Vescore Global Market Outlook February 2023

Quantitative Investments

Key takeaways

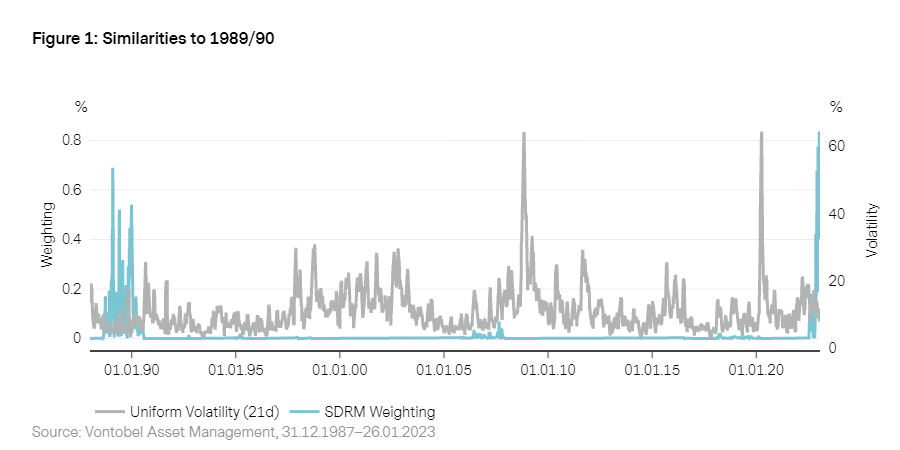

- Risk model shows parallels with the crisis years of 1989/90

- China’s economic outlook is slowly improving

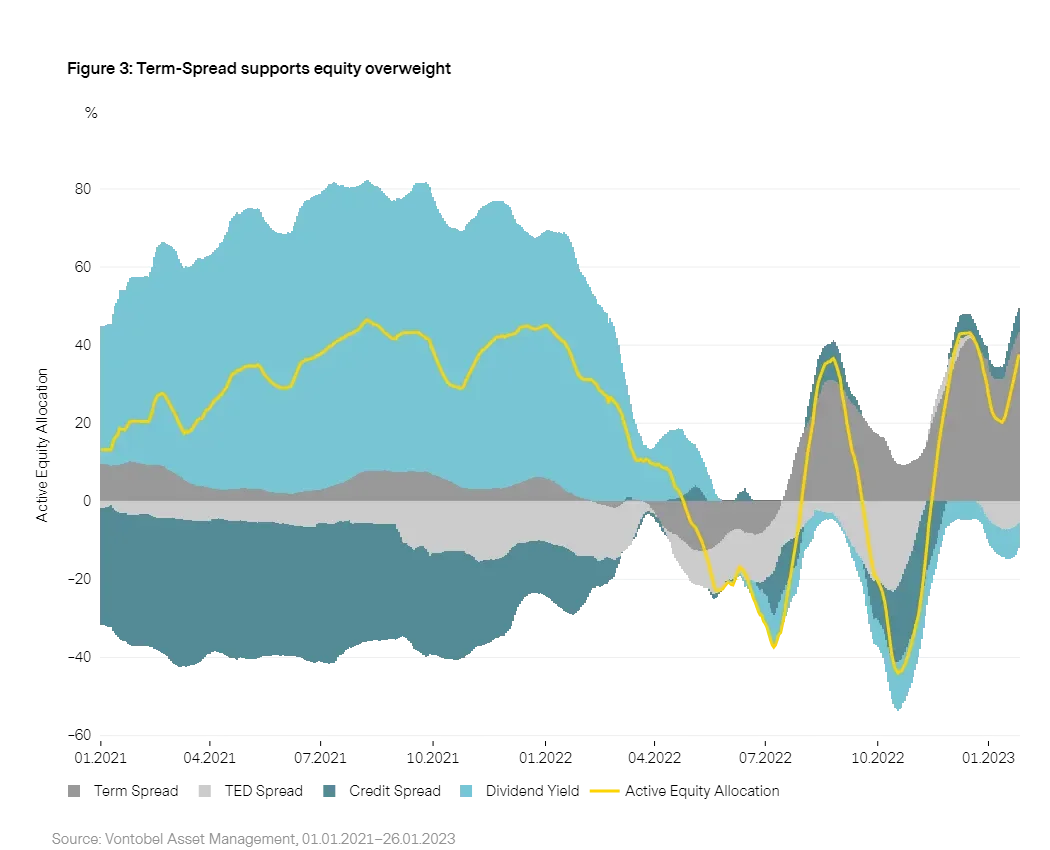

- Lower “near-term” recessionary risks support equity outlook

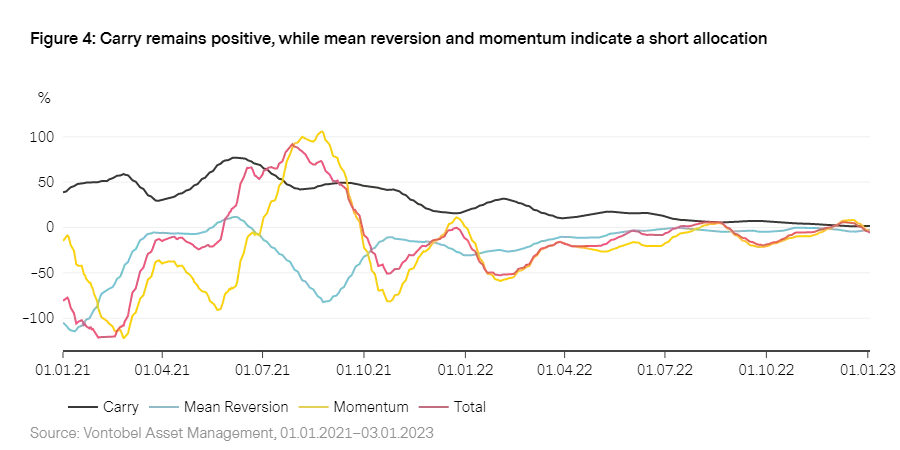

- Current risk-reward ratio argues against larger positions

Will there be a soft landing for the US economy?

The financial markets have been booming since last October, and the positive trend continued unabated in January 2023. The markets remain buoyed by expectations of an imminent end to the cycle of US interest rate hikes and a recession that will be mild at worst. There is also growing belief in a soft landing – an economic scenario in which growth slows, but a recession is prevented thanks to a cautious interest rate hike cycle.

But is it realistic to expect the eurozone and the US to avoid a recession this year? And if there is a recession, how severe will it be? We recently posed these questions to our Vescore models1. Our risk model2, which shows numerous parallels between the current market environment and the crisis years of 1989/90, and our US Wave both consider a US recession to be likely. The US Wave is currently at around 20 percent. A value this low was followed by a recession within the next twelve months in 70 percent of the cases observed since the 1950s.

However, the severity of the recession is subject to far greater uncertainty. A moderate and temporary downturn in economic output of one percentage point appears likely from a historical perspective3. With a few exceptions, recessions of this magnitude have always triggered a substantial correction in the US equity market in the past. However, this does not mean equities should be jettisoned without further delay, as our models also consider equity overweighting to be justified at present. Over the last 120 years, corrections in the S&P 500 have often only taken place just before the start of a recession. This means a certain grace period is still to come

Accordingly, the market recovery could continue in the weeks ahead, especially if the Fed concludes its cycle of interest rate hikes imminently, inflation continues to fall, and the start of the recession only occurs later in the year.

Risk environment similar to recession year of 1990

Our SDRM risk model continues to show similarities to 1989/90, the years in which the US experienced a savings and loan crisis (1986-1989) with the failure of numerous financial service providers as well as a recession (1990). The SDRM4 uses pattern recognition techniques to identify past risk environments with similarities to the current situation. Those crisis years were also preceded by an aggressive cycle of interest rate hikes by the Fed (+16 percentage points between 1976 and 1980) to combat inflation, followed by a more moderate cycle (+4 percentage points between 1987 and 1989).

Like today, the real money supply decreased by an almost unprecedented five percent, leading to a recession in the second half of 19905. However, volatility in the bond markets (MOVE index) and especially the equity markets (VIX) is currently falling, which suggests that the risk of recession is in decline. While the MOVE index remains above its historical average of 93 at 115 points, the VIX has returned to its historical average of 18.3 percent. This is likely to be due to falling inflation in the US and the reduction in energy prices, which has dispelled the risk of a severe recession in the eurozone. Accordingly, our SDRM model continues to show similar volatility patterns to 1989/90. However, the forecast is slightly less precise than before.

4. For an introduction to the model, please see

Risk management: Forward on calm seas, adaptive and agile in stormy phases.

5. See Walsh, C.E. (1993). What caused the 1990-1991 Recession? Federal Reserve Bank of San Francisco. Economic Review 2, p. 33-48.

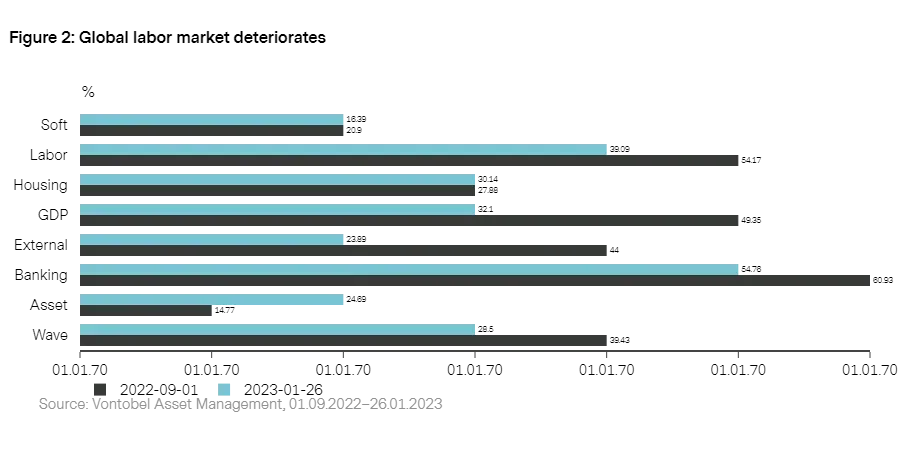

Economic outlook: Recessionary risks remain high

The global economic climate has continued to cool in the current year and our global Wave6 remains in “contraction”. Monetary and fiscal policy momentum also remain negative, which is reflected in the reduction in the real money supply. This means the probability of the “contraction” continuing is an extremely high 94 percent. A look at the Wave components confirms the scenario of an increasingly gloomy economy. Although household and business surveys show that sentiment has recovered slightly from historically low levels, the “hard” economic data (e.g. production and retail) indicates a growing probability of a recession.

Industrialized nations: US approaching a recession

Our Wave has improved in recent weeks for some European economies (such as France) and the US. However, the ongoing restrictive monetary policy means the probability of a “contraction” in the coming months remains high (60 percent). This means there is still a high likelihood of a recession in the eurozone and the US. Our analysis for the US shows that such a low Wave (December: 17 percent) has been followed by a recession within the next twelve months in over 70 percent of cases since the 1950s7. The labor market is also faltering – often the last indicator to deteriorate ahead of a recession – and increasingly losing momentum in the US and other industrialized nations.

Emerging economies: China could soon move to “recovery”

Our Wave for the emerging economies remains in “contraction”. As many as 61 percent of emerging economies, including China, are in “contraction”. The Wave has been impacted by China in particular, where economic growth fell to its lowest level since 1976 (excluding 2020) at just three percent in 2022. Although the withdrawal from the zero-COVID policy is currently weighing on the country’s ailing healthcare system, the medium-term outlook for the Chinese economy has improved as a result. Our Wave reflects this development, with the probability of a “recovery” in the coming months having risen to 70 percent. China’s more expansive monetary policy is also having a positive effect.

6. For a detailed model description of our “Wave” economic cycle model, please see our white paper "

The Vescore Wave – a superior business cycle model

"

7. For details of this analysis, please see “

What do our models think about US recession risk?

"

Equities: Confidence in the Fed supports equities

Market participants’ confidence in the Fed and the gradual end to the cycle of interest rate hikes is reflected in the model variables of our equity allocation model. The increase in the equity allocation in recent months has been driven by credit spreads and, in particular, term spreads.

On the one hand, the positive contribution of the term spread indicates that market participants are more confident regarding an imminent end to the cycle of US interest rate hikes and looser monetary policy in 2024. On the other hand, the positive contribution of the credit spread suggests that the risk of recession in industrialized nations has decreased and the potential economic impact could be less damaging than was feared last year.

Bonds: Risk-reward ratio argues against large positions

After several weeks of slight underweighting for government bonds in North America in particular, the Momentum component is no longer making a significant negative contribution to the bond allocation at present, resulting in only marginal overweighting. The government bond segment is receiving support from two sides: Inflation is continuing to fall more sharply than expected, while lower wage growth rates mean the US labor market is relaxing significantly. Both of these factors are curbing interest rate expectations in the US.

Despite this, our bond allocation model is unable to discern an attractive risk-reward ratio at present. Bond volatility as measured by the MOVE index remains relatively high, which is an argument against larger overweight/underweight positions. Additionally, yields have now returned too close to their long-term average. This means that both Momentum and Mean Reversion are currently making a virtually neutral model contribution. Meanwhile, flat or even inverse yield curves are delivering low Carry yields.

1. See Vescore (2023), “

What do our models think about US recession risks?

”

2. See “Risk model” section

3. This is the result of our study of the impact of interest rate hike cycles on economic growth in ten industrialized nations since the 1950s.

Important Information:

Past performance is not a reliable indicator of current or future performance. Indices are unmanaged; no fees or expenses are reflected; and one cannot invest directly in an index.

Any projections, forecasts or estimates contained herein are based on a variety of estimates and assumptions. There can be no assurance that estimates or assumptions regarding future financial performance of countries, markets and/or investments will prove accurate, and actual results may differ materially. The inclusion of projections or forecasts should not be regarded as an indication that Vontobel considers the projections or forecasts to be reliable predictors of future events, and they should not be relied upon as such. Diversification and/or asset allocation neither assures a profit nor eliminates the risk of investment losses.

Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice. This document is for information purposes only and does not constitute an offer, solicitation or recommendation to buy or sell any investment instruments, to effect any transactions or to conclude any legal act of any kind whatsoever.