ESG at Vontobel Quality Growth: A common sense approach

Quality Growth Boutique

Key takeaways

- ESG research is an extension of our philosophy of long-term thinking and fits seamlessly into our existing research process. We focus on material issues rather than broad ESG scores, which enables us to understand and get ahead of risks that can jeopardize earnings predictability.

- We continually review and enhance ESG data that is in our models and part of our research process. Regulation and market expectations will eventually catch up, and companies that fail to adapt will face real costs through taxes, fines, new regulation, or damage to their brand.

- Engagement has always been a critical part of our investment process and standard practice is that we vote all proxies with full independence.

- We establish ESG campaigns that cover themes such as gender diversity at the board level, biodiversity, or GHG emissions. Through engagement with each company in the campaign, we encourage disclosure, documentation, and goal setting for the long term.

Despite ample research on how board diversity, carbon emissions or labor relations can impact business results, such ESG issues are still beset by controversy in the mainstream investment community. Skeptics call for an outright ban on ESG mandates, while the ESG faithful lament a lack of higher global standards. Does adding ESG into an asset manager’s decision-making process make the challenge of outperforming the market even more difficult than it already is? We think not.

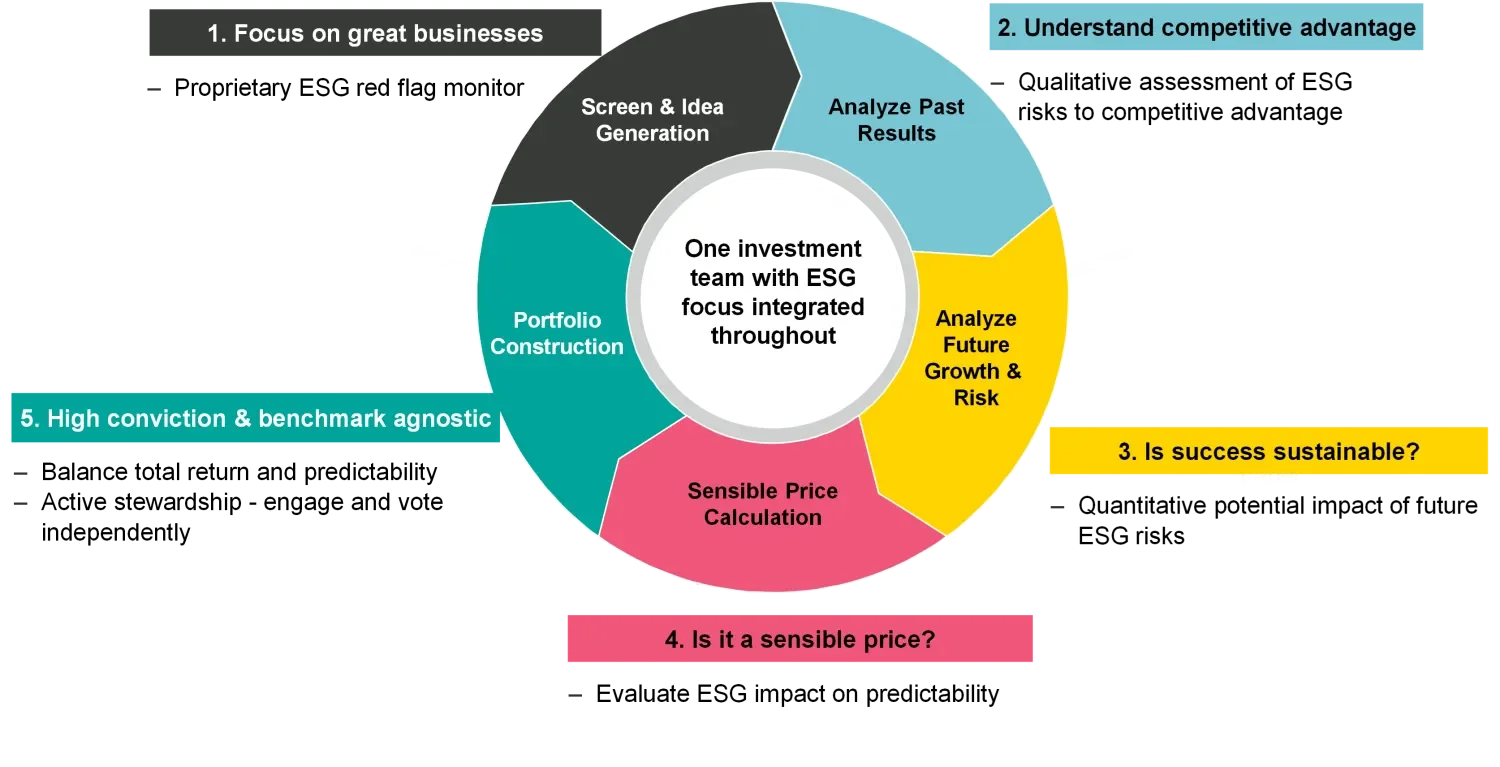

Building concentrated investment portfolios of high-quality businesses is what we do. We start with historical financial metrics that help isolate profitability and earnings stability. The next crucial exercise is for our research analysts to determine whether that superior performance is sustainable. Analysts follow a rigorous process to identify enduring quality and minimize risks of all stripes, some of which fell into the ESG bucket long before there was such a bucket. Once ESG risks have been identified, the next step is to figure out if they can be mitigated through engagement and proxy voting. This proactive approach can provide us an opportunity to effect change within our portfolio companies before the damage is done. If that’s not doable, it may impact our willingness to invest in the first place.

Many potential ESG risks and missed opportunities are less likely to have a significant impact in the short term. But such risks can converge with financial risks – and a once-in-a-decade event could thus become tomorrow's problem. Long before ESG terminology entered the industry’s vernacular, Vontobel Quality Growth found quality opportunities missed or underpriced by others who focus myopically on short-term results. ESG research is an extension of our philosophy of long-term thinking and fits seamlessly into our existing research process. The proper use of these considerations is to focus on material issues rather than broad ESG scores. This enables us to understand and aim to get ahead of risks that can jeopardize earnings predictability.

A component of research and risk management

We view ESG as an enhancement to the Quality Growth investment process, thus it is integrated into day-to-day research and not treated as a separate function. Our portfolio managers, research analysts, ESG specialists, and former investigative journalists on the team all contribute to the effort.

Figure 1: The Quality Growth Five-Step Investment Process

If a company meets the initial financial criteria and no significant ESG issues are flagged, the research analyst and portfolio manager test its financial endurance. Are there meaningful barriers to entry and competitive advantages? Are its investments sufficient? When it comes to sustainability issues or corporate governance, our research analysts work alongside the ESG team. We use a proprietary ESG Red Flag Monitor to focus on significant imbedded risks such as conflicts of interest, human rights controversies, water stress and so on.

Often, there isn’t a clear demarcation of an ESG concern vs. an operational one: A capital allocation misstep could be a corporate governance lapse, for instance. The consideration of ESG factors alone is rarely a reason to reject a stock outright – as we would reject a company that clearly does not fit our investment criteria. Rather, for companies that are otherwise investable but with mild ESG concerns, we may still invest and work with management teams to try to mitigate those issues in order to further improve the attractiveness of the investment thesis.

While the investment team is on the lookout for all business risks, our ESG specialists have expertise in areas that touch firms across both sectors and coverage responsibilities. Additionally, active stewardship is an ongoing process that requires routine monitoring and communication with management, as well as voting in support of long-term investment goals. The ESG team participates in company engagements and makes specific recommendations to portfolio companies for operational changes. This structure creates a blueprint for best practices across all our portfolios globally. A record of these engagements is published in our quarterly Stewardship Reports.

Investigative analysts also contribute to ESG research. Since 2010, Vontobel Quality Growth has hired three former journalists from BusinessWeek Magazine, The Wall Street Journal and The New York Times. This role enables us to expand beyond sell-side research for insight into risks and opportunities, especially qualitative ones like conflicts of interest with controlling shareholders or the regulatory outlook.

ESG research can lead to a hard pass on a potential investment. Such was the case with a well-known traditional Chinese medicine company, which has sold remedies for treating liver disease and pro-inflammatory conditions in China for hundreds of years. After one of our investigative analysts spoke with government officials, wildlife conservation NGOs and environmental lawyers, the integrity of the company’s supply chain came into serious question. A key ingredient – musk from endangered wild deer – was banned but we had reasonable suspicions that some of the illegally harvested musk had made its way into production due to enforcement loopholes.

When we identify red flags in companies we already own, our standard approach is to engage with management for clarification. Building a dialogue with decision makers is an important part of a long-term partnership and often consequential in maintaining conviction as investors. For instance, we were investors in a large broadcaster in India. When we developed concerns about board independence, our ESG team, the analyst, and the PM engaged with management about governance. The controlling shareholder’s ownership fell from around 40% to 5%, and we looked for board representation to change, even recruiting and proposing our own candidates. However, while the company removed the directors we opposed, it failed to name independent directors we were comfortable would represent the best interests of minority shareholders. Despite prolonged engagement with management, our view was that the response did not align with shareholder interests, and we exited the position.

Better disclosure and better data

A positive outcome resulting from the growing importance of ESG is that it has elicited several improvements in corporate disclosures, which have helped us better evaluate businesses. Alongside enhanced annual reports, companies are increasingly providing additional detailed sustainability reports, which can be a useful aid to a comprehensive research effort. We find that managements have been willing to provide disclosures and discuss issues they might not have shared with investors in the past. When one company makes disclosure improvements, it helps to push competitors in that industry to do the same. Also, the additional transparency provided by third-party data has made it far easier to research supplier best practices. A lack of disclosure may have masked shortages, risks to future supplies such as water from water stressed areas, or materials illegally sourced with the use of forced labor.

In some cases, technological improvements are enlightening areas previously difficult to audit or verify and forcing companies to change behavior – whether they’d like to or not. Such is the case with sophisticated real-time satellite imagery revealing previously hidden environmental damage caused by company negligence or ineptitude, in turn leading to greater liability risks. Newly launched satellites are finding companies either hiding or unaware of significant methane leaks in pipelines and processing facilities. This combination of environmental, business, and financial models is also giving greater insight into environmental damage caused by a company’s supply chain, especially around agricultural sites.

Much of the enhanced disclosures are voluntary at this point, but regulation is not far behind. Starting in 2024, the EU will implement the Corporate Sustainability Reporting Directive which will mandate and formalize many non-financial disclosures, such as resilience to sustainability risks and transition plans. In the US, the Securities & Exchange Commission only requires disclosures for companies with the highest greenhouse gas emissions (GHG) output; however, it may expand this requirement to all listed companies. The US government currently collects diversity data from companies with over 100 employees. While this data is not currently required to be disclosed by law, it’s not a stretch to expect that this, too, will soon be publicly available information.

New ESG data and insight become increasingly valuable over time. Its integration into the research process best supports investors like us with an early look at risks before they materialize. Regulation and market expectations will eventually catch up, and companies that fail to adapt will face real costs through taxes, fines, new regulation, or damage to brand reputation. To make sure we are ahead in this rapidly changing environment, we continually review and enhance ESG data that is in our models and part of our research team discussions.

Engagement, not activism

Activism is a coercive approach where you pressure management into making change. We do not believe this is the most constructive method – rather, we are more effective when we take a collaborative approach with management teams with whom we’ve established long-term connections. It’s part and parcel of being a long-term investor. Engagement, or one-on-one discussions with management and the board, has always been a critical part of our investment process and part of building relationships. We have also engaged with other investors on focus areas, such as modern slavery. ESG issues do not just lead to stand-alone discussions; they are interwoven into broader conversations with management on topics that cover capital allocation to future growth opportunities.

As we noted, new corporate sustainability reports allow ESG discussions to be more specific and productive. Consider water scarcity: Companies that take control of and manage water needs can reduce business interruptions. Semiconductor manufacturers, for example, require significant amounts of clean water to maintain the high degree of cleanliness required for production. New disclosures about water consumption enabled us to have more detailed conversations and better understanding about shortages and solutions.

Active voting

Standard practice is that we vote all proxies. We post our votes electronically through a third-party service. While we use the research and services of proxy advisory firms, we have full independence to vote in the way we see fit to represent the best interests of our investors. We use the services of Institutional Shareholder Services, Inc. (ISS) for the placement of our proxy votes and storage of our voting records. Importantly, we have a custom voting policy which has proxy voting guidelines that differ from standard ISS recommendations on certain issues. And, we have ongoing conversations with management and communicate our policies, so they are aware of our views and positions on focus areas.

We actively vote in alignment with resolutions that promote our custom ESG approach. We are not box-checkers. For instance, our view is that shareholders generally benefit when the role of CEO and Board Chair is split. From time to time, such as during a business transition, it might make sense for the two roles to sit with a single person temporarily. We may voice our opinion with management that the arrangement is not ideal, but we won’t necessarily vote against it when we believe the existing arrangement best serves investors. Thus, while a broad framework provides direction, each company’s circumstances matter.

Talent: pay and promotions

Few would dispute the value of meritocracy in hiring and promotion decisions, but in practice nepotism and personal biases get in the way. Outsized CEO pay packages often result in short shrift to other productive workers. We want our companies to recruit, retain and develop top talent based on skill and performance. This is especially important in businesses where human capital is a key asset, and even a competitive advantage (see Race, Role Models and the Future ). Balancing leadership remuneration between cost as a proportion of pre-tax profit against absolute dollars is challenging, especially in high-paid markets such as the US where the risk of losing capable managers to competitors from both public and privately held companies is real. When pay reaches certain thresholds it raises a red flag for us, and at that point we consider each case individually.

Tracking and scoring progress

Engagement is mostly specific to a company’s particular circumstances. But there are instances where sustainability issues cut across a group of companies. In those cases, we establish ESG campaigns, which cover themes such as gender diversity at the board level, biodiversity, or GHG emissions. These campaigns require individual engagement with each company in the campaign, all of which is tracked and recorded.

These projects are not designed for quick fixes; we look for measured progress over several years. The campaigns are also not the product of third-party outsourced engagement services. Our goal with campaigns is to encourage disclosure, documentation, and goal setting for the long term. Once a range of competencies has been established, we encourage our management teams to close existing gaps with market-leading peers. We provide progress updates in our Quarterly Stewardship Reports.

In Vontobel Quality Growth portfolios, carbon intensity tends to be well below the respective benchmarks. That’s because how we invest tends to shun the volatility of companies whose returns are driven by unpredictable commodity prices or have capital expenditure needs that drag on shareholder returns. Thus, we tend to hold underweight exposures to sectors with the highest GHG emissions, including energy, utilities, and materials.

While our portfolios tend to have carbon intensities below their benchmarks, this does not negate the need to track and estimate carbon emissions by company. We launched an engagement program across a number of our holdings on this front. We strongly encourage emissions disclosures and seek to understand what rates of GHG abatement may be possible for those still working through the process. We also want to know what progress has been achieved to date and what it will take in terms of time, adjustment, and investment to continue to reduce GHG. Finally, we will continue to engage and encourage action from companies that have yet to take these initial steps.

Delivering results

A direct connection between the implementation of ESG-related activities and financial outcomes is difficult, if not impossible, to quantify. For obvious reasons, challenges like managing people through a pandemic or overcoming a governance controversy garner managements’ immediate attention and response. On the other hand, low-probability risks are often ignored and the benefit of reducing such risks is rarely obvious, even after the fact. It’s like getting an insurance policy where it’s impossible to prove whether the price you paid was worth the trouble. It’s no surprise then that there’s so much controversy around assessing ESG efforts to mitigate low-frequency and evolving risks.

It’s also a challenge for any individual asset manager of a listed holding to influence corporate behavior. But we believe that investors like us with longstanding relationships with company managements, and working with other investors, have a better chance at effecting change. We are in an important position to provide valuable feedback that can help our companies be better at what they do through best practices and ESG policies. Importantly, as a concentrated investor with voting rights, we can lend support to management teams who seek shareholder buy-in to improve ESG-related disclosures and polices, as well as long-range sustainability goals. On the other hand, an exclusionary approach to ESG – where we would simply avoid controversy altogether – would not manifest in important changes in corporate behavior.

It can’t be overstated: The construct of our ESG effort is to focus investment research on material issues of risk, not ESG scores. Our singular goal is to better grasp and get ahead of risks that can jeopardize earnings predictability – and along the way, use our influence to improve outcomes for all stakeholders.

Important Information: Information, opinions and estimates provided herein are subject to change; not intended to predict actual results; and no assurances are given with respect thereto. Companies discussed herein for illustrative purposes only to help elaborate on the subject matter under discussion. They should not be considered as a reliable indicator of the performance or investment profile of any composite or client account.

Environmental, social and governance (“ESG”) and Sustainable investing and criteria employed may be subjective in nature. The considerations assessed as part of ESG and Sustainable processes may vary across types of investments and issuers and not every factor may be identified or considered for all investments. Information used to evaluate such components may vary across providers and issuers as these criteria are not uniformly defined characteristics. This investment approach may forego market opportunities available to strategies which do not utilize such criteria. There is no guarantee the criteria and techniques employed will be successful.

Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. Such information should not be regarded as an indication that Vontobel considers these forecasts to be reliable predictors of future events and they should not be relied upon as such. Actual events or results may differ materially and, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.