Everything you need to know about DATs (Digital Asset Treasuries)

Quantitative Investments

Have you been following Digital Asset Treasuries (DATs)? Once promoted as “intelligent leverage” on Bitcoin, they gave investors simple exposure through listed shares. But with ETFs now offering easier and cleaner access, the model faces growing pressure. In this piece, we explore whether DATs are here to stay—or fading fast.

1. What are DATs?

Digital Asset Treasuries are companies that raise capital from investors in various forms (e.g., equity, convertible debt), use the resulting proceeds to buy cryptocurrencies, and park them on their balance sheets. In some cases, DATs put cryptocurrencies to work to generate a yield.

2. Why do they exist?

If you exclude the case where DATs use cryptocurrencies to generate a yield, which is anyway the minority of the cases, and considering therefore that DATs raise capital to buy ‘things’ and hold them on a balance sheet, many investors are wondering why such a business model even exists.

2.1 The purple pearl analogy

Here’s an analogy. Picture a remote island whose wonderful nature produces 10 purple pearls a month. Further, assume that scientists proved that nature will only ever make 10,000 purple pearls. Note that there are 4,000 purple pearls already in circulation, owned by investors around the globe. For whatever reason, purple pearls became a highly demanded commodity.

Given the rate at which purple pearls are supplied, and that there are only 6,000 new pearls to be put in circulation, we deduce all purple pearls that will ever circulate will do so in 600 months, which is 50 years from now. After the publication of this fact by renowned scientists in the world’s top peer-reviewed journals, investors accelerated their hoarding of purple pearls. As it stands today, everybody wants purple pearls.

Owning purple pearls require some effort though. Investors need to set up a purple pearl vault at one of the authorized storage facilities in the island where they are produced. This requires taking a few days to travel to the island, and several bureaucratic steps. Purple pearl owners can trade purple pearls with each other through an automated purple pearl exchange facility, but this facility is only available to those who went through the trouble of opening a vault already.

The popularity of purple pearls grew so much that they became an accepted method of payment. In fact, your neighbor just bought his house by transferring purple pearls to the seller. Governments around the globe are looking at the phenomenon with skepticism, fearful that purple pearls, now a widespread, yet unofficial form of payment, will threaten their home currencies. Given the strong demand, the price of purple pearls has steadily increased.

An entrepreneur by the name of Albert Chemy (goes by ‘Al-chemy’ in his inner circle of friends) came up with the idea of founding Micro Purplery, a company incorporated on the Purple Pearl Island with the purpose of buying up purple pearls. The company was financed through an equity raise. Subsequently, the shares were floated through an IPO on the New York Stock Exchange.

At the time of the raise, purple pearls traded for USD 100,000 each. Alchemy announced that he would raise USD 30 million and use the proceeds in two ways. First, he would buy the next two years of new supply—10 pearls a month for 24 months, or 240 pearls. Second, he would buy 60 additional pearls from existing owners. This makes a total of 300 pearls which, at USD 100,000 each, amounts to USD 30 million. To fund the purchase, Alchemy issued 30 million shares at USD 1 each.

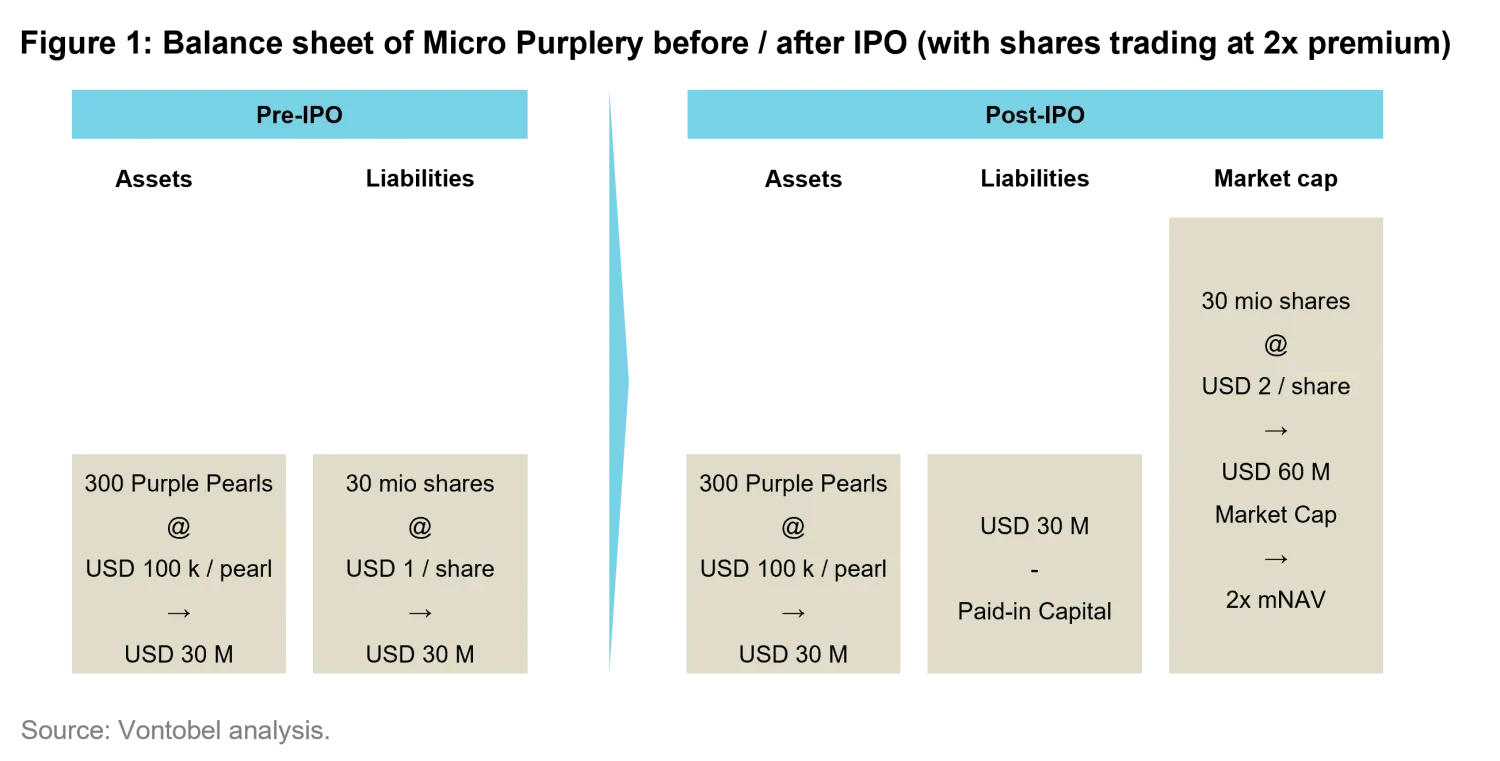

The left side of Figure 1 shows the balance sheet just before the IPO. For simplicity, we booked all 300 purple pearls as if they were already in the company’s vault1.

Each Micro Purplery share represents an indirect ownership of 0.00001 pearls (300 pearls divided by 30 million shares). If the price of a pearl doubles, so would the value of the shares.

After the IPO, shares trade in the secondary market, decoupling from the company’s balance sheet. The USD 30 million originally raised appears as paid-in capital. Micro Purplery made it easy for ordinary investors to join the purple pearl boom. Because the stock was publicly traded, anyone with an online brokerage account could participate. By contrast, setting up a pearl vault—the only option before—was complex and costly.

This convenience drove demand for Micro Purplery stock, lifting the price to USD 2 per share. That meant a two-times premium: the company’s market value of USD 60 million is now twice the USD 30 million of assets. The right side of Figure 1 depicts this premium graphically. In technical terms, we say that stock trades at a multiple of NAV (mNAV) of 2.

2.2 The real world reality

Let’s return to reality and replace purple pearls with Bitcoin—or, more generally, any cryptocurrency. During 2024, most financial regulators around the world adopted a more open stance towards cryptocurrencies. Even so, investors who want exposure to cryptocurrencies still face more obstacles than those investing in equities or bonds. Restrictions include outright bans or heavy tax burdens.

2.2.1 Sheer prohibition

In China, personal ownership of cryptocurrencies remains a grey area. Trading, mining, exchanges, payments and other financial services linked to cryptocurrencies have been banned since September 20215.

Eight other countries also prohibit holding, trading or mining. In Algeria, for example, Law 25-10, passed in July 2025, introduced a blanket ban on issuance, purchase, sale, possession, mining and promotion. Penalties include up to one year in prison and fines between 200,000–1,000,000 Algerian dinars (~USD 1,540–7,700)2. For comparison, the average monthly salary across Algeria is about USD 3173.

Table 1 lists the countries where prohibitions remain significant, together with their legal basis and key penalties.

Table 1. Countries with significant prohibitions: legal basis and key penalties.

| Country | Legal basis & latest development | Key penalties or restrictions |

|---|---|---|

| Algeria2 | Law 25-10 (24 Jul 2025) imposes a blanket ban on issuance, purchase, sale, possession, mining and promotion. | Jail up to 1 year; fines 200,000–1,000,000 DZD (~USD 1,540–7,700). |

| Bangladesh4 | Bangladesh Bank notices under the FX Regulation Act 1947 and AML laws; prohibitions issued 2017 and reiterated 15 Sep 2022. | Enforcement under AML/FX laws; banks barred from facilitating crypto. |

| China (mainland)5 | Joint circular of PBoC and nine agencies (24 Sep 2021) bans trading, mining and exchanges; courts continue to void crypto contracts. | Exchanges closed; mining illegal; contracts unenforceable. |

| Egypt6 | Banking Law 194/2020 forbids issuance, trading or promotion without CBE license (none granted); CBE warning Sep 2022. | Fines up to EGP 10m and prison. |

| Iraq7 | CBI circulars (2017, 2021) bar financial institutions from crypto activity; restrictions confirmed 2025. | Restrictions and AML/CFT prosecutions continue. |

| Nepal8 | NRB notices under the Foreign Exchange Act 1962/2019 BS impose a total ban; reiterated 2021–2022; status unchanged in 2025. | Arrests; website blocks; prosecutions under FX/AML provisions. |

| Qatar9 | QCB and QFCRA classify crypto/stablecoins as “Excluded Tokens”; banking and trading ban continues despite 2024 tokenisation law. | Banks, VASPs and individuals barred; AML penalties apply. |

| Tunisia10 | Central bank statement (2018) and FX/AML rules treat crypto transactions as illegal; no change by 2025. | FX/AML penalties; equipment seizure. |

| Afghanistan11 | Taliban decree (Aug 2022) banned crypto; enforcement ongoing. | Arrests and exchange closures. |

2.2.2 Taxation burdens

In the Netherlands, crypto is taxed under the capital growth (wealth) tax regime, which treats unrealized gains on assets—including crypto—as taxable based on a deemed return12. In India, gains from crypto transactions are taxed at a flat rate of 30 percent under Section 115BBH; only acquisition cost is deductible, and loss set-offs beyond that are generally not allowed13. In Spain, crypto income such as mining or “other income” can be taxed at rates up to about 47 percent, while capital gains (savings base) are taxed at lower progressive rates (≈19–28 percent). Loss offset rules are limited, especially when offsetting against non-investment income14.

In Japan, crypto gains are classified as miscellaneous income, taxed at progressive national rates from 5 percent to 45 percent; on top of that comes the local inhabitant tax15.

3. How do DATs work?

As discussed, digital-asset treasuries (DATs) give investors crypto exposure through a simple, familiar vehicle: the stock of a listed company. That’s the appeal. Because some DATs trade at a premium to their asset value, the press often calls them “intelligent leverage on Bitcoin.” In this section, we unpack that claim—first with a step-by-step illustrative example, then with a mathematical generalization.

Our conclusion is straightforward: when a stock trades at a premium to its net asset value (NAV), any subsequent equity issued at prevailing market price (i.e., preserving the premium) is accretive. That is, existing shareholders automatically get a higher exposure to the underlying asset on the balance sheet.

3.1 Step-by-step example

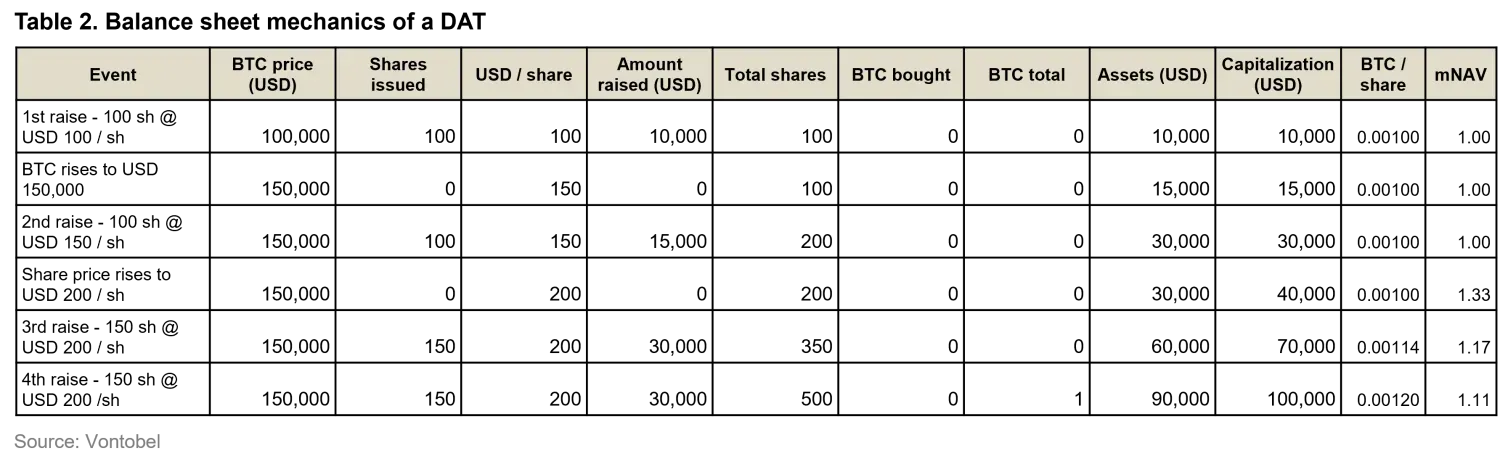

We work through examples and consider what happens to the balance sheet as capital gets raised. Follow the table below, where each row is an event.

3.1.1 First raise

Assume we incorporate a company and issue 100 shares at USD 100 each, raising USD 10,000. The company uses the proceeds to buy Bitcoin. With BTC priced at USD 100,000, it acquires 0.1 BTC. Divided across 100 shares, each share represents 0.001 BTC. John, a shareholder who bought 10 shares for USD 1,000, owns exposure to 0.01 BTC. If he had bought Bitcoin directly, he would also have held 0.01 BTC. His indirect exposure to Bitcoin through shares is therefore identical to an outright purchase for the same dollar amount.

In this setup, the company’s market capitalization equals the value of its Bitcoin holdings. There is no premium. We report this premium in the last column of the table as the ratio between market capitalization and asset value, denoted as mNAV.

3.1.2 BTC rises

If BTC rises to USD 150,000, and valuation remains fair, the company’s shares adjust to reflect the higher asset value. Each share now trades at USD 150. Fair valuation means that the company’s market capitalization equals its book value—that is, the value of the assets on its balance sheet.

3.1.3 Second raise

Now assume the company raises additional capital to buy more BTC. With shares now trading at USD 150, the raise takes place at that price. Because the issue occurs at the prevailing market level, it is called an at-the-money (ATM) raise. If demand is sufficient, there is no reason to issue shares below the market price—that would leave money on the table and give up more ownership than necessary.

As the table shows, nothing unusual happens. The company raises enough to buy an additional 0.1 BTC, bringing its holdings to 0.2 BTC. Asset value increases in line with the capital raised. BTC per share remains 0.001, and the company’s market capitalization equals the value of its assets. The mNAV stays at 1.

3.1.4 Share price rises

Now assume the stock price rises to USD 200 simply because buyers outnumber sellers. As noted earlier, DATs offer investors convenient exposure to cryptocurrencies, which can justify a “convenience premium.” Paying more than the fair value of the underlying assets is acceptable if the process to acquire exposure is made easier.

At this point, market capitalization exceeds the value of the assets: mNAV rises above 1. Beyond the convenience argument, other factors can explain the premium. Investors may believe BTC prices will move higher and price the stock on future potential rather than current value. Since equities are typically valued on expectations, it is not surprising that DAT shares can be seen through the same lens. The premium (mNAV), as one can calculate from the table above, is now 1.33.

3.1.5 Third raise

Assume the company raises capital again. Because a premium exists (mNAV > 1), the impact on existing shareholders is noteworthy. The company issues 150 shares at USD 200 each, raising USD 30,000. With BTC at USD 150,000, the proceeds buy 0.2 BTC, bringing total holdings to 0.4 BTC. Divided across 350 shares, each now represents 0.00114 BTC. This is where leverage appears. An investor who joined the previous raise initially held 0.001 BTC per share; after the third raise, the same share entitles the investor to an indirect exposure of 0.00114 BTC. Exposure rises without the investor taking any action. Meanwhile, the premium compresses. mNAV falls from 1.33 to 1.17, even though BTC prices remain unchanged. The reduction stems solely from the new issue.

For investors familiar with derivatives, this resembles a call option: the effective exposure to the underlying asset—measured by the option’s delta—increases as the asset price rises. Let’s continue and raise capital once more.

3.1.6 Fourth raise

We now reach the fourth ATM raise. Because a premium is still in place, BTC per share rises again—even though neither the BTC price nor the share price changes. This can be verified in the row “4th raise” of the table. The mechanics mirror those of the previous raise.

The only shift is in the premium. mNAV falls from 1.17 to 1.11. The pattern is now clear: equity raises conducted while mNAV > 1 increase investors’ BTC per share but compress the premium. Leverage rises, the premium falls. The conclusion is straightforward. If a premium exists and new capital is raised at that premium, existing shareholders gain in that their BTC per share increases.

In our example DAT, investors can build wealth in two ways: first, if BTC prices rise; and second, if leverage increases through capital raised while a premium persists.

3.2 Mathematical formalism

Let \(\pi_t\) denote the premium at time \(t\), defined as the ratio between market capitalization and asset value:

$$ \pi_t \;=\; \frac{s_t \cdot p_{s,t}}{\,b_t \cdot p_{b,t}\,} \tag{1} $$

where \(s_t\) and \(b_t\) denote the number of shares outstanding and the number of BTC held at time \(t\), respectively, and \(p_{s,t}\) and \(p_{b,t}\) denote the share price and BTC price at time \(t\), respectively. Define the BTC-per-share ratio:

$$ bps_t \;=\; \frac{b_t}{s_t}. \tag{2} $$

We can rewrite the premium as:

$$ \pi_t \;=\; \frac{\,p_{s,t}/p_{b,t}\,}{\,bps_t\,}. \tag{3} $$

Assuming we raise \(\Delta s\) shares at the prevailing price \(p_{s,t}\) and buy BTC at price \(p_{b,t}\), the new BTC per share becomes:

$$ bps_{t+1} = \frac{b_{t+1}}{s_{t+1}} = \frac{b_t + \Delta b}{s_t + \Delta s} = \frac{\,b_t/s_t \;+\; (\Delta s/s_t)\cdot (p_{s,t}/p_{b,t})\,}{\,1 + \Delta s/s_t\,}. \tag{4} $$

Using \(\nu = \Delta s/s_t\) and substituting \(p_{s,t}/p_{b,t}\) via (3) gives:

$$ bps_{t+1} \;=\; bps_t \cdot \frac{\,1 + \nu \cdot \pi_t\,}{\,1 + \nu\,}. \tag{5} $$

So long as \(\pi_t > 1\) (i.e., mNAV > 1), we have \(bps_{t+1} > bps_t\). In other words, as long as a premium persists, any subsequent ATM raise increases leveraged exposure.

4. How big is the market?

DATs were born on August 11, 2020, when Michael Saylor, CEO of MicroStrategy (later renamed Strategy, ticker: MSTR), announced via an SEC filing and a press release that the company had purchased Bitcoin as part of a “new capital allocation strategy, which seeks to maximize long-term value for our shareholders.”16

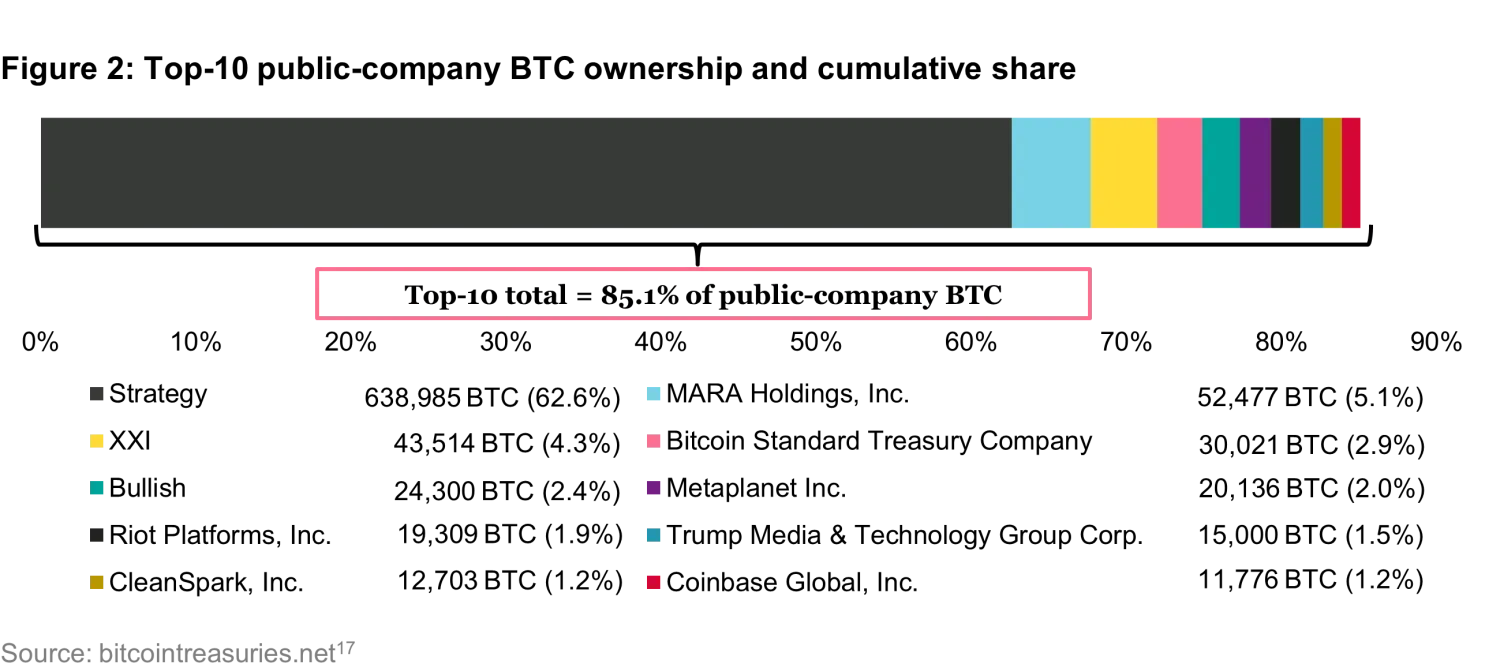

As of September 2025, 178 listed companies collectively hold 989,926 Bitcoin valued at about USD 107 billion, according to Bitcointreasuries.net17. Figure 2 reports the cumulative ownership of the top 10 Bitcoin DATs, along with their individual share of total Bitcoin held (across all Bitcoin DATs).

Strategy was the first to pioneer the business model and still leads by a wide margin. It holds 638,985 BTC, valued at about USD 68 billion, which represents 62.6 percent of all Bitcoin held by listed companies. Mara Holding (ticker: MARA), the second-largest holder, owns 52,477 BTC—less than one-tenth of Strategy’s stake.

Bitcoin ETFs emerged later than DATs but grew their holdings faster. The first Bitcoin ETF was launched in Canada in February 2021: the Purpose Bitcoin ETF (ticker: BTCC) listed on the Toronto Stock Exchange. This was the world’s first physically settled (spot) Bitcoin ETF18.

In the United States, the first Bitcoin ETF was the ProShares Bitcoin Strategy ETF (ticker: BITO), which began trading on the New York Stock Exchange on October 19, 2021. Unlike BTCC, it is based on Bitcoin futures, not physical Bitcoin. Spot Bitcoin ETFs in the United States were not approved until January 202419.

As of August 28, 2025, the 12 ETFs tracked by Bitbo.io hold about 1.29 million BTC, equal to 6.1 percent of the total 21 million BTC supply. By comparison, the 178 public treasury companies together hold 989,926 BTC, or 4.7 percent of supply20.

5. How is the market evolving?

5.1. Holdings growth

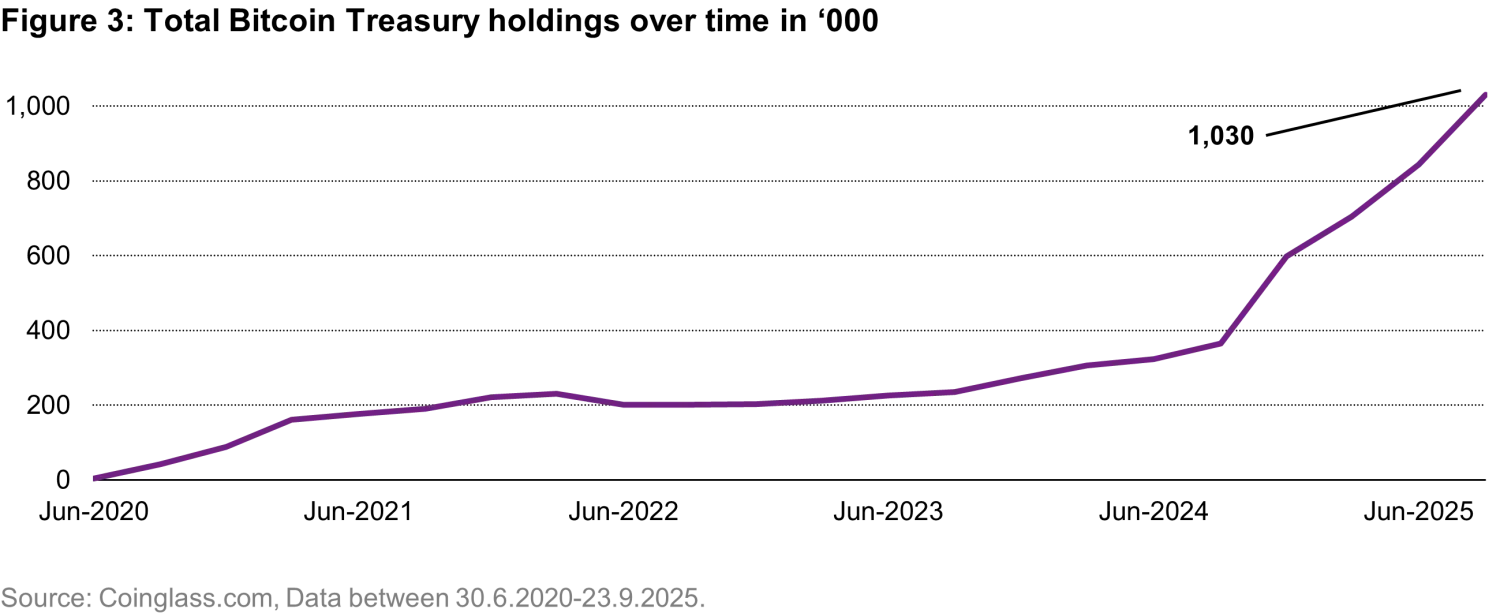

Bitcointreasuries.net reports BTC holdings by owner type, such as ‘governments’ and ‘public companies’, and tracks them over time. Figure 3 shows the evolution of BTC held by public companies. All DATs fall into the ‘public companies’ category, but the reverse is not true. Many firms with conventional operations have also started to accumulate BTC to diversify their cash balances, without making cryptocurrency their primary business focus.

Holdings of Bitcoin by institutional treasuries have risen sharply since 2020. Figure 3 shows an early surge in 2020–2021, a period of consolidation during the 2022 downturn, and renewed accumulation from 2023 onward. By September 2025, combined holdings reached about 3.7 million BTC, equal to nearly 18 percent of total supply21. This trend underlines how Bitcoin has shifted from a niche corporate experiment into a mainstream treasury asset across companies, funds and even governments.

As of September 23, 2025, Coinglass.com reported that public companies collectively hold just over 1 million Bitcoin (BTC). By contrast, global Bitcoin ETFs that hold physical Bitcoin (spot ETFs) own 1,381,685 BTC, or 6.6 percent of Bitcoin’s total supply of 21 million22. The United States dominates global ETF holdings, accounting for 94.8 percent, or 1.31 million BTC. Canada leads international markets with 51,000 BTC23.

In our view, the convenience argument that once supported DATs is no longer credible. ETFs now offer investors an equally easy, and economically cleaner way to participate in Bitcoin’s upside.

5.2. Diversification creativity

Beyond raising capital to increase their Bitcoin holdings, DATs are evolving in two notable ways.

First, they are becoming more creative in the types of instruments used to raise funds. Strategy leads here, offering a wide range that includes convertible senior notes, convertible preferred stock, senior secured notes and at-the-market equity offerings. The firm argues that diversifying instruments helps attract a broader set of investors, each with different objectives and risk tolerances. In the words of Strategy:

“By coming to market with zero-coupon convertibles, perpetual preferred stock and at-the-market equity, we create instruments tailored for every investor profile. Some seek volatility and upside, others want steady yield and lower risk. This approach allows us to tap different pools of capital at the right moment—maximizing our ability to accumulate Bitcoin while giving investors access to returns suited to their needs. The more routes we build into Strategy, the bigger and more resilient our Bitcoin engine becomes”.

Second, some public companies are pivoting into DATs for cryptocurrencies beyond Bitcoin, such as Ethereum (ETH) and Solana (SOL). According to The Block, seven ETH DATs hold 2.73 million coins as of August 31, 2025—an increase of 733 percent from 36,700 coins on March 31, 202524.

In addition to BTC, ETH and SOL, DATs now exist for BNB, XRP, HYPE, TON, XMR and SKY. We expect this trend to continue.

6. Have we seen this before?

As we saw, DATs can trade at a premium to NAV. The market often justifies this as the extra investors are willing to pay for convenience: “I can get crypto exposure by clicking on my screen and buying a stock instead of going through the pain of opening wallets, with the risk of being hacked or making mistakes”.

This is not the first time in financial history that investor demand for a hard-to-access asset was channeled into vehicles that were convenient in the short term, but not sustainable in the long-term.

In a blog series worth studying in detail, BeWater draws on J.K. Galbraith’s The Great Crash, 1929 and highlights similarities between DATs and investment trusts, a corporate invention of the 1920s that helped fuel the crash of 192925.

The history of the Grayscale Bitcoin Trust and, earlier, the Central Fund of Canada (CEF) and Central GoldTrust also provide instructive examples. We now turn to these cases to explore what lessons they may hold.

6.1. Investment trusts

Stocks have been around for centuries, with some historians tracing their origins as far back as the Bronze Age. In Mesopotamia, clay tablets recorded contracts that set profit shares for expeditions, based on each investor’s contribution. The first official stock exchange opened in Amsterdam in 1602.

Yet at the turn of the 20th century, it was far from easy for the public to own or trade stocks. For one, there were not many shares available compared to the demand at the time. More importantly, they were hard to buy. With no electronic systems, investors had to visit brokerage firms—few in number—bring cash and walk out with paper stock certificates. Building a diversified portfolio required repeating the process several times. It was cumbersome and costly.

Investment trusts were created to solve the problem of access. By buying one share in an investment trust, investors gained exposure to a diversified portfolio of companies while delegating the operational effort. As Galbraith put it: “The investment trust did not promote new enterprises or enlarge old ones. It merely arranged that people could own stock in old companies through the medium of new ones”.

The investment trust was the grandfather of the mutual fund. Unlike modern funds, however, trusts often traded at a multiple of NAV. Investors were willing to pay more than the assets were worth for the convenience.

BeWater highlights a striking example from The Magazine of Wall Street, published on September 21, 1929—just weeks before the crash of October 29. The magazine recommended the following guidelines for selecting trusts: “Shares of an investment company capitalized with common stock only and earning 10 percent net on invested capital might be fairly priced at 40 percent to 50 percent in excess of share liquidating value [equivalent to an mNAV of between 1.4 and 1.5]. If the past record of management indicates that it can average 20 percent or more on its funds, a price of 150 percent to 200 percent above liquidating value might be reasonable.... To evaluate an investment trust common stock, preceded by bonds or preferred stock, a simple rule is to add 30 percent to 100 percent, or more, depending upon one’s estimate of the management’s worth, to the liquidating value of the investment company’s total assets”.

As shown earlier, a stock trading at a multiple of NAV creates the premise for what we called ‘accretive dilution’. That is, issuing new shares at a prevailing premium (and using proceeds to buy more Bitcoin) increases leverage to existing investors. Investment trust managers in the 1920s understood this well. If one investment trust offered leverage, then a trust owning other trusts offered even more (you can verify this mathematically: the combined mNAV is the product of the two nested mNAVs). The result was a pyramid of nested ownerships.

Goldman Sachs pioneered this structure. Waddill Catchings, a partner at the firm, launched the Goldman Sachs Trading Corporation (GSTC) in December 1928 with an initial capitalization of USD 100 million—the largest investment trust ever created at the time. The public rushed in, bidding the stock from USD 104 per share (at issuance) to USD 226, well above NAV.

Economists J. Bradford DeLong and Andrei Shleifer, in their paper The Stock Market Bubble of 1929: Evidence from Closed-end Mutual Funds, documented how these pyramids were built. They note that GSTC’s largest holdings included the Shenandoah Corporation—another Goldman-created closed-end fund—which in turn organized the Blue Ridge Corporation. Each fund traded at a premium, so at the top of the pyramid GSTC was trading at “a premium to a premium to a premium to net asset value.”

Galbraith captured the mood in The Great Crash of 1929: “It is difficult not to marvel at the imagination which was implicit in this gigantic insanity. If there must be madness, something may be said for having it on a heroic scale”.

6.2. Gold trusts

Before the advent of gold ETFs, gaining exposure to gold was cumbersome. Investors had to buy physical bars in specific denominations, arrange bank custody, or trade gold futures—whose standard contract size is 100 troy ounces. At today’s price of around USD 3,000 per ounce, that equals USD 300,000 of notional exposure, well beyond the reach of many.

The Spicer family solved this access problem with the Central Fund of Canada and the Central GoldTrust. These closed-end trusts sold units to investors and used the proceeds to buy and store bullion. In the early 2000s, the units often traded at a premium.

This changed with the arrival of gold ETFs. Gold Bullion Securities launched in Australia in March 2003, followed by SPDR Gold Shares (GLD) in the United States in November 200426. With better terms, price transparency and liquidity, ETFs quickly displaced the gold trusts as preferred investment vehicle. Gold trusts started trading at a persistent discount. Eventually, Sprott Inc. acquired and merged the gold trust into the Sprott Physical Gold Trust (PHYS)27.

6.3. Grayscale trust

The Grayscale Bitcoin Trust (GBTC) launched in September 2013 as a private, open-ended trust for accredited investors. It began trading publicly in May 2015 under the ticker GBTC, becoming the first regulated vehicle that allowed institutional and traditional investors to gain Bitcoin exposure28.

At a time when setting up a Bitcoin wallet was more complex, GBTC solved a genuine access problem. The shares often traded at a large premium to the underlying Bitcoin. Accredited investors could exchange Bitcoin for GBTC shares during private placements, creating an almost risk-free arbitrage. If the mNAV was 2x, for example, an investor could deliver USD 100,000 worth of Bitcoin, receive shares valued at USD 200,000, and sell them in the open market after a lock-up period.

Three Arrows Capital (3AC) took the trade to extremes, borrowing heavily to amplify returns. When Bitcoin prices fell and GBTC’s mNAV shifted from a premium to a discount, 3AC was forced to liquidate. This accelerated the collapse of the premium and left GBTC trading at a persistent discount. The trust was eventually converted into a Bitcoin ETF, with its mNAV reset to 129.

6.4. History teachings

6.4.1. Convenience premium

The lesson is clear. Multiples over NAV in pooled investment vehicles can be justified when mainstream investors have no easy way to access a new asset class. We call this the ‘convenience’ premium. Today, however, with the proliferation of cryptocurrency ETFs, which provide exposure that is just as convenient—and arguably more direct—we do not see many compelling reasons for the convenience premium to persist in the long-run.

6.4.2. Skill premium

Another possible explanation for a premium is that investors believe that the management of DAT companies can create value above the value of the underlying assets. We call this the ‘skill’ premium.

Berkshire Hathaway offers a useful case study. The firm is publicly traded and holds stakes in a wide range of other listed companies. Under Warren Buffett and Charlie Munger—unarguably very skilled investors—Berkshire mostly traded at a premium. Note that most conglomerates historically trade at a discount to NAV, highlighting the fact that investors prefer focused businesses, and ascribe little value to the synergies of conglomerates.

Despite the premium, Berkshire’s board amended the buyback policy in July 2018, removing the price-to-book limitation and allowing repurchases whenever Warren Buffett and Charlie Munger believed shares traded below intrinsic value30. Since then, Berkshire has traded at premia of 30 to 80 percent above book value. The company has authorized USD 77.8 billion in buybacks under this revised framework—more than double Buffett’s investment in any other single stock31.

As of 22nd September 2025, Berkshire traded at approximately 1.60 times book value, a substantial premium. Over the past 13 years, its price-to-book ratio has ranged from 0.98 to 1.78, with a median of 1.40. Currently trading near the higher end of this range, Berkshire’s valuation reflects a premium that has prevented buybacks for four consecutive quarters32.

Berkshire has delivered exceptional long-term returns. From 1965 to 2024, book value per share compounded at 18.3 percent annually, compared with the S&P 500’s 10.4 percent. This performance translates into a 5,502,284 percent total return versus 39,054 percent for the index—meaning that USD 1,000 invested in 1965 would have grown to USD 44.7 million in Berkshire versus USD 342,906 in the S&P 50033.

Unlike most conglomerates, which typically trade at a 13 to 15 percent discount compared with more focused competitors, Berkshire has historically been one of the few star ‘performers’ to escape the conglomerate penalty. Its distinct structure and management approach have helped it avoid the inefficiencies that often weigh on overdiversified firms34.

7. How do premia evolve?

A 2025 report by Animoca Brands found that stocks of firms announcing crypto treasury pivots into altcoins surged by 150 percent on average within 24 hours, 185 percent within a week, and 226 percent within a month35. The long-term picture, however, is less favorable.

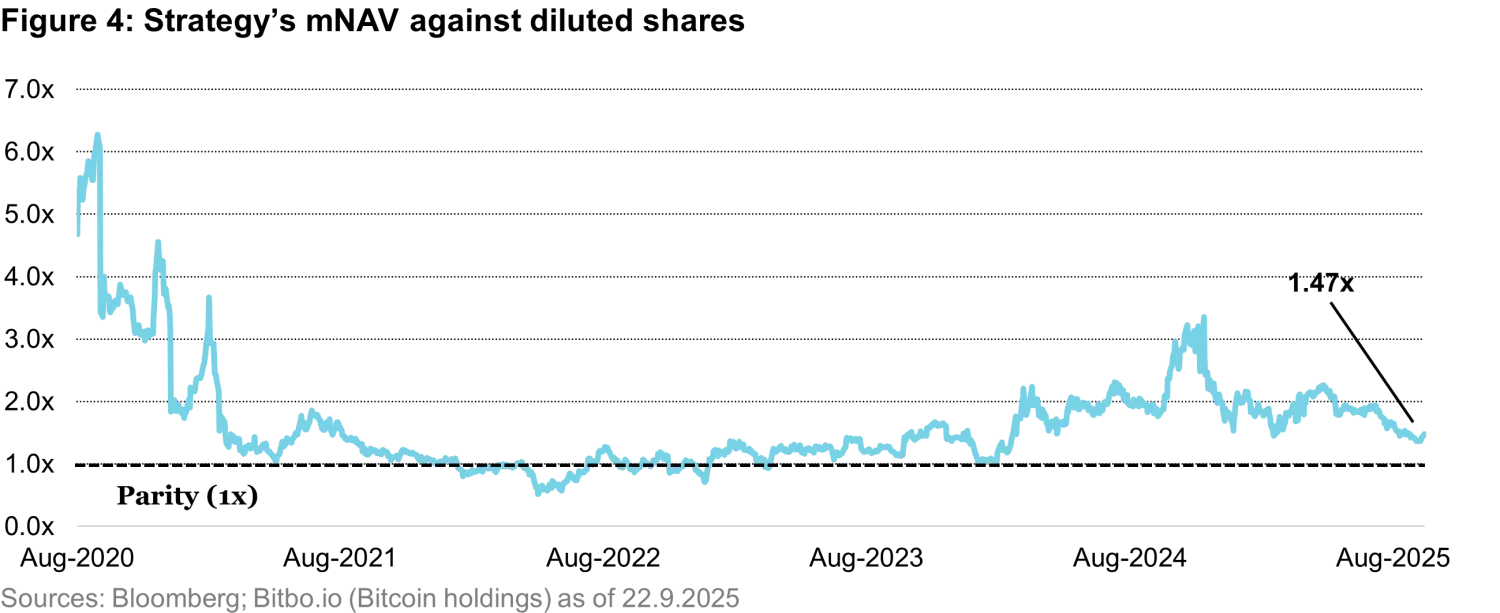

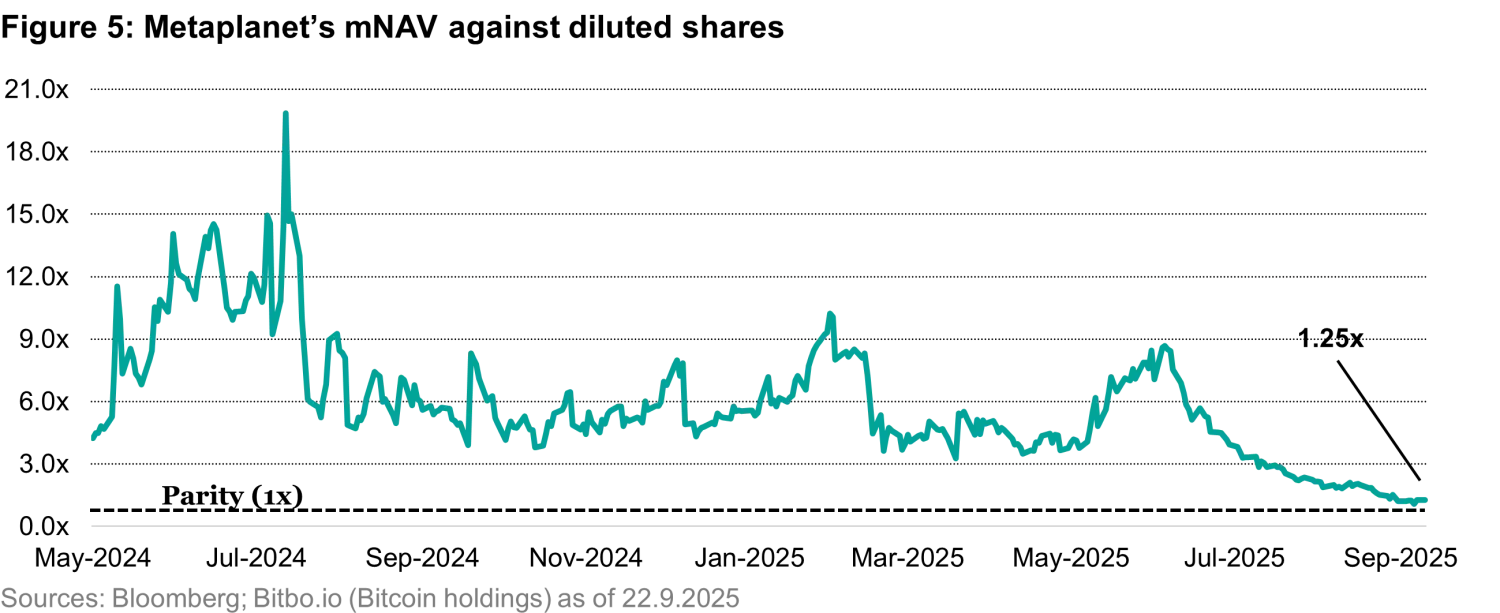

Figures 4 and 5 show the evolution of mNAV for the two largest Bitcoin DATs, Strategy and Metaplanet. Strategy’s mNAV peaked at 6.28x on September 7, 2020, before declining steadily to 1.47x on September 22, 2025. Metaplanet’s mNAV reached 19.84x on July 24, 2024, and has since fallen to 1.25x as of September 22, 202536.

There are also more extreme short-term cases. QMMM Holdings, a Hong Kong–based firm, saw its stock price surge by 3,816 percent from the close on Friday, September 12, 2025, to an intraday peak on Tuesday, September 16. The company, which owns two subsidiaries—Quantum Matrix and ManyMany Creations—had been fending off delisting notices when its pivot into crypto holdings was announced. The news propelled QMMM’s market capitalization from USD 141 million to USD 4.9 billion in just a few days37.

Evidence also suggests that after the initial surge and subsequent correction, prices tend to stabilize at levels still higher than those preceding the announcement.

8. Market oversight

Architect Partners quantified the rapid expansion of the DAT sector. They report that 154 U.S.-listed companies have announced plans to raise nearly USD 100 billion for bitcoin treasuries since January 2025, compared with just USD 34 billion from 10 firms in prior years38. These figures exclude treasuries targeting cryptocurrencies other than bitcoin, which implies that the total capital raised for digital asset treasuries is substantially higher.

On September 5, 2025, Nasdaq issued new rules requiring its listed companies to seek shareholder approval before raising capital to fund cryptocurrency purchases. Non-compliance may result in trading suspension or delisting. This requirement complicates opportunistic fundraising, as research suggests that unexpected announcements of treasury pivots lead to stronger price increases39.

Concerns about DATs have also been reinforced by index providers. Standard & Poor’s decision not to include Strategy in the S&P 500 Index, despite the company meeting quantitative inclusion criteria, has been widely interpreted as a deliberate refusal to extend institutional legitimacy to the DAT model40.

9. Conclusion

In this paper, we have provided investors with data and arguments to enable an informed view on DATs. The ongoing operational challenges of gaining cryptocurrency exposure, and unfavorable tax regimes in many jurisdictions, remain valid arguments for choosing the DAT route. Even with ETFs and futures now available, access is not always easy outside of U.S. markets.

DATs built on non-Bitcoin assets may offer attractive yields—like staking income—that are often complex or poorly taxed in traditional investment vehicles. Yield-generating assets like Ethereum and Solana offer additional features that may be hard for cryptocurrency holders to take advantage of. The management of DATs can do what’s needed to generate a yield, passing on the benefits to shareholders as dividends or capital gains.

We also showed that shareholders in DATs trading at a premium also enjoy efficient leverage through capital raises, so long as these occur through an at-the-money raise and an mNAV premium exists. We can see how DATs tightly integrated with operational crypto businesses, like miners, may benefit from financial engineering synergies. To see this, consider how a Bitcoin mined by a DAT owning a mining business lands in treasury assets directly.

That said, we remain bearish on the DAT business model as a long-term investment proposition. We expect crypto exposure to become easier, purer, and more broadly accessible over time—making DATs a transitional phenomenon, not a sustainable solution. When access is no longer a bottleneck, there’s no compelling reason to accept DAT premia.

The ‘efficient leverage’ argument can only stand while premia persist. If DATs trade at NAV (mNAV = 1) or, worse, at a discount, the proposition vanishes. Increasing leverage for existing shareholders through subsequent equity raises only works if the DAT trades at a premium (and if you find investors willing to invest, of course). If the premium disappeared, the proposition quickly fades. We acknowledge that DATs trading at a discount to NAV (mNAV < 1) may become acquisition targets, giving a lifeline to investors who may have entered while a premium existed.

All in all, the proposition seems fragile to us, or transitory at best. And if a realization of the long-term unviability of the DAT business model were to materialize soon, the ensuing deleveraging may precipitate the blockchain ecosystem into yet another crypto winter, leading institutional investors to freeze deploying capital into much-needed further experimentation.

On a personal note, two déjà vu moments stand out. First, those one-day price ‘pops’ on the announcement of a DAT pivot reminded us of the dot-com bubble, when companies with little substance (or revenues, if any) shot up 100 percent on the day of the IPO just because of their ‘dot.com’ label. Second, Strategy’s increasingly creative approach of diversifying its liability side with preferred equity, convertibles and debt led to structures that remind us of the tranches of collateralized mortgage obligations (CMOs) in 2007. Back then, sub-prime assets were artificially ‘cut’ into AAA, AA tranches and so forth, providing a false sense of security. The debacle of CMOs in 2008 reminded us that if the underlying asset were to fall too much and too quickly, no ‘tranching’ would protect investor capital.

Any information regarding digital currencies is provided in a limited capacity as it is incidental to our advisory business and investment strategies. This document was produced by one or more companies of the Vontobel Group (collectively "Vontobel") for institutional clients. This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. Views expressed herein are those of the authors and may or may not be shared across Vontobel. Content should not be deemed or relied upon for investment, accounting, legal or tax advice. Past performance is not a reliable indicator of current or future performance. Investing involves risk, including possible loss of principal. Diversification does not ensure a profit or guarantee against loss. References to companies provided for illustrative purposes only to address the subject matter discussed. References to these companies should not be considered a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the profitability or performance of any security associated with them. Where indicated, examples are for illustrative purposes only and should not be considered as a reliable indicator of current and/or future events. Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law.

References

1. In practice, only 60 pearls would qualify as assets at the IPO date. The remaining 240, tied to the supply agreement, should be recorded as receivables. This accounting detail does not change our argument.

2. Algeria — Law 25-10 (24 Jul 2025); fines 200,000–1,000,000 DZD (~USD 1,540–7,700). Cryptobriefing, “Algeria Bans All Crypto Activity.” Accessed Sep 2025. cryptobriefing.com/algeria-crypto-ban-legislation. See also Lightspark, “Is Crypto Legal in Algeria? Regulations & Compliance in 2025,” accessed Sep 2025, lightspark.com/knowledge/is-crypto-legal-in-algeria.

3. Average monthly salary in Algeria ≈ 42,848 DZD (~USD 317). RemotePeople, “Average Salary in Algeria 2025.” Accessed Sep 2025. remotepeople.com/countries/algeria/average-salary. 4. Bangladesh — Bangladesh Bank notices under the FX Regulation Act 1947 and AML laws; prohibitions reiterated 15 Sep 2022. Lightspark, “Is Crypto Legal in Bangladesh? Regulations & Compliance 2025,” Sep 11, 2025. lightspark.com/knowledge/is-crypto-legal-in-bangladesh.

5. China (mainland) — Joint PBoC/agency circular (24 Sep 2021) banning trading, exchanges and mining; enforcement ongoing. Lightspark, “Is Crypto Legal in China? Regulations & Compliance in 2025,” Sep 11, 2025. lightspark.com/knowledge/is-crypto-legal-in-china.

6. Egypt — Banking Law 194/2020; CBE warning Sep 2022. Lightspark, “Is Crypto Legal in Egypt? Regulations & Compliance in 2025,” Aug 21, 2025. lightspark.com/knowledge/is-crypto-legal-in-egypt.

7. Iraq — CBI circulars (2017, 2021); restrictions reconfirmed 2025. Lightspark, “Is Crypto Legal in Iraq? Regulations & Compliance in 2025,” Sep 11, 2025. lightspark.com/knowledge/is-crypto-legal-in-iraq.

8. Nepal — NRB notices (2017, 2021–22) under Foreign Exchange Act; full ban maintained. Coinfomania, “Cryptocurrency Regulations in Nepal: Ban, Challenges & Future Outlook,” Jun 18, 2025. coinfomania.com/cryptocurrency-regulations-in-nepal-ban-challenges-future-outlook.

9. Qatar — QCB & QFCRA rules classify crypto/stablecoins as “Excluded Tokens”; banking/trading ban. Lightspark, “Is Crypto Legal in Qatar? Regulations & Compliance in 2025,” Sep 11, 2025. lightspark.com/knowledge/is-crypto-legal-in-qatar.

10. Tunisia — BCT statement (2018); FX/AML treatment as illegal. Lightspark, “Is Crypto Legal in Tunisia? Regulations & Compliance in 2025,” Sep 2025; and Coinfomania, “Cryptocurrency Regulations in Tunisia,” Jun 2025. lightspark.com/knowledge/is-crypto-legal-in-tunisia — coinfomania.com/cryptocurrency-regulations-in-tunisia.

11. Afghanistan — Taliban decree (Aug 2022) banning crypto; enforcement via arrests and exchange closures. Al Jazeera, “Taliban Ban Cryptocurrency in Afghanistan,” Aug 27, 2022. aljazeera.com/news/2022/8/27/taliban-ban-cryptocurrency-afghanistan.

12. Netherlands — Box 3 reform (from 2025) taxes presumed/unrealized returns incl. crypto. KPMG, Flash Alert 2025-116. kpmg.com/xx/en/our-insights/gms-flash-alert/flash-alert-2025-116.html.

13. India — Section 115BBH: 30% flat tax on gains from virtual digital assets; limited offsets. Cryptact, “How crypto is taxed in India.” cryptact.com/en/blog/how-crypto-is-taxed-in-india-flat-rate-30-gains-tax-1-tds-and-no-loss-offset-rule-en.

14. Spain — AEAT rules: “other income” up to ~47%; savings/cap gains 19–28%; limited offsets. Kraken, “Spain Crypto Tax Guide.” kraken.com/learn/spain-crypto-tax-guide.

15. Japan — Crypto profits as miscellaneous income; 5–45% national + local inhabitant tax. Global Legal Insights, “Blockchain & Cryptocurrency Laws and Regulations — Japan.” globallegalinsights.com/practice-areas/blockchain-cryptocurrency-laws-and-regulations/japan.

16. Strategy (MicroStrategy), Form 8-K filing with SEC and press release, Aug 11, 2020. sec.gov/Archives/.../d104510d8k.htm

17. Bitcointreasuries.net, “Public Companies with Bitcoin Treasuries” (accessed Sep 2025). bitcointreasuries.net

18. Reuters (2024). “A decade-long journey: US spot bitcoin ETF.” reuters.com/technology/decade-long-journey-us-spot-bitcoin-etf-2024-01-10/

18. ProShares (2021). “ProShares to launch the first U.S. bitcoin-linked ETF.” proshares.com/press-releases/proshares-to-launch-the-first-u.s.-bitcoin-linked-etf-on-october-19

19. ProShares (2021). “ProShares to launch the first U.S. bitcoin-linked ETF.” bitbo.io/treasuries/historical-total/

22. Bitcointreasuries.net. “Public Company Bitcoin Holdings.” Accessed Sep 16, 2025. bitcointreasuries.net

23. Bitbo.io. “Bitcoin ETF Holdings.” Accessed Sep 2025. bitbo.io

24. The Block. “Crypto Treasuries: Institutional Holdings of ETH and SOL.” Accessed Aug 31, 2025. theblock.co/data/treasuries/crypto-treasuries

25. BeWater (2025). “Bitcoin Treasury Companies.” Accessed Sep 2025. bewaterltd.com/p/bitcoin-treasury-companies

26. World Gold Council / Gold Bullion Securities. “Gold Bullion Securities (ASX: GOLD) launch materials.” March 2003. (Product launch materials / archives.)

27. SPDR Gold Shares. “SPDR® Gold Shares (GLD) Launch Announcement.” November 2004. (Sponsor announcement / archives.)

28. Grayscale. “Grayscale Bitcoin Trust (GBTC) Fact Sheet / History.” Accessed Sep 2025. grayscale.com/products/grayscale-bitcoin-trust

29. SEC. “Order Granting Approval of Listing of Spot Bitcoin ETFs / GBTC conversion.” January 2024. (e.g., NYSE Arca filing / SEC order.)

30. Berkshire Hathaway. “Berkshire Hathaway Amends Share Repurchase Program.” Jul 17, 2018. berkshirehathaway.com/news/jul1718.pdf

31. Nasdaq. “Meet the \$1 Trillion Stock Warren Buffett Has Plowed \$77.8 Billion Into Since 2018.” Accessed Sep 2025. nasdaq.com/articles/meet-1-trillion-stock-warren-buffett-has-plowed-778-billion-2018

32. YCharts. “Berkshire Hathaway Price to Book Value.” Accessed Sep 2025. ycharts.com/companies/BRK.A/price_to_book_value

33. Morningstar. “Berkshire Hathaway Inc. Class B Quote.” Accessed Sep 2025. morningstar.com/stocks/xnys/brk.b/quote

34. Wikipedia. “Conglomerate discount.” Accessed Sep 2025. en.wikipedia.org/wiki/Conglomerate_discount

35. CoinDesk. “Public Companies Buying Altcoins? Animoca Brands Report Explores Strategic Shift.” Jul 18, 2025. coindesk.com/business/2025/07/18/public-companies-buying-altcoins-animoca-brands-report-explores-strategic-shift

36. Strategytracker.com. “Strategy (MSTR) and Metaplanet (MTPL) mNAV Data.” Accessed Sep 2025. strategytracker.com

37. Yahoo Finance. “Why QMMM Holdings Stock Skyrocketed.” Sep 16, 2025. finance.yahoo.com/news/why-qmmm-holdings-stock-skyrocketed-175438352.html

38. Architect Partners. “Q2 2025 Crypto M&A and Financing Report.” Accessed Jul 8, 2025. architectpartners.com/q2-2025-crypto-ma-and-financing-report/

39. Liam, Thomas. “Digital Asset Treasuries: Market Reactions and Price Dynamics.” SSRN, Sep 2025. papers.ssrn.com/sol3/papers.cfm?abstract_id=5341421

40. Investopedia. “Strategy Misses S&P 500 Inclusion This Month.” Accessed Sep 2025. investopedia.com/strategy-misses-s-and-p-500-inclusion-this-month-will-it-ever-make-the-cut-11805904