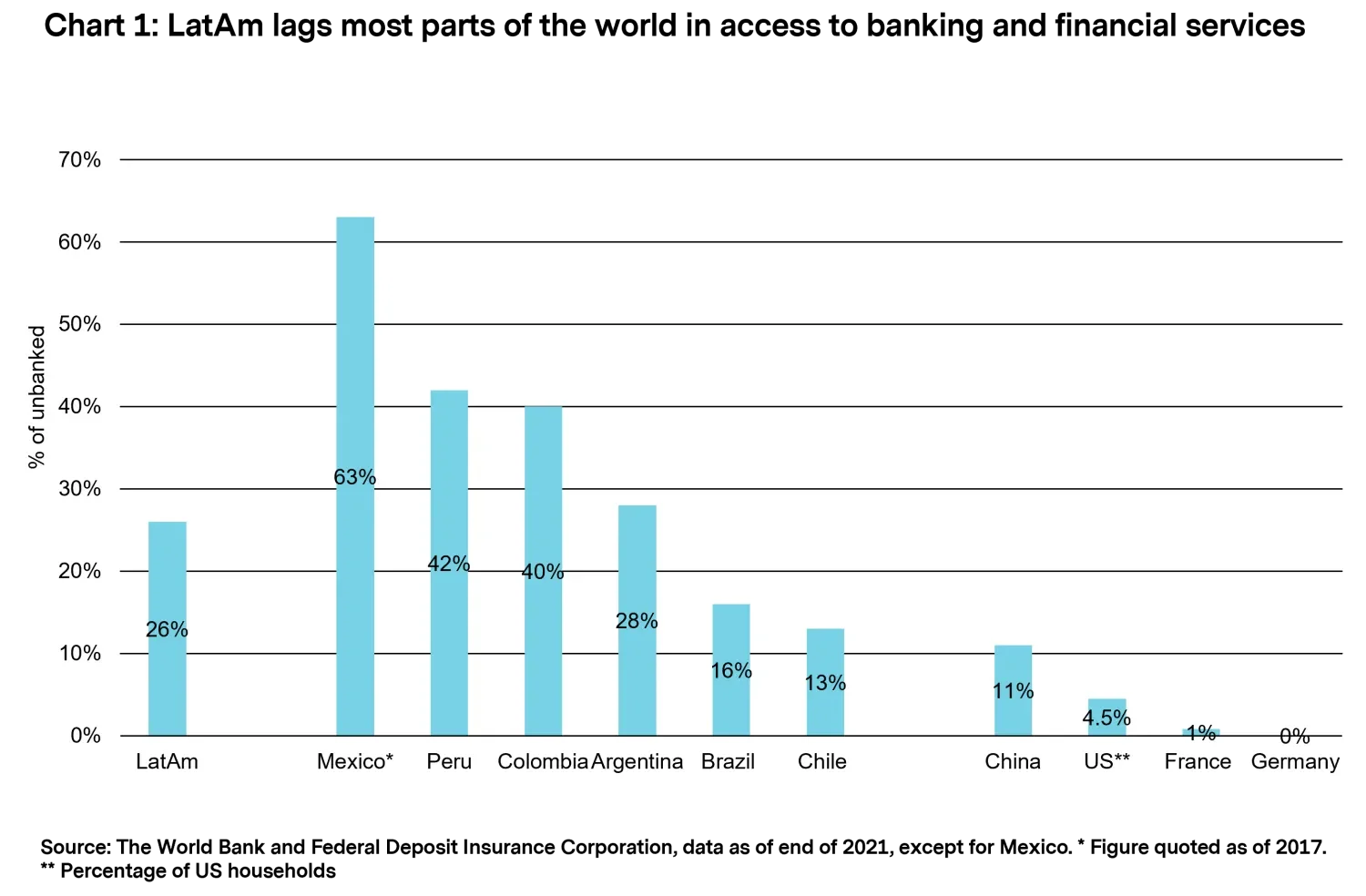

“Cash is king” is a well-known phrase throughout the world, and there are not many regions where it is more relevant than in Latin America (LatAm). With an estimated population of approximately 650 million people (World Bank, 2022), the LatAm region has significantly lagged most parts of the world when it comes to access to banking and financial services (see chart 1). Indeed, according to figures from the World Bank, an astonishing 120 million people in the region (26 percent of the population aged 15 and above) are “unbanked” i.e., they do not own an account at a financial institution or a mobile money service provider. Add to this the percentage of the population that is underbanked and it is unsurprising that a significant amount of transactions continue to be made in cash, with a Forbes article1 in 2022 putting an estimate for this to be as high as 58 percent of point-of-sale purchases.

A more granular breakdown of the figures reveals that there is a wide range of disparities among individual countries in the region. With the second-largest population of almost 128 million people, Mexico is a laggard in access to banking services (though we recognize the data is somewhat stale for Mexico and the gap to other LatAm countries may have closed somewhat). While the problem is not as acute in Brazil, the region’s biggest country with a population of 215 million people, there is still substantial room for improvement when compared to major developed economies such as the US, France, and Germany.

Problem and opportunity

In short, this type of situation creates serious socioeconomic issues and is a major headwind to one of the priorities of the United Nations Sustainable Development Goals (SDGs), which aim to ensure that all have equal rights to economic resources, including financial services (Goal 1: No Poverty). Indeed, the problems associated with a large proportion of the population having inadequate access to financial services are vast and varied, such as millions having no access to consumer credit (e.g., credit cards, personal loans), having no savings or investments as they approach retirement, the inability to access goods and services online, the security of transactions, driving without any or inadequate car insurance, and the collection of taxes.

While the obvious solution to the problem lies with the region’s banks, we note that in countries such as Brazil, the banks have traditionally focused on the wealthiest parts of society. Instead, there is a growing FinTech movement within the LatAm region, which could serve as a major catalyst for closing the gap between the region and the rest of the world. While there would be multiple winners should the percentage of unbanked within the population decline (including consumers, lenders, and locally based merchants), we believe there is one group of companies that could be set to benefit substantially.

The rise of e-commerce

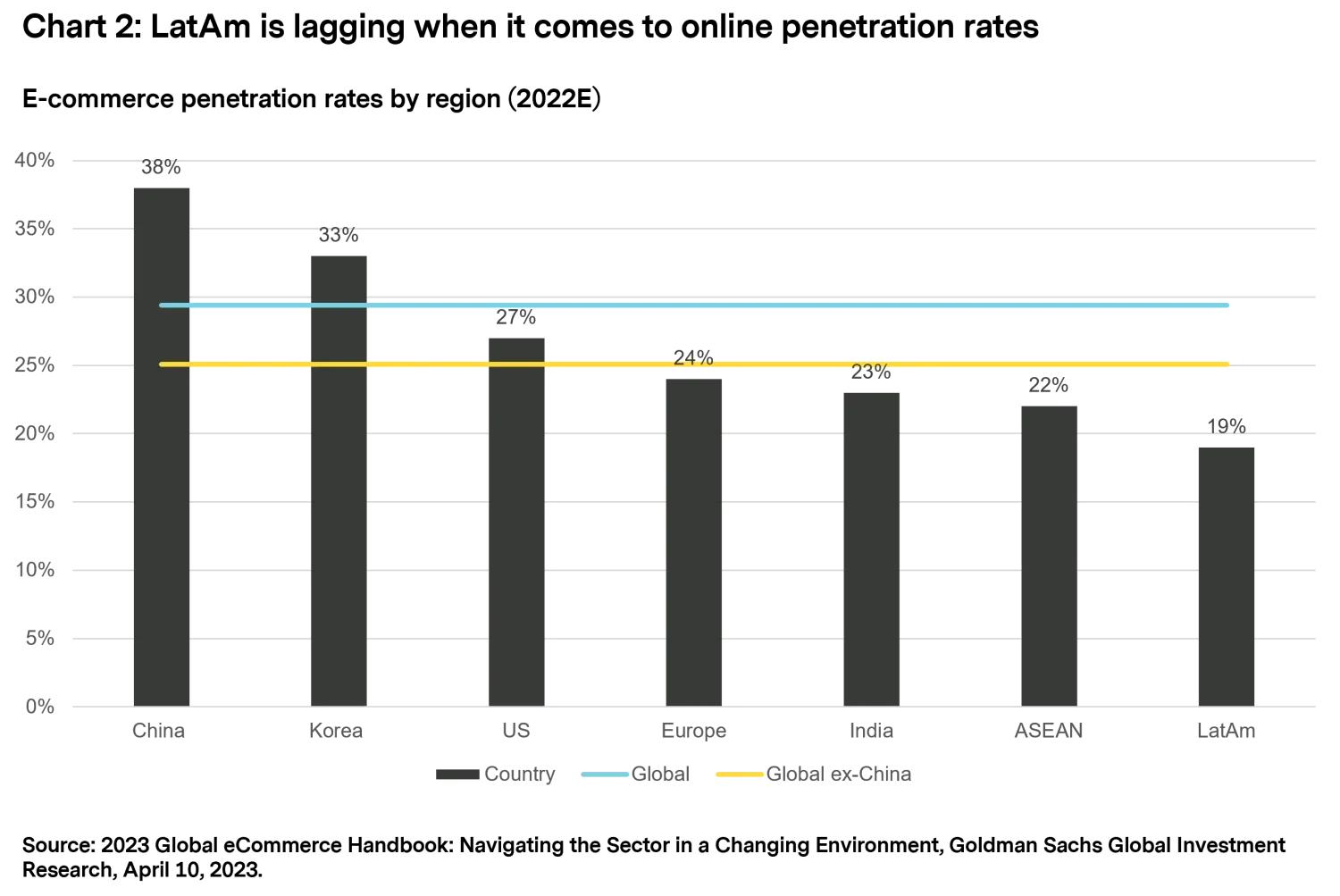

Given the significant level of transactions that are still made in cash, it is no surprise that the penetration rate for e-commerce in LatAm lags the rest of the world. Estimates included in the Goldman Sachs eCommerce Handbook2 (see chart 2) put online penetration in the region at around 19 percent in 2022, which trails the average for Global ex China of approximately 25 percent.

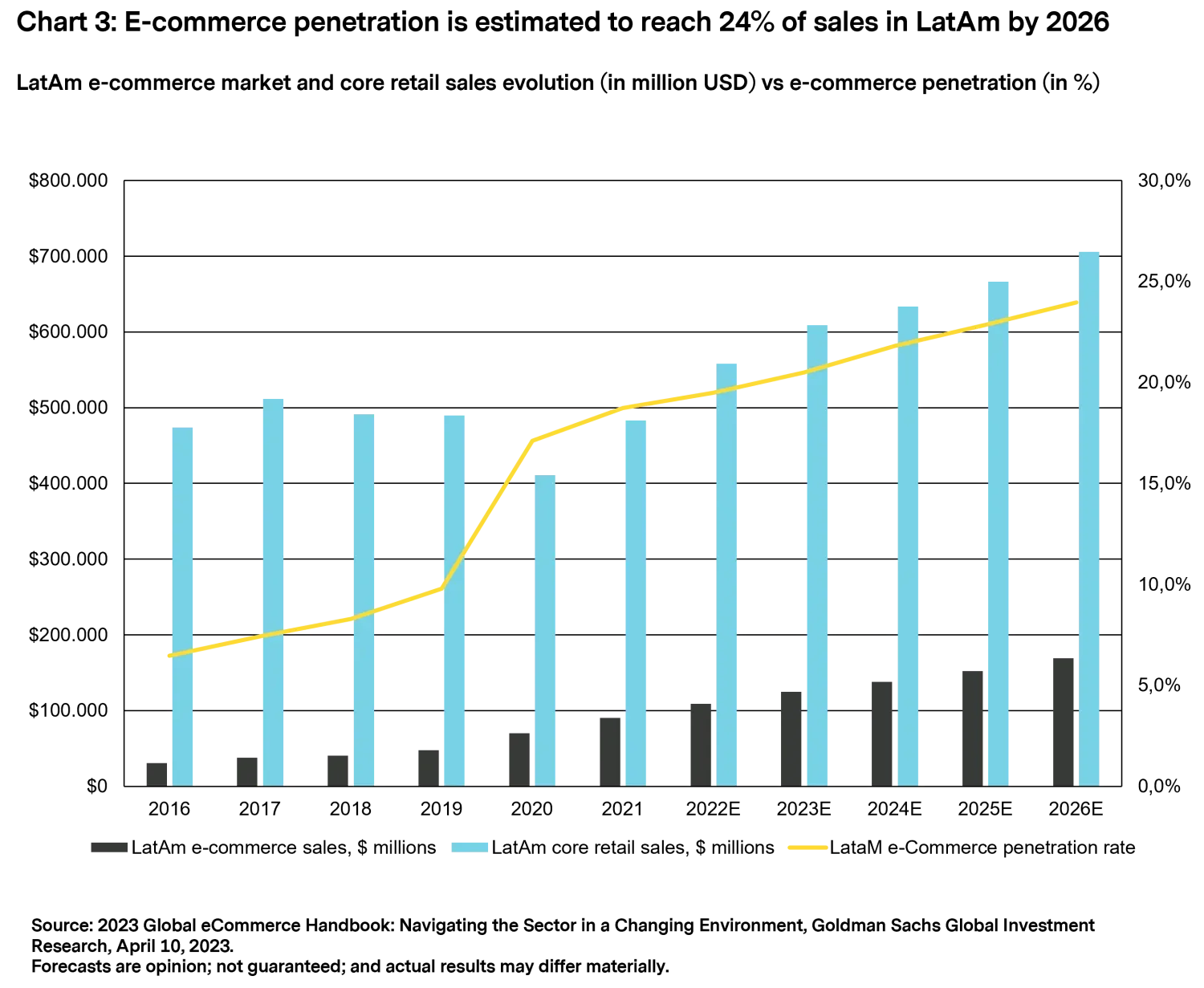

However, the Covid-19 pandemic in early 2020 meant that many people in the region were forced to move online, with an article by Latin America Reports3 estimating that 13 million people across LatAm made an online transaction for the very first time at the beginning of the pandemic. With this shift in mindset for so many people in the region, e-commerce penetration in LatAm is predicted to enjoy healthy annual growth from its current levels (see chart 3).

Winner takes it all?

Not exactly, but the e-commerce market in LatAm is quite concentrated, with three of the top players enjoying an estimated 42 percent market share in 2022. Within Brazil, which is responsible for the lion’s share of the e-commerce market in LatAm (approximately 41 percent, according to Goldman Sachs research), the dominance of these market leaders is even more significant, with an estimated market share of 59 percent. This dominance is not easily replicated, and companies wishing to usurp the incumbents would need to invest significant sums to try and take a foothold in the market.

These companies are in a unique position to offer short-term credit facilities to their customers and take more people out of the unbanked category, as unlike the banks, their focus is not on the wealthiest elements of society. Their large market shares and unique access to customer data enable them to do this in a sensible way as it pertains to underwriting credit facilities, which is naturally important from a return perspective. By expanding credit facilities, they also further embed customers within their ecosystems, which is vital to maintaining customer loyalty and can enable them to drive further growth and increase operating profitability.

Aside from e-commerce, other industries in LatAm can also benefit from plugging the “unbanked” gap by offering important financial services and protection products. Take insurance companies, for example. While everyone in Brazil is covered by public health care, statistics show that less than a quarter of Brazilians have access to private health care, which tends to have more sophisticated facilities and, of course, shorter waiting times, which can be vital when faced with life-threatening conditions such as cancer. Many of the larger insurance companies in the region often offer an extensive list of protection products (such as savings, life, and car insurance products) and provide consumer credit and educational loans. These businesses can also enjoy healthy growth, particularly as more consumers fall out of the unbanked category and are more open to exploring the different types of financial and protection products available to them and the various avenues available for purchasing them.

What are the key risks?

As with all investments, there is no certainty about outcomes, and there are risks that need to be seriously considered. These include increased levels of competition and a failure by the companies involved to execute their strategies successfully. Increased regulation is another risk we should not take lightly considering what we have seen in other parts of the world where the authorities have stepped in to limit the influence of e-commerce giants when it comes to financial services (such as Alibaba and Ant Group in China). While large countries such as Brazil and Argentina are regularly reviewing their policies related to personal finance and credit card loans, the threat of very restrictive regulation is not seen as imminent in LatAm. This is because there is a high demand for credit facilities and other financial products in these countries, meaning any legislation that would limit access would be deemed unpopular and damaging to consumption and economic growth.

Brighter future?

It appears that LatAm is on a good path when it comes to access to banking and financial services, which is very positive from a societal perspective. In some respects, the Covid-19 pandemic accelerated a movement that was bound to take place at some point, and strong growth in online transactions is expected over the coming years. This growth creates attractive opportunities for companies that have the ability to help those who are yet to cross over into the “banked” category, and as discussed throughout, the biggest beneficiaries could be the e-commerce and insurance industries. We recognize attractive industry dynamics at play here that have the potential to lead to higher future levels of profitability, which is exactly the type of outcome we seek for our clients.

1. Source:

https://www.forbes.com/sites/patriciakemp/2022/07/18/fintech-is-driving-financial-inclusion-in-latin-america/

2. Source:

https://marquee.gs.com/content/research/en/reports/2023/04/10/4ba22b9d-b025-4379-97ec-f1d992ee982d.html

3. Source:

https://latinamericareports.com/the-importance-of-fintech-for-the-future-of-latin-america/7223/

Important Information: Companies discussed for illustrative purposes only to elaborate on the subject matter under discussion. Information should not be deemed a recommendation to purchase, hold, or sell the same or similar nor should any assumption be made as to the profitability or performance of any company identified or security associated with them. Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such.