2026: Multi Asset Reloaded - Investors (Still) Need Diversification

Multi Asset Boutique

The year 2026 begins with an interesting market landscape. Equity markets — especially in the United States — have delivered exceptional returns; monetary policy is no longer synchronised across regions; inflation, though easing, remains more volatile than before; and the traditional relationships between asset classes have shifted in ways that challenge long-held assumptions.

Periods like these tempt you into investing more into what works, luring you away from the only free lunch in investing: diversification. But it’s exactly in times like these that you need it again. When a single asset class has dominated performance for years, when traditional hedges behave less reliably, and when macro forces start to pull markets apart rather than push them together, diversification regains its importance not as a theoretical ideal but as a practical necessity.

In this Quanta Byte we examine why 2026 will mark the return of the multi-asset cycle. Not because equities have run out of potential, or because bonds have lost relevance, but because the environment ahead is likely to reward investors who draw on multiple, distinct sources of return, rather than relying on one engine alone.

We focus on three structural shifts shaping our view:

- A decade of extraordinary equity strength — and what it implies for future returns.

- A new inflation regime that challenging government bonds.

- A revival in cross-asset dispersion that reopens opportunities for active, diversified allocation.

Together, these forces outline a simple conclusion: the next stage of the market cycle is unlikely to resemble the last. And in such periods, a, risk-aware multi-asset approach is not merely a defensive choice — it becomes a strategic advantage.

A strong decade behind us

The last decade has been extraordinary for equity investors. Global stocks — and U.S. large caps in particular — have delivered annualised returns of around 14–15%, well above the long-term historical average1. Ultra-low rates, margin expansion and, more recently, enthusiasm around Artificial Intelligence (AI) all supported this powerful run. But markets rarely move in straight lines. Strong returns today often borrow from tomorrow. That does not mean a downturn is imminent; it means starting points matter.

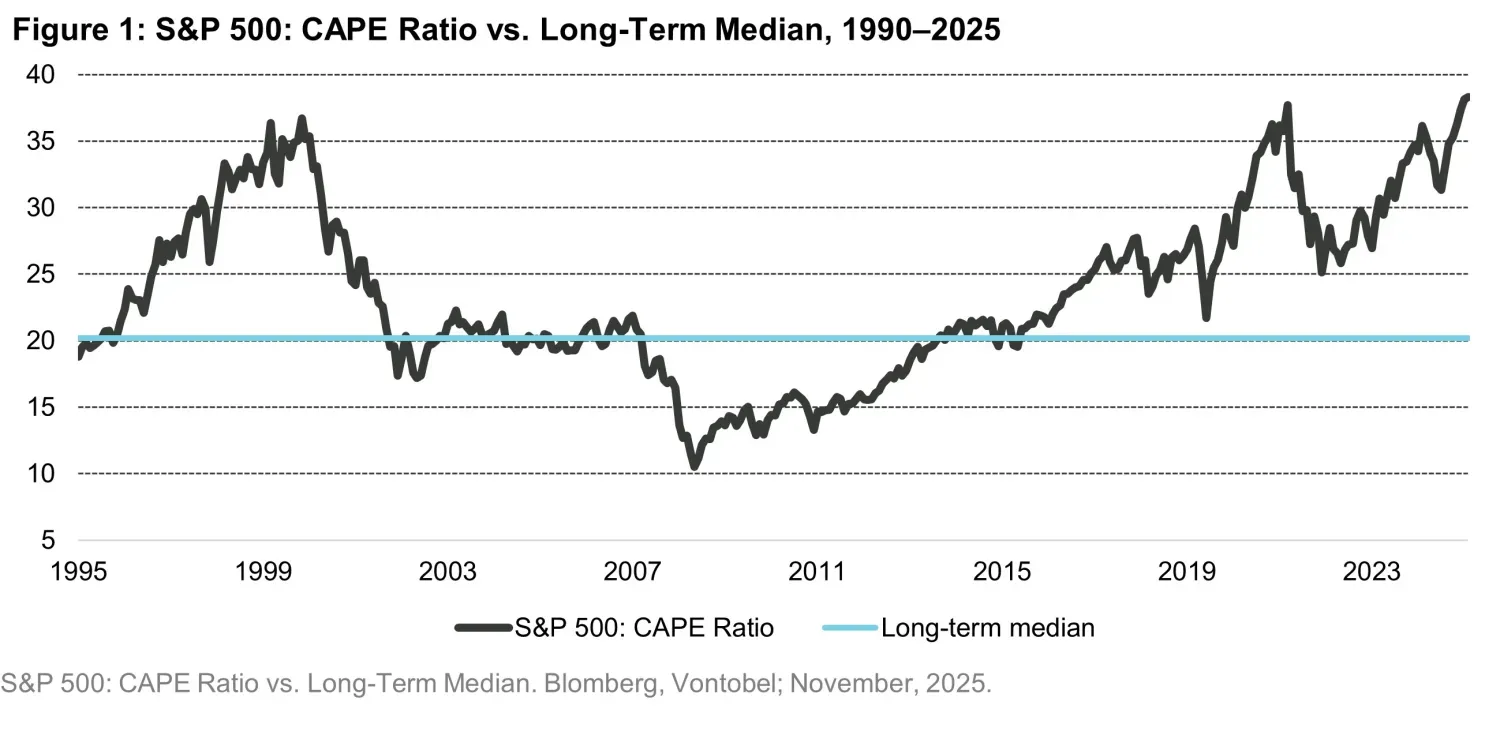

A simple way to see this is through aggregate valuation figures, as shown in Figure 1. The Shiller CAPE ratio — which compares equity prices to ten years of inflation-adjusted earnings — has a long-term median of roughly 16. Today it stands near 39–40, a level exceeded only during the late-1990s tech bubble2.

For investors, the intuition is straightforward: when you pay a higher price for the same earnings, your margin for surprise narrows. Importantly, the Shiller CAPE ratio is not meant to forecast equity returns over the next twelve months, nor to signal what markets will do in 2026 specifically. Valuation metrics like the CAPE ratio are blunt tools for short-term market timing. Their strength lies elsewhere: they provide a disciplined framework for thinking about long-term expected returns and the balance of risks and rewards over a full market cycle. When valuations are elevated, markets can continue to rise — sometimes for years — but the distribution of future outcomes gradually shifts. Upside becomes harder to extend, while the sensitivity to disappointments increases. In other words, valuation does not tell us when returns will moderate, but it does inform us about the return environment investors are likely to face over the coming decade. At the same time, market leadership has become unusually narrow. A handful of mega-cap technology companies now drives a disproportionate share of index performance. When they shine, indices climb fast. When they wobble, most portfolios feel it immediately3.

Put together, these conditions — high valuations, exceptional past performance, narrow leadership — make it harder to rely on one engine alone. Multi-asset investing recognizes that when the dominant engine of market performance slows or shifts, a diversified approach allows investors to better navigate market rotations and capitalize on new opportunities. By adding bonds, commodities, currencies and alternatives, a multi-asset approach keeps portfolios exposed to growth while reducing their dependence on a single, fully priced segment of the market.

When the Old Hedge Breaks

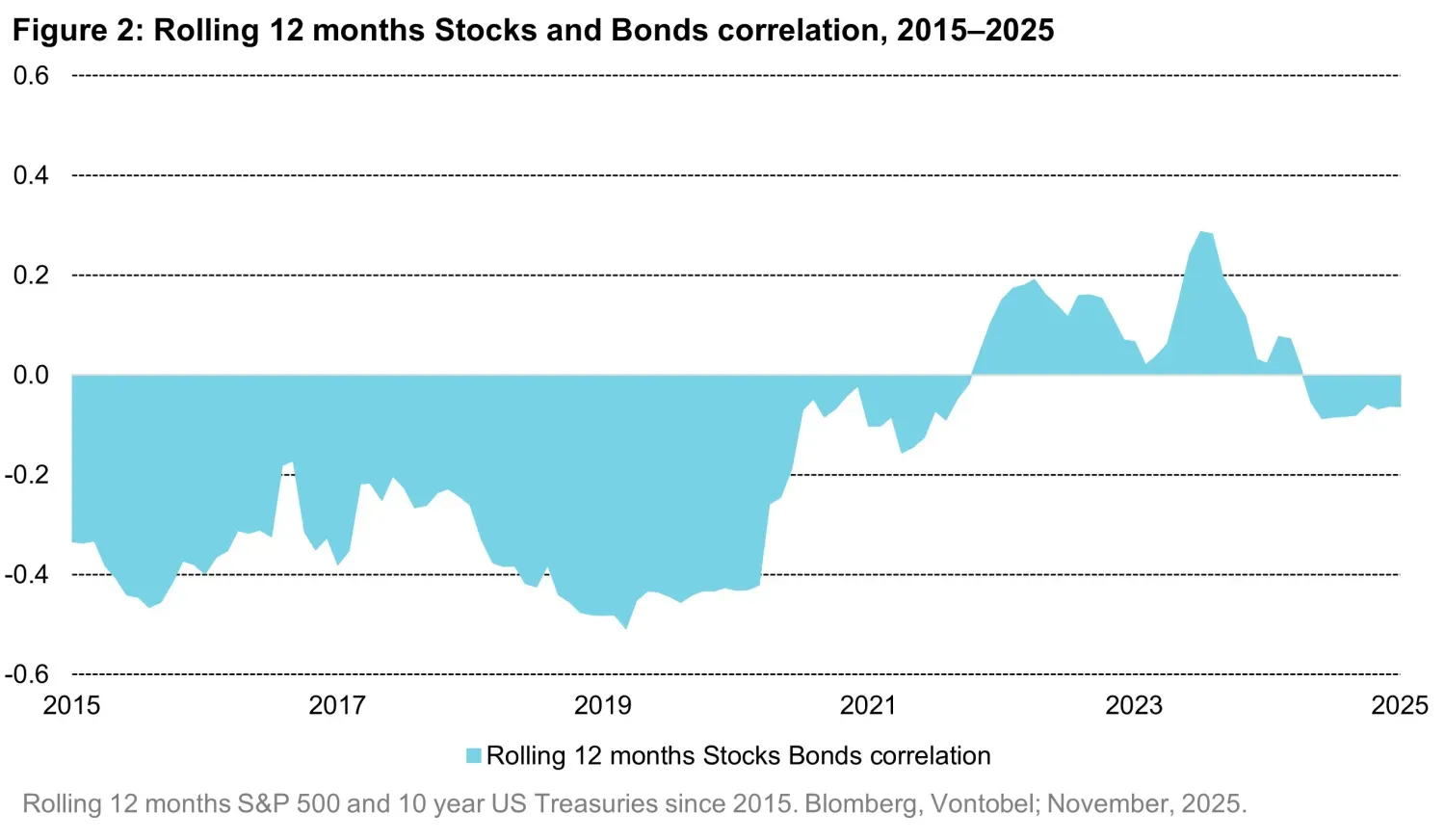

For decades, one pillar of portfolio construction seemed almost timeless: when equities fell, government bonds typically rallied. This negative correlation was the cornerstone of the classic 60/40 portfolio. Over the last few years, that pattern has shifted. Following the inflation shock of 2021–22, stock–bond correlations turned decisively positive, as shown in Figure 2. Monthly returns from equities and government bonds began to move together, not apart — the first sustained period of this behavior since the 1980s and early 1990s4. The reason is intuitive. In a low-inflation world, bad economic news pulls equities down but supports expectations of lower policy rates, lifting bonds. In a high-inflation world, inflation surprises dominate everything: they weigh on corporate earnings, reduce the real value of fixed coupons and raise expectations of interest-rate hikes. Equities and bonds both struggle — at the same time5. This dynamic was clear in 2022, when a typical 60/40 allocation posted one of its worst performances in decades. Both sides of the portfolio fell together — not an anomaly, but an expression of a new regime.

Academic and institutional research shows that stock–bond correlation is state-dependent. It tends to be negative when inflation is anchored and policy is predictable, and positive when inflation or policy uncertainty dominate. Today’s regime sits closer to the latter. For investors, the implication is clear: relying on government bonds alone as a hedge is no longer as reliable as it once was. Bonds still have a role — but they cannot carry the diversification burden on their own.

A multi-asset framework that blends fixed income with real assets, commodities and active currency exposures helps restore that lost cushion. It spreads risk across multiple drivers of return and allows for dynamic adjustments as correlation regimes evolve — rather than being tied to a static 60/40 mix that may no longer reflect today’s macro reality.

Dispersion Is Back

One of the defining features of today’s market is how far asset classes have drifted apart. In the decade after the Global Financial Crisis, returns across equities, bonds, credit and commodities were unusually aligned. Central banks kept policy predictable, inflation stayed low and growth was steady. Dispersion was muted. That world has changed. Over the past few years, dispersion — the gap between winners and losers — has returned in full force. Macro conditions now vary widely across regions: inflation trends differ, supply chains have been rewired, geopolitics has reintroduced tail risks, and central banks are no longer moving in unison. Asset classes that once responded to the same story now behave according to their own6.

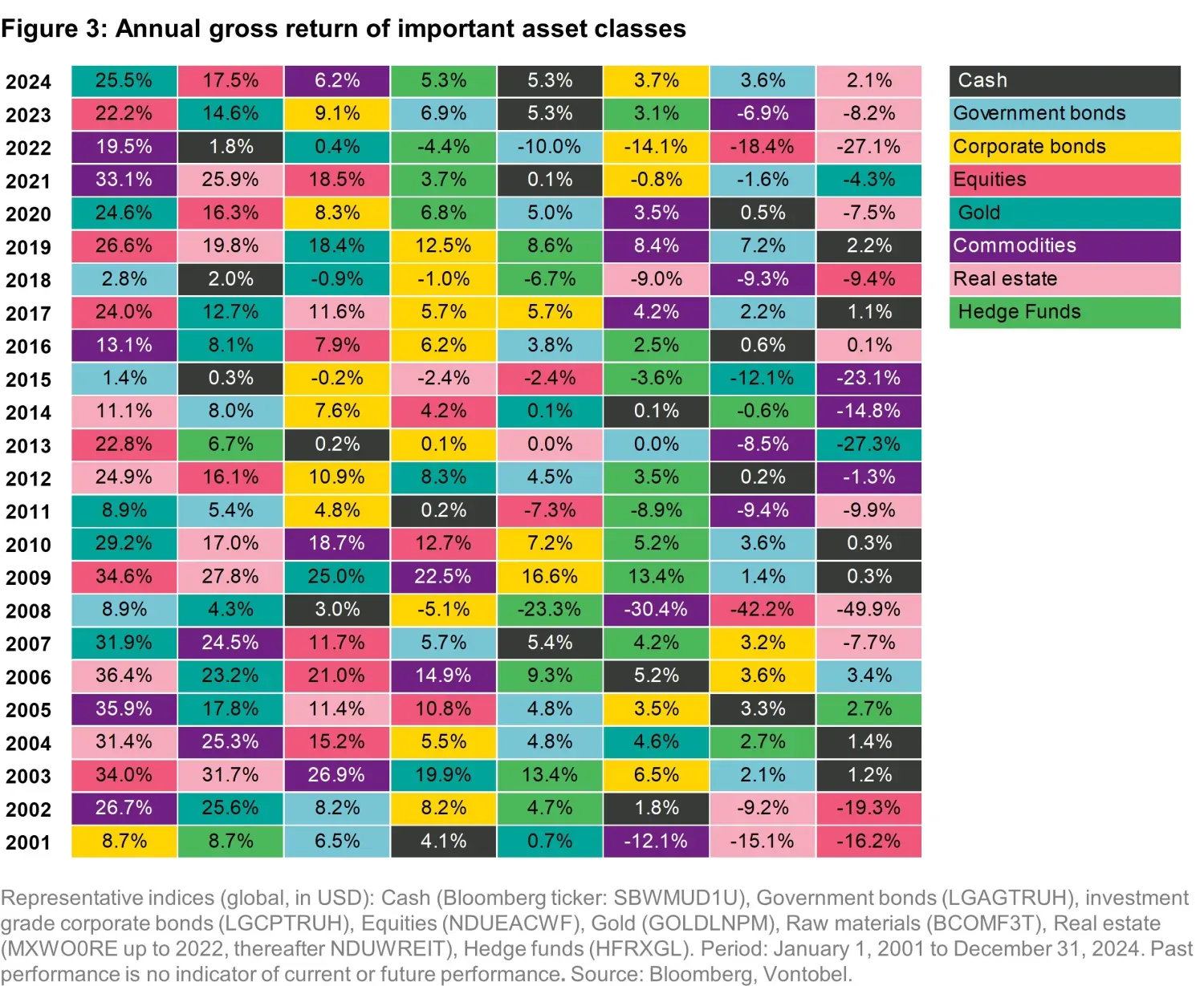

For investors, this shift does not make markets more predictable — it does the opposite. The “periodic table” of asset-class returns shown in Figure 3 highlights a constant of investing: leadership rotates and is difficult to forecast. Commodities can lead one year and lag the next; emerging-market equities alternate between strength and weakness; gold performs well in some stress regimes but not in others; even within fixed income, duration, credit and inflation-linked bonds respond to different macro forces. What is different today is not the existence of dispersion, but its persistence. With macro drivers no longer synchronized, relying on a narrow set of assets carries a higher risk of disappointment. In this environment, the most robust strategy is not to guess the next winner, but to remain broadly diversified, allowing diversification and rebalancing to work through the cycle.

In a diversified portfolio, something important is almost always working. The challenge is knowing what will work next — and that is where multi-asset shines. By distributing risk across multiple return drivers and rebalancing as relative conditions evolve, multi-asset investing uses dispersion rather than suffers from it7. Today’s environment highlights this clearly:

- Commodities and gold have decoupled from equities and bonds, supported by supply-chain realignment, geopolitical tensions and hedging demand.

- Currencies now provide meaningful opportunities as policy paths diverge across regions. FX trends have become persistent and largely uncorrelated to traditional asset classes8.

- Regional equities — from Japan to India to Latin America — have delivered performance disconnected from U.S. large caps, reflecting local reforms, growth cycles and demographics.

Dispersion is not noise. It is the return of a market environment where diversification becomes meaningful again. For 2026, this matters: growth, inflation, policy and sector cycles are likely to move at different speeds. A multi-asset approach does not need to forecast every twist. It simply needs to be aligned with the idea that different engines will drive returns at different moments — and that relying on one engine alone is riskier than it appears.

How do we navigate?

In a world of shifting macro regimes, elevated valuations and renewed cross-asset dispersion, we see multi-asset investing as one of the most effective ways to build resilience while still participating in upside. Our philosophy is conservative and intentional: we aim to deliver asymmetric returns — protecting capital when markets are stressed while remaining exposed to growth when conditions improve. This begins with risk budgeting, not return forecasting. We combine equities, bonds, commodities, currencies and selected volatility instruments because each responds differently to the economic cycle. Equities capture growth; high-quality bonds provide duration ballast when inflation stabilizes; commodities and gold hedge against supply and geopolitical shocks; currencies add a differentiated return source. This creates a portfolio that does not rely on a single narrative to succeed. Protection is central to our approach.

In our multi-asset portfolios, we use two instruments to deliver asymmetric returns. To protect capital, our first pillar, we systematically use option-based hedges, such as protective puts or volatility futures. These tools are not predictions of stress — they are insurance against it. They may feel costly during calm periods, but they help preserve the return asymmetry we target.

To grow capital, our second pillar, we use dynamic allocation. Narrow leadership phases can cause diversified portfolios to lag in the short term — but leadership always rotates. By reassessing risk premia, valuations and macro signals, we position for the next regime, not the last. This includes adjusting regional exposure, equity tils, duration, currency risk and commodity allocations as conditions evolve.

Finally, we believe 2026 will reward those who remain adaptable and avoid becoming too attached to a single asset class narrative, as it risks leading to disappointment. Growth is slowing but not collapsing; central banks are easing at different speeds; inflation trends diverge; geopolitical risks remain high. No single asset class is built to navigate all of this on its own. Our multi-asset allocation — supported by structural hedges, diversified return sources and active management — offers a way to participate in opportunities while mitigating the asymmetries of modern markets.

1. See Historical Average Stock Market Returns for S&P 500 (5-year to 150-year averages)

2. See S&P 500 Shiller CAPE Ratio

3. See When Many Own the Same Few.

4. See The correlation of equity and bond returns.

5. See Empirical Evidence on the Stock-Bond Correlation.

6. See Asness, C., A. Ilmanen, R. Israel, and T. Moskowitz. 2015. “Investing with Style.” Journal of Investment Management 13 (1): 27–63

7. Clifford S. Asness & Andrea Frazzini & Lasse H. Pedersen, 2012. "Leverage Aversion and Risk Parity," Financial Analysts Journal, Taylor & Francis Journals, vol. 68(1), pages 47-59

8. See Think you’re diversified? Check your FX

This marketing document was produced by one or more companies of the Vontobel Group (collectively "Vontobel") for institutional clients. This document is for information purposes only and nothing contained in this document should constitute a solicitation, or offer, or recommendation, to buy or sell any investment instruments, to affect any transactions, or to conclude any legal act of any kind whatsoever.

Views expressed herein are those of the authors and may or may not be shared across Vontobel. References to holdings and/or other companies for illustrative purposes only and should not be considered a recommendation to buy, hold, or sell any security discussed herein. Content should not be deemed or relied upon for investment, accounting, legal or tax advice. Past performance is not a reliable indicator of current or future performance. Investing involves risk, including possible loss of principal. Vontobel neither endorses nor is endorsed by any mentioned sources.

Although Vontobel believes that the information provided in this document is based on reliable sources, it cannot assume responsibility for the quality, correctness, timeliness or completeness of the information contained in this document. Except as permitted under applicable copyright laws, none of this information may be reproduced, adapted, uploaded to a third party, linked to, framed, performed in public, distributed or transmitted in any form by any process without the specific written consent of Vontobel. To the maximum extent permitted by law, Vontobel will not be liable in any way for any loss or damage suffered by you through use or access to this information, or Vontobel’s failure to provide this information. Our liability for negligence, breach of contract or contravention of any law as a result of our failure to provide this information or any part of it, or for any problems with this information, which cannot be lawfully excluded, is limited, at our option and to the maximum extent permitted by law, to resupplying this information or any part of it to you, or to paying for the resupply of this information or any part of it to you. Neither this document nor any copy of it may be distributed in any jurisdiction where its distribution may be restricted by law.