Biodiversity is essential for a strong and sustainable global economy

Asset management

Our Head of Investments, Christel Rendu de Lint, explores the topic of nature and biodiversity in the latest report from the FT Moral Money Forum, of which we’re a proud partner. Available for download now, the November edition asks why the natural world underpins the future of business, arguing that the dire threat that losses in nature and biodiversity pose to humanity are equally critical for business and finance.

It is clear that nature loss is a systemic risk, and investors must address it. It is also clear that investors increasingly need to integrate nature into their investment decisions. For the financial services industry, the collective question now is about finding the best way to do this.

Editorial

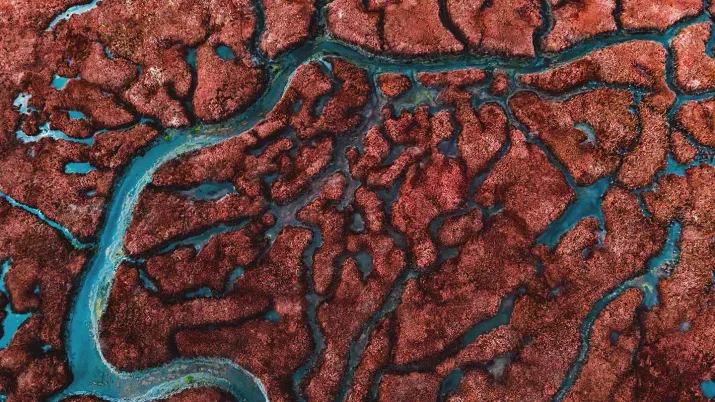

Healthy biodiversity is necessary to sustaining life on earth, but we’ve let it degrade into a pernicious situation that also threatens our global economy. The statistics around biodiversity are sobering: only 23 percent of species and 16 percent of habitats under the EU Nature Directives are considered in good health1 and we’re currently facing what the UN refers to as a “nature apocalypse”.2 Until now climate change has been the focus of many efforts to address the dangerous position of our environment, and while global warming affects nature, we’ve yet to zoom in on the degradation of our ecosystems with the same level of alarm and subsequent action.

The bitter irony is that while much of the erosion of a dynamic biodiversity is due to economic development, its destruction will boomerang back and have a damaging effect on the global economy. With all this in mind, seeking to deliver future-proof investment solutions must involve the consideration of biodiversity and natural capital at large. Nature loss is a systemic risk, and investors must address it. Investors increasingly need to integrate nature into their investment decisions. But how should they do this?

Nature as an economic building block

Thinking about nature in economic terms, biodiversity is valued at an estimated USD 44 trillion, roughly twice the GDP of the US, and close to half of the world’s GDP. Biodiversity is also a fundamental building block of industry and manufacturing and any impact on nature has a flow on effect into the global economy. Consider that soil health and quality are key for land fertility and crop yields, yet land degradation has already reduced the productivity of 23 percent of global land.3 And while 70 percent of global water consumption is used for agricultural purposes,4 we’ve already seen examples of major multi-national companies forced to close manufacturing sites in India and Pakistan due to

water scarcity.5

Even though nature is under pressure, the demands being placed on it will not decrease. The human population continues to expand at a rapid rate, and demand for these increasingly scarce resources will grow.6 With scarcity comes pricing pressure, which has the potential to radically affect the investment decisions people, companies and governments take with the help of investment managers. Resources, and their pricing, are at the very core of investing and investors can take a page from how we already assess commodities and apply it to other natural resources.

Resources

We already formally price natural resources like commodities, but we struggle to make the link elsewhere (e.g. water purification, clean air, soil quality). The United Nations has created a System of Environmental Economic Accounting that integrates nature capital contribution, but thus far, it is not a widely used framework. To truly understand our exposure to nature-related risks, corporations should be transparent about their full value chains, and publicly map their asset locations.

Despite the fact that we’ve made great strides on the accessibility of geospatial data with complex layers, from biomass to species, thus far we still see challenges in mapping relevant data for investors with value chain asset location. Ascertaining a company’s activities/manufacturing assets is often inaccurate. Supply chain mapping is often based on the assumption that access to resources will remain unfettered and ongoing, as will the trade resulting from that access.

Promising steps

So where does this uncertainty leave investors concerned about healthy biodiversity? The last few years have included some major steps forward in terms of countries and companies taking biodiversity and nature more seriously from a financial and economic perspective. As Sarah Murray mentions, last year’s UN biodiversity summit in Montreal was an important milestone, as it made clear that private sector companies are showing an increasing interest in protecting biodiversity . The conference ended with an agreement to impose nature reporting requirements for companies. In addition, more than 190 countries adopted the Kunming-Montreal Global Biodiversity Framework (GBF) in December 2022 which, among other targets, calls for a conservation of 30 percent of the Earth’s land and seas by 2030.

In 2020, we also saw the development of the EU's Biodiversity Strategy for 2030 and the EU Taxonomy (with objectives 3 and 6), which emphasizes its commitment to protecting nature and reversing the degradation of ecosystems. More specifically, the EU Deforestation-Free Regulation (EUDR) entered into force in June 2023, which establishes strict due diligence requirements for companies that place certain raw materials like timber and soy and derivative products on the European market or export them. Finally, the Corporate Sustainability Reporting Directive (CSRD), which entered into force in January 2023, requires businesses to disclose all policies relating to biodiversity and ecosystems and other environmental and social topics.

It's clear: companies cannot continue to value aspects of nature like water and even clean air as “free” resources – they are finite, and unfortunately increasingly scarce. We must make further progress on understanding how to price these resources to ensure a sustainable economy and society.

Vontobel and Financial Times poll

The Financial Times Moral Money Forum has been polling its audience about issues related to biodiversity. We decided to poll our LinkedIn followers with the same questions and aggregate the results.

Source: Vontobel and Financial Times

Sources

1.

https://www.wwf.eu/what_we_do/biodiversity/

2.

https://www.unep.org/news-and-stories/statements/bold-action-towards-deal-nature

3.

https://am.vontobel.com/insights/meeting-sustainability-and-investor-goals-by-supporting-biodiversity

4.

https://am.vontobel.com/insights/the-quest-for-resources

5.

https://www.theguardian.com/environment/2014/jun/18/indian-officals-coca-cola-plant-water-mehdiganj

6.

https://am.vontobel.com/insights/the-quest-for-resources