Taking shape: fixed income markets in 2026

Corporate bond issuance remains a key focus in financial markets, with trends such as “Reverse Yankees” and “US Hybrids” covered in our previous quarterly publications. However, the spotlight has now shifted to the refinancing of investments in Artificial Intelligence (AI).

In recent weeks, we have observed several high-profile bond deals, including a record-breaking USD 30 billion issuance by US technology giant Meta across six tranches in October. This deal attracted an astonishing USD 116 billion in investor demand, making it the largest corporate bond issuance of 2025 and the fourth-largest in history. This is just one of many examples.

The buzzword fuelling this surge is “AI Capex” – capital expenditures dedicated to building global data centers, AI infrastructure, and related power supplies. Market estimates suggest that these investments could total USD 5 trillion. However, the rapid expansion of data centers is facing significant constraints, including energy and power supply, real estate, water availability, commodity prices, and access to capital.

Energy and power supply, in particular, are expected to significantly impact the utility sector, as electricity demand is projected to outpace supply. According to the Lawrence Berkeley National Laboratory, energy consumption by US data centers is expected to rise from the current 175 Terawatt Hours (TWh) to approximately 325–580 TWh by 20281. This dramatic increase in demand highlights power supply as a critical bottleneck for data center growth.

Addressing these challenges will require substantial investments in energy infrastructure. However, scaling up power generation – whether through nuclear plants or new natural gas turbines – typically takes years. Nuclear energy, often cited as the preferred option in the US due to its large capacity and carbon-free generation, is one potential solution, but it requires time and resources to develop.

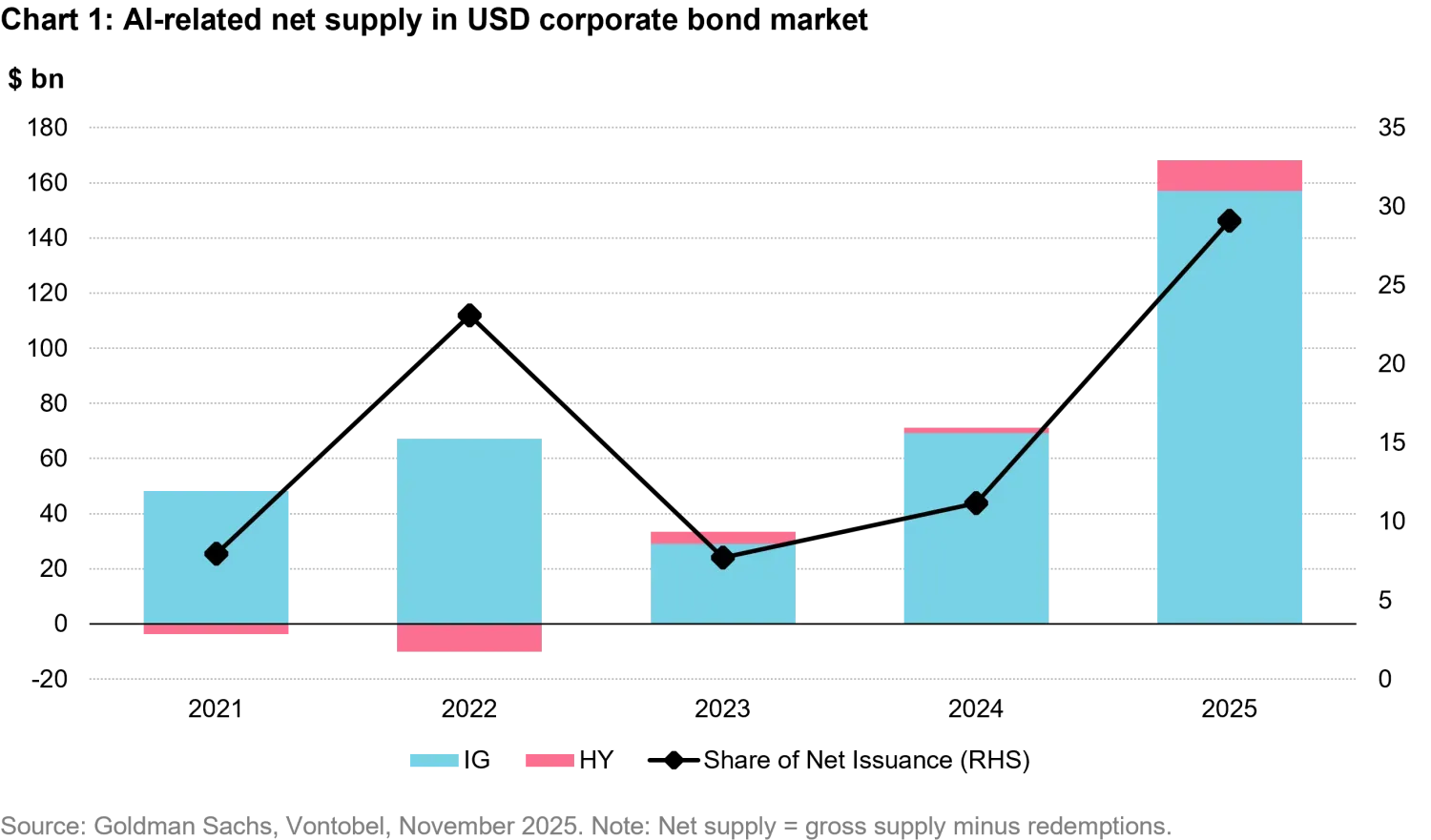

As illustrated in Chart 1, the surge in AI Capex is driving a rapid increase in bond issuance, with AI-related investments accounting for approximately 30% of total net issuance in the USD investment grade bond market in 2025. It’s important to note that these massive investment needs are only partially financed through the bond market, with other segments, such as private credit and leveraged finance, also playing a role.

In the corporate bond markets, current estimates project around USD 300 billion in AI or data center-related bond issuance over the next year, and approximately USD 1.5 trillion over the next five years. This would make the AI-related segment a significant component of corporate bond indices, representing 15 to 20% of most indices— surpassing even the US Banks component in some cases.

Demand for AI Capex-related bond issuance has been exceptionally strong, largely driven by the fact that most issuing companies are highly rated institutions. However, the substantial volume of bonds issued has begun to contribute to a widening of credit spreads. This trend may persist, given the significant issuance requirements anticipated for the coming year.

In summary, the AI Capex boom is making a profound impact on the corporate bond market, with ripple effects across multiple sectors. We believe that trend has the potential to reshape index compositions as well as create new opportunities and challenges for investors. Far from being a passing phenomenon, the AI-driven transformation of the bond market is expected to accelerate in coming months.

High yield markets are on track to generate solid total returns for the calendar year 2025. While dispersion across both ratings and sectors has previously been minimal, it is starting to increase as investors digest Q3 earnings, the end of the government shutdown, and reduced tariff-related headwinds.

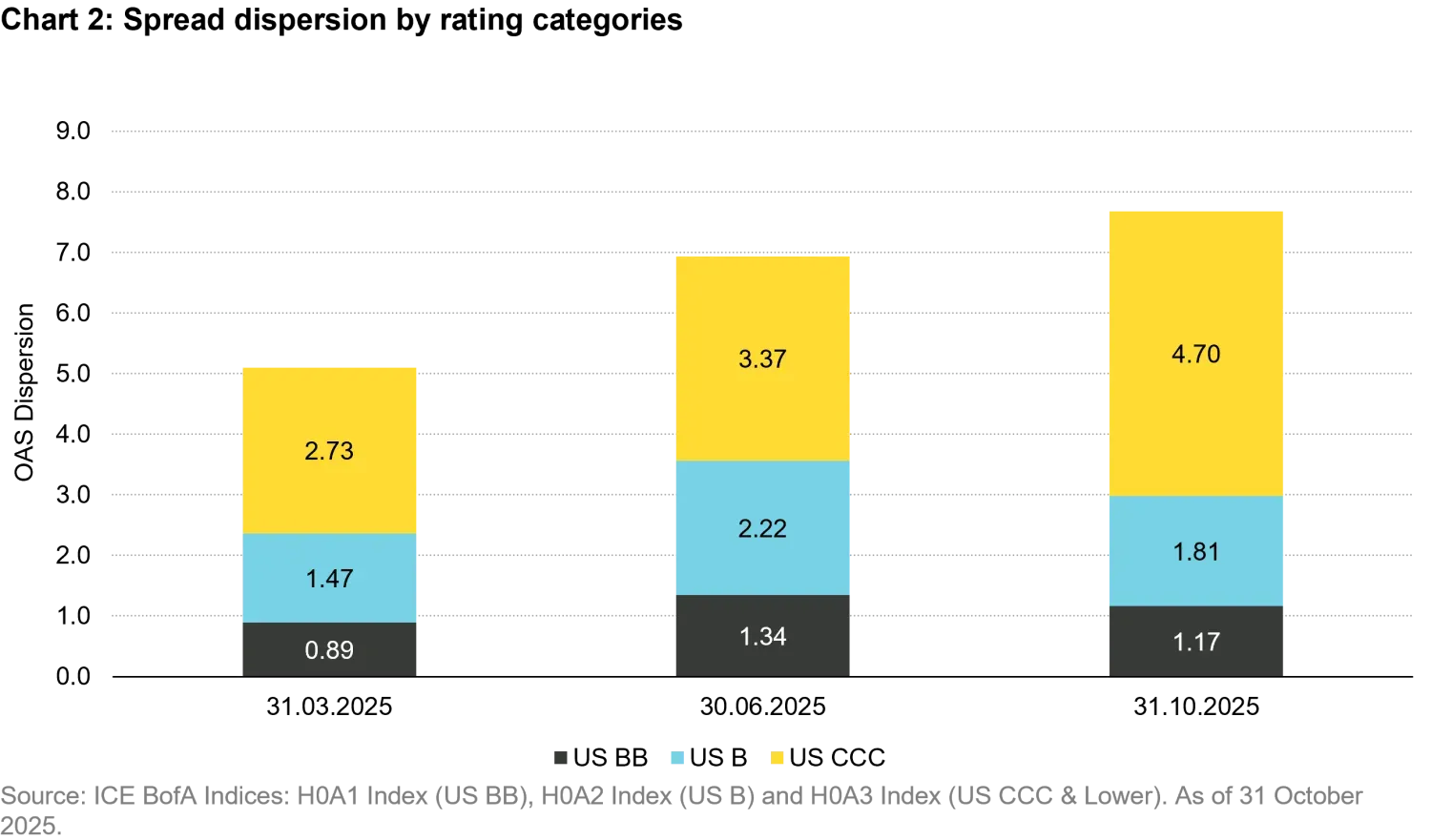

Chart 2 highlights that spread dispersion has increased across all rating categories since March, with a much more pronounced rise in lower-quality segments. BB-rated bonds saw only a modest widening in dispersion (from 0.89 to 1.17), indicating that the higher-quality segment of the high yield market has remained relatively stable. In contrast, single-B bonds experienced a more material increase (from 1.47 to 1.81), reflecting greater issuer differentiation that intensified mid-year and has since remained elevated. The CCC-rated cohort showed the largest and most persistent jump in dispersion (from 2.73 to 4.70), underscoring the significant broadening between stronger and weaker tail credits in this category.

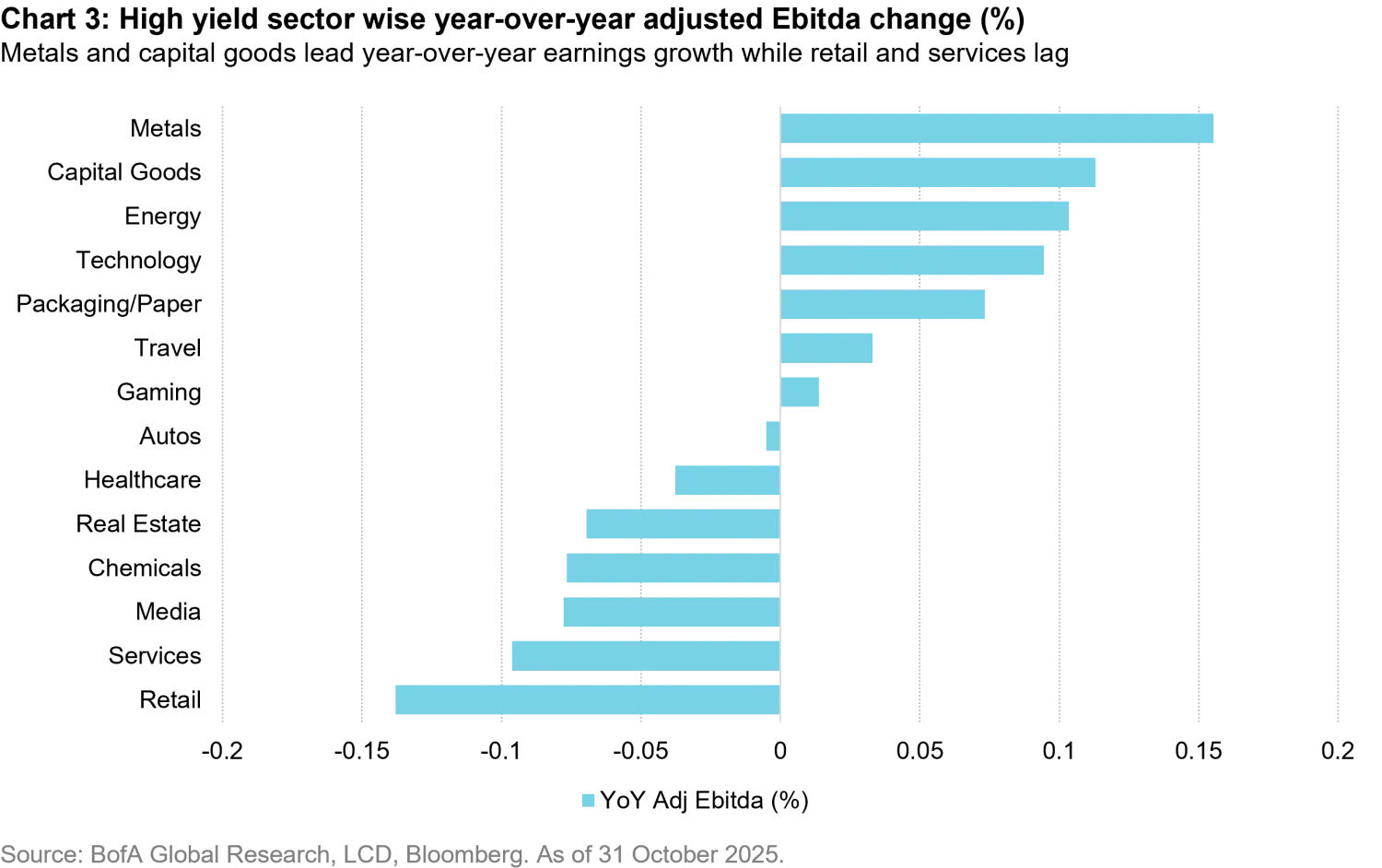

In order to understand the drivers of this increased spread dispersion by rating, we begin with the fundamentals and recent earnings results for Q3 2025, highlighted in chart 3. These were marginally better than last quarter as topline growth showed resilience, with year-over-year revenue up 4.5%. Profitability metrics were mixed as gross margins also improved, but adjusted EBITDA only grew 1.3%.

Unsurprisingly, we are also seeing sector-specific differences in updated financial guidance. In the chemicals and consumer sectors, both considered cyclical, more companies are lowering guidance than raising it, while in energy and services, a significantly higher number of companies are guiding up than down.

The key drivers of guidance and future performance are typically tied to common macroeconomic headwinds, which tend to shift from year to year. In 2025, tariffs and interest rates were the major headwinds, but as we head into 2026, these pressures are starting to ease. Current headwinds are now more tilted toward the timing of AI-related spending and productivity gains, along with the continued weakening of the lower-income consumer cohort. These factors will impact sectors in different ways, as reflected in Q3 guidance expectations from management teams.

Overall, it is critical to carefully assess which companies are better positioned to outperform compared to others with higher leverage and cash flow profiles more exposed to these evolving headwinds. In the energy services sector, we are excited to find issuers with low leverage, more than adequate liquidity, and solid market share that can take advantage of longer-term trends. For one issuer in particular, this profile coupled with a well-timed asset sale enabled the company to refinance its near-dated maturities, providing the runway to continue its growth strategy and further build equity value at reasonable leverage levels. As a result, the issuer’s bonds traded higher and remained stable despite increased volatility in commodity prices. Yields remain attractive given the inherent commodity risk associated with the sector, with the potential for spreads to tighten over time as growth strategies are achieved.

On the more challenging side, we remain cautious about more cyclical sectors, where we believe timing is critical. Negative trends can often persist until a catalyst emerges to signal a reversal. The chemicals sector includes many companies subject to this negative trend, which is currently amplified for many products by significant additions to capacity by Chinese chemical producers. In addition to supply factors, demand is also an issue for companies more exposed to struggling end markets such as housing, construction, and to a lesser extent, autos. Opportunities will exist for well-diversified chemical companies with the ability to reduce capital expenditures while the cycle plays out. In the meantime, we prefer shorter-dated maturities that can benefit from a variety of refinancing alternatives available to certain companies.

High yield markets continue to present an attractive risk-reward profile. Many issuers have taken advantage of declining interest rates to extend maturities and maintain default rates below the long-term median. In terms of sector weightings, we continue to favor telecoms due to their ongoing growth trends, which are less tied to typical macroeconomic drivers, as well as robust M&A opportunities. We also remain slightly overweight on the energy side, although we have trimmed our exposure given concerns about commodity price volatility heading into 2026. On the underweight side, we remain cautious of the more cyclical sectors such as chemicals, as mentioned above, where challenging supply and demand fundamentals persist.

The Swiss bond market has once again moved to its own rhythm. Swiss government bonds remain extremely scarce due to limited issuance, strict debt-brake rules, and a long-standing culture of fiscal surplus. As a result, investors are left competing for a small pool of outstanding Swiss government bonds. This scarcity, combined with renewed demand, has triggered a strong rally – particularly at the long end of the curve, where the very limited free float means that even modest buying pressure pushes yields lower and deepens the curve inversion.

At the same time, Swiss Average Rate Overnight (SARON) swap rates have barely moved, leading to a pronounced widening of swap spreads. This divergence is a uniquely Swiss phenomenon. In the US and Germany, heavy government issuance – driven by large fiscal deficits in the US and increased defense and infrastructure spending in Germany – ensures an ample supply of bonds. Combined with lingering concerns around the US dollar, this dynamic keeps government yields and swap rates moving more in tandem, resulting in inverted swap-government relationships across much of the curve.

In the CHF credit market, spreads versus swaps remain broadly stable, yet increasingly attractive relative to the rich valuation of Swiss government bonds. Bank treasuries have returned as active buyers, Basel III-related risk-weighted asset (RWA) effects continue to offer technical support, and the positively sloped curve enhances carry and roll potential. Additionally, domestic CHF credit has become increasingly expensive compared to foreign CHF-denominated credit, driven in part by sustained domestic investor demand without corresponding supply growth.

Looking ahead, the Federal Finance Administration (FFA) plans to issue CHF 4.5 billion in 2026 – an increase of CHF 1 billion from the previous year, but not enough to materially improve overall market liquidity. With no indication of a shift in the 12-year market-weighted issuance duration target, Swiss government bonds remain expensive, driven by structural factors, and are likely to stay that way.

We expect lower all-in yields to first filter into the high-grade segment and subsequently into the credit markets, with spreads remaining well supported and gradually tightening through the year as demand for the asset class grows. The new year is expected to bring a fresh wave of supply, which may offer compelling opportunities to selectively add credit risk. The current low-yield environment offers excellent opportunities for active managers – encouraging an active approach to duration rather than passive observation.

1. As of January 2025