One Big Beautiful Transition

Conviction Equities Boutique

The investment landscape in 2025 has been challenging to say the least. Question marks over US exceptionalism, tariffs and the changing pattern of global trade, geopolitical tensions, interest rates and Fed independence are just some of the hurdles that investors have had to navigate. Another area of concern for many is the world’s future commitment to the energy transition, given the return of President Trump to the White House and his administration’s well-publicised views of renewable energy. Changes made to US tax policy in July as part of President Trump’s ‘Big Beautiful Bill’, which included a shortening of many environmental tax credits introduced as part of the Inflation Reduction Act (IRA), served only to reinforce the narrative that the energy transition is stalling or even dead.

We have no such concerns and firmly believe that the transition to a lower carbon economy is here to stay. While policy support in the US has certainly been weakened, energy security involving the increasing use of renewable energy sources (RES) remains a strategic priority for most other parts of the world (both developed and emerging). Crucially, this is no longer just an ethical or moral choice – renewable power, building technology solutions and electric vehicles are now economically competitive. In fact, the most mature renewable technologies, such as solar and onshore wind, remain the cheapest and fastest new source of power supply almost everywhere on the planet and come with limited technology risks. Yes, it is fair to predict more bumps in the road going forward, but the destination has in some respects never been clearer to us.

2024 was a record year

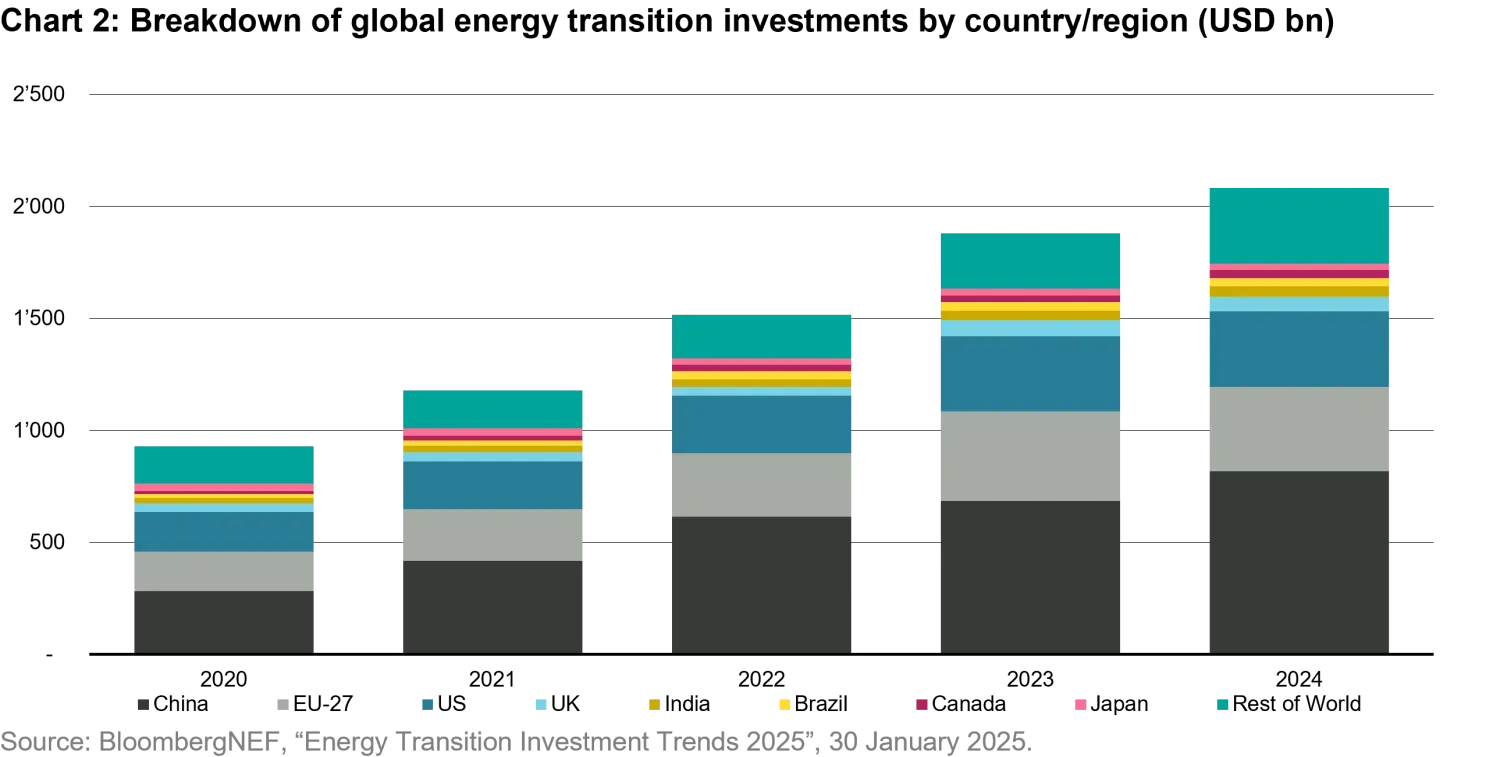

According to its annual report, Bloomberg estimates that investment in the global energy transition exceeded USD 2 trillion for the very first time during 20241. This represents a growth rate of approximately 11 percent from total investments made during the previous year, with the more mature sectors of electrified transport, renewable energy and power grids accounting for 90 percent of the overall spend. While the annual growth rate of 11 percent is admittedly lower than what was achieved in previous years, this is understandable for several reasons including the overcapacity issues in certain parts of the supply chain (such as solar), the higher levels of global interest rates and the general normalization of growth rates that can be expected when technologies move through their natural lifecycle into the more mature phase.

From a regional perspective, China’s contribution to the energy transition has grown substantially and they are now the clear global leader. With a spend of over USD 800 billion, China represented almost 40 percent of the total investment into the global energy transition space in 2024. China’s increase in investment from the previous year also accounted for two thirds of the world’s total increase in spending during 2024. In contrast, the contribution from the US was much lower at approximately 16 percent, however, it is worth noting that even during the term of President Biden (pro-environmental administration, rejoining of the Paris Agreement, introduction of the IRA) the contribution from the US did not go any higher than 19 percent.

“It’s the economics, stupid!”

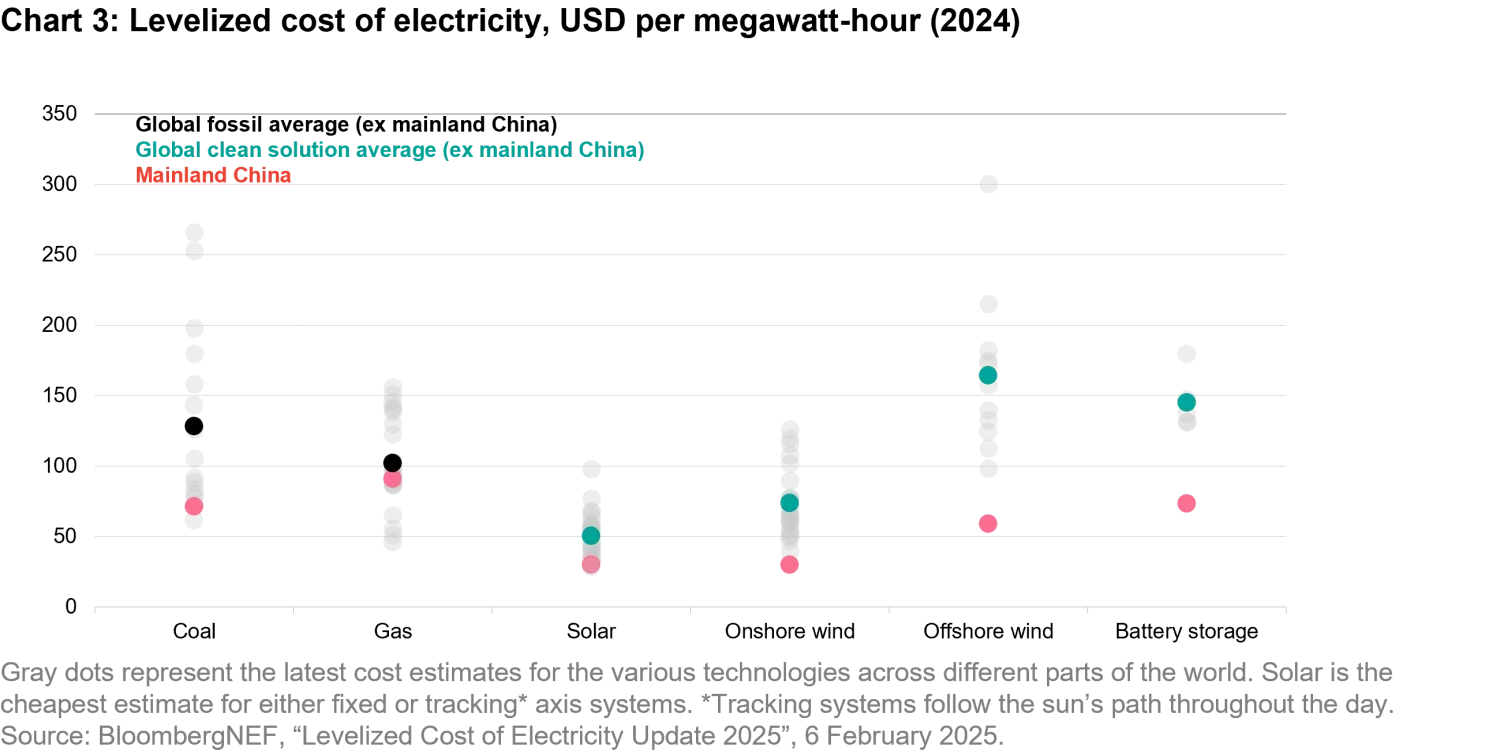

While the historic growth in energy transition investments has been impressive, the bigger question of course is why we believe these investments will continue to grow into the future. In our view, the economics behind mature renewable technologies is hard to argue against. On a levelized cost of electricity basis, RES are increasingly competitive, particularly solar and onshore wind, while offshore wind and battery storage are getting closer to where they need to be. With the increasing levels of demand being placed on electricity networks around the world (more on this later), this need to generate greater power has never been more crucial and it is hard to ignore the cost efficiencies RES bring to the table.

Despite the rhetoric, this dynamic is very much playing out in the real world with financing for fossil fuel projects falling significantly during the first eight months of this year compared to the same period last year. In fact, the lending of Wall Street’s top six banks to oil, gas and coal projects fell by 25 percent during this eight-month period2. This is a downward trend not many may have predicted at the beginning of the year given President Trump’s promise to ‘Drill, baby, drill!’. While we believe the recent policy changes in the US are certainly going to reduce the pace of clean energy installations, some experts still expect 300 gigawatts of solar and wind to be built in the US between 2025 and 2030, which would be on top of the 500 gigawatts of renewable energy available in the US at the end of 20243. In other words, growth in the US will very likely be slower but it is growth nonetheless!

Switching to the demand side of the equation, rising power demand is not only being driven by population growth and the electrification of our lives (just think about the number of devices in our home that need charging!), but by the significant power requirements of data centers to power the advances in artificial intelligence (AI). Electricity demands for data centers in Europe are expected to increase by a staggering 150 percent between 2024 and 20354 and with major players in the hyperscaler space tending to have credible climate pledges5, it suggests that plenty of additional clean power is going to be needed. Regardless of policies, additional gas turbines for traditional power generation are not readily available due to manufacturer capacity constraints, while restarting mothballed nuclear power stations can take at least five years to bring them back online. In our view, this makes RES the best option to rapidly increase power generation and power the developments in AI.

To accommodate this additional power coming from RES, there is no doubt that significant investment in global energy grid networks is required. In our previous viewpoint Is the energy transition gridlocked?, we made the case that the blackout in Spain and Portugal in April 2025 highlighted the necessity for this investment to start as soon as possible. While Spain can be commended as being a leader in the adoption of RES (particularly solar), with the country often recording negative electricity prices6, it has failed to keep the same pace when it comes to investing in the resilience of its grid. We believe this experience will serve as a helpful signpost for many other countries around the world that have similar aspirations to decarbonize their electricity grid networks, and will add further to the future levels of investment we see in the energy transition.

Greatly exaggerated

“The reports of my death are greatly exaggerated” is a famous quote attributed to the American writer and humorist, Mark Twain, when he allegedly referred to a newspaper article that had wrongly reported his passing. In a similar vein, we believe that the rhetoric surrounding the energy transition is prompting many to falsely claim its demise. Like any long-term process, it is unreasonable to expect it will progress in a smooth and linear fashion. There will undoubtedly be periods in time when sentiment is positive and negative, and we can certainly agree that the past year has been difficult given the political environment.

However, we believe that this negative narrative is masking some vital truths, including the economic rationale behind the increasing use of renewable technologies. This is no longer just an ethical choice – mature renewable technologies are economically competitive and make sense from a financial perspective. In addition, it’s important to remind ourselves of the strides we are making, with experts such as Michael Liebreich7 setting out his view that future real growth in renewable energy only needs to be ‘a couple of percentage points’ higher than global GDP growth for fossil fuels to be completely phased out over the coming decades8.

We continue to believe that this backdrop can provide strong structural tailwinds for companies offering scalable solutions to environmental challenges. Yes, there will be bumps in the road, but we firmly believe we are still on track. In our view, the energy transition is big, beautiful and here to stay.

1. BloombergNEF, “Energy Transition Investment Trends 2025”, 30 January 2025.

2. BloombergNEF, “Banks’ fossil fuel heel turn”, 6 August 2025.

3. BloombergNEF, “The Energy Transition: Resilient or Under Threat?”, 14 August 2025.

4. Ember, “Grids for data centres: ambitious grid planning can win Europe’s AI race”, 19 June 2025.

5. BloombergNEF, “Power Hungry Data Centers Are Driving Green Energy Demand”, 18 August 2025.

6. Financial Times, “The story behind Spain’s solar power meltdown”, 11 August 2025.

7. Michael Liebreich is Chairman and CEO of Liebreich Associates. He is Senior Contributor to Bloomberg New Energy Finance, which he founded in 2004 and sold to Bloomberg in 2009.

8. BloombergNEF, “Liebreich: The Pragmatic Climate Reset”, 28 July 2025.