Diagnosing a giant: On-the-ground insight into UnitedHealth Group’s rise and fall

Quality Growth Boutique

Investigative analysts help the Quality Growth team with original, on-the-ground research to support or refute a stock thesis. There’s never a preset agenda: the assignment is to tap an array of sources to understand what might be missing from consensus opinions, for better or worse. These analysts are part of the process when portfolio managers initiate a position, and they provide an ongoing stream of information and analysis during the holding period and as the outlook morphs. Ideally, these former journalists identify a pivot in sentiment and outlook long before it’s fully appreciated by the market. With UnitedHealth Group (UNH), our investigative analyst's work was fundamental to both building the position and identifying the sell signal.

By the time the CEO of UNH was fatally shot in Manhattan on December 4, 2024, the level of consternation by the general public about the US health insurance system was laid painfully bare. Insurance companies are the perennial bad guys, but in a bizarre and tragic twist, Brian Thompson’s murder unleashed a vitriol that hit new lows, spurred on by social media. With the US Attorney General Pam Bondi now angling for Luigi Mangione’s death penalty, the headline risk to UNH and the insurance sector are today abundantly obvious.

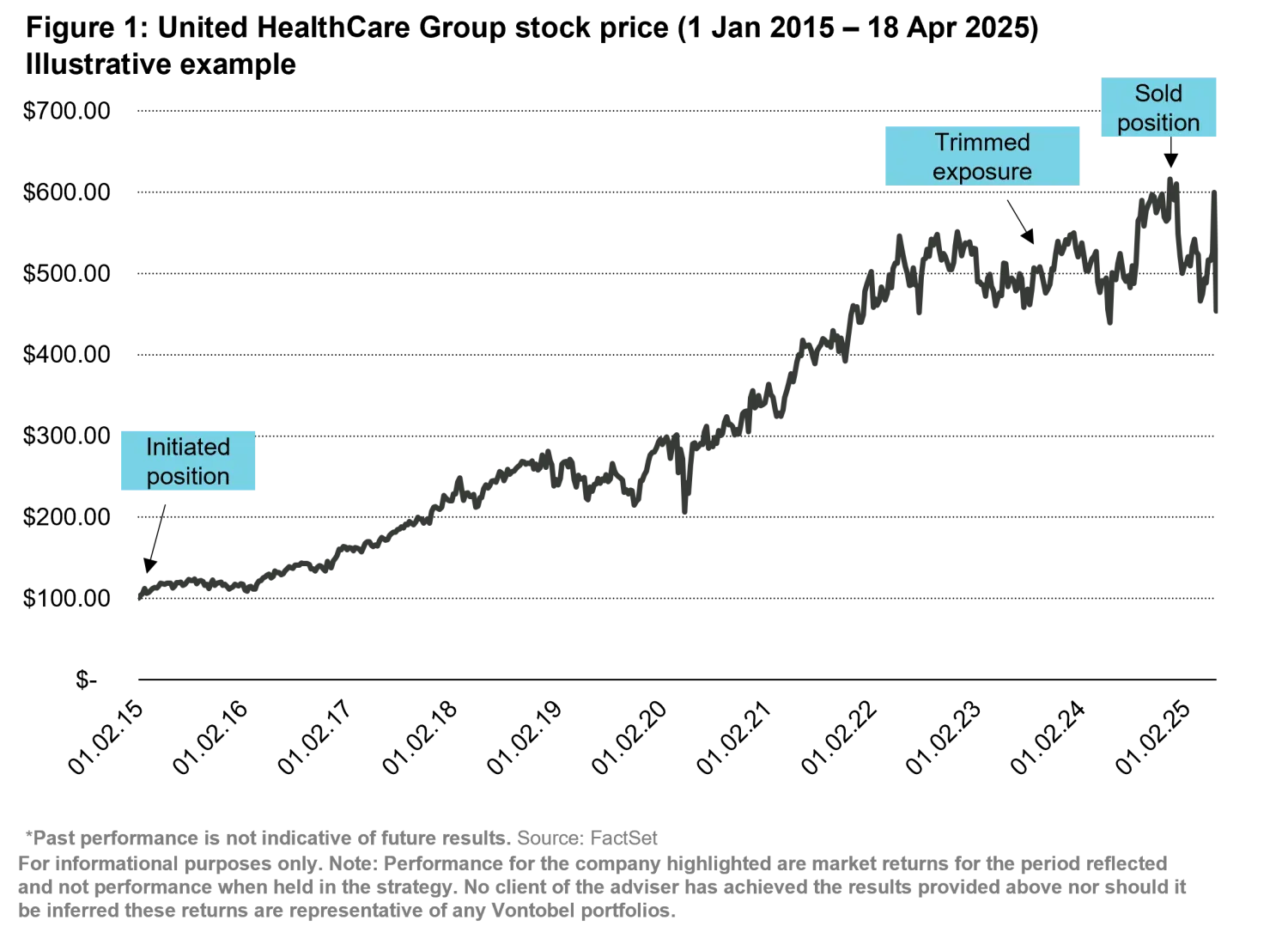

An earnings hit followed. On April 17, 2025, UNH revised its 2025 earnings forecast downward significantly due in part to higher-than-expected medical care costs. The stock fell nearly 20%, marking the most significant single-day decline in its stock in more than 25 years. Then on May 13, UNH CEO Andrew Witty abruptly stepped down and the stock tumbled further. UNH had been a top-10 holding for the Vontobel US Equity portfolio for nearly a decade and was also held in the Global Equity portfolio. But based on our journalist’s insight, we began to trim UNH in 2023, even in the face of what would be a peak earnings year of more than $22 billion in profits, a four-fold increase since we initiated the position in 2015. The stock had quintupled since initiation and hit an all-time peak of $625 in November before the murder—but we had already begun to trim, and by December 2024, we were out of the position fully.

Uncovering mounting regulatory and legal pressures

After two years of investigative research, a picture emerged that UNH’s competitive advantage of size and analytics capabilities was becoming a regulatory liability. Through a series of at least 20 strategic acquisitions of both doctor practices and tech companies, it became a government sanctioned, vertically integrated giant. But as it engulfed the entire chain of health care services from actuarial to patient care, it started running afoul of a central tenet of the Affordable Care Act.

The ACA and the government assumed that with size and breadth and the right reimbursement incentives, UNH would deliver better health outcomes for lower cost, afforded by a more holistic view of the patient and the entire system. Instead, UNH leaned into old insurance tricks of denials and deferring care, squeezing benefits while costs continued to rise. Covid and a costly $3 billion cyberattack at its subsidiary, Change Healthcare, didn’t help results. Even worse, it was becoming clear that UNH was just a traditional insurance outfit supercharged by artificial intelligence and outsized market power. Were future earnings sustainable?

Our Vontobel Quality Growth CIO Matt Benkendorf directed Mara Der Hovanesian, one of three investigative analysts on the team, to look closer at the Federal Trade Commission’s (FTC) 2022 investigation of UNH’s Pharmacy Benefit Manager (PBM), OptumRx. Wall Street analysts who once covered the PBMs when they were publicly traded and independent dismissed the investigations as routine. She pored through lawsuits and independent audits and regulatory filings. She tapped dozens of wide-ranging sources from state auditors to private auditors and spoke to corporate customers who were back-engineering UNH plans they had paid for, discovering significant overcharges for drugs and coverage. She spoke to patient advocates and doctors, and former insurance claim employees who complained about new algorithmically automated denials for care.

Kaiser Family Foundation (a venerable nonprofit healthcare research/data group) eventually confirmed last year that private/commercial insurance was twice as likely to deny coverage vs. Medicare – and is more expensive. UNH is now being sued in several class action lawsuits for using AI algorithms in these systematizing denials. And on April 22, the editors at the Washington Post labeled Medicare Advantage a “boondoggle,” citing that private plans were costing the government $84 billion more than traditional government plans and called for reform. Our investigative research was piecing together that thread, plan by plan, well before it became fodder for the editorial pages.

“This is a runaway train. We are not focusing on the patient; we are focusing on how health care is administered and applied. They control the chess board, and the health care workers are all the pawns.”

Mara spoke with antitrust lawyers and well-placed former policy makers including those at the Department of Health and Human Services (HHS) and the FDA. Some cited worrisome upcoding schemes (where inhouse doctors upgrade diagnoses for higher reimbursements) and offshore accounting schemes that have been potentially set up to skirt federally mandated profit thresholds. Other questionable practices, such as UNH’s use of rebates and other fees to pharmaceutical companies, continue to be under scrutiny: Over the course of her research, some 225 PBM-reform related bills were introduced across 48 states, reflecting a growing chorus of concern that those focused on DC politics alone might have missed.

In the end, we found ourselves handicapping company break-up scenarios, just months before the Department of Justice (DOJ) announced it was investigating UNH for antitrust violations. That case is still pending as is the FTC’s investigation of UNH’s PBM business. With three large federal agencies on its tail—the FTC, the DOJ and the Centers of Medicare and Medicaid—UNH’s regulatory woes were clearly mounting. This, all before the murder in Manhattan.

It’s “too hard to break up the company” but they can “close the loopholes” and “promote competition in pharmacy benefit management” and “there’s some chance that they might make it harder for physician groups to get purchased.”

A former winner focused on returns and reshaping US health care

Before the ACA was passed in 2010, UnitedHealth Group fought it tooth and nail. As the country’s largest commercial insurer, it had lots to lose under the new law: higher costs to cover people with pre-existing conditions, thinner more tightly regulated margins and more competition at new mandated marketplaces called exchanges. Those marketplaces were murky pools of risky, very sick Americans and it ended up costing the industry and UNH a small fortune. With the law facing a litany of constitutional challenges (three Supreme Court cases), the entire regulatory framework for health care insurance seemed up in the air.

Maybe the ACA was the first step towards a single-payer system which would eliminate private insurance altogether? There was significant uncertainty surrounding the stock and the sector even back then. Again, the CIO directed our investigative analyst Mara to study different sectors in health care, from medical devices to insurance, to figure out winners and losers in the new normal.

In 2015, before we initiated our position, Mara also spoke to key health care and government administrators in Canada, Australia, the UK, and Germany and beyond to do a first-hand comparative analysis of global government-run health care systems. She interviewed new upstart online marketplaces and different constituents across the health care space from drug distribution to doctors. She confirmed that UNH was in a strong position to deliver as management was considered best in class and had proven for decades to manage medical costs with unequaled precision and reliability. The company had delivered annualized returns of 24.7% as far back as 1984 through 2015, and indeed through decades of government reform disruptions. The Catamaran (analytics) and OptumRx (PBM) acquisitions were huge growth drivers and competitive advantages. Medicare Advantage, value-based care, and population management contracts were growing meaningfully. The physician practice acquisitions had only just begun.

At the time, we viewed UNH as a winner. UNH promised to be a consequential catalyst in the effort to convert an inefficient U.S. health system from one that rewarded and reimbursed for over-use –more beds, more medicine equals more profits -- to one that incentivized and paid more in reimbursements for better health outcomes. In early days, it seemed destined to deliver on that promise for the long term, and profits and the stock price soared.

Identifying the turning point

The track record and diversification of UNH’s business model (government, individual, small business, and exchange), and the firepower to invest in new technologies and data combing molded UNH into a powerful franchise. It may yet be still—should it prove to customers, patients, and the government that it will deliver quality care at fair prices. Right now, investors have UNH on watch as it grapples with soaring medical costs and falling government reimbursements. The wait and see is easy. But to stand contrarian about its future fortunes in the face of market leading size and power and a soaring stock price required going against the herd. In-depth and differentiated information and analysis from our investigative analyst, along with healthy team debate, helped us to identify that turning point before it was common knowledge.