Conviction Equities Boutique

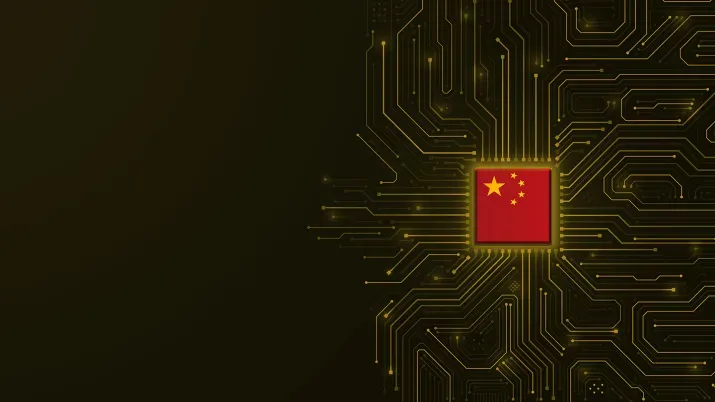

Does the China stock market rally have legs?

The driving force behind this performance is the Chinese tech sector, fuelled by hopes that a larger adoption of AI could boost earnings. A confirmation of improved earnings, the resurgence of consumption confidence and sequential stabilization of the overall economy will be needed to solidify and extend the recent rally.