Fixed Income quarterly webinars

Join us for our quarterly Fixed Income webinars as we explore evolving global markets and the geopolitical risks reshaping investment landscapes.

Weaker fundamentals but lower uncertainty may reduce “Armageddon” risk in Fixed Income, but volatility will persist.

The global economy is not synonymous with the US economy. There is, however, a real sense among market participants that the US economy’s ability to both decline and recover rapidly means that, when making forward-looking predictions about the global economy, one should focus first and foremost on the US economy. We have previously made reference to the fact that US dominance is waning, and emerging markets, in particular, have managed to avoid challenges faced by the US economy – perhaps even benefitted from them.

As we moved through 2025, the probability of a recession in the US remained stubbornly high. As we approach the end of the year, data continues to support this view. If anything, we appear to be ending 2025 in slightly more negative territory than where we began.

And yet, we believe that the probability of a catastrophic decline has decreased. In other words, while the “average” of all forward-looking projections looks worse, the cone of probabilities appears tighter. As Fixed Income investors, we perceive this as good news on a net basis and supportive of the continued strong inflows into Fixed Income assets.

Fixed Income investors are generally less concerned with small deviations in economic conditions, as our focus is on defaults and default cycles. Clearly, if equity markets sell off, Fixed Income will follow suit, but yields should defend us. What we really fear, however, is a credit cycle.

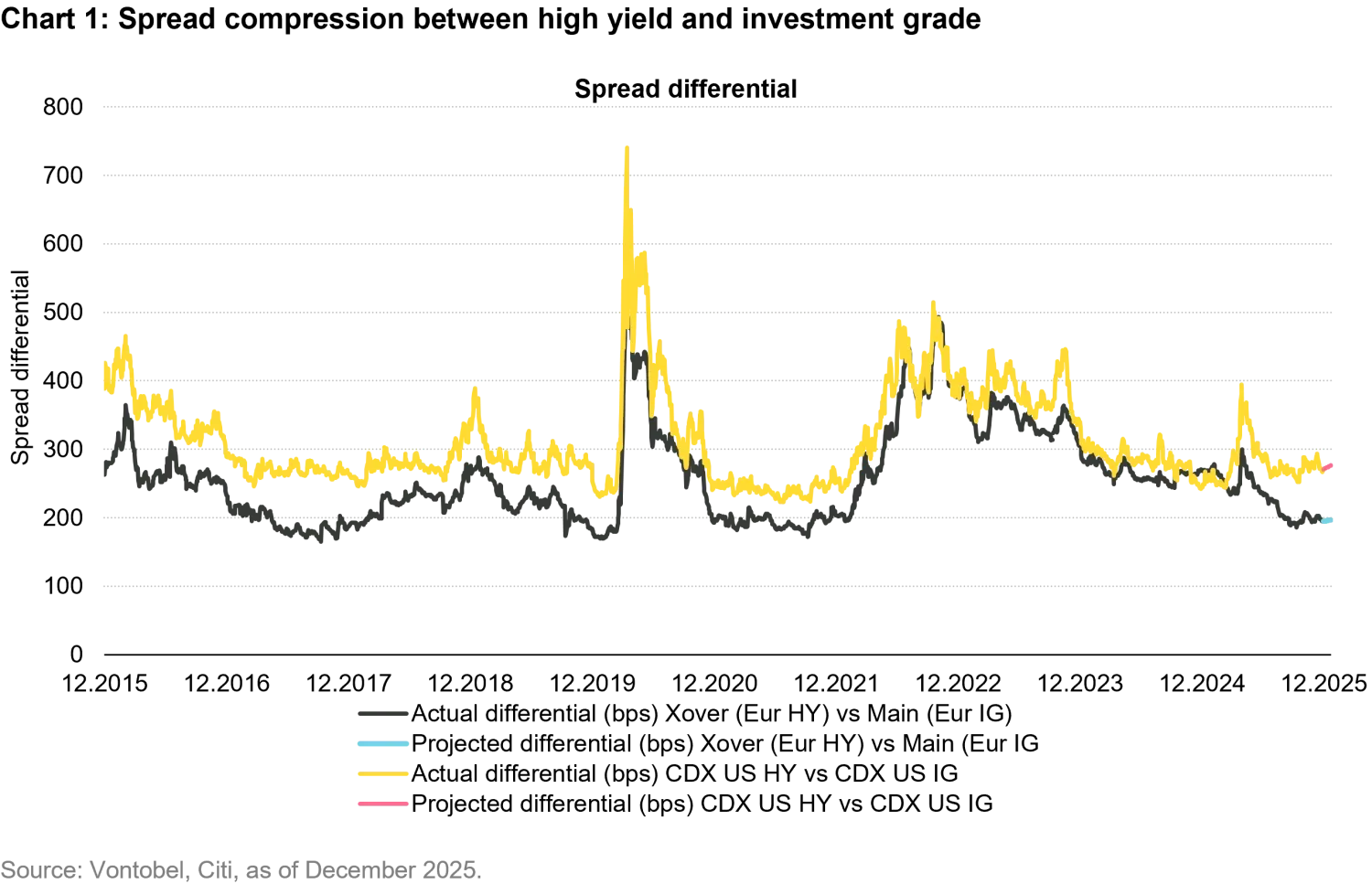

We have previously written about the strength of fundamentals within Fixed Income assets. Both consumers and corporates appear significantly less leveraged than we would expect given where we are in the credit cycle. Recently, we have also been closely monitoring another factor that tends to emerge in the absence of a market correction: “compression.”

This effect is the natural end consequence of investors stretching further down the risk spectrum in an effort to squeeze the last juice out of markets. Throughout 2025, we have certainly observed some evidence of this trend. Investors have gradually reduced their cash balances, shifted out of money market funds into more traditional Fixed Income instruments, and even moved flows into Emerging Market Fixed Income.

That said, there have been some areas of caution. The recent bout of uncertainty around private credit has sounded alarm bells for investors in lower-rated segments. Within the Financials space, we continue to see embedded risk premia in subordinated debt.

Once again, we find ourselves concluding that while spreads in Fixed Income markets are undoubtedly tight, the alarming irrationality, desperate hunt for yield, and rising leverage are not quite at the levels of peak bullishness that would prompt those of us with a bearish tint to start licking our lips. The notable exception to this broad view lies in new issues where demand for paper remains robust. Syndicate desks are certainly not struggling to get deals done, though perhaps this is the exception that proves the rule.

After reading all of the above, you would be forgiven for expecting to see a higher risk appetite score for Fixed Income markets. Indeed, if Fixed Income markets existed in a vacuum, our score would be higher – perhaps even a very bullish +3 score would be warranted. But we do not exist in a vacuum and have held our risk appetite score steady at 2. While our observations do not conclude that Fixed Income markets are currently “stretched,” it is clear that other asset classes look and feel increasingly so.

A recent conversation with a former colleague was very comforting. Prior to the conversation, I was concerned that my prediction that 2026 would continue to be volatile may be very wrong, and perhaps instead we might be heading for a period of relative calm. And then my former colleague pointed out that current prices of gold and cryptocurrencies are a major sign that investors are feeling acutely bearish. He concluded that this, almost by definition, means that US equity markets are “dramatically undervalued.” He then went on to warm my heart by telling me that cryptocurrencies, as an asset class, are the most undervalued of all asset classes. At that point, I warmly shook him by the hand and wished him well for 2026. Needless to say, my confidence that 2026 and beyond will be volatile is now fully restored.

Our footing remains cautious but nimble. 2025 has been one of my most enjoyable years as a Fixed Income investor, and 2026 is shaping up to be another great year for active managers.