A recession may not be as bad as you think

Fixed Income Boutique

Key takeaways

- Recessions are not financial crises

- A brief period of stagflation is possible, but won’t be a repeat of the 70s

- A growth revival in China would cushion the blow from possible recessions in the US and Europe

We’re reaching the point where even my Uber drivers lecture me about recession. The R-word has taken over the public discourse in a way that we have not witnessed in previous cycles.

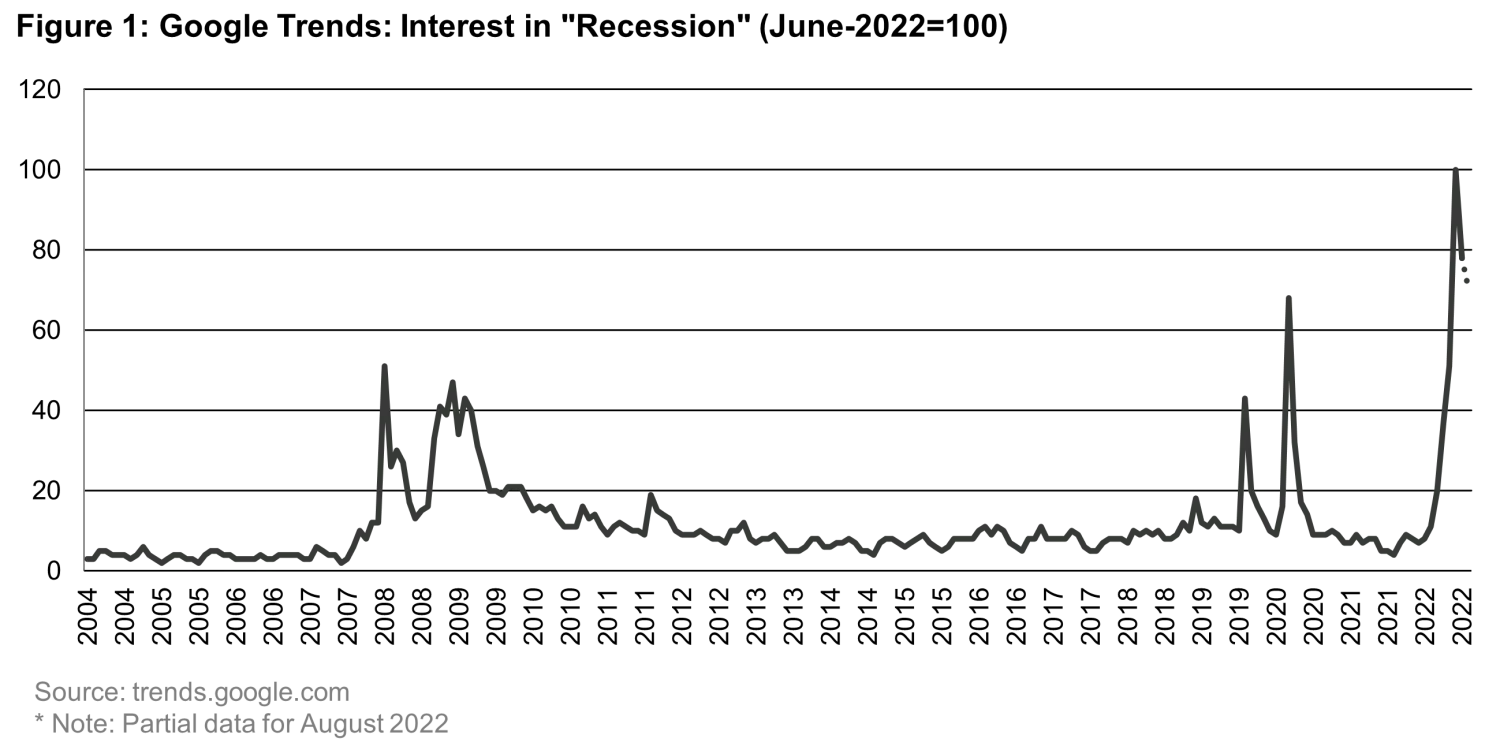

In the United States, for example, Google searches for “Recession” in the US were twice as popular in June 2022 as in October 2008 when the Global Financial Crisis (GFC) started, even though the economy is still creating jobs.

The US has experienced eight recessions since 1970, while Germany experienced 12 in the same period, so recessions are neither rare, nor do they universally lead to economic meltdown. A recession is commonly defined as two or more consecutive quarters of real GDP decline, this is also known as a technical recession. Furthermore, recessions aren’t always severe, they can also be mild and not affect the lives of most people.

Was there a US recession in H1 2022? Technically, yes. But not for the broad economy

In the first half of 2022, US GDP contracted for two consecutive quarters, so by our definition above, the US economy was in a technical recession in H1 2022. However, in the US, the National Bureau of Economic Research (NBER) is the institution in charge of officially determining when recessions begin and end. Their definition isn’t as simple as two consecutive quarters of GDP decline.

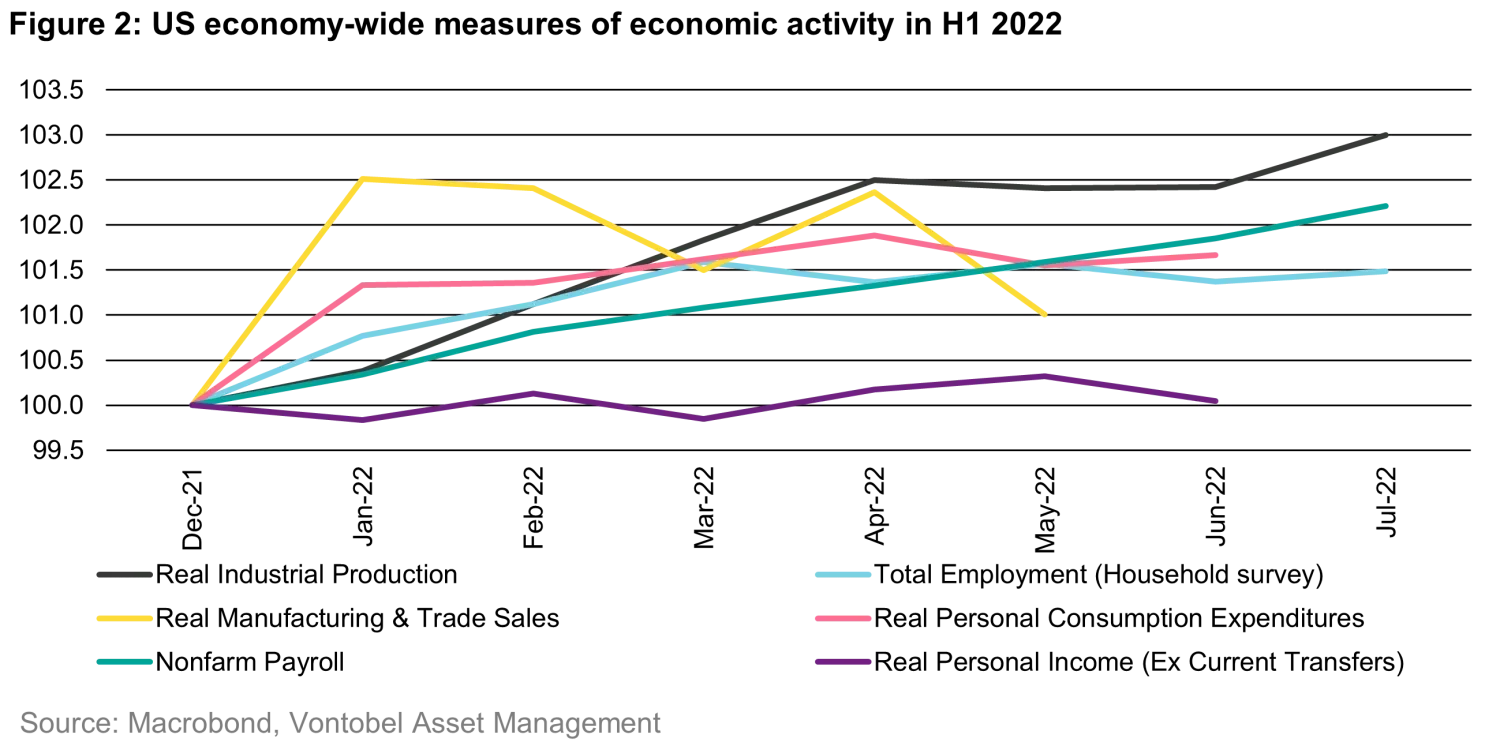

The NBER’s committee looks at “economy-wide measures of economic activity… because a recession must influence the economy broadly and not be confined to one sector.”

Figure 2 shows that except for real personal income – which stagnated due to inflation – all other variables the NBER tracks expanded in H1 2022, therefore, the committee is highly unlikely to declare a recession.

Recessions are severe when tied to a financial crisis

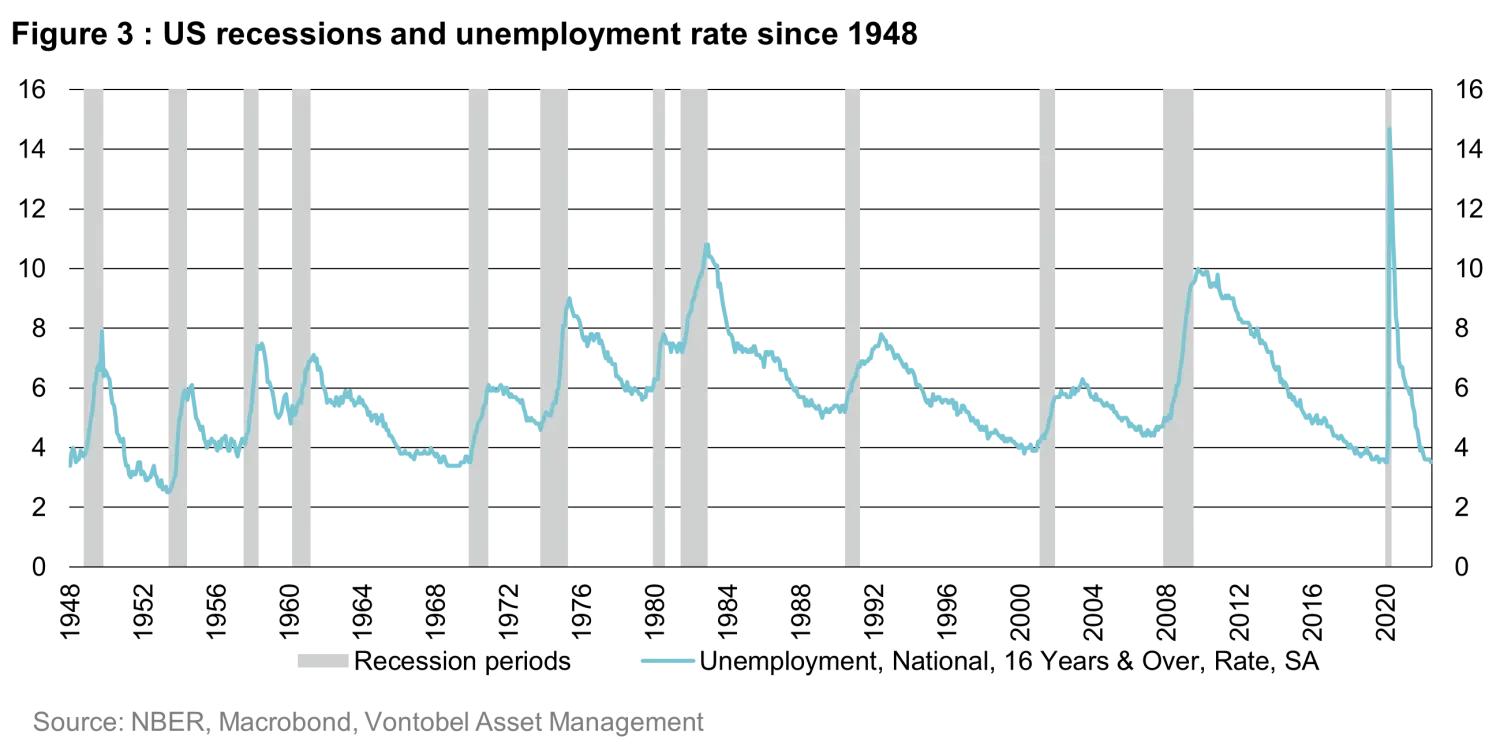

In 2001, the US economy was in recession from March until November, which resulted in an economic contraction of just 0.3% from peak to trough and an increase in the unemployment rate from 3.9% to 5.9%.

In the same year, GDP fully recovered, but unemployment remained slightly above 5% for four years. That sounds mild but it was not too far from the 3.6 percentage point unemployment increase of the median US recession.

In contrast, the unemployment rate reached 10% during the GFC (2008-09) and stayed above 5% for eight years. That’s because the GFC was not a normal recession. It was accompanied by a financial crisis, which are typically associated with deeper declines and much slower recoveries because in these situations, banks are unable to finance the recovery effectively.

After the GFC, US and European banks went through a long process of deleveraging and much tighter regulation to prevent a repeat of the 2000-era excesses that caused the crisis.

Today these banks are perceived to be in good financial health, as shown by their ability to provide large amounts of credit that helped their economies recover quickly after the pandemic. So, it appears implausible that the next recession will be a financial crisis.

Why do so many market participants think a recession may be around the corner?

Developed countries are currently experiencing the most severe bout of inflation in four decades due to a combination of demand and supply factors – prices rise when supply can’t keep pace with rising demand.

On the demand side, excessive monetary and fiscal stimulus during the pandemic, combined with pent-up demand for services are pushing prices up.

On the supply side, global supply-chain constraints due to the pandemic lockdowns, combined with inadequate investment in energy commodities in the previous decade, are now resulting in an insufficiently elastic supply of goods and energy. This has also coincided with sanctions disrupting or threatening energy security.

Central banks can’t do anything to increase the supply of goods and services to lower prices –their only option is to reduce demand by constraining credit and money growth. They do it by raising interest rates so that banks reduce lending, while people and companies reduce their borrowing and investment due to higher financing costs. This often leads to a recession, which brings inflation down.

It comes down to what kind of inflationary cycle we’re in. When inflation is slightly high, a modest increase in interest rates is enough to dampen demand and bring the economy back to a low inflation equilibrium, resulting in a soft landing. But when inflation surges, like now, surprising central bankers who had never seen such levels of inflation in their entire careers, then faster and larger interest rate increases are necessary to break the back of inflation – like in the 70s, making a recession more likely. However, the beginning of disinflation in July in the US, and the economists’ consensus forecast of inflation falling below 3% by Q4 2024, provide a glimmer of hope for the soft-landing (no recession) scenario.

Are we heading toward 70s style stagflation – a period of low growth and high inflation?

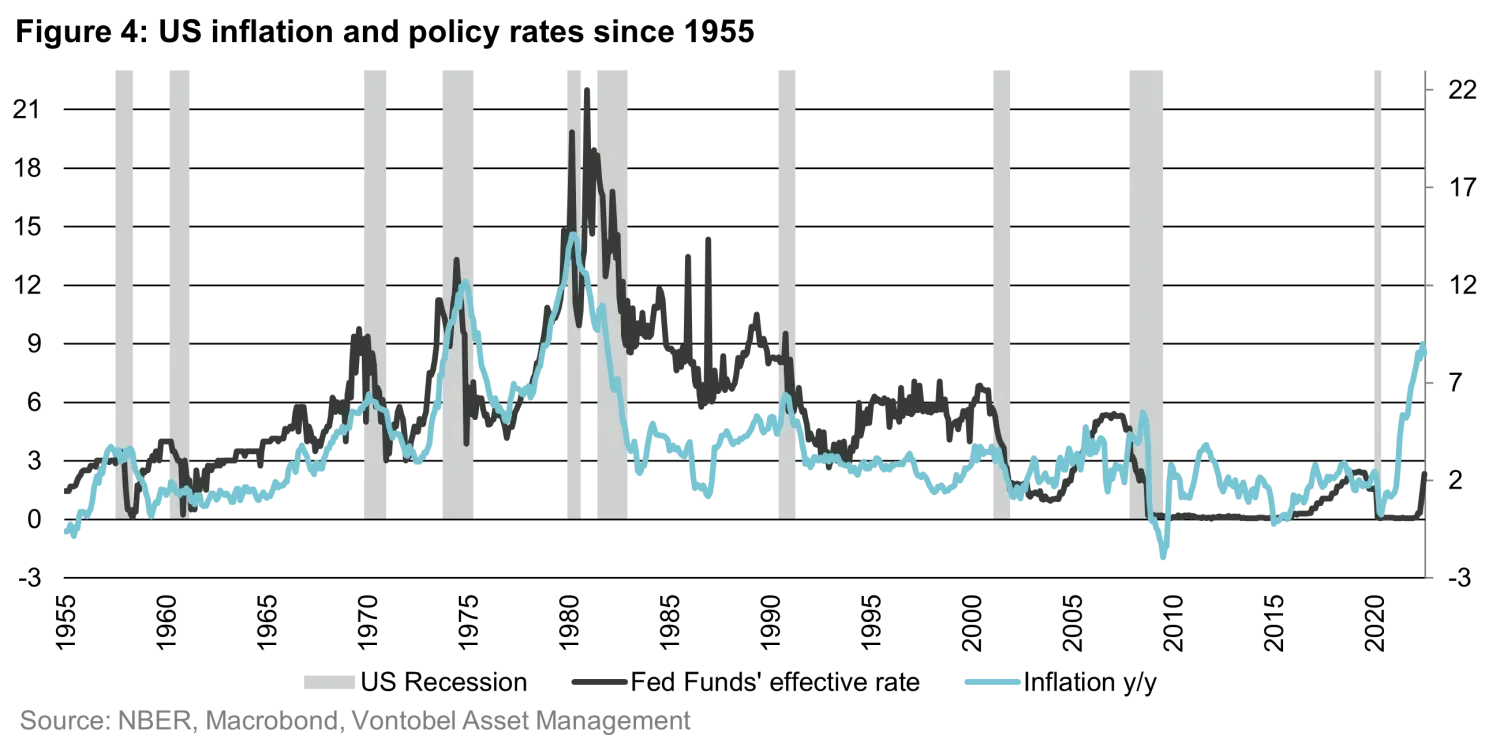

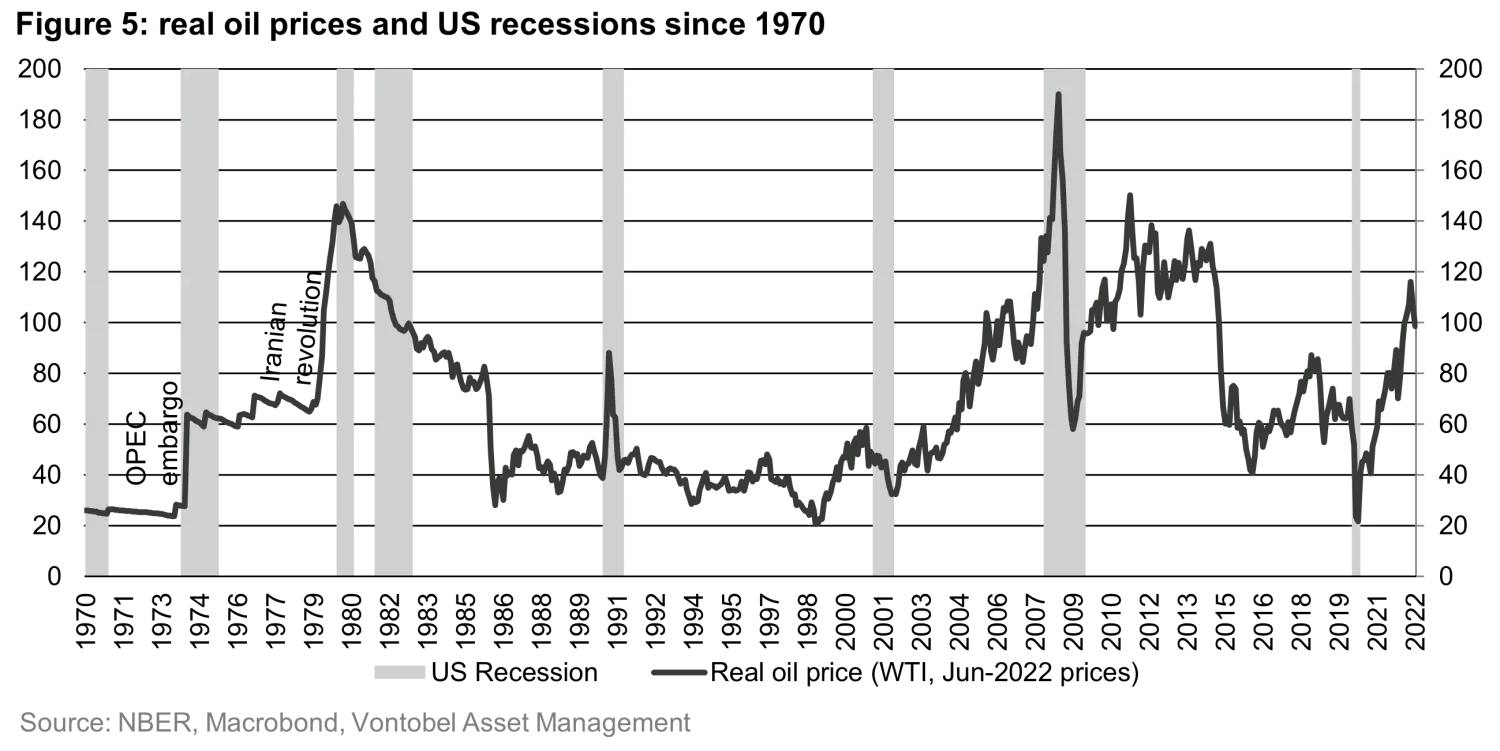

In October 1973 inflation in the US was already high (8%) following the end of the Bretton Woods System (suspension of dollar convertibility to gold) and the subsequent devaluation of the dollar against the Deutsche mark, Swiss franc, and Japanese yen.

Then, OPEC countries imposed a six-month oil export embargo on countries that had supported Israel during the brief “Fourth Arab-Israeli War”. Oil prices almost tripled overnight, which drove inflation up to 12.2% by November 1974 and forced the US Federal Reserve to hike interest rates from an already high level of 10% to over 13% by mid-1974.

A 3.1% drop in GDP took the unemployment rate up to 9%, which remained above 6% for the next three years. However, inflation remained above 5% throughout the rest of the 70s, probably because the Fed did not maintain high interest rates for long enough – a policy mistake that contributed to higher macro and financial volatility. Something the Fed Chairman Jerome Powell recently highlighted as a mistake they do not want to repeat by cutting rates too soon in 2023.

In 1979, another oil crisis shocked the world economy with oil prices tripling again with the Iranian revolution and then the Iran-Iraq war. Inflation surpassed 15% in the US by the mid-1980s, and the US and other developed countries fell into recession again. This time, the Fed, led by Paul Volcker, acted much more decisively, hiking interest rates to 22% by the end of 1980. Since then, inflation in the US had remained relatively low and stable until recently.

A brief period of stagflation is possible in the US, but unlikely to be as bad or long as in the 70s

Oil prices have roughly doubled in the last year and a half – not tripled in a few months like in 1973 and then again in 1979. More importantly, thanks to technological efficiency, the global economy is much less dependent on oil today than 40 years ago.

According to the IMF , the world needed 3.5 times more oil back then to create the same amount of economic output. Additionally, the share of workers represented by labor unions in the US has halved since the early 80s, reducing labor bargaining power. This is bad for workers, but helps reduce inflation persistence by reducing wage indexation.

Furthermore, monetary policy and central bank credibility were not well established before the Volker era. The Fed and other developed central banks may have fallen behind the curve last year, but they’re now determined to hike rates until inflation is under control again. Thus, while developed countries could slip into stagflation briefly, it is unlikely to be as severe and long as in the 70s.

Emerging market central banks are ahead of the curve in this cycle

Global inflation is also affecting emerging markets (EMs) – a large and diverse group of countries. The weighted average inflation of the 15 largest EMs stood at 8.6% in June, up from 3.3% a year earlier, but surprisingly similar to the weighted average in developed countries (8.2%).

Like developed countries, some EMs may have overdone the stimulus in 2020. But most EMs are currently ahead of the curve in fighting inflation compared to developed markets, perhaps due to their more recent experiences with high inflation. Most EM central banks have been hiking rates since last year and, in some cases aggressively. Asia is an exception because they currently face lower inflationary pressures than most regions.

Brazil may have some lessons for the world because it is ahead in the current economic cycle

Analogies with the 70s stagflation period are useful, but we can also draw parallels with countries that are further ahead in the current economic cycle to analyze how things will pan out in the rest of the world.

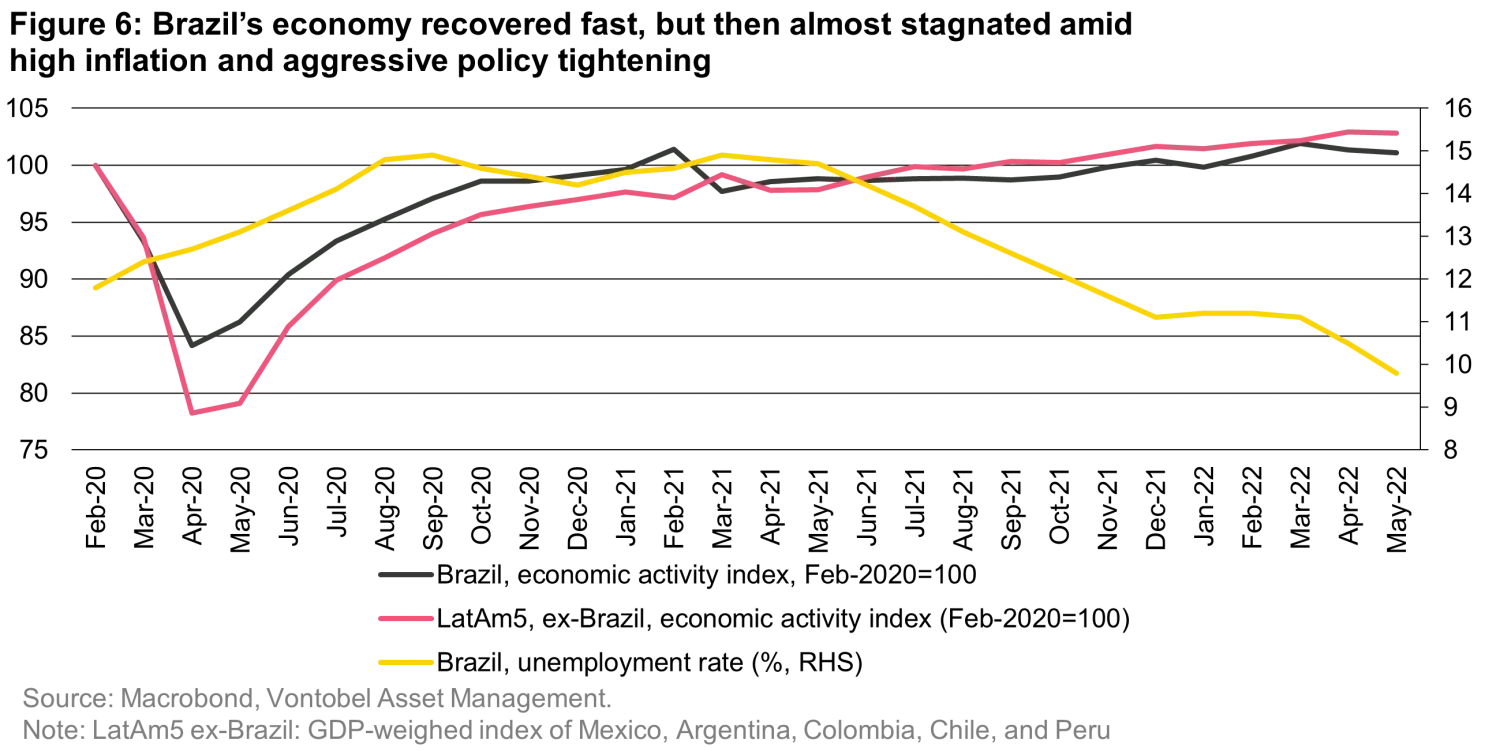

Brazil is probably the prime example. Having had light and short-lived Covid-related restrictions (amid President Bolsonaro’s Covid skepticism) and having imposed relatively large monetary and fiscal stimuli by EM standards, Brazil’s economy had fully recovered by December 2020, earlier than most countries in the region.

But the recovery also started to face challenges early on. The economy experienced a mild (0.2%) GDP contraction in Q2 2021, and inflation picked up pace more quickly in H1 2021 than in most places.

Unlike in developed markets, Brazil’s central bank reaction has been quick and decisive, raising interest rates from 2% in March 2021 to 13.75% by August 2022. Growth has been relatively slow since mid-2021, but unemployment has continued to decline.

Inflation remains high (10.8% in June) despite rate hikes, driven by global factors. And the economy will probably remain close to stagflation until global inflation decelerates allowing Brazil’s central bank to loosen monetary conditions gradually and credit to start flowing again.

Other emerging economies may have to go through similarly volatile cycles, particularly those whose economies appear overheated such as Chile and Colombia.

While recession may still be avoided in countries where stimuli was modest and there’s still spare capacity in the economy to absorb recovering demand. For developed countries, Brazilian-style rate hikes would be unrealistic, of course. But they appear likely to eventually follow a similar path to Brazil’s: higher interest rates, slower economic growth and, potentially, a recession before inflation normalizes to an acceptable level.

China could cushion the blow from recessions in the US and Europe

Another silver lining is that while most developed economies will go through an economic slowdown, and possibly through mild recessions, China’s economy is expected to reaccelerate due to its eventual full reopening once the zero-Covid policy is abandoned. This could happen in 2023 following Xi Jinping’s re-election in November 2022 and once more progress has been achieved on the vaccination front.

China is the second largest economy in the world and is either the largest or second-largest trading partner for almost all EMs. Thus, a growth revival in China would cushion the blow from possible recessions in the US and Europe, particularly for commodity-exporting EM countries. Therefore, a global recession appears unlikely.

Disclaimer:

The views and opinions herein may change at any time and without notice. Such information is not intended to predict actual results and no assurances are given with respect thereto. Certain information herein is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity of countries, markets and/or investments. We believe such statements, information, and opinions are based upon reasonable estimates and assumptions. Actual events or results may differ materially and, as such, undue reliance should not be placed on such forward-looking information. Vontobel reserves the right to make changes and corrections to the information and opinions expressed herein at any time, without notice.