Five reasons to invest now in emerging markets fixed income

Fixed Income Boutique

Key takeaways

- Institutional investors have told us they are likely to increase their exposure to emerging markets bonds in the next two years, but are still concerned about the risks.

- Common arguments against emerging markets fixed income include: a strong US dollar, US Federal Reserve hikes, the risk of global recession, and higher default risk in emerging markets.

- We argue these are manageable risks based on attractive yields, better growth expectations than developed markets, and high levels of diversification.

- As 2023 progresses, it’s now the time to look beyond the sell-off in emerging markets and stop watching from the sidelines.

Now that the US Federal Reserve’s hikes are well underway, disinflation has already begun, and the market is pricing in a 5 % Fed funds rate in a matter of months, investors are wondering whether the time has come to reduce cash balances and increase their allocation to emerging markets.

Our survey of over 300 global institutional investors found that two thirds are likely to increase their exposure to emerging markets bonds in the next two years.

Find out why.

Looking beyond the sell-off in emerging markets, we find strong supporting arguments for the asset class. Yields are looking now decidedly attractive. The International Monetary Fund has better growth expectations for emerging markets compared to developed markets. High levels of diversification can significantly reduce specific risks.

Common arguments made against investing in emerging markets fixed income include: a strong US dollar amid aggressive Fed hikes, the risk of global recession, and higher default risk in emerging markets. We reveal why we think that these are manageable risks.

Watching from the sidelines may not be the best investment strategy in 2023.

Five reasons to invest now in emerging markets fixed income

Financial markets have had one of the worst years in several decades in 2022 across all asset classes. Risk assets — including emerging markets investments — have suffered particularly. As a result, emerging markets are perceived as high risk and are therefore underrepresented in investors’ portfolios.

We commissioned a survey of more than 300 institutional investors in Europe, the Americas, and Asia-Pacific, which we published in May this year. We found that two thirds were likely to increase their exposure to emerging markets bonds in the next two years for the following reasons:

- 64 % of respondents embrace fixed income assets in emerging markets for diversification, ESG performance, and yield.

- More than three in four investors endorse active strategies for emerging markets fixed income as they see opportunities for alpha in mispriced and inefficient emerging markets.

- Diversification, income, and ESG alignment lead investors toward emerging markets corporate bonds.

Unsurprisingly, participants of the survey also expressed concerns against investing in emerging markets fixed income.

We reveal in this article the five reasons that we believe put this asset class in favor over others, and why we think that current investor concerns are manageable risks.

Losses in 2022 have been mainly driven by a sudden adjustment from over a decade of very low inflation to an uncertain period of high global inflation. Emerging markets assets have been among the worst-affected this year. The repricing of interest rates has been incredibly negative for risk assets generally and it is no surprise that the sentiment towards emerging markets has turned extremely negative.

The protracted 14-month sell-off has been wearisome for investors. The JP Morgan Corporate Emerging Markets Bond Index (CEMBI), the reference index for emerging markets corporates, delivered only three modest positive months of return between September 2021, when the sell-off began, and October 2022.

This compares to a two-month sell-off in 2020 at the outbreak of the Covid pandemic and a five-month sell-off in 2018 at the start of US President Donald Trump’s antitrade rhetoric. That was the longest since the Great Financial Crisis sell-off, which lasted for just two months.

Rates, spreads and equities have all suffered with the Ukraine war worsening the global inflation problem, sapping optimism. However, the sentiment towards emerging markets seems to have significantly improved since November 10, when the US released lower-than- expected inflation figures.

It is usually not a good idea to read too much into a single data point, but this one confirmed that disinflation is indeed taking place with headline annual inflation declining for the fourth consecutive month. This also confirmed the view that the Fed is approaching the end of its hiking cycle, and thus it is likely to slow the pace of hikes and pause in the first quarter or second quarter of 2023.

Given the challenging backdrop, investors have voted with their feet. They have redeemed substantial amounts of emerging markets fixed income assets since the start of the year — estimated at over USD 80 billion according to EPFR data as of mid-November — and appear to be maintaining high cash levels that they should be looking to invest once stability returns.

This, combined with very low levels of primary issuance through 2022, should provide positive technicals in 2023. There has been a small pickup in emerging markets issuance in the fourth quarter of 2022, suggesting a more balanced view of market participants.

This primary activity has included a few issues where the premium spread offered above the existing issuer curve has been substantial. Primary markets are another fertile playground for active asset managers, which tend to pay new issue premiums and enhance the liquidity of the markets and portfolios.

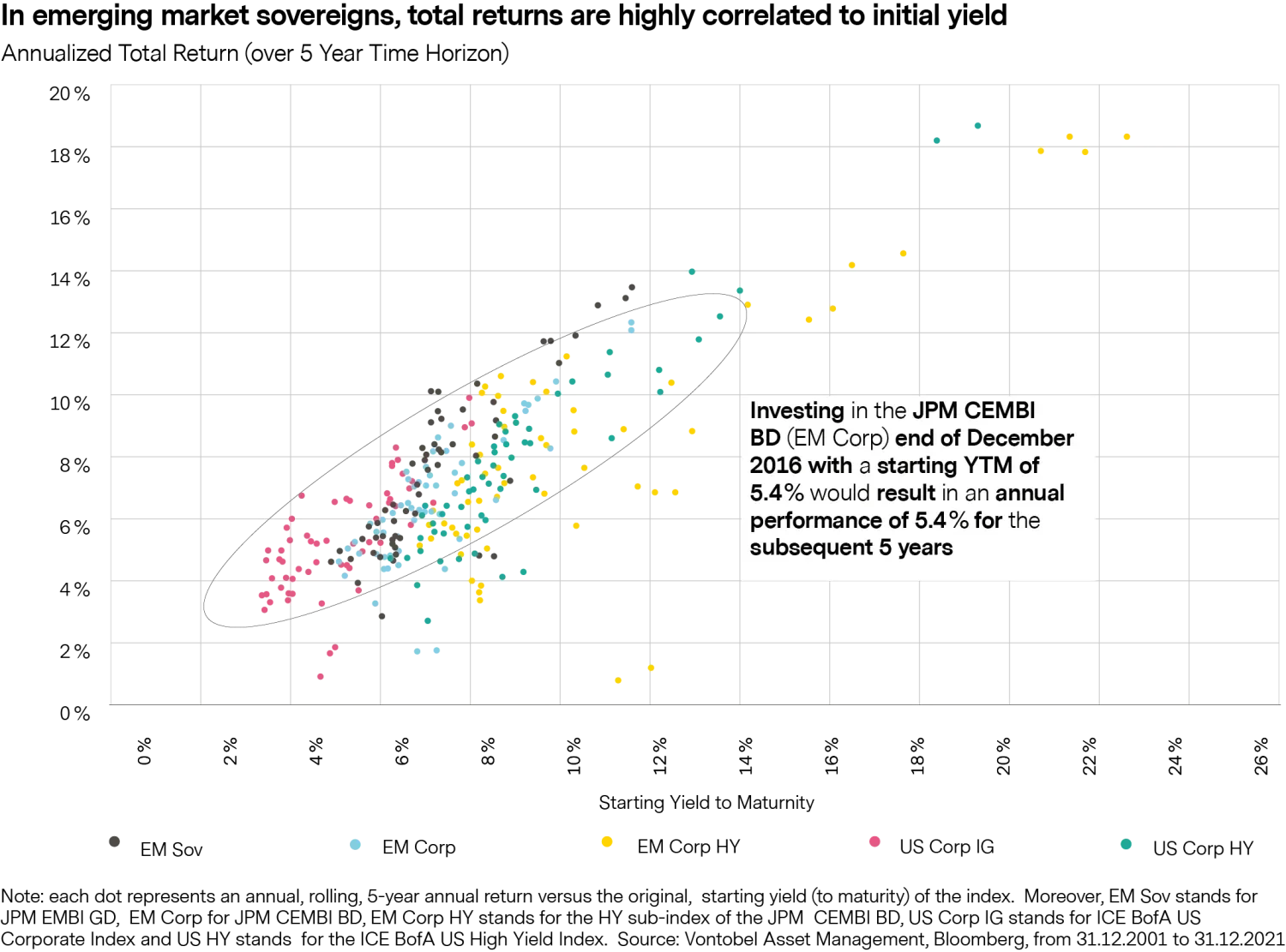

Volatile markets create opportunities. Given the rise in rates, widening of spreads and overall higher yields, the former consensus that equities (mainly US equities) are the growth asset class of choice has been severely challenged. In other words, "TINA" — there is no alternative (to equities) — is no more. Fixed income, which emerging markets are a growing and increasingly popular part, is a viable investment destination once more. Some investors might ask: why bother with emerging markets with US corporate yields above 5.5 %?

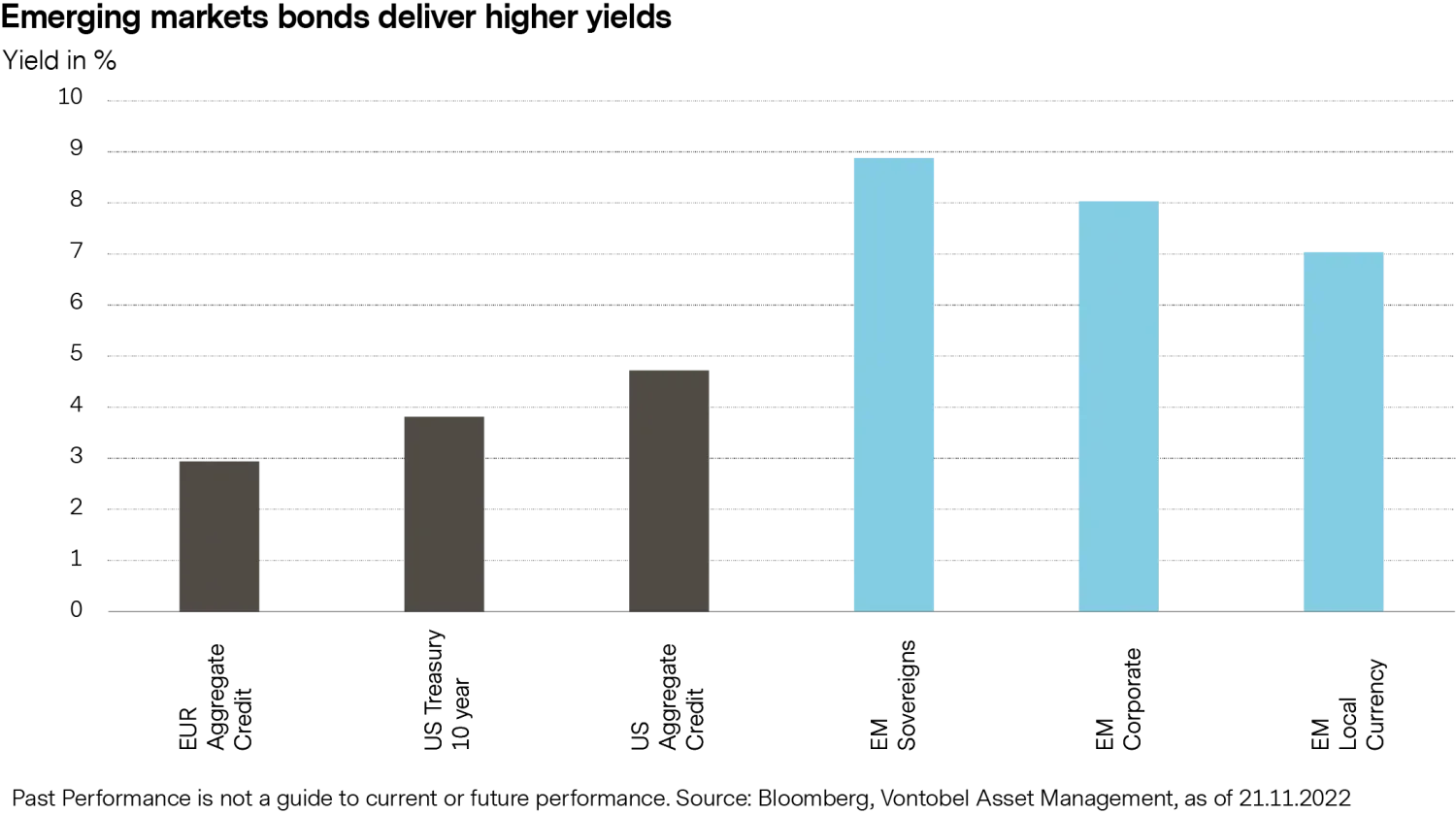

Emerging markets fixed income segments provide a significantly higher yield than their developed market counterparts, not to mention that 5.5 % is still far below inflation. For example, emerging markets corporate and local-currency bonds have a yield of around 8 % and 7 % respectively, while emerging markets hard-currency sovereign debt offers a yield of almost 9 %. By comparison, the yield for 5- and 10-year US treasuries is less than 4 %, and less than 2 % for German bunds.

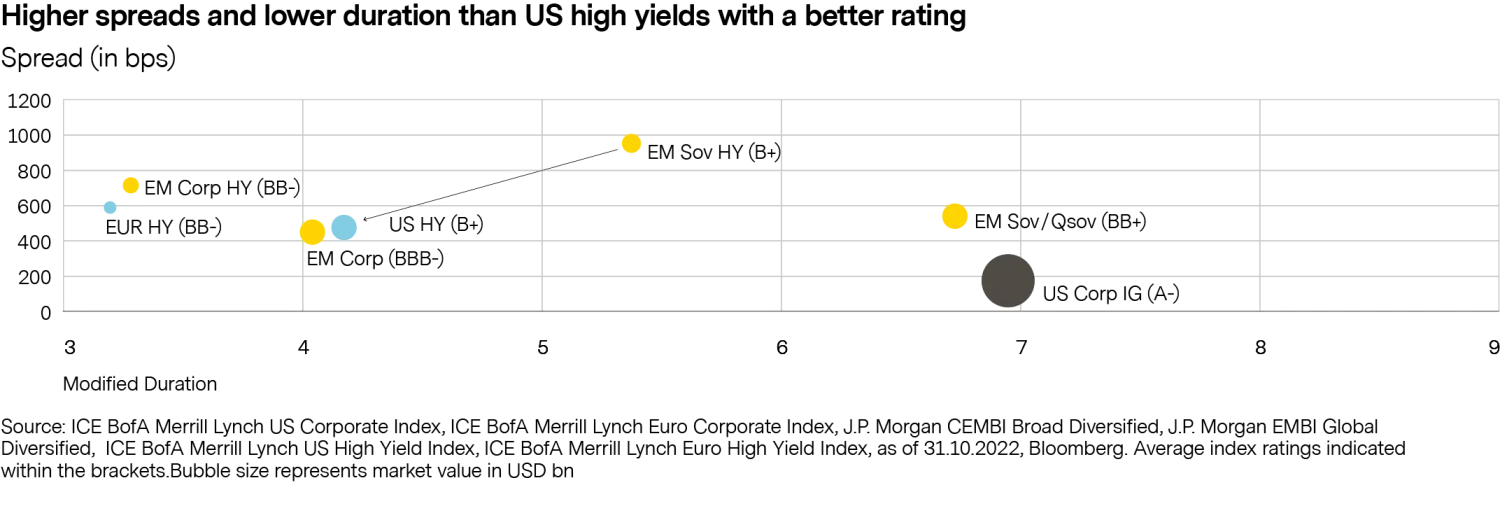

Emerging markets high yield spreads also have a more favorable outlook compared to developed markets high yield spreads. The chart below compares spread and duration, and at a glance shows that emerging markets (green) offer higher spreads than developed markets high yield (pink) or corporates (blue). Comparing market segments shows that emerging markets corporate high yields have better ratings and less duration risk, but still show a spread pick up compared to US high yields. Emerging markets sovereign high yields have the same rating, slightly higher duration but nearly 100 % spread pick up.

That’s why emerging markets corporate fixed income could be an alternative for investors seeking higher spreads and yields as well as lower duration amid recession fears and rate hikes in developed markets. Meanwhile, with disinflation already ongoing in the US and in a few emerging markets, emerging markets hard-currency sovereigns with higher duration and much higher spreads may be the ideal sub-asset class for investors who are more optimistic about duration.

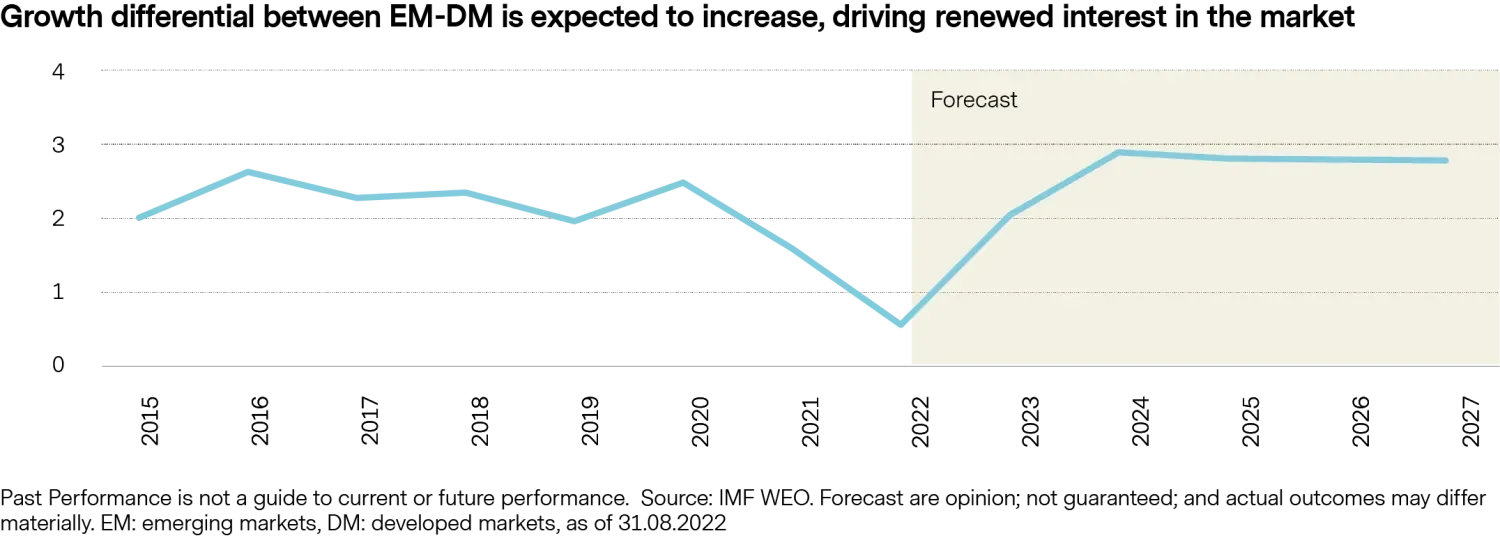

The IMF downgraded its global GDP growth expectations in October and highlighted the increased probability of a global recession. However, the downgrade was much more severe for Europe and the US than for emerging markets.

This means that after the somewhat exceptional period of the pandemic rebound, when developed markets were growing almost as fast as emerging markets, GDP growth differentials appear likely to return to normal, with emerging markets resuming their previous growth pace.

And this is despite the much slower growth forecast in China going forward: the easing of zero-Covid curbs is expected to be gradual and fiscal stimulus to remain modest, with clear upside if this changes.

GDP growth is not a significant variable in the determination of relative emerging markets spreads. It is indeed useful as a signal for emerging markets equities, but not for emerging markets fixed income spreads. In short, fast growth can sometimes be unsustainable, while slow growth can sometimes be the consequence of austerity measures that restore debt sustainability.

However, like the US dollar strength negatively affecting sentiment, faster GDP growth in emerging markets compared to developed markets usually leads to improved investor sentiment (the famous "cash chases growth" principle).

On average, emerging markets corporates have healthier balance sheets than their equivalents in developed markets. This explains why they have a better average rating (despite the sovereign cap, meaning that in several countries, corporates are rated lower than the sovereign despite robust fundamentals) and have had a low long-term average default rate of just 3.7 %.

However, this year has been different. The real estate crisis in China and Russian sanctions following the invasion of Ukraine, which pushed Russian corporates to default, have pushed the default rate in emerging markets corporate high yields to 11.3 % during the first ten months of the year. The default rate is expected to remain at similar levels through 2023—or decline to 7.3 % if Russia, which is now out of the index, is excluded (source: JP Morgan).

Excluding China’s property sector and Russia / Ukraine corporates, the emerging markets high yield corporate default rate stands at just 1 % in 2022, so emerging markets corporate default rates are far from alarming and in fact, some defaults can even present attractive opportunities for active investors.

Moreover, while the default rate is likely to remain high in the China property sector, bond prices fully reflect this expectation. The average price of Chinese high yield real estate bonds in the CEMBI broad index stood at 28.5 cents on the dollar at the time of writing, which strongly limits the potential downside for investors going forward.

Sovereigns have also seen defaults recently, which created sensational headlines and the lazy perception that emerging markets are “emergency” markets. Whereas the facts show the opposite:

- If we exclude Russia and Ukraine, the market cap of defaults is very modest;

- When an emerging country defaults, there is next to no contagion effect on its neighbors. Investors have grown a lot more sophisticated over the years and can now differentiate between “basket cases” and “normal stories” ever since the Covid wave of defaults.

Diversification is often underestimated. Indeed, there have been some concentrated blow ups in emerging markets corporates, such as Russia and Ukraine, China high yield and Mexican non-bank financials. But outside these pockets, default rates appear to be under control given the distinctive reasons for each of these setbacks.

Investors seem to underappreciate the low degree of contagion these markets demonstrate.

Turkish macro woes have not affected neighbors much, the Chinese Covid wave is painful for global macro, but not for a given sector in country A or B. This brings us back to the all-important argument of diversification within emerging markets.

With more than 80 countries classified as emerging markets, an investor can obtain much greater diversification than investing in some developed markets regions, where single events affect a much larger share of the investable universe.

"Investors seem to underappreciate the low degree of contagion these markets demonstrate."

Investors’ main concerns and why they are manageable

The sentiment towards emerging markets assets has been particularly bleak as the Fed has hiked faster than other developed central banks resulting in a rapidly appreciating US dollar.

Moreover, the looming end of an era of plentiful global liquidity has raised fears of multiple defaults in frontier mar- kets that issued eurobonds for the first time during the last decade and now find themselves without market access.

Some of the prevalent arguments made against investing in emerging markets fixed income include:

The US dollar has strengthened 16.67 % against major developed markets currencies year-to-date in the first ten months of the year, as per the DXY index. Usually, one would expect emerging markets currencies to fare worse during Fed hiking cycles – as it was the case during 2018, for example.

However, the pure forex return of the JP Morgan Government Bond Index-Emerging Markets stood at -10.87 %year to date in the same period. In other words, several emerging markets currencies are faring much better than non-dollar developed markets currencies. In fact, the Brazilian real, the Mexican peso, and the Peruvian sol are all up against the dollar year to date.

Emerging markets currencies tend to weaken when carry is eroded by Fed hikes. Yet, emerging markets carry has not been eroded this year, it has in fact been rebuilt despite Fed hikes and is now the highest since mid-2017.

This is because emerging market central banks, particularly those in Latin America, started hiking rates much earlier than the Fed and have been much more aggressive at doing so—a third of the 15 largest countries in the GBI-EM index now have double-digit central bank policy rates.

Emerging markets local-currency bonds have fared much better than hard-currency despite the strengthening dollar. Both emerging market corporate and emerging market local have fared better than developed market sovereign debt due to their lower duration.

A strong dollar makes emerging markets external debt burdens heavier. But these aren’t usual times. The logic of a strong dollar making emerging markets’ external debt burdens less sustainable goes like this: if you borrow in a foreign currency and your own currency depreciates, then your liabilities have increased when measured in your local currency. Your income remains the same as it is mostly earned in domestic currency via taxes.

That may apply in usual times, but these aren’t usual times. First, most emerging markets borrow in a mix of local and foreign currency. If domestic debt entails half of the country’s public debt, then the dollar strength effect is already reduced by half.

"... many emerging markets have seen revenues increase at a faster pace than GDP through 2022, with several countries experiencing higher revenues as a share of GDP compared to pre-Covid times."

Debt composition is very heterogenous, going from countries that typically mostly borrow in foreign currency due to chronic high inflation—such as Argentina—to countries like Brazil, where 97 % of the public debt is in local currency and should thus be almost unaffected by a strong dollar from a debt sustainability perspective.

Second, emerging markets are also experiencing high global inflation. If a country had 10 % inflation this year, its nominal GDP will also be 10 % higher even without growth, which would more than compensate for the equivalent dollar strength.

Also, many emerging markets have highly regressive taxation systems, particularly developing countries, where VAT and import duties are more important than income taxes.

In a context of high inflation, revenues collected from VAT and duties increase immediately, while income taxes lag. Thus, many emerging markets have seen revenues increase at a faster pace than GDP through 2022, with several countries experiencing higher revenues as a share of GDP compared to pre-Covid times.

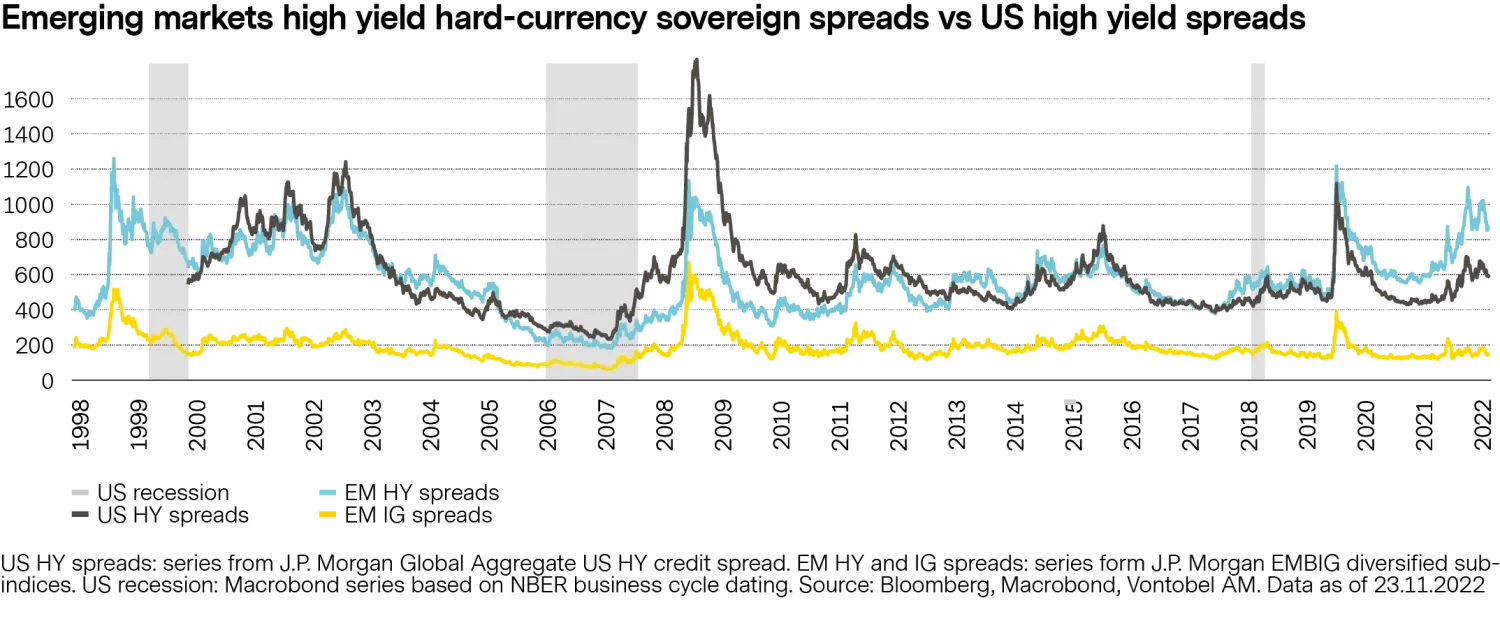

In principle, yes. But emerging markets high yield spreads were recently trading at around 1,000 basis points, close to the level seen in December 2008, when the GFC was already in full swing and higher than during the 2001 US recession. Spreads tightened in November (below 900 bps) as US inflation data confirmed that disinflation is already happening, yet this is still a very high level as activity data suggests that the economy remains resilient, and recession is not yet imminent.

Moreover, we have previously argued that the upcoming recession is unlikely to be as bad as the GFC. In contrast, US high yield spreads are not looking particularly wide compared to their history, the absolute level of yields is high simply because US treasuries have gone up a lot.

Emerging markets high yield hard-currency sovereign spreads are now close to the levels seen during the GFC and higher than during the 2001 recession, while US high yield spreads are not far from their historical average.

"Selected countries can stay out of the markets for a while without necessitating a debt restructuring, creating opportunities for investors."

One could argue that high yield spreads in emerging markets are this high precisely because default risk is high. Or, conversely, that with such high spreads there are even countries with sustainable debt burdens that may not have market access.

During the October IMF meetings in Washington, DC, several investors expressed concern that if the current state of affairs remained unchanged for long, then a wave of emerging markets defaults would become inevitable.

Indeed, if spreads remained as elevated as they were in October forever, then even countries with solid fundamentals would eventually get in trouble. Yet, it seem unlikely that by the end of 2024 global inflation will still be running close to 10 % and the Fed Funds rate will still be at, say, 5 %. The US inflation print in October – the fourth month of declining headline inflation — confirms that the current state of affairs is unlikely to become permanent.

Several analysts have jumped to the conclusion that if a country does not have market access now, it must run out of liquidity soon and will be forced to restructure its debts. However, that seemingly logical conclusion assumes that developing countries must constantly roll over their debt maturities like developed countries.

But this is not the case for most developing countries, which typically issue eurobonds (i.e. external debt) in a rather opportunistic and infrequent fashion. In fact, most African eurobond issuers do not have significant debt maturities until 2024 or 2025. So they can afford to stay out of global capital markets until global financial conditions improve.

Moreover, sovereigns tend to have several lenders of last resort which they can rely on when market access is lost. The IMF, together with other multilateral institutions like the World Bank and regional development banks, act as lenders of last resort. Additionally, several nations enjoy the favors of bilateral partners that can also act as fallback lenders. Egypt, for example, enjoys the support of petrodollar-rich Gulf countries.

There are some rotten apples and we’re likely to see more defaults in terms of the number of countries restructuring debt in the next two years, but with bond prices of distressed countries trading at or below 40 cents on the dollar compared to the average recovery value in emerging markets restructurings of 52-53 cents on the dollar, restructurings seem to be already priced in.

In short, the current global macroeconomic environment is very challenging, and indeed we’re likely to see a few more sovereign debt restructurings over the next two or three years because not all countries have solid fundamentals.

Yet, the existence of several lenders of last resort and the fact that most developing countries are infrequent issuers of eurobonds, implies that selected countries can stay out of the markets for a while without necessitating a debt restructuring, creating opportunities for investors.

After a stellar recovery in the last months, is there much left in emerging market bonds?

Time to stop waiting on the sidelines?

Overall, our survey of over 300 global institutional investors, which we published in May 2022, found that two thirds are likely to increase their exposure to emerging markets bonds in the next two years.

The global macroeconomic environment remains very challenging, but the bulk of the sell-off in fixed income markets appears to be behind us. Although the Fed is not done hiking yet, hawkish surprises are much less likely going forward as there are already signs of disinflation and the market is no longer expecting a Fed pivot.

Markets have already priced in the Fed’s well-telegraphed intention to keep rates elevated until inflation comes down closer to target.

Predicting the exact moment when inflation declines more meaningfully, the Fed stops hiking, the dollar deflates, and the sentiment turns outright positive towards risk assets is nearly impossible. Yet it is reasonable to expect that these things will occur at some point in 2023. When they do, light positioning on the asset class, coupled with attractive valuations, superior fore casted growth and very low issuance from emerging markets debtors, imply that emerging markets bonds may perform well.

One thing of note is that local currency is demonstrating a lot better performance compared to hard currency. Fundamental reasons for that have been covered above (more agile rate policy, improving growth differential, current accounts also improved). Interestingly, this is not matched with asset allocation trends. As 2023 dawns, we do see a solid niche for the emerging markets local currency bonds as a further diversification segment within emerging markets.

Waiting on the sidelines may have been the smartest thing to do through 2022, but may not be the optimal decision for much longer.