EM equities: From lost decade to resilience?

Conviction Equities Boutique

Key takeaways

- Emerging market (EM) equities have endured a difficult period of performance since the early 2010s due to several headwinds, with rising geopolitical risk premia, the persistently strong US Dollar and the constant dilution of shareholder earnings chief among them.

- However, EM equities performed impressively in 2025, with many investors now questioning if they have missed the rally. In our view, the strong performance during 2025 could just be the beginning of a new positive cycle for EM equities.

- In this viewpoint, we set out our rationale for this argument and why we believe there is plenty more runway available when it comes to EM equities. We will also highlight what we believe are some of the most interesting sector dynamics that we expect to see during the year ahead.

With a return of over +30 percent in USD terms, emerging market (EM) equities were certainly one of the biggest winners of 2025, marking the first annual outperformance of developed market (DM)/US equities since 2017. It’s a welcome return to form for an asset class that has struggled to keep pace with its DM counterparts, particularly US equities, during a bleak period that is often described as a ‘lost decade’. The reasons for this underperformance are multiple, with rising geopolitical risk premia, the persistently strong US Dollar and the constant dilution of shareholder earnings chief among them. Given this backdrop and the ‘Trump Trade’ that took place during the final quarter of 2024, there were not many that were predicting such a strong year for EM equities.

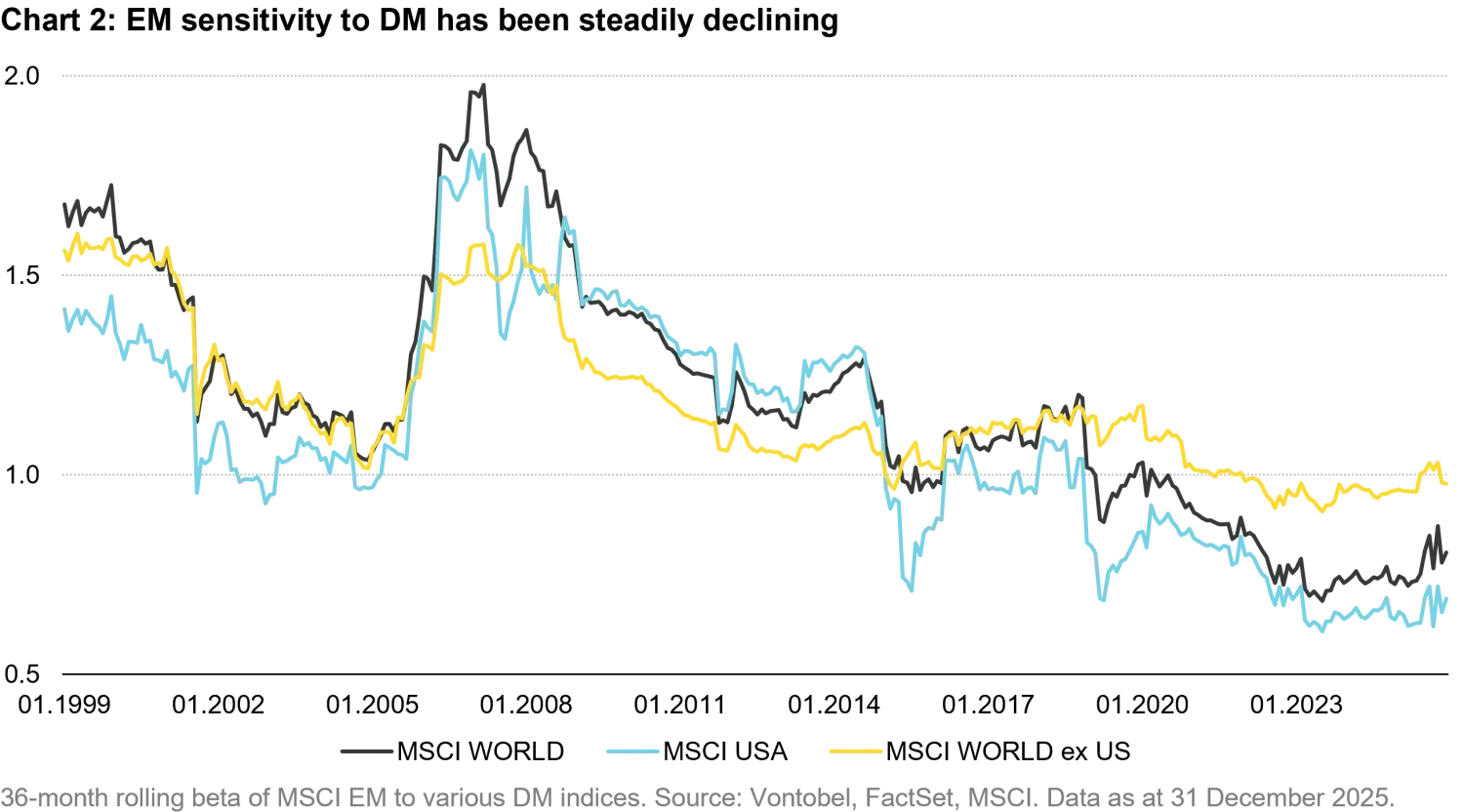

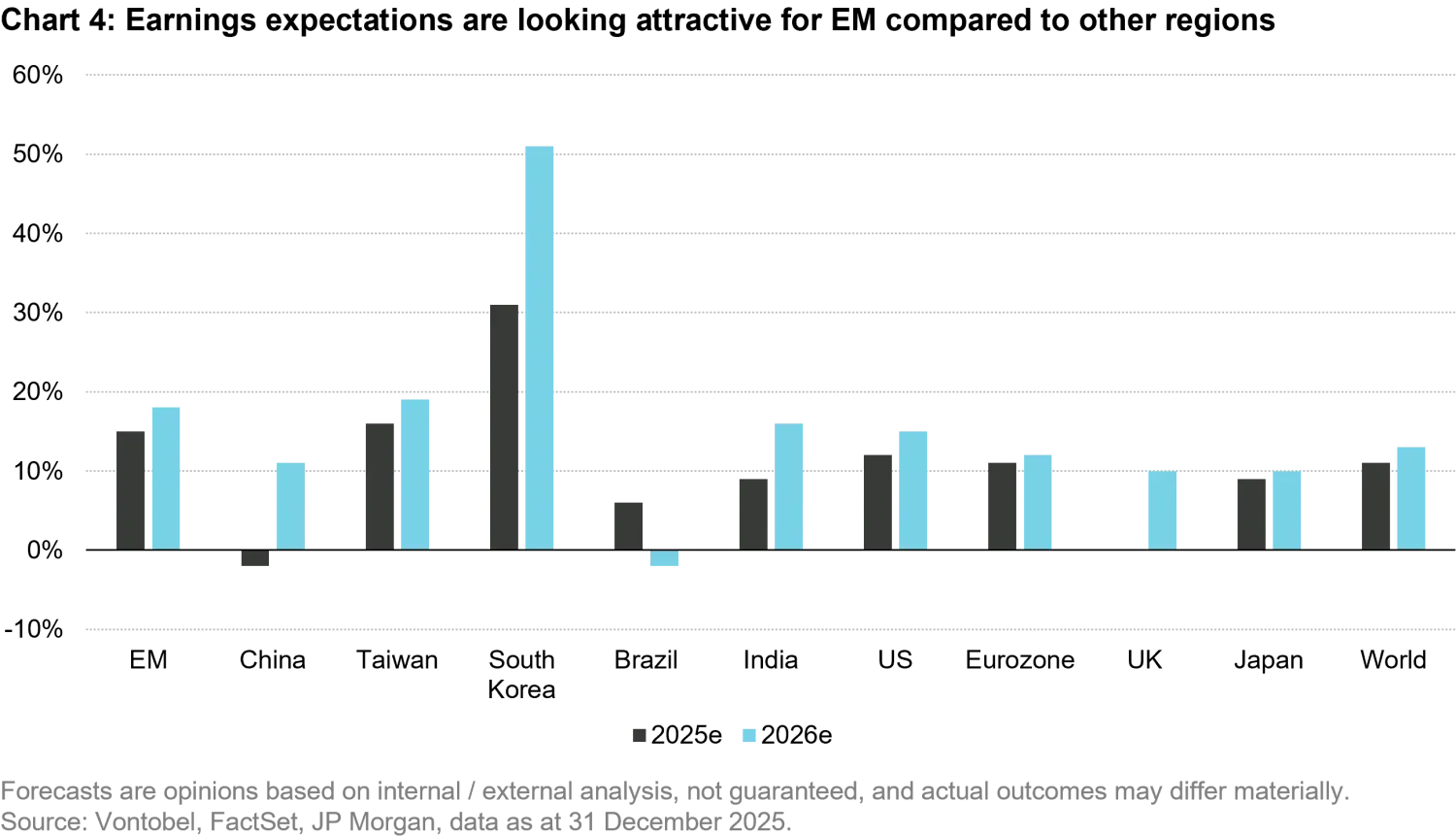

However, as outlined in our global equity outlook for 2025 (Global equities in 2025: Balancing structural drivers with opportunistic exposures), we felt there was potential for a positive surprise from non-consensus trades such as EM equities. Our reasons for this were varied and included the lower dependency of EM economies on trade with the developed world (a key perceived risk at the time given the imminent arrival of the Trump administration), solid earnings expectations from EM corporates, and light investor positioning amid very appealing relative valuations.

Naturally, the question on many investors’ minds now is have they missed the boat when it comes to EM equities? In our view, the strong performance during 2025 could just be the beginning of a new positive cycle for EM equities due to the support of some strong structural forces. In this viewpoint, we will set out our rationale for this argument and why we believe there is plenty more runway available when it comes to EM equities. We will also highlight what we believe are some of the most interesting sector dynamics that we expect to see during the year ahead.

Why the lost decade?

In our view, there are three key structural reasons why EM equities trailed their DM counterparts since the early 2010s:

- The ‘nominal growth premium’ usually associated with EM over DM economies has narrowed significantly in recent years due to rapid disinflation (and even deflation in China), and less obvious competitive advantages. For example, a much-used argument for investing in EM markets in the past has been their appealing demographics and lower labour costs. However, this is no longer a uniform argument across all EM markets. Economies such as China, Taiwan and South Korea are facing significant demographic issues while many EM economies are becoming increasingly sophisticated and are no longer just focused on low-cost manufacturing.

- The risk premium associated with investing in EM equities has not benefited from the lower macro volatility resulting from lower potential nominal growth rates, quite the contrary. EM multiples have structurally declined (in other words, cheaper valuations failed to attract investors) under the influence of higher political and/or geopolitical risks resulting from both policy and political volatility in some key countries (e.g. common prosperity policy in China, failed coup in Korea, political instability in many Latin American/Southeast Asian countries).

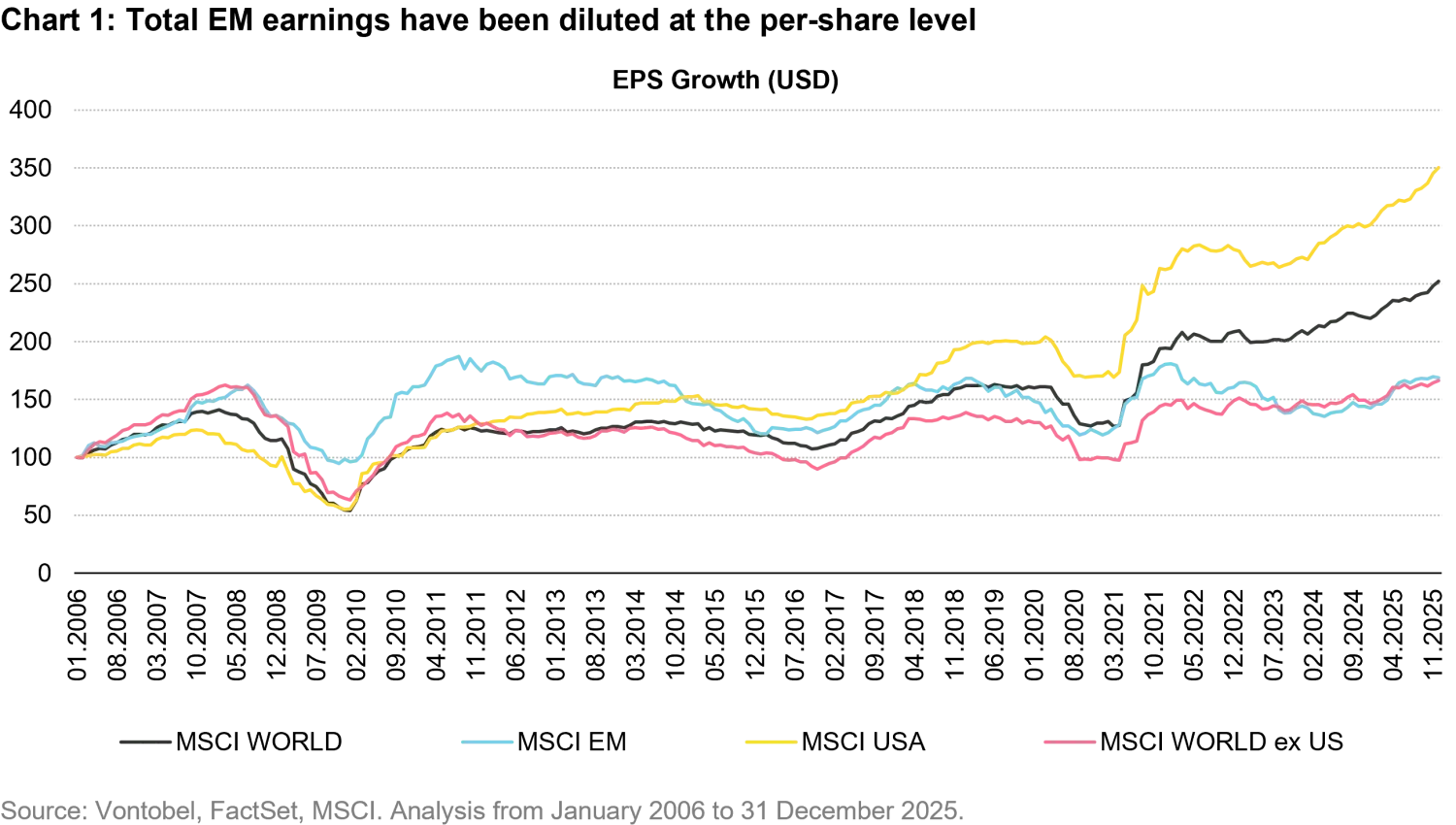

- A less known dimension was the lost translation between strong earnings accumulated by EM corporates and diluted returns for shareholders in terms of earnings per share (EPS). While EM corporates have been growing their earnings over time, impressively ahead of the MSCI World during the period analysed below, they have trailed both DM and US corporates when it comes to EPS. This is a key metric for investors as it highlights how a company is performing from an operational efficiency perspective1 and what share of earnings returns to pre-existing investors. It also facilitates a useful comparison framework for stocks within industries and across countries. While total earnings for EM corporates have done a good job of keeping pace, per-share earnings have been significantly diluted by new share issuances, meaning that future earnings and dividends are being shared among a larger shareholder base. This has led to what is referred to as a negative buyback yield. In contrast, share buybacks are utilized extensively by US companies, boosting earnings per share and creating a positive buyback yield.

It is important to remember that these three structural dimensions took place in the context of a very strong US economy and US Dollar, which incentivised global investors to park an ever-growing part of their allocations in a US stock market with super strong institutional foundations that efficiently rewards equity investors.

What has changed?

While no significant rewidening of the nominal growth gap in favour of EM economies should be expected any time soon, we believe 2025 marked the first year of positive change regarding the two other structural factors identified above. Before we outline the details of these positive changes, it’s important to recognise that the headwind of US dominance has also been softened given the initiatives of the Trump administration.

Reduced risk premium: Far from being the victim of the trade war ignited by the Trump administration, many emerging economies – and particularly China – have demonstrated a much higher level of resilience than what was expected. As highlighted in our 2025 global equity outlook published one year ago, growing levels of intra-EM trade reduced significantly emerging economies’ dependency on the developed world, with the MSCI EM index having a lower exposure to international sales than the Stoxx Europe 600 for example. The advantages of this rerouting of trade were evident in the negotiations between the US and China, the two largest economies in the world, in which China was able to withstand the punitive tariffs that President Trump (temporarily!) applied to Chinese imports. Given that China now only represents around 10% of total imports into the US (it was 21% in 2017), the threat of these extraordinarily high tariffs was pretty much brushed aside by the Chinese authorities.

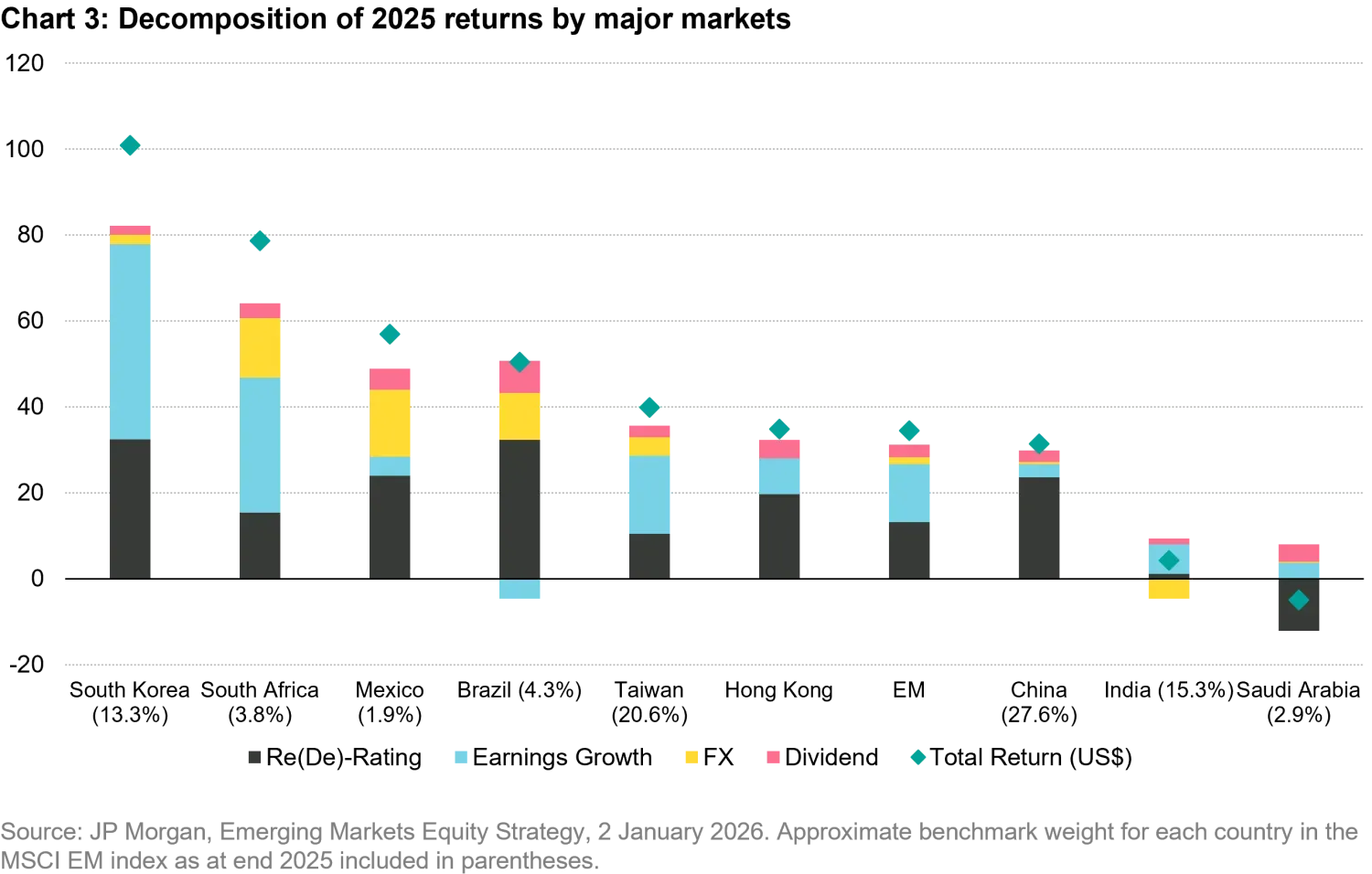

On the financial side, while many DM economies (from the UK to France and even the US) have raised investors’ concerns regarding the long-term sustainability of their public debt levels, catalyzing upward pressure on their long-term sovereign yields, many EM economies have been praised for showing fiscal prudence and have now greater room on their balance sheets to provide support to their respective economies. Beyond fiscal policy, regulations that had been quite extreme in China relative to the profitability of the private sector, or at least some segments/companies, have reverted to a much more market friendly stance. Taken altogether, these various developments have contributed to meaningfully reduce the perceived risk of EM, leading to impressive multiple re-ratings that explain a significant proportion of the returns achieved by many EM markets in 2025, particularly China where re-rating accounted for three quarters of the returns generated.

Focus on shareholder returns: The structural conditions necessary to recycle strong aggregated earnings into higher shareholder value (EPS) have started to improve. In our view, there has been a clear change in attitude from EM corporates over the past few years when it comes to share buybacks, with their cumulated amounts increasing fivefold since 2020. This is a trend we believe is likely to continue heading into 2026 and beyond, particularly given the various high-profile ‘value-up’ initiatives taking place in countries such as South Korea and China. These shareholder-friendly initiatives are government-backed and focused on increasing the valuation of local shares, which in our view makes it very likely that they will not only continue but be potentially adopted more broadly by other emerging countries.

These better structural conditions that have led to a lower risk premium required by investors to hold EM stocks are providing a favorable context for EM markets, opening the way to a potentially lasting period of outperformance if earnings growth continues into 2026 and beyond. Despite the risks to trade, earnings held up remarkably well for EM corporates during 2025. Looking out to 2026, we note that EM corporates are once again expected to lead the way.

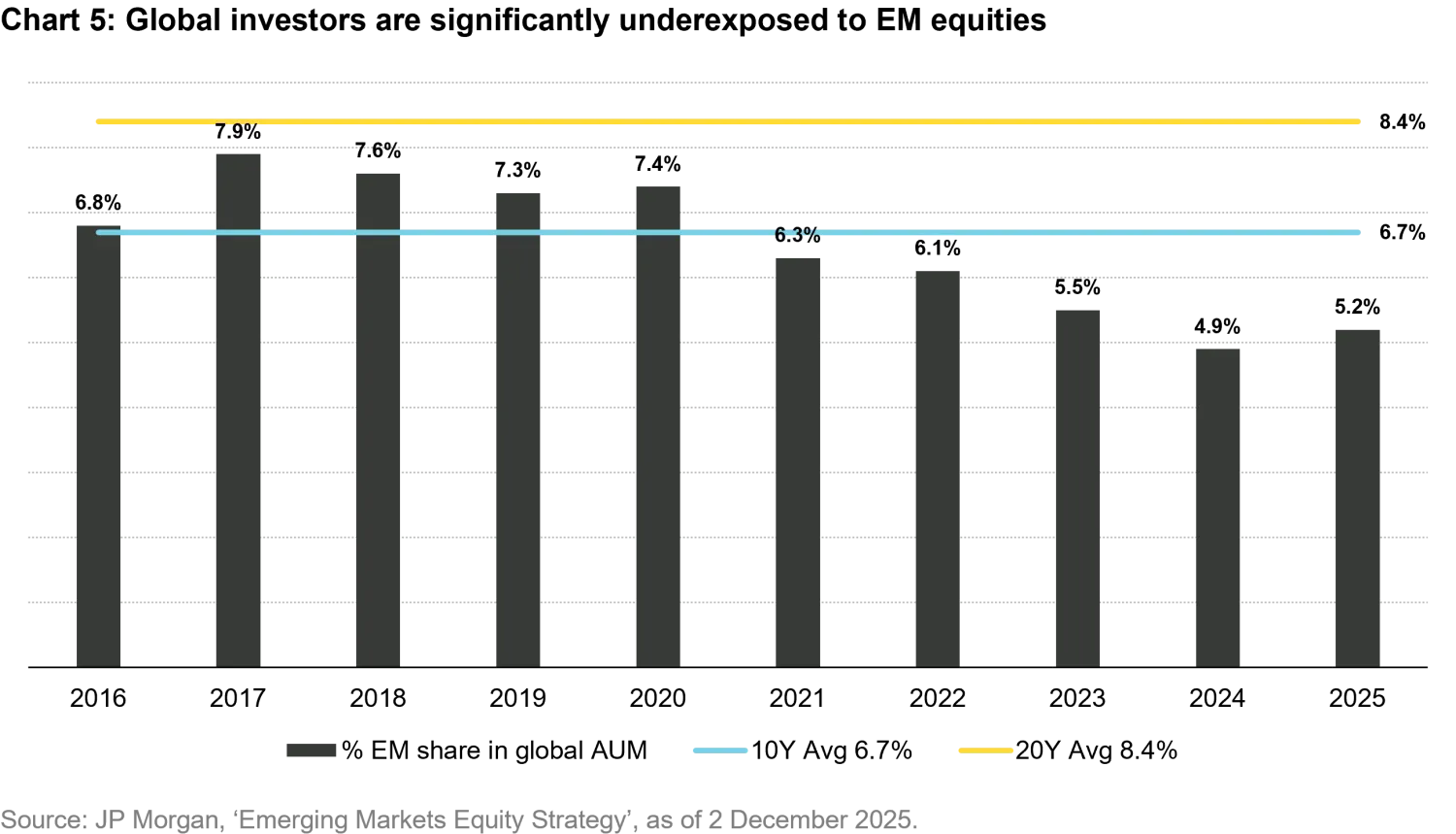

Despite the rerating of EM equity multiples, they continue to trade significantly cheaper compared to their DM counterparts, and in particular the US, at the precise time where some of the key institutional benefits of the US markets are being increasingly questioned by investors. Using the Shiller P/E framework (cyclically adjusted price to earnings ratio that adjusts ten years of earnings for inflation), EM equities continue to trade at a significant discount of -45 percent compared to DM equities2. The persistent light positioning of global investors is another factor that should help support a broad rally. Estimates suggest that USD 340bn would flow back into EM equities if global investors moved back in line with their 10-year average holding allocation (moving from an allocation of 5.2% to 6.7%).3 In comparison, the share of EM companies in the MSCI All Country World Index is even higher at around 10%. For this reason, we believe the runway for EM equities is very long, bearing in mind that 2025 only saw inflows of approx. USD 31bn.

Expectations for 2026

While EM economies are becoming more integrated among themselves, given the increase in intra-EM trade, they remain highly diverse in nature which calls for a granular and active approach. Therefore, we believe increasing exposure to EM stocks should remain very selective. In the final section of this note, we share the views of our four mtx research clusters4 regarding their strongest convictions heading into 2026.

Technology

Our technology research cluster expects AI-related demand to continue to rise with supply struggling to keep pace. We believe this demand will continue to be driven by the major US hyperscalers (Alphabet/Google, Amazon/AWS, Meta, Microsoft), with these companies generally able to finance this investment with the support of strong underlying cashflows. Given these market dynamics, we see some attractive opportunities on the technology hardware side, such as cooling solutions and memory, which are supporting this growth in AI servers. On the supply side, we note the disciplined approach to capacity expansion that global leaders such as TSMC are pursuing, the result of which means that the capacity of advanced packaging solutions remains well below current levels of demand.

While much of the debate towards the end of 2025 centered around a possible bubble when it comes to the AI theme, we do not believe that we are in bubble territory yet. Valuation multiples for technology stocks are still some way off the peak reached just prior to the TMT (technology, media, telecom) bubble burst in early 2000. In addition, we note the undemanding valuations for some of the key cloud service providers in EM (e.g. Alibaba, Baidu, Tencent) compared to their US counterparts. This undervaluation could be argued is harsh given local monetization strategies of AI, which look on many dimensions (especially ecommerce and marketing/advertisement) more advanced than in the US.

Consumer

Discretionary outperformed staples during 2025 and we believe this trend could continue heading into 2026. Falling levels of inflation and interest rates in several key EM economies, such as India, Brazil and South Africa, create an environment that is generally more conducive to discretionary names. Within China, we also have a preference for discretionary names, given that staples are more sensitive to deflation and there is less consolidation potential for companies in the staples space. Hospitality businesses could see a possible profitability turnaround in the second half of 2026 while structural tailwinds still support AI/Cloud, emotional/lifestyle goods. Within healthcare, some key themes to watch will be the expiration of patent protection, price regulation and the impact of tariffs.

Financials

In our view, diversified revenue sources, innovation and operational/capital strength for M&A will be increasingly important when it comes to evaluating banks. In a rate-cutting cycle environment (which is the case with many markets in EM), net interest margins are likely to come under increasing pressure. In our view, this type of scenario compels banks to find alternative sources of revenue, a task that is made trickier given the increased levels of competition they are experiencing from fintech disruptors. As a result of these challenges, we believe there will be more levels of consolidation going forward. Finally, capital market reforms in certain countries, such as South Korea, could be an interesting angle to play in 2026.

Within China, we have a preference for insurance names as we believe they can benefit from the weaker US Dollar and lower rate environment, while demand is also improving. While Chinese banks are in our view trading at cheap levels of valuation, net interest margins and asset quality are still yet to bottom out and the government is not expected to deviate from its policy of piecemeal stimulus i.e. no major stimulus policy expected. When it comes to India, we have a preference for non-banking financial companies (NBFC) and private banks, which we believe can benefit from falling rates, fiscal easing and improved liquidity conditions. Within Latin America, some major macro events create both opportunity and risk. These include the Brazilian Presidential elections, the formal review of the US-Mexico-Canada trade agreement, not to mention recent geopolitical concerns following the ousting of President Maduro from office in Venezuela.

Infrastructure

On the materials side, we continue to expect positive momentum for gold given the significant purchases by EM central banks and the increase in ETF purchases. Possible interest rate cuts by the Federal Reserve in the US could put even more pressure on the US Dollar, which could be another driver for the gold price.

Energy transition and AI-related demand for copper is in our view set to continue. In addition, copper supply has been significantly constrained by some significant events at high profile mines, which are not expected to be rectified in the short term. Finally, while global steel prices and margins are coming under pressure, we continue to have a more favorable view of the Indian steel market.

While the oversupply in oil has resulted in a reduction in the oil price during 2025, we believe the markets may be overly pessimistic. For example, the US is working to replenish its strategic oil reserves, which were significantly depleted during the COVID-19 pandemic, dropping from approx. 600 million to 350 million barrels. In a similar move, China has been increasing its strategic oil reserves.

More to come after an impressive year

While 2025 was indeed an impressive year for EM equities, in our view there is good reason to believe that 2026 can produce another strong year of performance for the asset class. A reduction in the perceived risk associated with EM equities and a decreasing likelihood of future EPS dilution are both positive structural changes that we believe started to materialize in 2025. Under these new conditions, attractive relative valuations and light investor positioning stop being the symptoms of investor angst and instead turn into potential catalysts for a long and sustained rally in EM stocks. That said risks remain and dispersion in returns is likely to increase further, which we believe shines a light on the benefits of an active approach. The mtx team and portfolios will continue to focus on the bottom-up fundamentals that we believe are vital to generate positive alpha i.e. high and improving levels of profitability, industry leading positions and attractive valuations.

1. MSCI, ‘Long-Term Investing in Emerging Markets: Identifying Drivers of Total Shareholder Return in Emerging Market Equities’, Winter 2025.

2. Vontobel, FactSet, data as at 31 December 2025.

3. JP Morgan, ‘Emerging Markets Equity Strategy’, 2 December 2025.

4. The mtx analyst team is organised within four research clusters (technology, consumer, financials and infrastructure). The relevant sectors for each cluster are as follows: technology (IT and comm services), consumer (staples, discretionary, health care), financials (financials, real estate) and infrastructure (energy, materials, utilities and industrials). These clusters meet once a week to discuss existing holdings, debate new research opportunities and analyse relevant macro developments.

References to holdings and/or other companies are for illustrative purposes only as of the date of publication to elaborate on the subject matter under discussion. Information provided should not be considered research or a recommendation to purchase, hold, or sell any security nor should any assumption be made as to the present or future profitability or performance of any company identified or security associated with them. The content is created by a company within the Vontobel Group (“Vontobel”) and is intended for informational and educational purposes only. Views expressed herein are those of the authors and may or may not be shared across Vontobel. Any projections or forward-looking statements regarding future events or the financial performance of countries, markets and/or investments are based on a variety of estimates and assumptions. There can be no assurance that the assumptions made in connection with such projections will prove accurate, and actual results may differ materially. The inclusion of forecasts should not be regarded as an indication that Vontobel considers the projections to be a reliable prediction of future events and should not be relied upon as such. Vontobel reserves the right to make changes and corrections to the information provided herein at any time, without notice.