Forget about rotating into value

Quantitative Investments

Value and growth are likely to do equally well in the period to come. Artificial intelligence explains why and tells us what to expect next.

After all the temporary inflation talk by central banks last year, surging inflation numbers caught many investors off guard. In the US, headline inflation jumped from 1.4% in December 2020 to 7% in December in 2021, reaching the highest rate in 40 years. Meanwhile, the Fed has changed tack and markets are expecting rate rises of 125 basis points this year, starting in March. As a result, investors are hailing the biggest stock rotation since the 90s anticipating great benefits for value.

Two Fed policy cycles, two outcomes

While interest rate rises aren’t particularly good news for equity markets in general, they are bad news for growth stocks that derive most of their value from expected cash flows well ahead into the future. During inflationary periods, value is often favored as it offers shorter duration compared to growth. However, if the economy manages to stay on a high-growth path alongside inflation, growth stocks can still offer a premium.

Given equity markets' strong bias towards growth over the past decade, it will be crucial whether the upcoming policy tightening cycle will thwart growth prospects and usher in a factor regime change favoring value over growth.

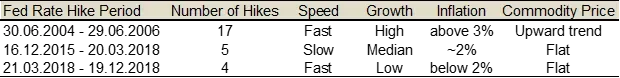

The answer can be found in an analysis of the last two major policy tightening cycles (2015-18 and 2004-06) over the last 20 years (see table 1), which triggered different market reactions and factor behaviors (see table 2) due to the cycles' diverging characteristics. The 2015-18 cycle has a slight twist to it as it was marked by two different speeds of rate hikes which warrants a division of the period into two sub-periods. An artificial-intelligence approach comparing today’s economic environment with the past shows that the current economic environment bears much less similarities to the more recent cycle of 2015-18. Instead, the 2004-06 Fed tightening phase offers more pronounced analogies and more insights on what investors can expect to happen next in the current economic environment.

Table 1: Fed hiking cycles characteristics differ in characteristics

Source: Vontobel

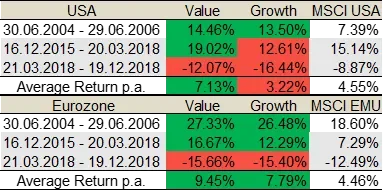

Table 2: Growth and value performance vary depending on the rate hiking cycle

For illustrative purposes only. The table shows the annualized return of factors in each rate hiking period. We use the MSCI USA, MSCI EMU indices as the broad market indices for USA and the Eurozone respectively. We first construct the value and growth factors from mid- and large-cap stocks of USA and the Eurozone respectively. For each factor, we select the 15% of stocks with the highest factor exposure from the investment universe, i.e. around 100 stocks in USA and 30 in Eurozone in the current portfolios. The portfolio weights are assigned starting with equal weightings and followed by a tilt to top factor exposure stocks. Past performance is not indicative of future results. Source: Vontobel

2015-18: Major Fed policy mistake makes value and growth tumble

Market reactions to the 2015-18 cycle were negative, at least to the second part starting in late 2018. In 2014, the Fed shifted slowly towards policy normalization, followed by a measured pace of five rate hikes over two years. Despite the economic recovery from the Global Financial Crisis (GFC), growth remained muted in both the US and the Eurozone which helped value outperform growth in both regions. As the Eurozone was plagued by a severe debt crisis following the GFC, the European Central Bank adopted an extremely dovish policy in contrast to the Fed. This explains why Eurozone growth was still able to beat the overall market whereas US growth lagged the MSCI USA by almost 3% between December 2015 and March 2018.

However, when the Fed switched gears in 2018 stepping up the pace of its rate increases to four within the space of just a few months, the Fed overestimated US and global economic resilience as well as the inflationary pressures that had built in the background. So, in blatant disregard of the worsening economic outlook in the second half of 2018, the Fed kept its autopilot of rate hikes switched on. Meanwhile, market perception of a policy mistake was rising which culminated in a severe global equity market sell-off in late 2018. As a result, both factors, value and growth, plummeted and fell behind the broad market indices of both regions.

2004-06: Strong economic environment absorbs aggressive rate hikes - factors thrive

In 2004-06, despite fast and frequent Fed rate hikes within two years, growth prospects remained solid throughout the cycle of 2004-06 thanks to the beneficial aftereffects of lose fiscal policy in the early 2000s in the aftermath of the dotcom bubble. These aftereffects supported strong productivity growth and above-trend wage growth that led to a self-sustained growth cycle. This made the aggressive Fed hiking cycle digestible for market participants, allowing for a strong equity market performance. As a result, both value and growth performed well.

2022: Value and growth could both outperform the general market

Today’s environment resembles the above conditions. US economic growth and the US labor market remain strong. As historically high COVID-related budget deficits have started to shrink already, we are unlikely to return to the post-GFC (2010-2020) regime of fiscal prudence. Even though productivity growth is not where it was in the 2000s, it keeps rising thanks to continued fiscal support. Despite a market re-pricing of 200 basis points on US rate hikes for the 2022-2024 period since early 2021, financial conditions are still loose, which indicates easy re-financing conditions.

In addition, inflation could ease as several supply side constraints have slowly started to dissolve. Already today we observe a moderation in chip and container prices, for example. Also, market participants' inflation expectations have plateaued around 2.5% in the US since November. The Fed's hawkish shift in tone had further stabilizing effects. Easing inflation pressure later in the year may even take the burden off the Fed to hike as much as the market currently prices in.

If history repeats itself, there is a good chance that today’s growth prospects remain intact despite high inflation. As a consequence, value might have to defer its much debated victory over growth and the current rotation into value is likely to fizzle out as both factors are likely to outperform the broad market indices. However, there is a risk that another Fed policy blunder could throw a spanner in the works of the economy like in 2018 which would likely trigger a correction for both value and growth. Ultimately, much depends on the Fed's ability to maintain the delicate balance between the economy's needs and market expectations.

Disclaimer

Certain of the information contained in this article is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. Vontobel believes that such statements, information, and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.

The views and opinions herein are those of the individuals mentioned above and do not reflect the opinions of Vontobel Asset Management or Vontobel Group as a whole. The views may change at any time and without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.