Emerging market equities: time to shine again

Conviction Equities Boutique

Key takeaways

- Emerging markets (EM) are back in the lead – after years of lagging, the MSCI EM has outperformed the US in 2025, with year-to-date gains of around 27%, driven by valuation re-rating, currency tailwinds, and reforms.

- Flows have turned positive – EM equity funds have attracted USD 2.7 billion in 2025 through mid-September, reversing heavy outflows in 2024, with ETFs capturing the bulk of new allocations.

- Structural drivers support durability – a weaker US dollar, global rate cuts, and record-high shareholder returns (buybacks set to reach USD 110 billion in 2025) point to a more sustainable EM upcycle.

- Independence is increasing – stronger intra-EM trade and domestic consumption reduce reliance on developed markets (DM), while global investors remain underweight EM, leaving room for re-allocation.

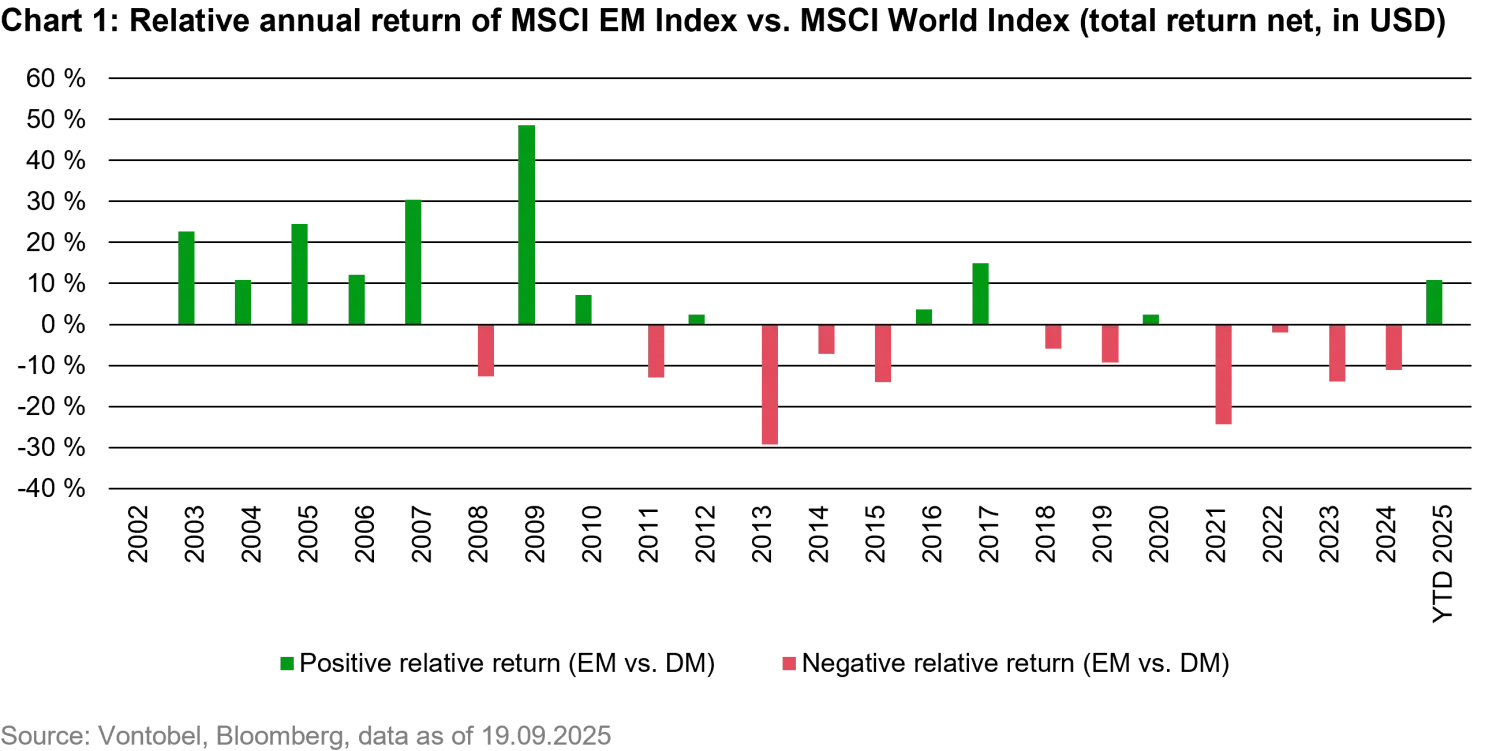

A decade in the shadows

For much of the past decade, emerging market (EM) equities have left investors disappointed. Despite compelling narratives around economic growth in Asia, Latin America, and parts of Eastern Europe, EM performance lagged significantly behind developed markets (DM), particularly the US, where mega-cap technology stocks drove exceptional returns. Several factors contributed to this underperformance: a persistently strong US dollar (USD), recurrent global and regional crises, uneven policy execution across key EM economies, and the constant dilution of shareholder profits. These forces eroded investor confidence and left EM valuations depressed relative to their developed peers. The retrenchment was also visible in flows: EM equity funds saw net redemptions of more than USD 33 billion in 2024, and their share of global equity assets shrank to just 4.9% in 2024, the lowest in over a decade according to data from J.P. Morgan and EPFR Global. Many global investors had effectively capitulated, reducing allocations to multi-year lows.

That picture changed decisively in 2025. The MSCI EM Index has gained around 27% year-to-date, outpacing the 17% rise of the MSCI World Index by far. This outperformance is meaningful not only in magnitude but also in breadth, with multiple regions, sectors, and policy reforms contributing to the rally. However, nearly half of the index gains stem from a few technology stocks. Moreover, like in the US, albeit to a lesser degree, the MSCI EM Index exhibits a concentration of stocks influenced by the artificial intelligence (AI) theme.

After years in the shadows, EM equities are not merely catching up – they are leading global markets. Flows have followed performance. According to data from EPFR Global, EM equity funds have attracted USD 7 billion of net inflows in 2025 to date, marking the strongest resurgence of investor interest since 2023. Importantly, the bulk of these inflows has been channeled through ETFs, while active managers have continued to bleed assets – a sign that investors for the moment still prefer passive, broad-based exposure in re-entering the asset class.

Why EM outperformed in 2025

The rally in 2025 has not been built on spectacular earnings growth. In fact, aggregate EM earnings were flat in the second quarter. Instead, the driving force has been a powerful re-rating of valuations combined with supportive currency dynamics. According to J.P. Morgan, more than 70% of the year’s EM equity returns have been generated by price-to-earnings multiple expansion and foreign exchange appreciation, rather than corporate profit growth. We believe this reflects investors’ recognition that fiscal frameworks are more stable, debt burdens have moderated, and governance has improved across several key markets.

The weakening of the USD has been especially important. Unlike past rate-cutting cycles, which were reactive and crisis-driven, the Federal Reserve (Fed)’s current easing is pre-emptive and designed to sustain growth. Markets now expect two further cuts by year-end, with additional easing in 2026. This shift has driven a meaningful USD depreciation, in turn boosting EM currencies, reducing the cost of servicing USD-denominated debt, and channeling international capital back into local equity markets.

Earnings sentiment, while muted in the aggregate, has shown important signs of improvement. Revision breadth – the balance of upgrades versus downgrades – has been steadily improving over four consecutive months, led by EM Europe. However, China, Brazil, Mexico, and South Africa have also seen strongly positive revisions, and consensus now expects EM earnings growth of about 10% in 2025 and 13% in 2026. Certain sectors, including technology, communication services, and real estate, are leading the recovery, offsetting weakness in consumer-focused industries.

Another important driver has been the reform agenda in major EM economies. In China, a wave of capital market reforms has encouraged record-high share buybacks and higher dividend payouts, with dividend yields on the CSI 300 (representing the Shanghai and Shenzhen stock markets) reaching decade highs. Equally significant is Beijing’s push to improve corporate efficiency under the so-called “anti-involution” policy, which seeks to reduce wasteful competition and redirect resources toward productivity and innovation as well as their renewed support for private enterprises. Korea has also made strides, with its “Value-Up” initiative catalyzing governance improvements and spurring an 82% surge in buybacks in 2024, with further momentum this year. Meanwhile, in India, the government’s cut in the Goods and Services Tax (GST) is designed to support consumer demand, complementing broader policy measures to boost household incomes and retail equity flows. Together, these reforms underscore a more shareholder-friendly corporate culture as well as a policy environment increasingly attuned to long-term growth and higher shareholder returns.

Finally, regional standouts have added to the momentum. South Africa delivered more than 30% net income growth in the first half, Taiwan posted double-digit gains, and smaller markets, such as Thailand and Peru, reported earnings growth of 30 to 40%. These examples illustrate the broad base of the 2025 rally and underscore why investors are beginning to view EM as more than just a tactical trade.

Why the outlook remains bright

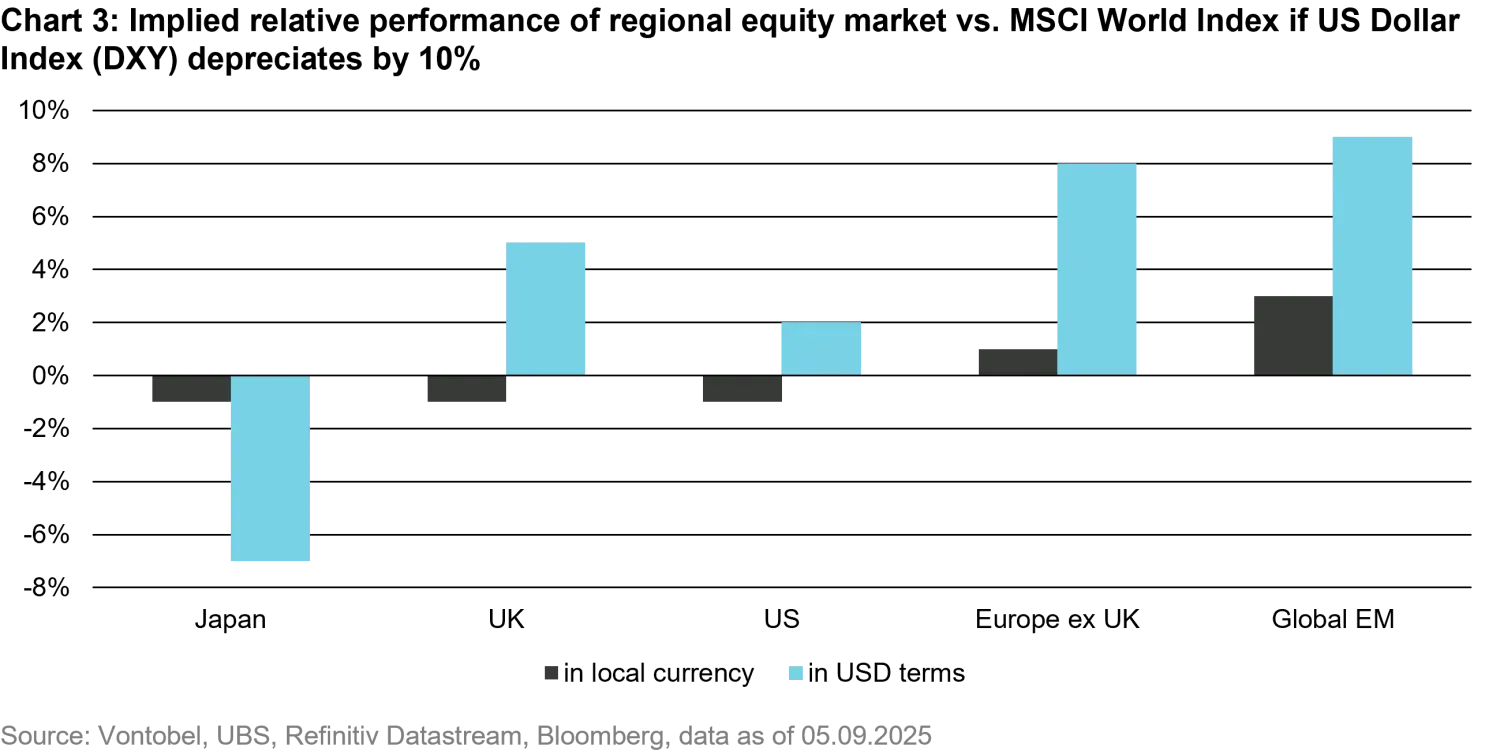

Looking ahead, the case for EM outperformance extends beyond the current year. One potential structural factor that could play a significant role is the weakening of the USD. History shows that a 10% USD depreciation has typically been accompanied by roughly 9% relative outperformance in EM equities. With US fiscal deficits widening, reserve managers diversifying away from USD, and Fed easing underway, the conditions for a weaker USD are firmly in place. For EM economies, whose external debt is often denominated in USD, this trend is particularly supportive, for both macro stability and equity valuations.

This time, the weakening USD may not only be a cyclical by-product of Fed cuts, but also part of a more structural trend. The US is running persistent fiscal and current account deficits, which historically have left the USD more vulnerable to depreciation and served to ease external imbalances. At the same time, the growing use of the USD as a geopolitical tool has accelerated diversification by global reserve managers, many of whom are gradually shifting towards gold and non-USD assets. Together, US domestic imbalances and international reserve diversification suggest that the multi-decade trend of USD dominance may be eroding. For EM, where roughly two-thirds of external debt is denominated in USD, this creates a powerful tailwind – reducing debt burdens, supporting capital flows, and enhancing equity performance.

Historically, EM equities tended to rally strongly in USD down-cycles: UBS estimates that a 10% USD depreciation typically coincided with about 9% relative outperformance of EM equities versus DM. Past periods of Fed easing reinforce this pattern. In both the 2003 to 2007 and the 2010 to 2013 cycles, when the Fed was cutting rates and the USD was softening, EM equities delivered double-digit annualized returns and outpaced US and European stocks.

The global monetary policy backdrop also favors EM. Lower US interest rates create room for EM central banks to cut as well. Indeed, most EM economies – Brazil being the notable exception – are already in easing mode, with inflation falling back into target ranges. Because EM debt typically has shorter maturities and higher rate sensitivity than DM debt, these cuts will have a more pronounced impact, stimulating domestic demand and reinforcing equity performance.

As we have highlighted in previous articles, another secular tailwind for EM equities is the steady rise in intra-EM trade. Shifts in global supply chains and new trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP), are accelerating commerce between Asian economies, while Latin America is deepening ties with Asia’s commodity demand. China has now overtaken the US as the largest trading partner for most Asian and African economies, and the Association of Southeast Asian Nations (ASEAN) is China’s largest trading partner in return. At the same time, stronger household income growth is fueling higher domestic consumption across major EMs, from India’s expanding middle class to rising consumer spending in Brazil and Southeast Asia. The result of these dynamics is that EM economies are becoming more resilient and less dependent on developed markets for growth. For investors, this greater self-sufficiency reinforces the structural case for EM equities as an asset class with its own distinct drivers, rather than simply a leveraged play on global growth.

Another supportive factor for EM equities is the gradual diversification of global portfolios away from US assets. Morningstar’s survey of asset owners shows a clear tilt toward reducing US allocations over the past year, with net decreases most pronounced in Europe and Asia-Pacific, where more than 40% of respondents reported cuts. The drivers range from USD volatility and trade tensions to regulatory uncertainty in the US. At the same time, EM equity allocations remain deeply underweight: EM equity funds account for just 5.1% of global equity assets under management in 2025, well below the multi-year average of around 7 to 8% seen from 2016 to 2018. This combination of falling US weightings and structurally low EM allocations creates a powerful opportunity for rebalancing in favor of EM.

Fundamentals also appear to be turning in favor of EM. Earnings revisions are broadening, especially in Asia, and consensus forecasts for double-digit growth over the next two years are well supported. At the same time, shareholder-friendly practices are becoming a defining feature of EM markets. Buybacks are on track to reach a record high USD 110 billion in 2025, nearly three times as much as in 2015, while dividends remain healthy in the range of 2.5 to 3%. China and Korea stand out as reform leaders, but the trend is evident across multiple regions. These changes reflect a cultural shift in corporate capital allocation and suggest that the improvements in governance are here to stay. EM provide access to broad-based growth opportunities beyond AI-driven semiconductor and hardware investments, with growing domestic consumption, energy transition, and advanced manufacturing also serving as key drivers.

Conclusion

After a decade of underperformance, EM equities are finally back in the spotlight. Unlike prior rallies, which were often fleeting and narrowly based, today’s drivers are broad and structural: a softer USD, synchronized global rate cuts, stronger corporate governance, and a renewed commitment to shareholder returns. In our eyes, with valuations still deeply discounted and global portfolios still underweight EM exposure, the potential for further inflows is significant.

We believe this is not just a short-term rebound. The foundation is being laid for a more durable cycle of outperformance – one that long-term investors cannot afford to ignore. For EM, the time to shine may truly have arrived.

Views expressed in the above content are those of the authors and may or may not be shared across Vontobel. The above content should not be deemed or relied upon for investment, accounting, legal or tax advice. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information provided herein at any time, without notice.