Conviction Equities Boutique

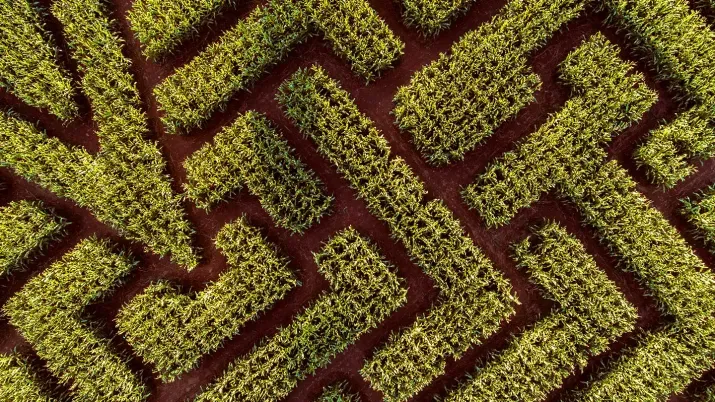

Emerging market equities: time to shine again

Following years of underperformance, emerging market equities are leading global markets in 2025 to date, driven by a softer US dollar, policy reforms, and renewed investor confidence. With valuations still discounted and structural tailwinds in place, this rally signals a potential long-term shift in global equity dynamics.