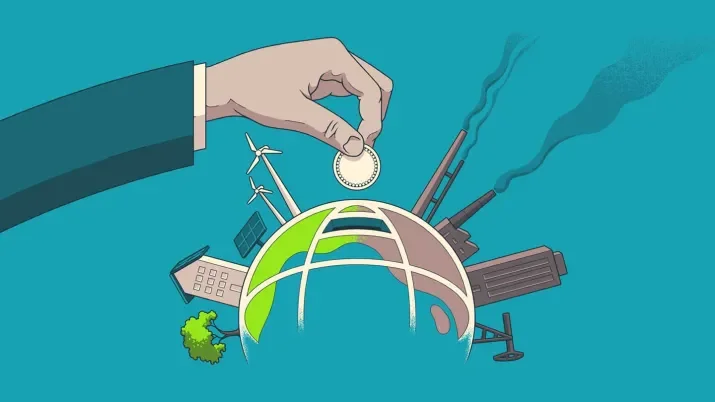

Asset management

Embracing the potential of impact investing in public markets

Given the estimated needs for transition financing, the success of impact investing in public markets is critical to achieve the necessary scale. To ensure a growing adoption of impact strategies, it is critical that investment managers deliver measurable impact and at least equivalent financial performance through the cycle compared to “traditional” strategies.