Emerging-market investment-grade bonds as a strategic anchor

Our strong conviction in emerging market (EM) local-currency bonds remains unchanged. EM local-currency bonds continued to perform well in the last quarter, delivering total returns of 4.1% (in USD) for the three months ending September 9. While these returns are impressive on an annualized basis (17.3%), they were not as remarkable as those seen in the first half of the year, which were 12.3% or 26% annualized. In fact, returns for EM local-currency bonds fell between those of hard-currency sovereign bonds (5.6%) and hard-currency corporate bonds (3.8%).

There were two main factors behind the performance of EM local currency bonds lagging that of hard-currency sovereigns in the last quarter. First, spread compression boosted hard currency returns across all credit products, particularly in African sovereign bonds, as discussed in the hard-currency section. Second, the US dollar traded sideways over the past three months, following a sharp decline during the first half of the year.

We have several reasons to maintain the bearish outlook on the US dollar that we initiated in the previous fixed income quarterly. First, the US labor market is less resilient than investors previously thought. Second, the Federal Reserve is poised to resume rate cuts. Third, while disinflation continues in the rest of the world, inflation in the US remains high and could accelerate further due to tariffs. Last but not least, concerns about the quality of US institutions have grown.

The US dollar's decline accelerated around Liberation Day, driven by the realization that the US economy would likely face significant headwinds from tariffs, while the rest of the world was expected to experience less pronounced slowdowns. In Q3, the relative stability of the dollar coincided with increased market optimism about trade deals in July. This optimism followed the US postponement of the tariff deadline to August 1st and the subsequent announcement of multiple trade agreements, beginning with the one with the EU. It is reasonable for the dollar to consolidate after dropping more than 10% year-to-date; however, we argue that there are sufficient factors for the dollar's decline to resume. We also believe that EM local-currency bonds are well positioned to continue performing well, independent of our expected dollar weakness.

First, the trade deals reached so far, while preferable to a full-scale trade war with retaliatory measures, are not favorable for the US economy. These effects have already manifested in the US economy, particularly in the labor market. The US economy grew at an annualized rate of 2% in the first half of the year, a slowdown from 3% growth in the first half of 2024 and 2.6% in the second half of 2024. More importantly, job creation has decelerated sharply, averaging just 35,000 jobs per month in the three months ending July, down from 168,000 jobs per month in 2024.

Second, as highlighted in our article on global rates, Fed Chair Jerome Powell indicated that it is time for the Fed to resume rate cuts, despite persistently elevated inflation. In his recent speech at Jackson Hole, Powell emphasized downside risks to employment and upside risks to inflation. Importantly, it appears that the European Central Bank (ECB) and most other major global central banks are unlikely to follow the Fed this time. Many of these central banks have either largely completed their rate-cutting cycles or continue to grapple with high inflation, as is the case with the Bank of England (BoE) and the Bank of Japan (BoJ).

Some EM central banks may also resume rate cuts. For example, the central banks of the Dominican Republic and Peru have been cautious about further rate reductions due to compressed interest rate differentials with the Fed. However, this is not the case for most countries, which have already decoupled by cutting rates well ahead of the Fed – just as they did during their hiking cycles. This divergence suggests that the nominal interest rate advantage of the US dollar over other developed market currencies and low-yielding EM Asian currencies will gradually erode, undermining one of the key pillars supporting a strong dollar in recent years.

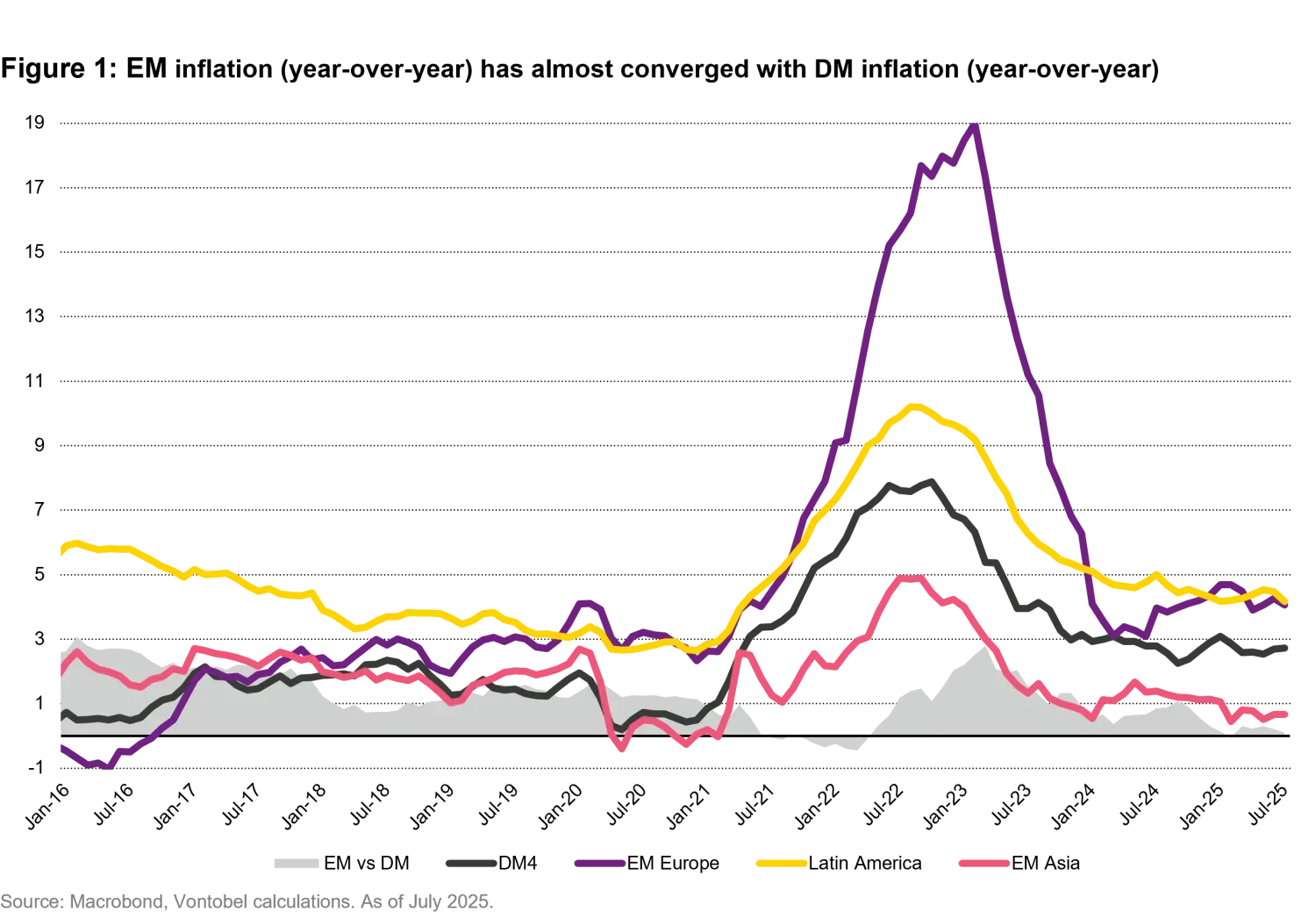

Third, as we predicted, the tariff shock has so far proven to be disinflationary for the rest of the world and inflationary for the US. In the euro area, core inflation is very close to the 2% target. In Asia, inflation remains extremely low and has fallen further below central bank targets in recent months. In China, inflation stands at 0%; Thailand has fallen deeper into deflation; and India’s inflation rate has declined to 1.6%, well below the lower bound of its 2-6% target range.

In Eastern Europe and Latin America, inflation remains above target in most countries, but disinflation continues to progress in an orderly manner. Moreover, countries with the largest deviations from their inflation targets, such as Brazil and Colombia, also have the highest real policy rates. This indicates that their central banks are actively working to bring inflation back to target and that investors are probably being appropriately compensated for the higher inflation risks in these countries. This is a positive development for the asset class.

Orderly disinflation across most of the world has resulted in capital gains on EM local-currency bonds, accounting for almost a quarter of the total return year-to-date. After all, it is not just about EM FX and clipping coupons – rates also play an important role. Year-to-date, rates have declined significantly, partly due to more favorable inflation dynamics in EM compared to the US.

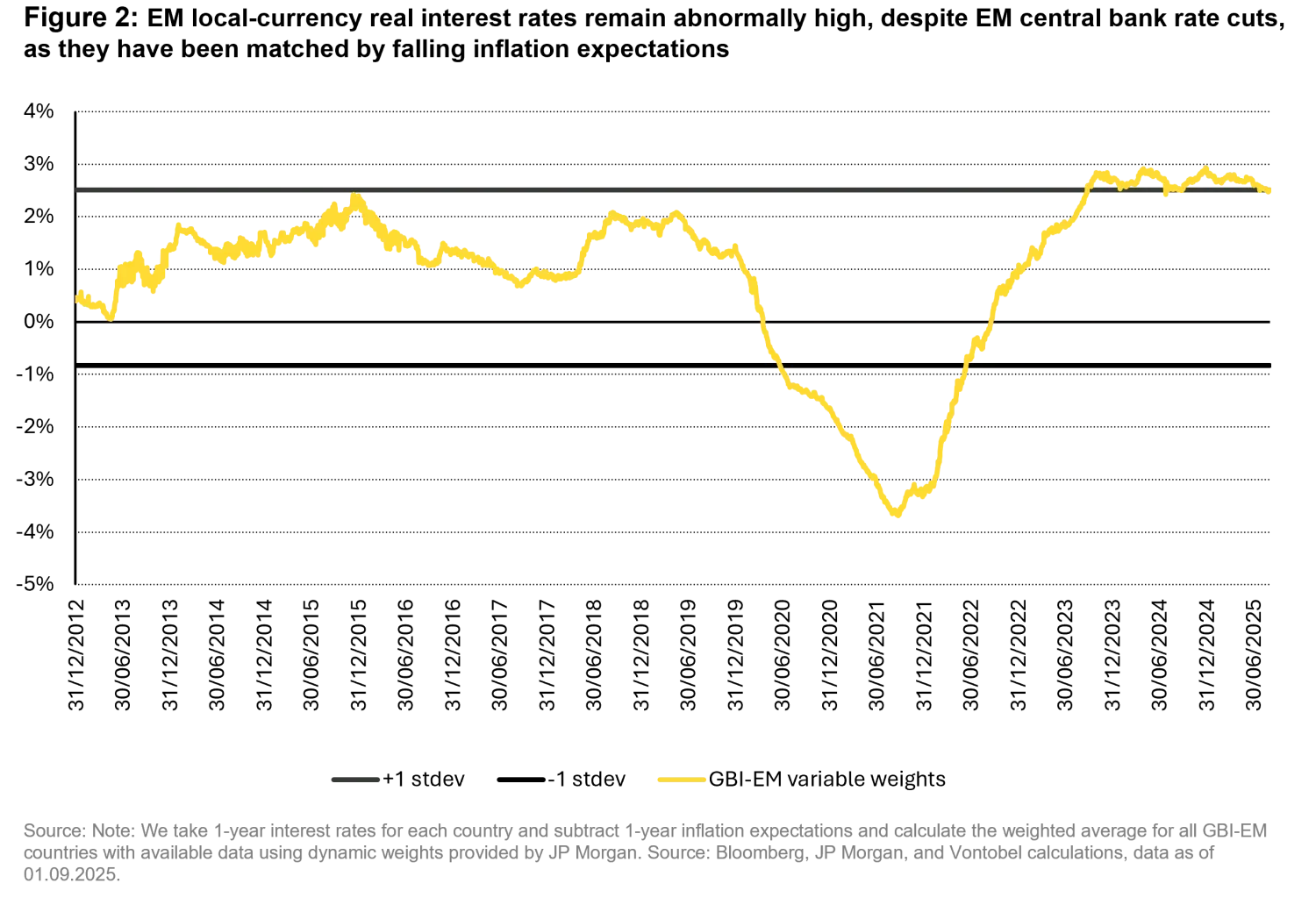

Declining inflation expectations are a key component of this analysis. The IMF projects that the inflation differential between EM and DM will continue to narrow to levels that have not been consistently sustained in the past. This trend is partly due to persistently high inflation in some DMs – such as the US, UK, and Japan – and partly attributable to the effective efforts of most EM central banks in establishing credibility. As a result, real interest rates across EM remain significantly above their historical averages.

Figure 2 illustrates the weighted average of one-year nominal interest rates minus one-year inflation expectations across the 15 largest EM countries in the JP Morgan GBI-EM index. These elevated real interest rates are expected to continue supporting EM currencies in the future, regardless of whether our bearish outlook on the dollar proves accurate.

Relative inflation explains most of the long-term exchange rate developments. Higher inflation in EM economies explains why EM exchange rates tend to depreciate over the long term, just as lower Swiss inflation explains the long-term appreciation of the Swiss franc. However, the current trend of a narrower-than-ever inflation differential between EM and DM supports a lower depreciation rate for EM currencies over the long term.

Another factor strongly supporting EM currencies is the widespread accumulation of foreign exchange (FX) reserves by nearly all EM countries included in the GBI-EM index over the past twelve months. One notable exception is Brazil, which already maintains more than adequate FX reserve levels. This trend can be attributed to generally favorable terms of trade, restrictive monetary policies in most EM countries, and tighter fiscal policies in several nations. Together, these factors have contributed to modest domestic demand growth and, consequently, contained import growth.

Metal and mineral exporters, such as Peru and South Africa, have experienced double-digit growth in their FX reserves over the past year. Eastern European countries have also seen rapid FX reserve increases, despite Europe’s sluggish industrial growth. Additionally, Turkey has achieved significant reserve accumulation despite political challenges, which have supported its carry trade.

These dynamics lead us to conclude that the strong performance of EM currencies against the US dollar is not solely a result of a bearish US dollar; there are fundamental reasons for EM currencies to sustainably appreciate toward a stronger equilibrium level.