EM local-currency: more reasons to maintain our high conviction

Increased global risk appetite has resulted in tighter spreads across all fixed income segments, with EM hard-currency bonds performing very well in this context. Short-term capital appreciation opportunities are now less abundant and less apparent than three months ago, which makes us more cautious about EM credit risk than in the previous quarter. However, we find two powerful trends that justify tight EM spreads relative to history – and relative to other asset classes – and may result in EM spreads grinding tighter absent an unexpectedly negative global shock. These trends are: improving credit ratings and the return of inflows into the asset class after three years of outflows.

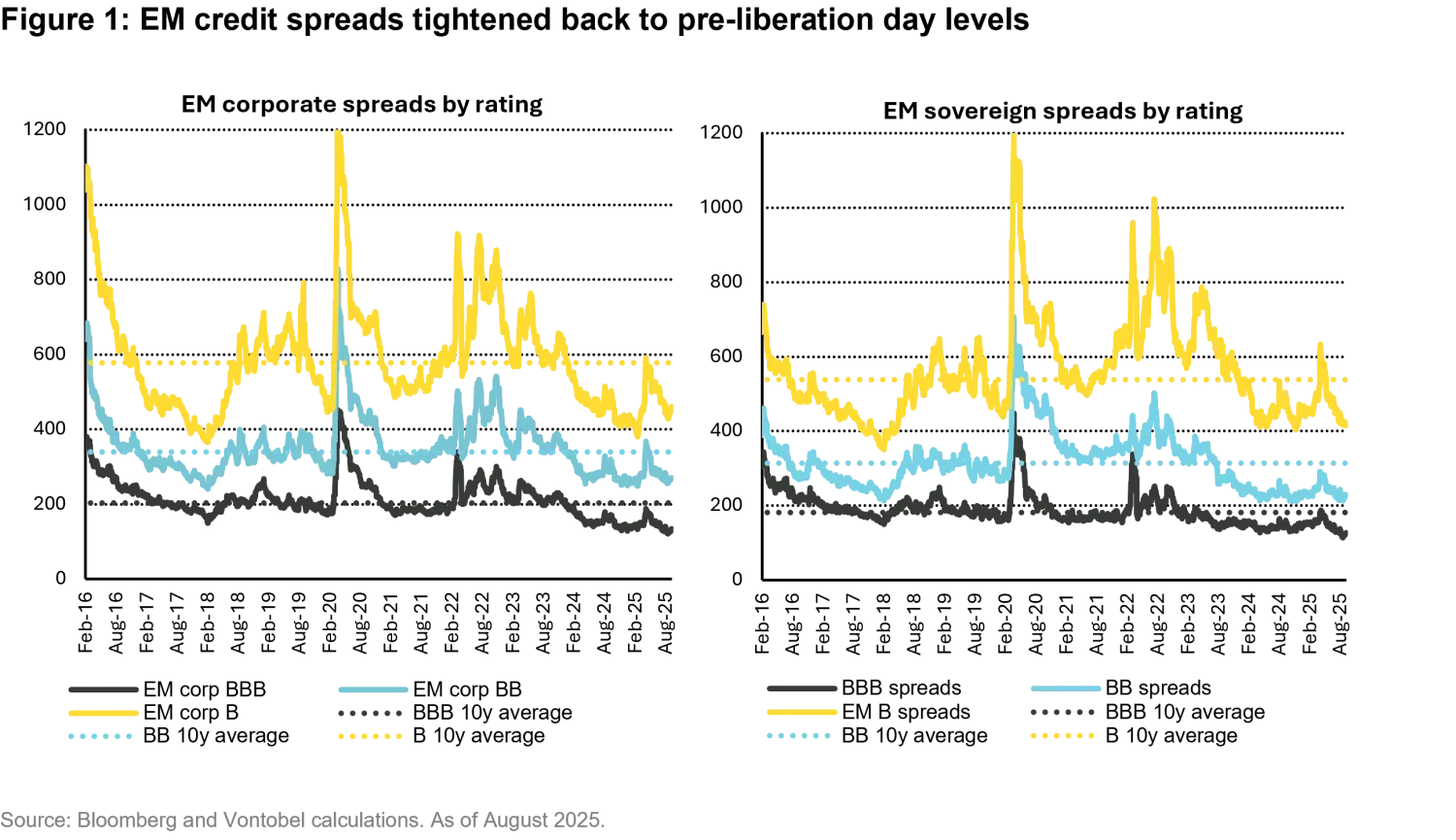

In our previous Fixed Income Quarterly, we highlighted that “Liberation Day” had created compelling value opportunities in EM hard-currency bonds. At that time, EM spreads were still significantly wider than their February lows, and we identified particularly attractive opportunities in select African sovereigns.

Three months later, these opportunities have played out extremely well. EM hard-currency sovereign spreads are now tighter than their February lows, while EM corporate spreads are almost as tight as in February (see Figure 1). This spread tightening is in line with other fixed income segments. Yet the performance of hard-currency sovereign (+5.6%) and corporate (+3.8%) bonds over the three months to September 9 (equivalent to annualized returns of 24.5% and 16.3%, respectively) are stellar. Furthermore, African sovereigns experienced the most significant spread tightening and delivered the best absolute return at +7.4% in a single quarter (equivalent to 33.2% annualized).

There are reasons to be cautious: short-term upside potential for the asset class is now more limited than it was three months ago, given that spreads are tight relative to their historic levels. This is also true for developed market credit. Additionally, uncertainty around the US economy remains elevated amid a sharp slowdown in the US labor market, persistently high inflation, and worries about the Federal Reserve’s independence going forward. Despite this economic uncertainty, two important trends justify tighter spreads:

1. Accelerating EM sovereign rating upgrades

We have observed a positive trend of credit rating upgrades in EM sovereigns since the second half of 2023, and in EM corporates since the second quarter of 2024 (corporate rating trends usually lag sovereigns). This trend accelerated in the last three months, with eleven upgrades and two downgrades, the highest net upgrades in over a decade. At the same time, several highly rated developed market (DM) sovereigns (US, Austria, Belgium, Finland) were downgraded, while only smaller EU countries (Portugal, Ireland, Slovenia) were recently upgraded.

Within this trend, we have identified clusters of countries. On the high-grade side, Azerbaijan (Baa3/bb+/BBB-) and Oman (Baa3/BBB-/BB+) have been on an upgrade trajectory for three years and have recently regained investment grade (IG) ratings after falling to high yield (HY) status years ago. Bulgaria (Baa1/BBB+/BBB+) was upgraded by two agencies after receiving EU approval for eurozone accession; it will join in January 2026. Similar to Croatia three years ago (when the country was accepted into the eurozone), we anticipate further upgrades for Bulgaria over the next two years. India (Baa3/BBB/BBB-) also received its first upgrade since 2017, driven by strong growth, low inflation, and fiscal consolidation.

Colombia (Baa3/BB/BB+) was the only relatively high-rated country downgraded – twice in the past three months. While it still holds one IG rating, the downgrades were expected given fiscal deterioration since the pandemic, worsened under President Petro’s administration. Despite this, markets shrugged off the move, and Colombian bonds performed well on expectations of a market-friendly government after the 2026 elections and recent liability management operations.

Turning to HY markets, a common EM trend over the past two years has been the accumulation of foreign exchange (FX) reserves. This can reflect stronger external accounts – such as exports, remittances, tourism, and foreign direct investment (FDI) – or rapid external borrowing via Eurobonds (e.g., Romania), portfolio inflows, or large multilateral loans (e.g., Argentina).

Gold exporters like Uzbekistan (Ba3/BB-/BB) and Ghana (Caa2/CCC+/B-) have benefited from the gold rally, building reserves and earning upgrades. Another group – Turkey (Ba3/BB-/BB-), the Dominican Republic (Ba2/BB/BB-), and Kenya (Caa1/B/B-) – also increased their reserves. Strong tourism is an important driver for all three, along with record-high remittances for the Dominican Republic and Kenya. Turkey has pursued orthodox economic policies since President Erdogan’s re-election in 2023. While inflation remains high, it is falling as the central bank tightened sharply. Despite political setbacks, Turkey moved firmly from B to BB-.

Kenya also belongs to a third group: sovereigns that were distressed in 2022-23 and have regained market access. We believe rating agencies were overly aggressive in downgrades during 2022–23, particularly from single B to CCC, and are now reversing them. Nigeria (B3/B-/B), Argentina (Caa1/CCC/CCC+), and Pakistan (Caa1/B-/B-) are also in this camp, all of which are pursuing significant reforms. Nigeria eliminated multiple FX rates and fuel subsidies under President Tinubu, while oil production is recovering. Pakistan is rigorously implementing its IMF program and adjusting fiscally after near-default in 2023. Argentina’s turnaround is more complex, with reforms underway, but it has not regained market access yet. This third group of countries is particularly important because their fundamental improvements reduce default risks for the entire asset class.

On the downgrade side, Bolivia (Ca/CCC-/CCC-) and Senegal (B3/B-) were recently downgraded. Bolivia is facing a classic balance-of-payments crisis following over a decade of reserve depletion. This has led to a political shift: in the October 2nd round of elections, the leftist MAS party is expected to be ousted, with both a centrist and a right-wing candidate vying for the presidency. Both candidates have pledged debt restructuring and policy changes. Senegal, on the other hand, is dealing with the fallout from hidden debts accumulated under the previous administration, which pushed its debt-to-GDP to 119% last year. The new government has begun fiscal consolidation but has yet to secure an IMF program. Despite strong growth from rising gas output, restructuring risk remains.

2. Inflows are finally returning to EM after three years of outflows

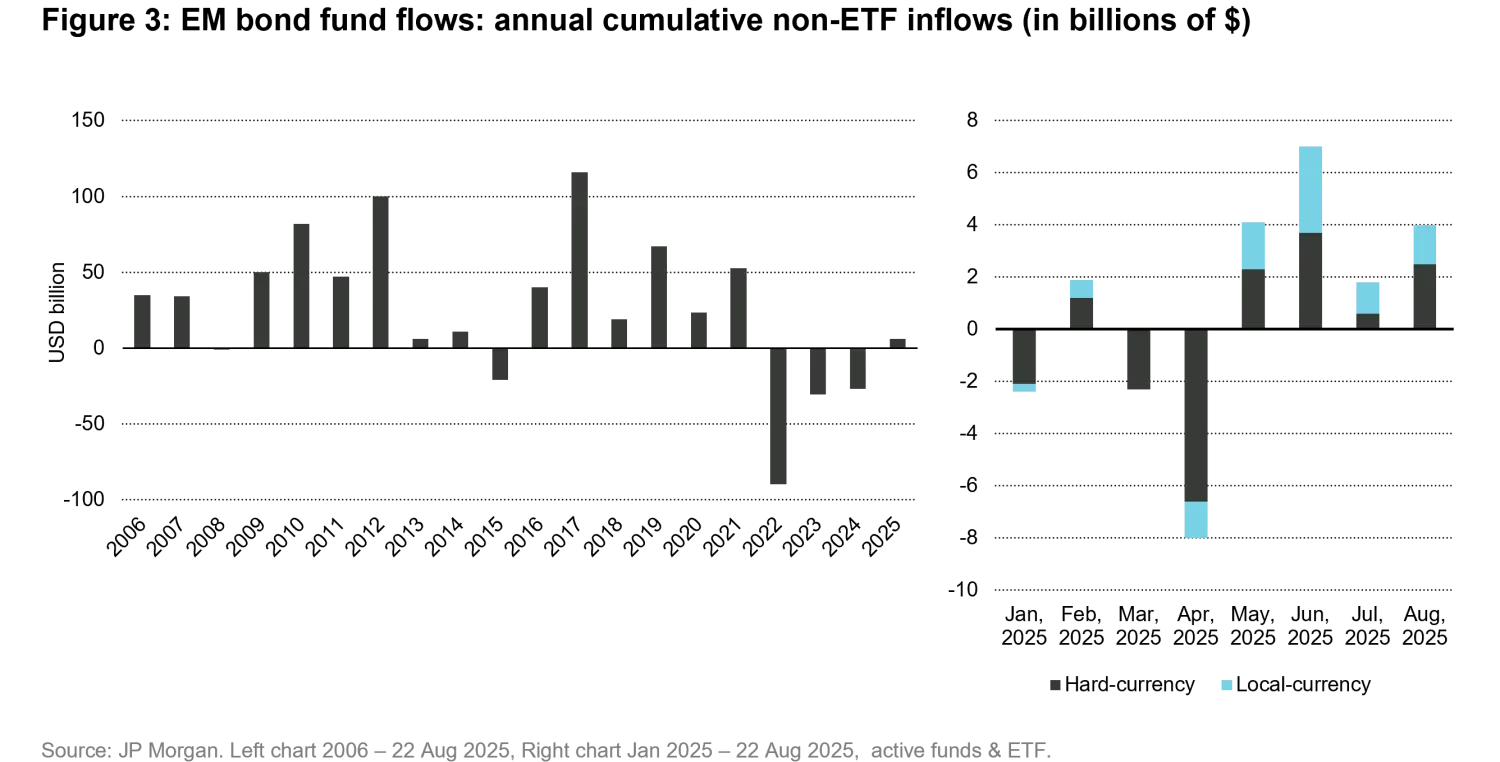

A second factor likely to help keep spreads tight is the return of inflows into the asset class. After a brief spell of risk aversion that resulted in $USD 8 billion in outflows from EM bonds in April, the asset class has since received inflows every month. Year-to-date, flows have returned to positive territory, totaling $USD 6 billion. Absent any major global shocks that would result in a return of risk aversion, the current environment should result in further inflows into the asset class.

Several reasons underpin this expectation. First, spreads are also quite tight across DM credit. Second, the Federal Reserve is poised to resume its rate-cutting cycle at a time when inflation is still relatively high. This will, therefore, not only erode nominal yields of US fixed income but also further erode real yields. Thus, the search for higher yields is bound to intensify, keeping EM spreads relatively tight for longer. Third, after three consecutive years of large outflows, asset allocators in aggregate are likely still underallocated to the asset class.

In summary, while the potential for near-term spread compression has lessened following such strong performance, the twin forces of accelerating rating upgrades and renewed inflows into the asset class are likely to support EM spreads relative to their historical levels and other credit markets. Barring a major global shock, we expect EM to remain resilient, offering stable carry even if capital appreciation becomes more difficult to capture.