TwentyFour

The Southgate bond strategy – no subs in the second half

For any fixed income investors that follow the England football team, the plan for H2 2024 may feel somewhat familiar – no substitutions in the second half.

Quantitative Investments

Why covered calls?

In this three-article series, we revisit covered call strategies. In this second article, we argue why covered calls offer a compelling way to play equities in the new decade (the “Why”).

TwentyFour

CMBS shows ongoing challenges for commercial real estate

Securitisation made its latest appearance in the mainstream financial press this week with the news that the European commercial mortgage-backed security (CMBS) market is set to experience its first losses on AAA bonds since the global financial crisis.

Quantitative Investments

U.S. elections 2024

How will the upcoming U.S. election affect global markets? The latest Quanta Bytes by Quantitative Investments analyzes how US election outcomes influence equity markets, the link between candidate policies and investment performance, as well as our unique election prediction model.

Fixed Income Boutique

Why should fixed income investors take the perceived extra risk with emerging markets?

This latest article from Fixed Income explores the potential of Emerging Markets (EM) in the current economic landscape, despite significant outflows and perceived risks. Despite outflows and perceived risks, EMs offer promising opportunities for fixed income investors.

Quality Growth Boutique

Through the prism: how investigative journalists can enhance equity research

Former journalists are a key part of the Quality Growth approach. Their unique skill set brings fresh perspective and sparks healthy debate during the research process. This has been shown to help identify trends ahead of the market, avoid potentially costly investment mistakes, and test new and existing investment rationales.

Asset management

Are fatigue and backlash catalysts for transformative change?

The journey to corporate DEI has been challenging, with many expressing fatigue on the topic in the current climate, but it’s also been crucial. Why? It’s not just about fairness, it's smart business. Read the latest by our co-CEO Christel Rendu de Lint for the FT Moral Money Forum.

Asset management

Decoding ESG selection: What do you need to know to improve your investment decisions?

Our latest papers explore the interplay between financial acumen, sustainability, and cognitive dimensions shaping ESG recommendations.

Quantitative Investments

What are covered calls?

In this three-article series, we revisit covered call strategies. In this first article, we introduce the basic workings – the “what” – of covered calls.

Asset management

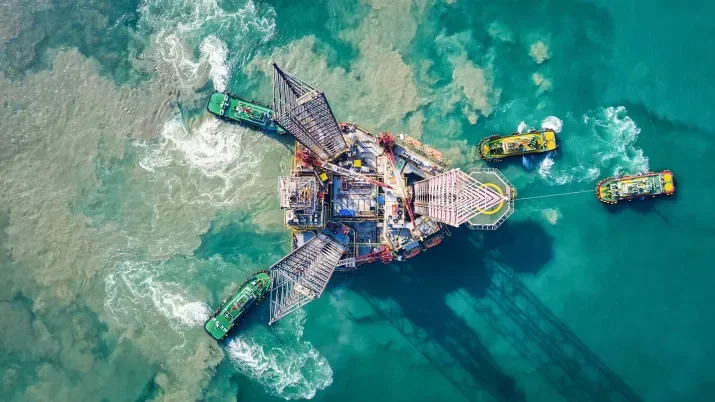

The quest for resources

A thorough consideration of resources, and their pricing, is a key element to a sound investment strategy. Future-proof investing requires an understanding of the world we operate in today and will inherit tomorrow. Resources, quite literally, shape that world.

TwentyFour

Global headlines aplenty but trends continue

For the fixed income fanatics amongst us, June was always going to be one for the books with all three of the major central banks meeting, elections, and continued data.

Fixed Income Boutique

What Mexico’s elections could mean for markets

From the potential for maintaining a status quo that has delivered stability and decent returns in the last few years, to the risks of renewed volatility during a potential second Trump presidency, our latest article from Fixed Income on the upcoming elections in Mexico provides a comprehensive analysis.

TwentyFour

The duration deliberation - to extend or not to extend?

TwentyFour Asset Management’s Chris Bowie, takes a closer look at how he is thinking about duration within fixed income portfolios and shows how following conventional wisdom on duration might prove costly for some investors this year.

Quality Growth Boutique

Supply chain risks in India: can multinationals affect change?

Child labor and imposing unnecessary medical procedures on women were recently identified in the sugar industry in India. While multinationals such as Pepsi and Coca-Cola are not directly linked to poor labor conditions, they can affect change. As active investors, we engage with our portfolio companies on these important issues.

TwentyFour

Finding quality in fixed income

Quality investing in the fixed income sector is as much about making sure that we avoid the losers as it is about trying to pick the winners.

TwentyFour

ECB wage data - can I get a raise?

The European Central Bank (ECB) will almost certainly start their rates cutting cycle next month. Supportive inflation data and clear guidance from the governing council has driven market implied probabilities of a June cut to almost 100%, with little in the way to derail that.

TwentyFour

Don't miss out on scarcity premium in AT1s

The first four months of this year have seen €11.6bn in gross Additional Tier 1 (AT1) issuance from European banks, across euros, dollars and sterling markets.

Multi Asset Boutique

Is a golden era for quality investing upon us?

Quality companies can keep pace with bull markets due to above-average profitability and consistent growth prospects. In bear markets, investors flock to quality companies as their stable earnings and strong balance sheets can minimize drawdowns. While now may be the time for quality, this style can perform well in different market regimes.

Multi Asset Boutique

Market update: Israel-Hamas conflict

With its most recent escalation, the Israel-Hamas conflict now threatens to spread and become a broader conflict in the region.

What are corporate hybrids and how do they work?

Corporate hybrids are bonds issued by companies that combine characteristics of both debt and equity.

Asset management

Mind over matter: behavioral finance and quality investing

The beginning of a new year is often when we look to change the way we behave, but how we invest can also influence our behavior. From inspiring confidence to encouraging discipline, our Chief Economist, Dr Reto Cueni examines how investing in quality can have positive effects on investor behavior.

Asset management

AI’s transformative role in asset management and ESG

The increasing capabilities of Artificial Intelligence (AI) have made the technology one of the most hotly discussed and debated topics in the public discourse, and its impact on multiple facets of business and society is indisputable. An open question remains: will it be a net positive or negative overall?

TwentyFour

AT1s caught in the crossfire but junior bank debt is here to stay

Over the course of last week, we saw several headlines around Additional Tier 1s (AT1s). First, the Dutch Finance Ministry indicated it is exploring the possibility of modifying or abolishing the asset class.

Asset management

World Water Day 2024: Will water scarcity threaten global stability?

Fresh water is an essential but scarce resource, plentiful in some regions and sparse in others. On World Water Day, our Chief Economist Reto Cueni examines the global risk landscape related to water scarcity, and possible solutions to alleviate a growing problem.